Analysis: Why physician practice acquisition by health systems is a growing trend

Based on a new Health Care Cost Institute report, a Healthcare Dive Brief states in part:“Healthcare services performed in outpatient settings grew from 11.1% of care visits to 12.9% between 2009 and 2017. Echocardiograms and drug administration saw the biggest increases in outpatient setting services.”

Why are more services being provided in provider-based settings? Hospitals are increasingly acquiring physician practices and employing physicians. The article goes on to say, “A recent report by Avalere Health and the Physicians Advisory Institute found that hospitals now employ 44% of physicians. Hospitals acquired 8,000 medical practices between July 2016 and January 2018. The number of hospital-acquired physician practices increased from 35,700 in 2012 to more than 80,000 in January 2018.”

Takeaway

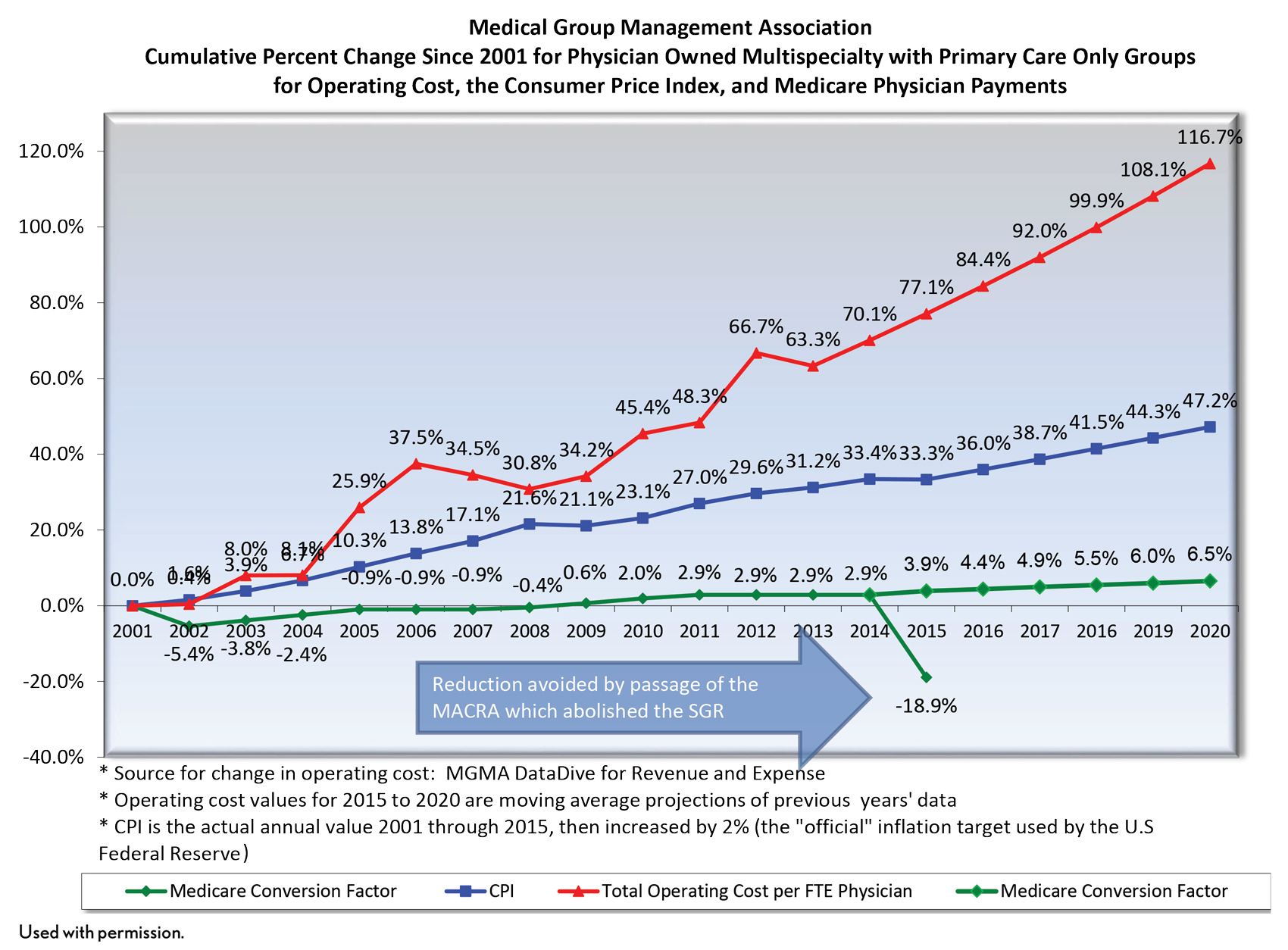

Medicare and Medicaid don’t pay physicians “a living wage” for the services they provide. The administrative burden on small practices (e.g. promoting interoperability and MACRA requirements) has also increased significantly over the last 10 years. Therefore, as the economics of running a practice become more untenable, it should not be surprising to see independent doctors selling out in droves to hospitals, insurance companies or private equity groups. As an anecdote, I was in a five-provider (three MDs, two NPs) primary care practice in the Southeast over the summer as part of a site visit. They had two onsite revenue cycle staff, an office manager and two contracted revenue cycle support staff. It’s an understatement to say that’s a lot of administrative overhead for five primary care providers. And it doesn’t include the “front of the house” staff. Anders Gilberg at the MGMA has brilliantly illustrated this trend at the national level (see slide below). As long as the spread between cost and revenue growth widen further, we’ll see more services provided in HOPDs as physician sell their practices.

The rationale for physician practice acquisition by a health system is to improve integration and care coordination. The argument is if we’re moving to a world where providers are going to be held at risk, then the risk-bearing entity (the health system) needs the degree of economic alignment and shared, hardwired infrastructure with the practices in the community that can only be achieved by employment. Purchasers have long eyed this argument with suspicion. And now we’re starting to see them more aggressively push back in a variety of ways ranging from more legal challenges to practice acquisitions to Medicare’s site-neutral payment policy for Evaluation and Management Services provided in hospital-based clinics. I suspect this pushback will only increase, and I would expect to see additional site-neutral policies from CMS targeting imaging and diagnostic services soon.

Moving forward, for health systems evaluating a practice acquisition, the pro forma needs to work under freestanding rates. Any business case predicated on the facility fee runs the risk of losses if, and when additional site-neutral payment policies are implemented more broadly.