Humata Health prepares providers for Medicare’s WISeR model launch

Providers in six states are preparing for the model's January launch.

The CEO of one of the six vendors implementing Medicare’s new prior authorization (PA) program recently addressed provider concerns on its payment model, uncertainty of the approach of the AI used and challenges in submitting data.

The six-state CMS Wasteful and Inappropriate Service Reduction (WISeR) model, which launches Jan. 1, will require either PA or post-service pre-payment medical review for 17 procedures and services in traditional Medicare.

One vendor was selected for each of the six states in WISeR (Arizona, Ohio, Oklahoma, New Jersey, Texas and Washington) to conduct those PA or pre-payment medical reviews.

Humata Health, which will conduct the PA and pre-payment medical reviews for CMS for all providers in Oklahoma, is educating providers in the state in preparation for next month’s launch.

“We’re doing everything that we can with webinars and direct outreach to providers to both educate them on what the model means but also how to make sure that you’re doing it most efficiently so that you can deliver your care to patients,” said Jeremy Friese, MD, founder and CEO of Humata Health.

The company is already known to many health systems for helping them streamline and improve their claims submissions to payers, including helping them meet PA requirements.

Leading concerns

The model has drawn a range of concerns from providers and others over its expansion of PA into traditional Medicare. Those concerns stem in part from aggressive and increasing use of PA in Medicare Advantage (MA), which health systems blame for extensive payment delays and administrative costs.

“There are two main pushbacks on the model: one is just that prior auth is a pain in the butt and ‘why would we add something that’s a pain in the butt to fee-for-service Medicare?’” Friese said. “And the answer is, there’s a whole lot of care that’s getting delivered to Medicare beneficiaries that is inappropriate.”

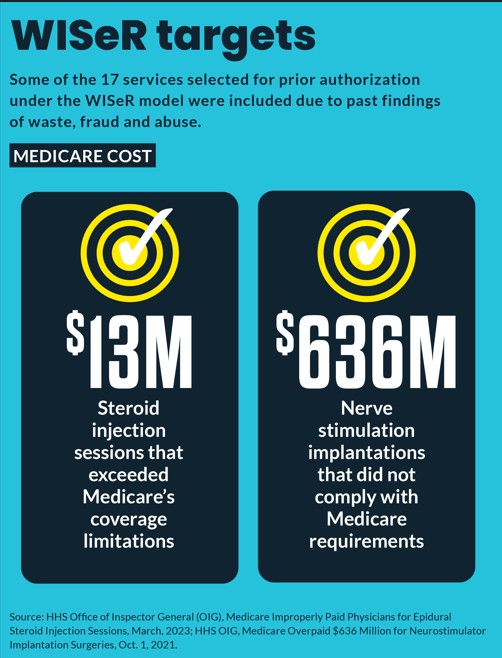

A key element of the model is that it is tightly targeted on those previously found to have high rates of misuse, he said.

“WISeR will exclude inpatient-only services, emergency services, and services that would pose a substantial risk to patients if substantially delayed,” said a CMS fact sheet.

“And so … it’s both a way to protect beneficiaries, but also make sure that we as taxpayers are getting our money’s worth,” he said.

The second major concern raised about WISeR is that its contractors will be paid “a percentage of the savings associated with averted wasteful, inappropriate care as a result of their reviews,” according to CMS.

CMS has indicated that participating vendors will receive 10%-20% of the savings associated with care denials, American Hospital Association (AHA) said in a letter to CMS on WISeR. “Such a structure creates a perverse incentive to deny care that otherwise may be appropriate, as vendors may increase their profits by denying care,” AHA wrote.

“The issue on the payment model is one where we as partners didn’t have any say in this,” Friese said when asked about concerns over the model’s payment structure. He noted WISeR’s payment structure differs from the way commercial payers compensate Humata for its AI-driven PA services.

“We think that the way the [WISeR] model is starting from a financial reimbursement perspective, is probably going to evolve over time. And exactly what that will look like, we don’t know,” he said.

He noted that the WISeR vendor payments will also be adjusted based on factors that include quarterly CMS audits of accuracy and provider satisfaction.

AI transparency

Another common provider concern is that AI-driven WISeR determinations require substantial oversight and appropriate guardrails to ensure it accounts for patient-specific care details.

When asked about concerns over AI-driven reviews, Friese underscored that the software does not deny any services or claims but only flags ones that it cannot clear for clinician review.

“The real key here is the only thing the algorithm can do is say, ‘yes,’ It can’t say ‘no,’” he said. “And if the answer from the computer is ‘not sure,’ it goes to a physician or nurse, so that physician or nurse then has the full picture of ‘what’s the clinical nuance of the patient?’”

The AI review, according to a CMS overview, will be limited to screening PA requests or post-service pre-payment reviews for items and services that:

- May pose concerns related to patient safety if delivered inappropriately

- Have existing publicly available coverage criteria

- May involve prior reports of fraud, waste and abuse

“There are very, very clear rules that need to be met for these particular codes and these rules are not changed, these are not new rules,” Friese said.

Limiting AI’s role to initial screening of claims makes the subsequent clinician review critical. Friese said his company has hired a vendor to perform that function since it does not perform that role in its claims review work for Blues plans or UnitedHealthcare. Although nurses will be involved in reviews, he said physicians will make all final decisions.

In calling for a six-month delay in the program, AHA specifically said it was needed because “many prior authorization vendors previously have not employed or managed physician staff to complete claims review.”

“Additional time would help to ensure that these vendors can properly decipher medically necessary care from superfluous services,” said AHA.

Amid concerns from providers that the new PA process in traditional Medicare would impose new time demands, Friese emphasized the model’s goal of PA approvals within 72 hours for most cases.

“Even though it’s going to go to a human [decision] it still needs to have that super-fast response, which is not standard in Medicare Advantage or in commercial plans,” he said. “These health systems are going to get answers back within three days, and that is unprecedented in the rest of the prior auth industry.”

For its part, CMS has emphasized that providers and suppliers with a demonstrated record of compliance may receive a limited exemption or “gold card” from the WISeR full review process in the future.

“This will help ensure the model focuses on providers and suppliers at higher risk of delivering unnecessary and potentially unsafe care,” said a CMS FAQ.