Capital reserve requirements for bond insurers have recently changed, making bond insurance once again a viable option for hospitals or health systems seeking credit enhancement on their fixed-rate debt issuance. Before pursuing this option, however, healthcare bond issuers should understand the context for these changes.

The bond insurance industry, which historically served primarily as insurers of municipal bonds, was turned upside down during the financial crisis of 2008-09. Many bond insurers had expanded to insuring collateralized mortgage obligations among other structured products. The implosion of these structured products caused the major rating agencies, which had rated many of the insurers “AAA,” to downgrade most of the bond insurance industry, essentially eliminating the value of most insurers’ credit to the healthcare marketplace.

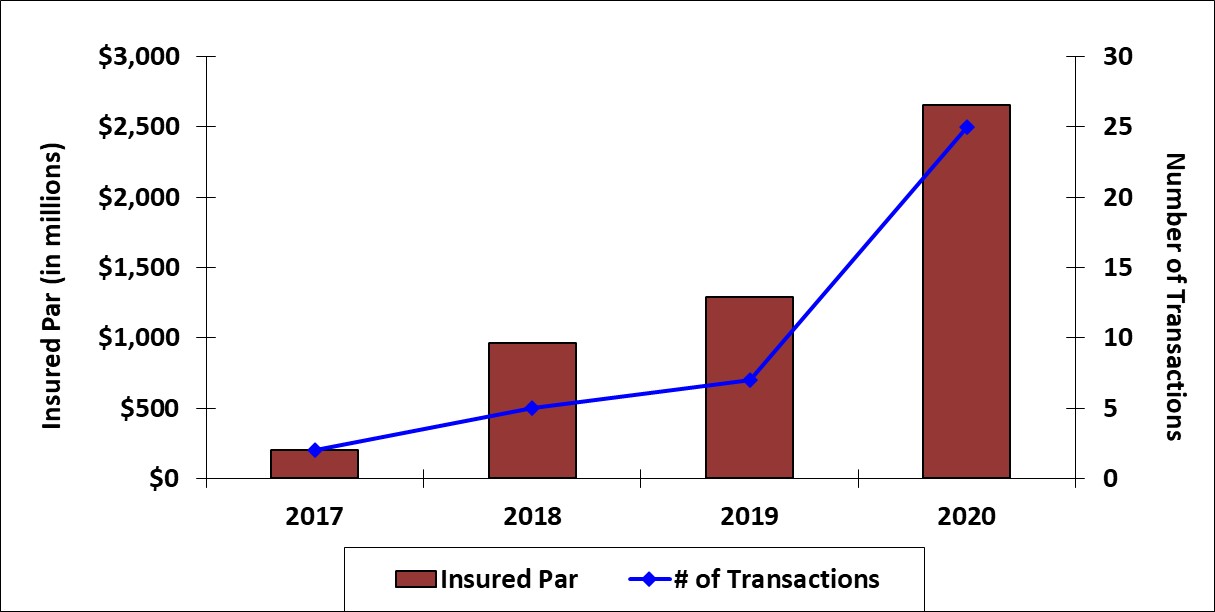

In 2017, Puerto Rico officially declared bankruptcy, leaving bond insurers exposed to billions in potential claims from multiple Puerto Rico borrowing entities — a situation that remains in litigation and is an unresolved risk to the industry. That year, the par amount of healthcare bonds with bond insurance had dwindled to less than 1% of acute not-for-profit healthcare bonds. .

Since then, there has been significant growth in insured healthcare bonds. Assured Guaranty, the market leader in healthcare bond insurance, provided credit enhancement to about 10% of acute not-for-profit healthcare bonds in 2020.

Growth in bond insurance activity for healthcare revenue bonds, 2017-20

Source: Refinitiv SDC and Bloomberg. Data includes corporate-CUSIP transactions, which are regarded as public finance business by the insurer, Assured Guaranty.

This growth was driven primarily by a 2019 change in the capital charges required by Standard & Poor’s for insurers of healthcare bonds. Bond insurer ratings are essentially a proxy for the strength of an insurer’s capital reserves, and a high rating is essential to writing new insurance business. The 2019 capital charge modification reclassified acute care providers to a lower risk category, leading to a reduced cost of insuring acute care bonds. As a result, bond insurance has become viable again in healthcare as bond insurers have been able to reduce the premium they charge for insuring acute-care bonds to a level more acceptable to the market. Nonetheless, the value to acute care borrowers depends not only on the insurer’s premium charged but also on the value investors find in the credit enhancement.

