More hospitals adopt tech-driven screenings for charity care eligibility

States are increasingly mandating various types of charity care pre-screening.

More hospitals are implementing technology-driven screenings of their patients to automatically qualify them for charity care, according to recent industry outreach.

Undue Medical Debt, a non-profit that has worked to forgive $15 billion in medical debt for 22 million patients, reached out to hospital and health system finance leaders and others to identify challenges, opportunities and lessons learned from implementing charity care presumptive eligibility approaches.

“More and more we hear it’s becoming more common, and hospitals are beginning to think through how they can deploy these predictive analytic tools farther upstream in the workflow, where they might have traditionally just used them downstream as a part of their debt collection process,” Eva Stahl, vice president of policy engagement and research at Undue Medical Debt. “In terms of how widespread it is, I don’t think we fully know quite yet, but certainly in one-on-one conversations with hospital partners, it’s something that is a more common conversation point.”

The need for implementing front-end screening for charity care may soon increase.

“We know that there will be increased volume in demand for financial assistance as people lose their insurance over the coming couple of years due to policy changes and cuts at the federal level; that seems inevitable,” Stahl said.

Her organization’s examination of incorporating presumptive eligibility screenings for charity care into financial assistance programs came as the American Hospital Association (AHA) recently recommended the practice to finance leaders. Analyzing readily available financial and other data to approximate a patient’s financial need as part of presumptive eligibility screenings “could be even more critical moving forward, for both the patients receiving financial assistance and the hospitals seeking to avoid excessive administrative burden,” said an AHA blog post.

Data-driven charity care eligibility screenings aim to move beyond traditional patient applications for assistance, which are unevenly used because patients may be overwhelmed by that process or never pursue it because they avoid reading their bills, Stahl said.

“It becomes increasingly important for hospitals to think about alternative ways to help people get to the financial help that they need and make sure they’re getting credit for that charity care and reducing the front load administrative burden for those in working in revenue cycle and medical billing,” Stahl said.

State requirements

The efforts by hospitals come amid a growing number of state mandates on charity care screening.

For instance, beginning in January, North Carolina hospitals will be required to implement screening policies to determine charity care presumptive eligibility for individuals with incomes up to 300% of the federal poverty level (FPL).

The requirement applies to the 99% of hospitals in the state that opted into a comprehensive debt reduction initiative that used federal Medicaid funds to cancel up to $4 billion in medical debt.

The North Carolina program aims to ensure all eligible patients are guaranteed financial support, prior to receiving a bill. Those hospitals also will need to limit co-payments for ED visits based on incomes.

Despite some states implementing charity care pre-screening requirements, hospital uptake nationally remains a “patchwork,” said Stahl.

