Staking a claim in home-centered care: A partnership-based strategy

Home health’s position among post-acute care options is likely to strengthen.

“We have declared home health as the new frontier in value-based medicine.” This quote by William Fleming, president of Humana Healthcare Services, was made in a presentation to investors that also identified home health as one of the “five most impactful areas of influence in health (Humana: Investor Day 2019, March 19, 2019).”

There is a good deal of logic behind Humana’s focus on the home. The U.S. population is aging. Technology is expanding the range of medical services that can be delivered at home, as well as the ability to remotely monitor and connect with patients. Home health is typically a much lower-cost alternative to care delivered in institutional settings. Payers are increasingly recognizing the value of home-based non-medical services that address social determinants of health. New market entrants — including electronics retail giant Best Buy — are investing in home-centered services.

For health systems, a home-centered strategy may be advantageous across a range of settings. Home health can help manage costs under value-based payment structures. Home care can increase patient satisfaction and help build consumer engagement with a health system through services that assist aging or recuperating individuals with the necessities of daily life. For those systems with provider-based health plans, a home-centered strategy can help manage total cost of care, enhance member satisfaction and offer a point of value differentiation.

This article takes a closer look at the case for home health and home care services as components of a home-centered strategy. It then discusses why a partnership option with a home health or home care operator may be the best path for health systems to explore.

The case for a home-centered strategy

Home health services and personal home care services are the pillars of a home-centered strategy.

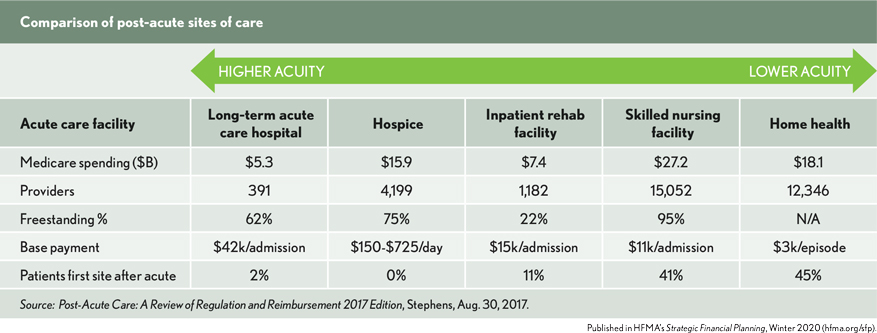

Home health services. Home health is already the leading site for post-acute care following an inpatient discharge. It is second only to skilled nursing facilities (SNFs) in Medicare fee-for-service spending, but costs for an episode of home-health care are significantly below the cost of an episode of care in a SNF.

Home health’s position among post-acute care options is likely to strengthen. While there is some risk associated with changing payment models, home health operators have proven adept at containing cost growth. Factors to consider include

the following:

Growth trends. The CMS Office of the Actuary predicts that home health services will be one of the fastest growing areas of healthcare professional services over the next decade.

Clinical outcomes evidence. Studies have found little difference in outcomes for patients who receive post-acute care at home instead of from an institutional provider and have found the potential for significant cost savings.

Consumer preferences. There is clear data that consumers would prefer to stay in their homes as long as possible and avoid hospitalization and intensive care in the later stages of life.

Payment trends. The new Home Health Patient-Driven Group Model goes into effect on Jan. 1, 2020; the model is intended to be budget-neutral and financial impacts on the home health sector are not yet known. The Medicare Payment Advisory Commission (MedPAC) has also recommended reductions in the base payment rate for home health agencies, in part because of the industry’s success in controlling costs and maintaining Medicare margins. The possibility of reduced rates for home health should, however, be weighed against the savings that a home health strategy could generate under risk-based payment structures.

Home care services. A combination of demographic and policy trends makes a home-centered strategy that incorporates personal home care services worth consideration. Factors to consider include the following:

Growth trends. With the U.S. Census Bureau predicting that the over-65 age group will grow from 49.2 million in 2016 to 78 million in 2035, the opportunities for personal home care services will grow significantly. Growth in the senior population will also put strains on the ability of family members to serve as caregivers.

Policy changes. Medicare Advantage plans, which have seen enrollment nearly double over the past decade, are now able to offer supplemental benefits to their members to include services that might have been considered daily maintenance and thus not allowable under previous guidance.

Understanding social determinants of health. Despite widespread belief that addressing social determinants of health can have significant beneficial impacts, there is still limited evidence of which interventions are most effective and for which populations. A home-centered strategy that focuses initially on private pay home care services can start to build that understanding, while positioning the health system to serve the daily needs of a growing senior population.

The partnership option

Although demand for home-centered services is likely to grow, many health systems have been divesting their home-centered operations and are opting instead for joint ventures or other partnerships with home health and home care operators.

Partnership offers health systems several benefits:

- Creating a partnership that leverages the resources of an existing home health or home care operator can provide a faster route to bringing a home-centered program up to scale.

- A home health or home care operator already will have the bandwidth and skills to manage a home-centered program. They may also have expertise in areas such as improved patient experience and data analytics to inform post-acute care decisions.

- Home health and home care operators have experience with the employee recruitment and compensation issues unique to the business, including relatively high employee turnover.

- A partner operator can free up health system management expertise and capacity to address other strategic priorities.

There are some key considerations for health systems when structuring a partnership. First, the health system should enter into the partnership with a clear view of what it hopes to achieve. It should work with its potential partner to define mutually agreed upon financial and quality of care metrics for the partnership and milestones for determining the partnership’s success.

Next, if a health system is trying to build a home-centered strategy, it should not make the success of that strategy dependent solely upon its partner’s performance. The health system should negotiate appropriate control provisions to ensure that its community mission is enhanced and that incentives are aligned to support broader strategic objectives such as population health management. It should also define an exit strategy if the partnership does not meet expectations.

A home-centered strategy aligns both with a health system’s interest in engaging with and meeting the needs of an aging population and with the increasing demand for high-quality, low-cost care delivery models. Home health and home care operators already know the terrain of this new frontier. For health systems seeking to stake a claim in home health, home health and home care operators can be valuable partners in executing a successful home-centered strategy.

For a more detailed discussion of a home-centered strategy, view Staking a Claim in Home Healthcare Care: A Partnership-Based Strategy.