Hospitals and health systems are constantly challenged to maintain a strong revenue cycle amid fluctuating industry dynamics. Leaders must remain vigilant, looking for ways to speed cash flow, reduce the cost-to-collect, maintain regulatory compliance and respond to new and emerging payment models. The increasing use of technology, along with rising consumerism and shrinking margins, are also factors organizations must deal with as they aim to improve and sustain performance.

To learn more about revenue cycle challenges and how hospitals and health systems are addressing them, the Healthcare Financial Management Association (HFMA) surveyed 108 hospital and health system CFOs and revenue cycle management (RCM) executives. The survey took place across two weeks in September, with some of the questions revisiting topics from previous studies conducted in 2018 and 2017. This HFMA Research Highlight, sponsored by Navigant, discusses key takeaways.

EHR adoption hurdles still outweigh the benefits

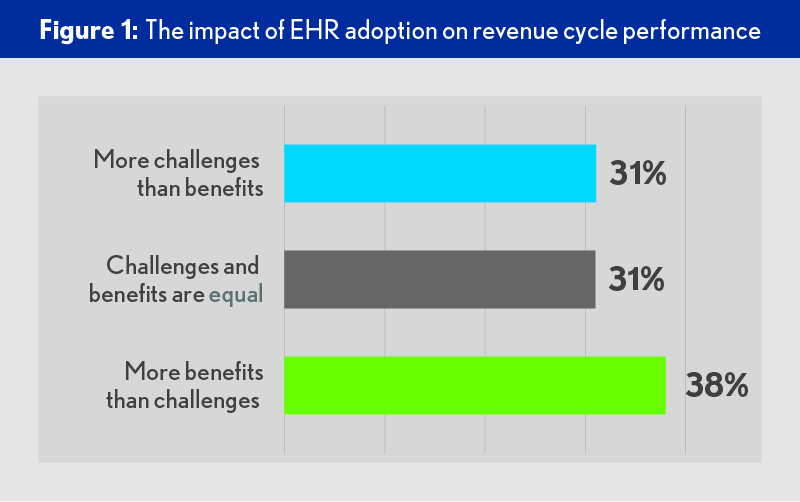

Although many in the industry believed that electronic health records (EHRs) and their revenue cycle management components would streamline operations, this technology has not fully delivered, particularly regarding revenue cycle performance. The majority (62%) of healthcare executives surveyed suggest that EHR adoption challenges have been equal to or outweigh the benefits specific to their organizations’ revenue cycle performance — up from 56% in 2018. More hospital-based and small hospital executives have this perspective versus health system and large hospital executives.

Part of the problem organizations are having with their EHRs is that they struggle to keep up with upgrades or they underutilize available functions. More than half of providers (56%) indicate their organizations wrestle with these issues.

“Given the wide range of priorities healthcare organizations face, keeping on top of EHR upgrades and taking advantage of new functionalities can be a tall order, especially if these tools require staffing resources from already overstretched IT and revenue cycle departments to keep current,” says Chad Mulvany, director of healthcare finance policy, strategy and development for HFMA. “It can be hard to justify the disruption that comes with an EHR upgrade or optimization effort if an organization doesn’t immediately see the benefits of improved accuracy and efficiency translating into increased cash yield from revenue cycle operations.”

Consumer self-pay remains a concern

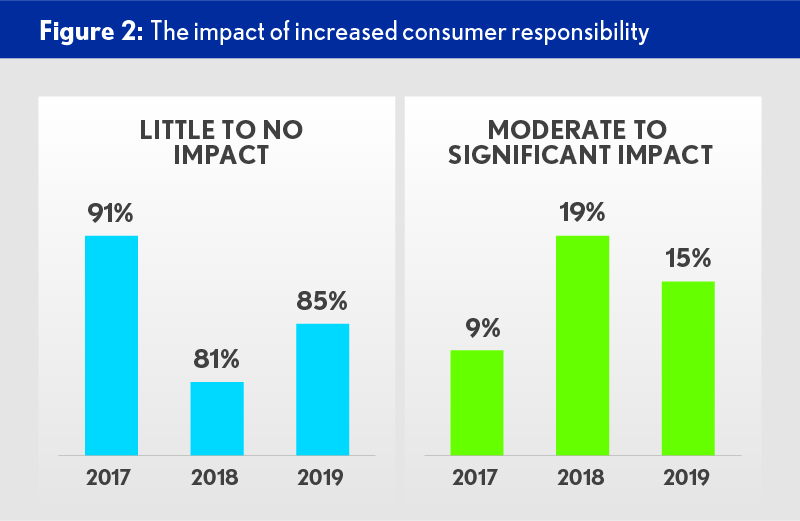

As the amount of revenue tied to patient payment continues to grow, concerns around self-pay persist, with 85% of executives believing consumer self-pay will affect their organizations, up from 81% in 2018. Executives from large hospitals seem especially concerned as 100% of those surveyed predict moderate to significant consumer self-pay impact.