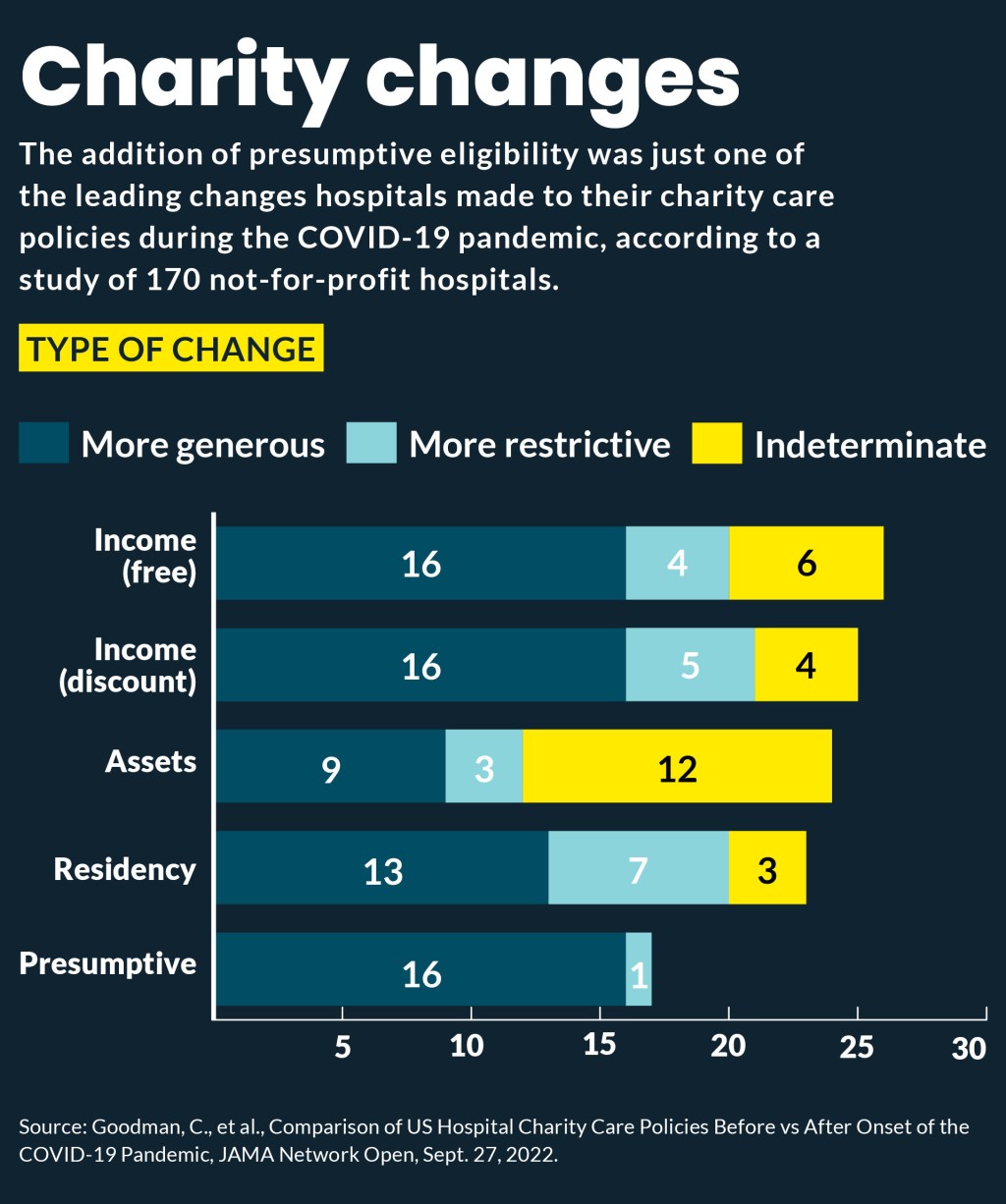

One study of 151 tax-exempt hospitals reported 84% updated their charity care policies between 2019 and 2021, with some expanding charity care and eligibility criteria and 16 expanded presumptive eligibility.

Charity care costs have sharply accelerated since the COVID-19 pandemic and some hospitals have expressed concern over the trend. For instance, in Colorado, where a state mandate for income-based charity care went into effect in September 2022, hospitals have seen their charity care costs nearly double from that year to 2025, according to a report by the Colorado Hospital Association.

Making the case

Using tools and vendors to access the data needed for prescreening patients for charity care can be expensive, so hospitals will need to justify the cost.

Leveraging data tools at the front end of the patient financial workflow to accelerate offers of financial assistance can reduce administrative burdens for hospitals, said Stahl.

“It helps your patients and it can help redirect your staff toward denials prior auth and other burdens that they’re sitting with,” Stahl said.

Data-driven front-end screening also may help some uninsured patients who are eligible for Medicaid enroll in that program.

“We appreciate that all of these tools are costly and I think there are some creative activity happening around the country to think about other ways to access income information from the government directly,” Stahl said.

She cited efforts in several states, including Oregon, Washington and California to provide hospitals with that data.

Additionally, such tools can ensure hospitals are not inadvertently increasing their bad debt.

“If you have non-paying patients, you would rather have them be in charity care than bad debt because that counts as a community benefit and you don’t want bad debt on your books,” Stahl said.

Implementation efforts

Stahl said that beyond cost concerns, hospital executives have concerns about whether screening tools are accurate.

Some have opted to test them by deploying the tools slowly moving up the workflow.

Her group’s assessment of such hospital initiatives identified several key areas of concentration:

- Workflow. Bolster existing financial assistance policies and procedures to include a robust presumptive eligibility screening and determination approach

- Technology. Adjust current financial assistance policies and procedures to fully leverage predictive analytic tools

- Evaluation. Conduct routine data and landscape scans to understand how best to target, tweak and scale financial assistance policies and presumptive eligibility initiatives

- Communication. Proactively share data and trends with patients, partners and policymakers

- Leadership. Develop champions among senior leaders and board members who will invest in the technology, workforce and infrastructure to upgrade financial assistance policies and procedures as an integral part of delivering quality care

“Obviously hospitals have different structures and under their revenue cycle umbrella about how and where financial assistance workflows fit,” Stahl said. “Some fall to community benefits, some don’t.

Some health systems examine their community benefit data and medical billing data to identify local areas or ZIP codes where they have high levels of financial assistance or unpaid medical bills. That can help target such tools where there’s a high likelihood that patients will need financial assistance.

“Increasingly we’re going to see more and more people show up in need of some form of financial support, whether it’s because of underinsurance, which is already a trend, or just being uninsured because they’ve lost their coverage due to policy changes,” she said. “This is a tool to really help mitigate what we anticipate will be an increase in volume.”