When you imagine the future of healthcare, what comes to mind: an accountable care organization or a CVS HealthHUB store?

A decade into the transition to value-based care, there is general consensus that the transition has been slower than expected. Healthcare providers have been working to build capabilities and structures needed to deliver value-based care. For example, the number of accountable care organizations (ACOs) in the country has grown from 58 ACOs in 2011 to more than 1,000 today.

Yet only one in 10 Americans receives care from an ACO. In 14 of the nation’s 306 hospital referral regions (HRRs), ACOs cover less than 2% of the population, while on the other end of the scale, only 14 HRRs have 30% or more of the population covered by ACOs (Muhlestein, D., Saunders, R., Richards, R., et al., “Recent Progress in the Value Journey: Growth of ACOs and Value-based Payment Models in 2018,” Health Affairs, Aug. 14, 2018).

In June, CVS Health Corp. announced plans to open 1,500 HealthHUB stores by 2021. Within two years, there could be more CVS HealthHUBs across the nation than there are ACOs. HealthHUBs are expanded in-store clinics that focus on prevention and treatment of chronic conditions. One estimate says that if CVS expanded its 1,100 existing MinuteClinics into HealthHUBs, 75% of U.S. households would be within 10 miles of a HealthHUB (Tully, S., “CVS Wants to Make Your Drugstore Your Doctor,” Fortune, May 17, 2019).

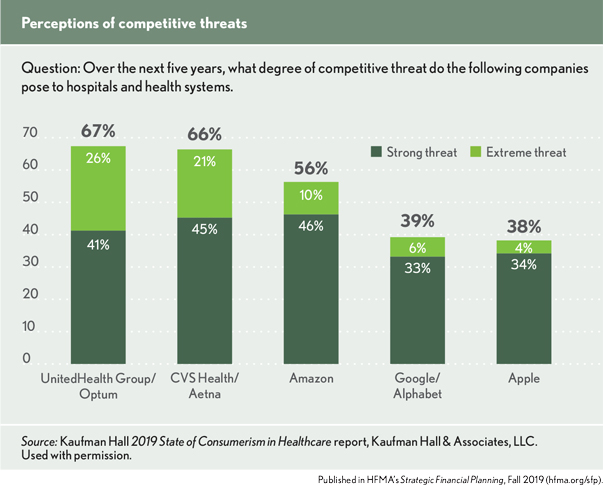

Healthcare organizations have taken notice. In a recent Kaufman Hall survey on consumerism, 66% of respondents said that CVS Health/Aetna poses a “strong” or “extreme” competitive threat to hospitals and health systems over the next five years (see the bar graph below). A similar number saw an equally significant threat in UnitedHealth Group/Optum, which has targeted 75 markets for growth in primary and outpatient services provided outside the control of hospitals and health systems. UnitedHealth Group CEO David Wichmann recently said that it has no interest in adding hospitals to its OptumCare portfolio but would be interested in health system partnerships “in markets where there [are] maybe less assets for us to accumulate and build from” (Haefner, M., “UnitedHealth CEO: Optum Won’t Build Hospitals,” Becker’s Hospital Review, June 5, 2019).

On the slow road to value, hospitals and health systems are now at risk of being overtaken by disruptive new business models that are working hard and fast to shift the center of healthcare away from hospital-based systems.

A new front door to healthcare

Both CVS and Optum have spoken of offering a new “front door” to healthcare. Optum is pursuing the more traditional route, acquiring and redeploying an existing network of independent physician practices and freestanding surgical centers. The front door to this network will be Rally Health, a digital health platform that steers consumers to Optum’s network of high-quality, low-cost providers.

This strategy builds on a known fact: Independent physician groups have proven more successful than hospital-based health systems in controlling patient care costs in programs such as the Medicare Shared Savings Plan. They can be more easily incentivized to reduce utilization of inpatient or hospital-based outpatient and ancillary services because these reductions do not affect their revenues.

CVS’s approach is more radical in that it is creating a new form of provider experience for consumers, with convenient, low-cost settings of care built within its existing retail pharmacy footprint. HealthHUBs within the retail pharmacies will be CVS’s new front door.

Optum and CVS are targeting the same patients who have been the focus of value-based payment initiatives: the 60% of Americans with one or more chronic conditions who account for 90% of healthcare spending in the United States. Their shared bet is that by unbolting much of the care for these patients from hospital-based health systems, they can drive reductions in cost that will reduce expenses for their own health plan members, improve the customer experience and create a service that will be attractive to other payers.

A paradigm shift for health systems

The new emphasis on healthcare’s front door requires a paradigm shift for health systems. The front door envisioned by Optum, CVS and a host of other new entrants in the healthcare marketplace is a door that is easily found and always open to the consumer. Once inside, the consumer can expect minimal delays, attentive service and a focus on providing quality care in the most cost-effective way possible.

In contrast, health systems have too often been organized around the needs of those who work inside the system instead of the needs of those who are trying to enter the system for care. Their front doors often have been hard to find, with long lines waiting to get in. Incentives for those working within the system have not been sufficiently aligned to ensure a focused attention on the cost-effectiveness of care. Physicians have been reluctant to adjust their schedules or build team-based care models that could improve the convenience of care for patients. To the extent that ACOs have been an outgrowth of these systems, they have been burdened by the same problems and have struggled to achieve the results that would support further growth.

The changes required are both significant and difficult.

- Making services available when and where patients want them, not when and where it is convenient to deliver them.

- Transforming cost structure to ensure that primary care, outpatient and ancillary services can be delivered at a competitive price point.

- Understanding the many needs and interests of the consumer — health-related, financial, emotional — and placing them at the center of decision-making across the organization.

By placing consumers at the center of their business models, new competitors have redrawn the road map to value. Health systems that fail to realign themselves around consumer needs will find their journey to value not only disrupted but headed down the wrong path.