How to achieve best-in-class capability for value-based risk contracting

As the healthcare industry continues to pivot toward risk, health systems have an opportunity to share a greater portion of that risk through partnerships and joint ventures with health insurers. Yet success with such a strategy will depend on how the health system weighs its options and lays the groundwork for the initiative. Three areas require a health system’s attention for this purpose. (See also the sidebar describing elements required for a tailored approach.)

1. Understanding market profit pools

The basis of competition is shifting much more quickly in the government segment than in the commercial segment due to fundamental differences in how those markets are structured and how the profit pools are distributed. Medicare Advantage (MA), in particular, is a risk-based business. Organizations that have enjoyed success in the MA space (e.g., Iora, ChenMed and Oak Street) have done so through being fully capitated, risk-based models. The pace at which such models proliferate will accelerate as increased capital flows into the space and providers scale their models within and across markets. Assumption of risk will be important for profi tability in both Medicare and Medicaid.

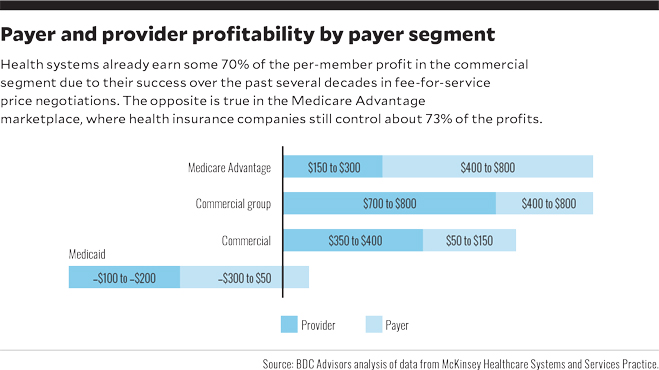

A recent analysis of data from McKinsey Healthcare Research Institute found that providers assuming risk to increase their share of profitability in the premium dollar will likely do better by focusing on the government-sponsored markets, and MA in particular, rather than trying to compete in the commercial segment (see the exhibit below).a

An advantage for providers in the MA marketplace is that MA premiums are risk-adjusted, so to the extent providers can precisely code and document clinical conditions, they have protection against adverse patient selection. There is also the potential for top Star ratings for superior clinical and patient care performance. The Kaiser Family Foundation has reported that, in 2018, 74% of MA enrollees were enrolled in plans with Star ratings of 4 or more, making those plans eligible for bonus payments, and that MA plans received $6.3 billion in bonuses, averaging $321 per enrollee on top of their base rates. Such protection is not available in the commercial market.b

The MA market also is growing. About 35% of Medicare benefi ciaries (roughly 20 million people) are currently enrolled in MA plans, according to the Kaiser Family Foundation, which also cites a projection by the Congressional Budget Office that, driven by population aging and growth, MA plans will cover 42% of Medicare beneficiaries by 2028.

Strategic focus for government versus commercial markets. Tight payer-provider integration, with specialized primary care, is required for success with MA plans. Such integration is not nearly as important in commercial contracting, however, where the important strategic elements include shifting to lower-cost sites of services, curating a network of highly efficient specialists and improving productivity.

Because the fee-for-service (FFS) commercial market segment still drives profi tability for most health systems, the contracting strategy for this segment generally should focus on preserving and growing market share over the next contracting cycle or two, rather than on positioning the organization to get more of the premium dollars to make margins on insurance operations. Notable exceptions include markets where lower-cost providers have an opportunity to take share from higher-cost providers through value-based contracts and direct-to-employer relationships.

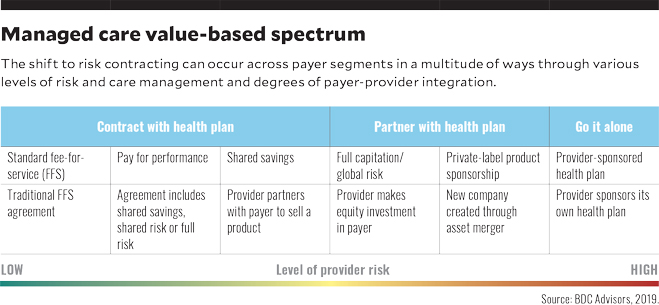

A need for an explicit payer contract strategy. Developing explicit payer contract strategies allows a provider’s managed care team to be more focused and identify the results needed to achieve success in each agreement. As providers increasingly focus on value-based care, they must define preferred risk-value models and the levels of risk they should take in contracting. As part of this effort, a provider should assess its clinical risk management capability by payer contract, to effectively negotiate upside and downside risk corridors.

Physician integration and patient segmentation also are essential elements regarding clinical performance for risk/value contracting. To properly address these issues, health systems should adopt a team-based approach that facilitates communication among patients, physicians and other providers, with a unified care plan across the treatment continuum. The results will be shared decision-making and collaboration among patients and providers concerning risks and seriousness of conditions to be treated, as well as the costs and benefits of treatment alternatives.c A relatively low degree of integration is required for standard FFS, pay for performance and shared savings. As the level of provider risk increases, more complete integration and medical cost management capabilities are required.

2. Acknowledging the inherent challenges presented by the health plan market

Provider systems often have underestimated the capabilities required to successfully enter the health plan business. A performance review of 37 new provider-sponsored health plans (PSHPs) and five acquired health plans launched since 2010 found only four were profi table five years later.d Five have gone out of business and two were in the process of being sold. Many start-up health plans have struggled with slow enrollment growth and financial losses.e (See the sidebar for analyses of factors that impeded the success of two initiatives.)