Amid these dynamics, organizations are pursuing several strategies to better engage consumers on healthcare costs. Executives state their organizations are offering comprehensive financial counseling and payment plans (40%) and online portals for price estimates and payment (32%).

“Patient payment responsibility is going to continue to grow,” says Mulvany. “High-deductible health plans are omnipresent and healthcare costs to the patient continue to increase. Having tools in place to help patients better understand their responsibilities is critical as is having straightforward options for resolving those obligations. When it is hard to know what and how to pay, people may delay or even avoid the activity, which experience has shown results in delayed cash collection, patient dissatisfaction and increased bad debt for the organization.”

The growth in revenue cycle IT budgets remains steady

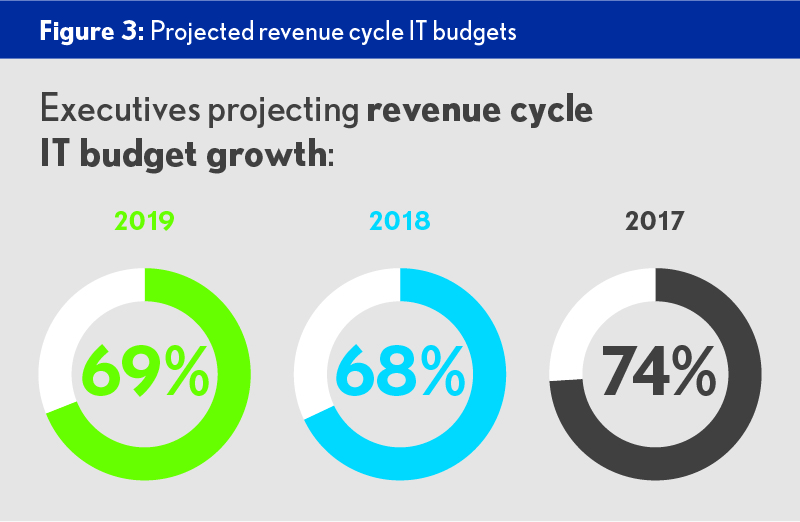

In an ongoing effort to better manage revenue cycle challenges, nearly 70% of executives predict their organizations’ IT budgets will increase over the next year, up slightly from last year. Significantly more hospital-based executives are projecting spending increases (74%) versus health system leaders (55%). In fact, almost one in five health system executives predict their budgets will go down this year as compared to only 1% of hospital executives.

Focusing on revenue integrity and RPA to drive future RCM improvements

While executives are pursuing a range of strategies to enable long-term revenue cycle success, revenue integrity tops the list for the third straight year. Nearly 30% of respondents are zeroing in on this area, up 21% versus 2017. Organizations are also considering strategies that weren’t even on the radar a year ago. For example, 15% of health system executives are targeting robotic process automation (RPA) in 2019 as compared to none in 2018. Moreover, one out of four executives in health systems and large hospitals suggest they are using advanced health IT, including RPA, to help increase economies of scale across revenue cycle operations.

“New technologies leveraging RPA, artificial intelligence, and machine learning have unlocked significant opportunities to reach previously unattainable levels of revenue cycle performance,” says Kent Ritter, director, Navigant. “As we’ve learned with EHR implementations, there are no silver bullets. These tools are not ‘plug and play,’ and the ability to integrate operational and technical expertise remains key to provider success.”

In addition to leveraging technology, organizations are also partnering with outside experts to improve revenue cycle performance. Nearly half (46%) of those surveyed indicate they are collaborating with external entities, exploring outsourcing and vendor partnerships to cultivate improvement.

“It was anticipated that EHRs would be the main driver of broad performance improvement, but that has not occurred in many cases,” says Timothy Kinney, managing director, Navigant. “Instead, providers are now taking other steps, including looking outside their organizations to collaborate with external entities and leveraging advanced technology solutions, and they’re seeing successes.”

About Navigant Consulting Inc.

Navigant Consulting Inc. (NYSE: NCI) is a specialized, global professional services firm that helps clients take control of their future. Navigant’s professionals apply deep industry knowledge, substantive technical expertise, and an enterprising approach to help clients build, manage, and/or protect their business interests. With a focus on markets and clients facing transformational change and significant regulatory or legal pressures, the firm primarily serves clients in the healthcare, energy, and financial services industries. Across a range of advisory, consulting, outsourcing, and technology/analytics services, Navigant’s practitioners bring sharp insight that pinpoints opportunities and delivers powerful results.