Survey: Hospitals overspending on corporate services could reduce costs without impacting quality

Hospitals and health systems face pressure to curb costs and increase quality, prompting them to look closely at spending to see if there are opportunities to standardize and streamline operations. Controlling costs in corporate services — non-clinical functions that include information technology, revenue cycle management, supply chain and more — can go a long way toward helping healthcare organizations manage their total cost of care.

To gain a better understanding of hospital and health system corporate services spending patterns, the Healthcare Financial Management Association (HFMA) surveyed a group of healthcare organization leaders, including C-level executives, vice presidents and directors. The survey was in the field for two weeks during November 2019 and involved 114 respondents from around the country. Navigant, a Guidehouse company, analyzed the research HFMA conducted. The following sections discuss key takeaways from the survey.

The current state of corporate services spending

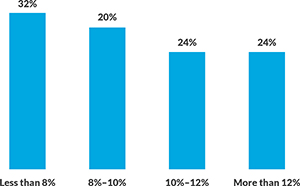

For most healthcare organizations, corporate services spending represents a meaningful portion of their budgets. While the term corporate services can be defined in many ways, in the context of this survey, it encompasses administration, finance, information technology, human resources, supply chain, revenue cycle, marketing, facilities, real estate and plant operations. Nearly half of the provider executives surveyed indicate they are spending at least 10% of their total operating revenue on these areas, with one out of four spending 12% or more. Health systems are more efficient than hospitals with their corporate services spend, according to survey results. Hospitals are almost three times as likely to spend 12% or more on these functions when compared to health systems.

“It’s not surprising that stand-alone hospitals typically spend more on back office functions than health systems,” says Chad Mulvany, director of HFP Perspectives and Analysis for HFMA. “Health systems can leverage economies of scale to spread relatively fixed costs over more units of activity. That scale also makes it easier for health systems to acquire more sophisticated and specialized capabilities in these areas.”

A decrease in spending without compromising quality is possible

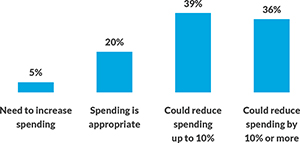

Nearly three-quarters of provider executives believe their corporate services spending could decrease without negatively impacting quality or efficiency. And more than one-third (36%) say they could cut it by 10% or more. Optimization in this area could free up key funds to be applied elsewhere for more mission-critical tasks.

“Revenue growth remains a constant challenge for hospitals and health systems due to such aspects as stagnant reimbursement and meager inpatient growth, prompting many providers to grow inorganically via mergers and acquisitions (M&A) while targeting corporate services for meaningful cost reductions,” says Robert Green, partner at Guidehouse. “Corporate services will likely become more of a target area for greater short- and long-term cost reductions going forward as hospital budgets tighten even further due to the COVID-19 pandemic. This economic reality requires providers to explore creative opportunities to simplify and streamline a complex organizational structure while consolidating, automating and outsourcing functions to drive more efficient and effective corporate and shared services delivery.”

Figure 1: Corporate services spend

Q: What is your annual spend for corporate services as a percentage of total operating revenue?

Figure 2: Reducing spending without compromising quality

Q: How much total spend on corporate services do you believe your organization could remove without negatively impacting service quality and efficiency?

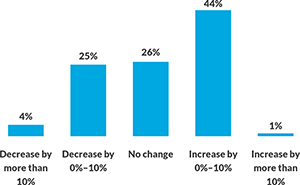

Figure 3: Projected corporate services budgets

Q: How is your organization’s corporate services budget projected to change in the next 12 months?

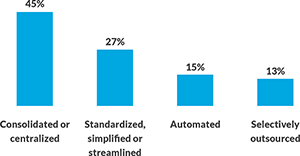

Figure 4: Few providers leveraging corporate services automation

Q: What percentage of your organizational corporate services fall under the following categories?

Revenue cycle, IT and supply chain under consideration

Reining in corporate services costs is a priority for most organizations. More than half of the executives surveyed say they will be held accountable for cutting corporate services budgets (29%) or, at a minimum, holding them flat (26%) over the next year. Certain functions will be targeted more than others. Survey respondents indicate that revenue cycle management (23%), the supply chain (20%) and information technology (19%) will be priority areas of focus for reducing corporate services expenses going forward.

Healthcare is falling behind other industries regarding automation(a)

A key strategy for reducing corporate services costs while simultaneously improving accuracy and efficiency is to use emerging technologies, such as robotic process automation (RPA), artificial intelligence (AI) and enterprise resource planning (ERP) solutions. These technologies have helped companies across multiple industries improve their performance while cutting expenses.

However, survey results suggest that healthcare providers lag other industries in using emerging technology. Just 15% of providers have automated their corporate services functions, with large hospitals being much more likely to automate (18%) versus smaller ones (6%). Moreover, while one-in-three providers have deployed an ERP system, only 12% have optimized the technology. The good news is that may change over time. More than half of providers predict they will deploy or optimize their ERP over the next two years.

Before onboarding any new technology, organizations should make sure they have laid the groundwork for success, reviewing workflows, standardizing processes and creating a change management strategy. “New technologies leveraging RPA, ERP and machine learning have unlocked significant opportunities to drive back office efficiencies,” said Jeff Palmieri, associate director of robotics automation at Guidehouse. “As many providers have learned the hard way, overlaying technology as the ‘solution’ without first reengineering the processes and concurrently embedding a change management program has proven to be frustrating at best, and value-degrading at worst.” By having a solid plan for implementing these innovative technologies, an organization is more likely to realize the full benefits they can provide. Organizations can also identify other ways to optimize corporate services spending through benchmarking. To get a true snapshot of current performance and improvement potential, providers must look outside their organizations – and sometimes even outside the industry to identify best practice.

“To uncover potential efficiency and effectiveness opportunities, providers must look beyond their facility’s four walls and leverage benchmarking data that compares their corporate services performance against that of comparable peers,” says Green, who also leads Guidehouse’s Corporate Services Peer Network and Database, comprised of 55 health systems nationwide. These kinds of external comparisons can demonstrate where your organization is on the road to change and how far you must travel to fully realize best practice.

About Guidehouse

Guidehouse’s Health segment is comprised of consultants, former provider administrators, clinicians, and other experts with decades of strategy, operational/clinical consulting, public health, managed services, revenue cycle management, and outsourcing experience. Professionals collaborate with hospitals and health systems, physician enterprises, payers, local and federal government, and life sciences entities, providing performance improvement and business process management solutions that help them meet quality and financial goals. For more information, please visit: www.guidehouse.com/capabilities/industries/healthcare.

Navigant was acquired by Guidehouse, a portfolio company of Veritas Capital, in October 2019.

Footnotes

a. Digalaki, E., “The impact of artificial intelligence in the banking sector & how AI is being used in 2020,” Business Insider, Dec. 17, 2019. https://www.businessinsider.com/ai-in-banking-report (Accessed March 10, 2020).