More recently, health systems entering the insurance market have sought partnerships where they can take advantage of the skill set, capabilities and tools existing in the health plan space while leveraging their own clinical risk management capabilities. Providers have fared well using this approach, which is now widely seen as preferable to developing a PSHP. (See the sidebar for examples of success stories.) The development of a private-label health plan will still require both parties to have substantial risk and skin in the game. A joint venture is advantageous, however, because less capital is required from the health system to meet state reserve requirements, and fewer resources are needed to rent or build the plan infrastructure.

3. Developing the key elements for successful value-based contracting

Building a winning value-based contracting strategy requires consensus around the pace of change, specific plans for several key areas and new organizational capabilities. To be successful, organizations must cultivate the following elements.

C-suite leadership. Developing a successful value-based contracting capability requires significant leadership involvement from the executive team. Such executive involvement is essential to ensure any decision regarding the scale of an organization’s eff orts across the value continuum is informed by the executive team’s understanding of the market’s dynamics and of the organization’s strengths, weaknesses and position vis-à-vis the competition. To be successful, a value-based contracting organization requires a balance among clinical, financial and actuarial leadership. A dyad leadership structure (e.g., comprising a physician and an administrative leader) tends to work best in providing balanced clinical, administrative and financial decision-making, with appropriate actuarial support for rate setting and pricing.

Service-line leadership. Leaders at the serviceline level should fully understand the cost, revenues, quality and clinical outcomes needed to achieve patient and provider satisfaction and overall health system goals.

Network design. Most value-based products will be focused around the provider’s clinical network, or a narrower subset of the overall medical staff. The design challenge will be in having a defensible methodology for selecting or excluding physicians from the network. Assuming an MA product will be launched, the network should be deep enough to ensure Medicare beneficiaries will want to switch to it from open-network FFS Medicare, where they have broad flexibility in selecting specialists. In evaluating physicians for the network, it will be important to assess their performance relative to performance metrics and intensity-of-service data that are deemed vital indicators of high-quality care, improved patient outcomes and reduced administrative burden.f

Product pricing. A major design question is to ascertain the price point at which consumers will buy a narrow-network product with benefits like or better than standard Medicare benefits. The organization will require a methodology to solve for the correct price point, which may require consumer household surveys and focus groups to test various design and pricing propositions. Specific considerations in pricing include:

- Market size and value of service to provide future growth rates

- Elasticity of demand and price shop-ability

- Price comparisons in the market regarding market alternatives

- Desired future price positioning

Well-developed clinical risk management capabilities. The organization’s clinical risk management capabilities should be assessed by payer segment to identify factors, such as the lack of actionable data to reduce variations in cost or quality, that could inhibit the organization’s ability to effectively negotiate value-based payment agreements.

Balanced contracting/actuarial capabilities. As value-based contracting increases in importance, inevitable tensions will exist between the traditional FFS contracting group and the new value-based care agendas. The organization will need to develop separate contracting teams to ensure the correct strategic decisions are made regarding tradeoffs between FFS and value-based arrangements with payers. The organization will require a strong actuarial team to provide perspective on key contract terms and to audit and reconcile payments to ensure they are appropriate.

A need for meaningful investment

As the basis of competition for market share and margin shifts from a strict FFS model to a more balanced risk-based and volume-based model, health systems must invest at scale in their clinical and financial risk-management capabilities. Merely contracting for value across different segments will result in slower growth, marketshare losses and erosion of profitability in more competitive markets. The Medicare segment is already risk-based in many markets, with the ACA commercial exchanges following close behind. The most progressive health systems are beginning to look at their Medicaid and self-pay segments as fully capitated. To reduce losses, those systems are investing in managing social determinants of health, integrating behavioral health and providing more efficient and cost-effective access points across the continuum of care. Health systems should carefully assess their vulnerabilities relative to their competition — both traditional and innovative — and develop their capabilities for a multiyear risk-management strategy.

Footnotes

a. More than 50% of the nation now live in urban areas where the largest provider systems have gained more market share than the largest payers did between 2012 and 2016, and nearly 33% of the population live in areas where a single leading provider system has more than 35% market share. These trends have given providers an edge in negotiating more favorable commercial rates for specialty, tertiary and quaternary services, cutting into healthcare insurance profit pools.

b. Jacobson, G., Damico, A., Neuman, T., “A Dozen Facts About Medicare Advantage,” Henry J. Kaiser Family Foundation, Nov. 13, 2018.

c. Dickinson, R., Fairchild, D., and London, A., “Building a Magnet Physician Enterprise,” hfm, November 2018.

d. Baumgarten, A., “Analysis of Integrated Delivery Systems and New Provider-Sponsored Health Plans,” Robert Wood Johnson Foundation, June 1, 2017.

e. Baumgarten, A., and Hempstead, K., “New Provider- Sponsored Health Plans: Joint Ventures Are Now Preferred Strategy,” Health Affairs Blog, Feb. 23, 2018.

f. There are two major types of measurement metrics for improving network and service-line performance: performance metrics, which address clinical resourceutilization, sites-of-care costs and efficiencies and high-level patterns and outcomes of care comparing various aspects of quality across organizations and geographies; and quality metrics, which detail patient care and administration processes that support medical decisionmaking, benchmarking and the achievement of quality goals. (Quality metrics include patient and provider satisfaction and the precision of clinical documentation.)