Rural hospitals face significant payment disparities compared to urban hospitals

The data may provide fodder for rural hospitals to demand better rates from commercial payers.

The most rural and independent hospitals, as well as government-run rural hospitals, face the worst commercial payment rates among all hospitals, according to new analysis.

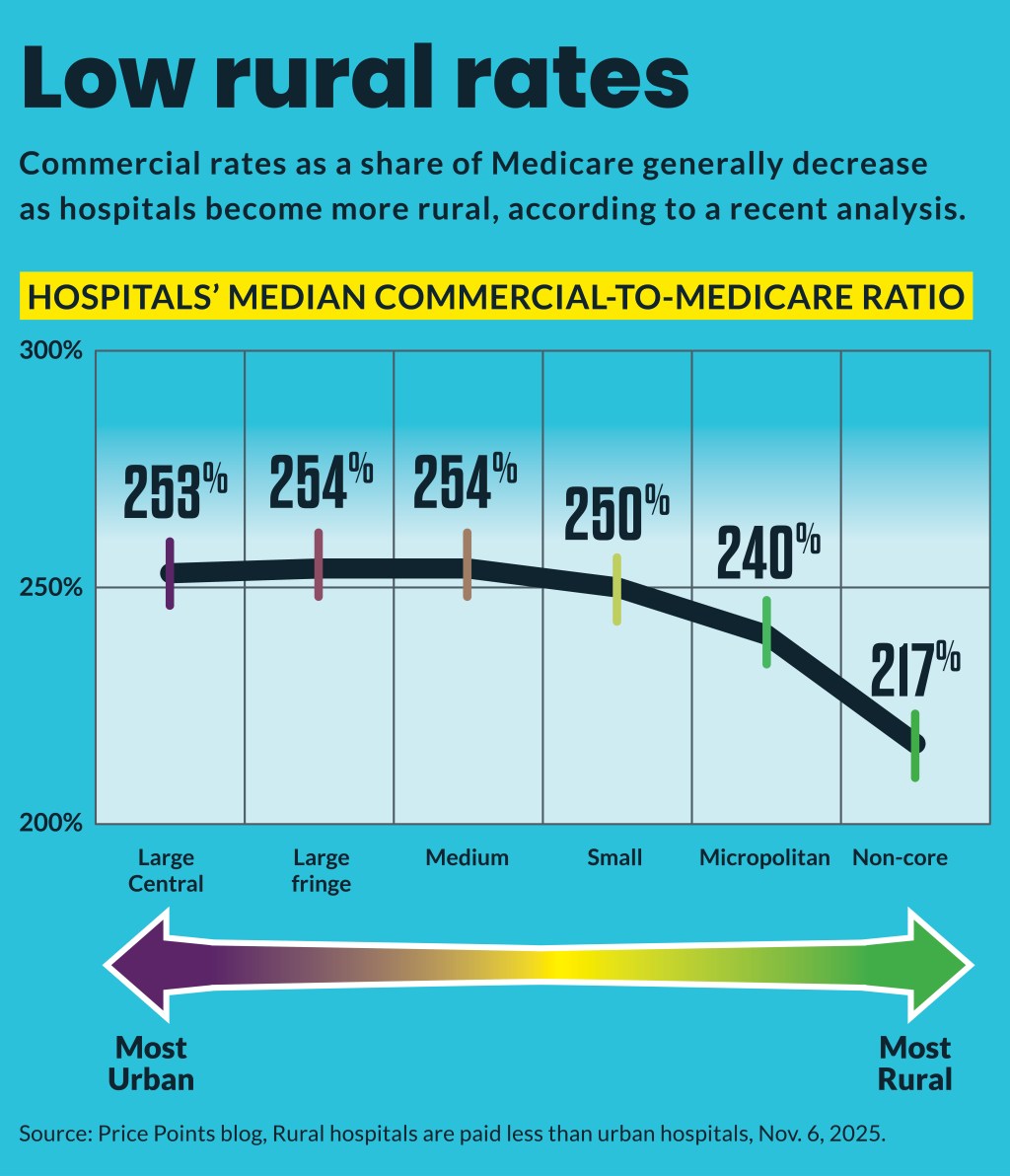

Overall, rural hospitals are reimbursed roughly 20 percentage points less than urban ones, relative to baseline Medicare rates, according to an analysis of price transparency data from more than 5,000 U.S. hospitals by Dan Snow, a researcher and data scientist at Turquoise Health. The examination of PPO commercial rates found the median rate at a rural hospital is 232% of Medicare, while the median commercial rate at an urban hospital is 253% of Medicare.

“The gap was larger than I thought,” said Snow.

But the commercial rate gap also widened as hospitals’ locations became more rural. Hospitals in the most rural counties are reimbursed roughly 33 percentage points less than urban hospitals, and 23 percentage points less than rural counties closer to urban areas, he found.

“There’s just like a very clear decline in the commercial-to-Medicare ratio as you get more rural,” Snow said. “And I just didn’t quite expect the trends to be that clear.”

Snow further found that rural hospitals’ commercial rates were the worst among the most-rural independent hospitals and at rural government-owned hospitals.

In contrast, there was little rate variation found among urban classified hospitals, where medians are around 250% of Medicare across the board.

Snow said the findings could be useful for rural hospitals in their negotiations with commercial payers.

“They can take this to payers and be like … ‘We’re not getting the same deal as everyone else,’” Snow said. “Maybe this data alone would not be convincing, but now that price transparency data exists, and they can see everyone else’s prices, they might see something like this, go check the rates for some of their providers in their market and start demanding higher rates.”

Service line gaps

The rural-urban hospital commercial rate gap extended to service lines, with the analysis finding the largest gaps including:

- Behavioral health

- Cardiovascular

- Oncology

- Dermatology

Only in radiology and laboratory/pathology did rural hospitals garner higher rates.

The findings came as a new report of increasing rural hospital service line closures by the Center for Healthcare Quality and Payment Reform (CHQPR). That report found 27 hospitals closed their labor and delivery units or plan to shutter them by the end of 2025, compared with 21 last year. Additionally, only 41% of rural hospitals now offer labor and delivery care, according to the report.

That followed previous reports of other services discontinued by rural hospitals. For instance, a 2024 Chartis analysis found 382 rural hospitals halted chemotherapy services from 2014 to 2022.

“The primary cause of these overall losses is not low Medicaid or Medicare payments or losses on uninsured patients,” said the CHQPR report.

Instead, it blamed “private insurance companies (including Medicare Advantage plans as well as commercial health insurance) paying rural hospitals less than what it costs to deliver services to patients.”

CHQPR argues commercial health plans need to provide payment rates high enough so that they not only cover the costs of services to the patients with private insurance but also offset the hospitals’ losses on services to uninsured and Medicaid patients.

Snow’s analysis didn’t find rural hospitals were able to hike commercial rates to cross-subsidize their higher share of Medicare patients.

Outpatient advantage

Snow’s analysis also found a consistent disparity between commercial rates for inpatient and outpatient care, with the latter consistently receiving higher rates relative to Medicare.

In the four urban classifications in his analysis, the gap between inpatient and outpatient rate medians ranged between 55 to 65 percentage points. However, that gap jumped to roughly 95 percentage points for rural hospitals.

“That trend holds like almost no matter what you’re looking at — inpatient is just seemingly always lower than outpatient on average as a percent of Medicare,” Snow said.

He noted that despite the rate gap, the dollar amounts likely remain much larger for inpatient care.