Potential benefits of bond insurance

The primary benefit of bond insurance to providers is a lower overall cost of capital. Other benefits include improved ability to market the bond and manage any needed changes over its lifetime.

For lesser-known or less-frequent issuers, bond insurance can support market access and investor breadth. Large buyers of healthcare bonds are often big funds (e.g., mutual funds, exchange-traded funds, separately managed accounts, hedge funds) that typically require credit preapproval prior to purchasing bonds issued by a hospital or health system. Because large funds already have active bond insurers on their preapproved list, they may be more willing to consider insured bonds from a lesser-known issuer.

Bond insurance can also promote international demand for hospital and health system bonds. The insurer’s credit analysis can provide added due diligence beyond a rating agency review, which may give comfort to sovereign wealth funds less familiar with the nuances of the U.S. healthcare system. In some cases, foreign governments reduce the required capital charges for holding U.S. bonds if they are insured, making these bonds more attractive to international funds.

The backstop that bond insurance provides reduces risk to investors and supports bond prices in the secondary market. A credit-enhanced bond is more likely to hold its price even if the hospital’s credit is downgraded, which can add to its relative marketability and potentially lower the hospital’s interest cost at issuance.

Finally, bond insurance can help ease the process of obtaining changes, waivers or consents over the life of the bond. Since most MTIs allow for a majority creditor (as defined by the bond documents) to act on the behalf of all other bondholders, the bond insurer can serve as a sole investor for the hospital or health system to deal with for the life of the transaction.

When bond insurance might not make sense

Acquiring bond insurance is not always the best option.

“The decision to use bond insurance really depends on the credit profile of the issuing hospital or health system, market dynamics at the time of the deal, and how the provider values any of the non-monetary benefits of bond insurance.” says Leigh Nader, managing director of healthcare for Assured Guaranty. Importantly, bond insurance’s value also primarily relies on an investor community that finds value in the insurer’s credit enhancement.

The market for bond insurance in the U.S. today is practically limited to public fixed-rate bonds. As long as interest rates stay low relative to historical averages, this will likely remain the primary market for bond insurance. Bond insurance has been applied to new debt instruments in the past, so the market may expand in the future as new financial instruments are developed.

Hospitals and health systems should first confirm that bond insurance would lower their overall cost of capital. In estimating this benefit prior to pricing, organizations should not only make historical comparisons but also examine current market indications. Borrowers should also consider the impact of any incremental covenants against this benefit. If the overall benefits look promising, bond insurance may prove to be an effective means for credit enhancement.

How bond insurance works

Bond insurance is essentially a form of credit enhancement, guaranteeing investors will receive their future principal and interest payments as originally scheduled should the hospital be unable to pay. This additional security may allow the hospital to issue bonds at a lower overall interest rate so long as the benefit of improved borrowing costs is greater than the cost of the insurance. In exchange for the insurer’s promise to pay future debt service, if needed, the insurer charges an up-front premium, which is typically paid at the time of closing from bond proceeds. Bondholders of insured paper receive the benefits of both the hospital’s underlying credit rating and the credit rating of the insurer.

The bond insurance premium is based on the insurer’s view of the hospital, informed by quantitative and qualitative factors, and the insurer’s proprietary rate of return model.

Quantitative factors include financial performance and projections, while qualitative factors include environmental, social and governance considerations and the strength of management.

Insurers typically price premiums, quoted as a percentage of total debt service on the insured bonds, so that there is a shared benefit with the provider. Leigh Nader, managing director of health care for Assured Guaranty, notes that “for bond insurance to make sense in a transaction, the insurance premium charged should lower the provider’s total overall interest cost while still meeting the insurer’s required rate of return.”

Simply put, healthcare borrowers should ensure that the interest rate benefit of insurance is greater than the premium charged. Borrowers often look to an economic analysis to inform their decision and ensure that bond insurance would provide a meaningful benefit to overall transaction economics, inclusive of the bond insurer’s premium

Historically, bond insurance has come with incremental covenants and provisions. Before executing a policy, borrowers should carefully review all legal requirements. Bond insurers try to use bond documents “as is,” while remaining consistent with what healthcare bond investors are demanding in the marketplace at the time of bond issuance. Covenants are crafted most often within the issuer’s existing bond documents (e.g., Master Trust Indenture [MTI]), using pre-existing language to the extent possible.