Q&A: One system’s approach to presumptive charity care

The approach increased Trinity Health's charity care but reduced its bad debt.

A national health system, Trinity Health, moved in recent years to adopt presumptive charity care to assist their patients.

The approach brought both costs and benefits and it required changes over time.

Such initiatives were recently recommended to finance leaders by the American Hospital Association.

FastFinance recently discussed the health system’s approach to data-driven upfront charity care determinations with Emily Huizenga, vice president of business operations strategy at Healthrise, which is Trinity Health’s enterprise revenue cycle partner.

FastFinance: What was Trinity Health’s experience with upfront charity eligibility determinations?

Huizenga: Because Trinity Health is a national organization, we had to expedite our presumptive charity upfront review because we have Oregon, which was one of the first states in the nation to really say ‘You have to run presumptive charity, actually before a statement even goes out.’ So, before a patient even gets a bill, for Oregon, we are actually evaluating for presumptive charity and then letting the bill go out.

California will soon follow Oregon, but for all other states we essentially let patients get a statement and then review for presumptive charity. And then we’ll adjust off or continue down the billing path.

It’s really lightened up the load on our colleagues because we just have fewer applications to process. So, patients are getting the adjustments, and then they get a little letter saying that ‘We adjusted this presumptive charity, and if you think you’re eligible and want ongoing charity, still submit an application.’ But for the most part, it’s that one transaction and done. But we found the education for patients is a good thing: Why was it adjusted off? What does it mean to them?

Automated presumptive charity definitely made it easier to process applications. So, we run presumptive charity on all patients now. Whether they qualify or not, it’s actually good to have the score in our system, so that if a patient calls up and has questions or concerns about a bill, if we see that, ‘Oh, they’re kind of on the threshold, they’re over [income], but they may qualify for financial assistance,’ we’ll jump there first. The idea is ‘It sounds like that balance is really stressful for you. Would you like to see if you qualify for financial assistance?’ And then a lot of times they actually do. It’s just that the presumptive scoring is imperfect, so we don’t know the exact level [of need].

FF: What are the next steps in those instances?

Huizenga: A full financial assistance application, ‘Can you share your full pay stubs with us’ and then we can get it processed.

For the presumptive charity scoring, we use a vendor. Most people do. They go off of address, ZIP code, credit report history; it’s not perfect. [For instance] you could live with your parents or your parents could live with you, and it completely skews or makes them look one way or the other. So, we definitely don’t take it as gospel. But it is a great first indicator of ‘can a patient pay for the service or not?’

FF: Are there large expenses for such services?

Huizenga: Yes. The initial technical setup and exchanging data — because most systems use a vendor — could be cost prohibitive. And then it’s usually a tiered-based, per transaction [cost]. Since Trinity Health has so many transactions, on a per-transaction basis, it’s actually quite low.

You can play with the algorithms and the extracts to make sure that you’re staying within a budget. Because otherwise it could quickly get out of hand. So, be mindful of the timing of when you’re sending transactions that you’re not sending [for individual] visits [but for the patient’s overall] accounts once a month. Because they probably didn’t change their income in that month.

Some other health systems have really transitioned more to the presumptive charity model and have very few people actually processing applications. Presumptive charity could offset the cost of processing applications, although we’ve not seen that yet.

We’ve not made that jump just because it is imperfect and probably over-captures a bit.

FF: What impact has that had on your charity cost trend?

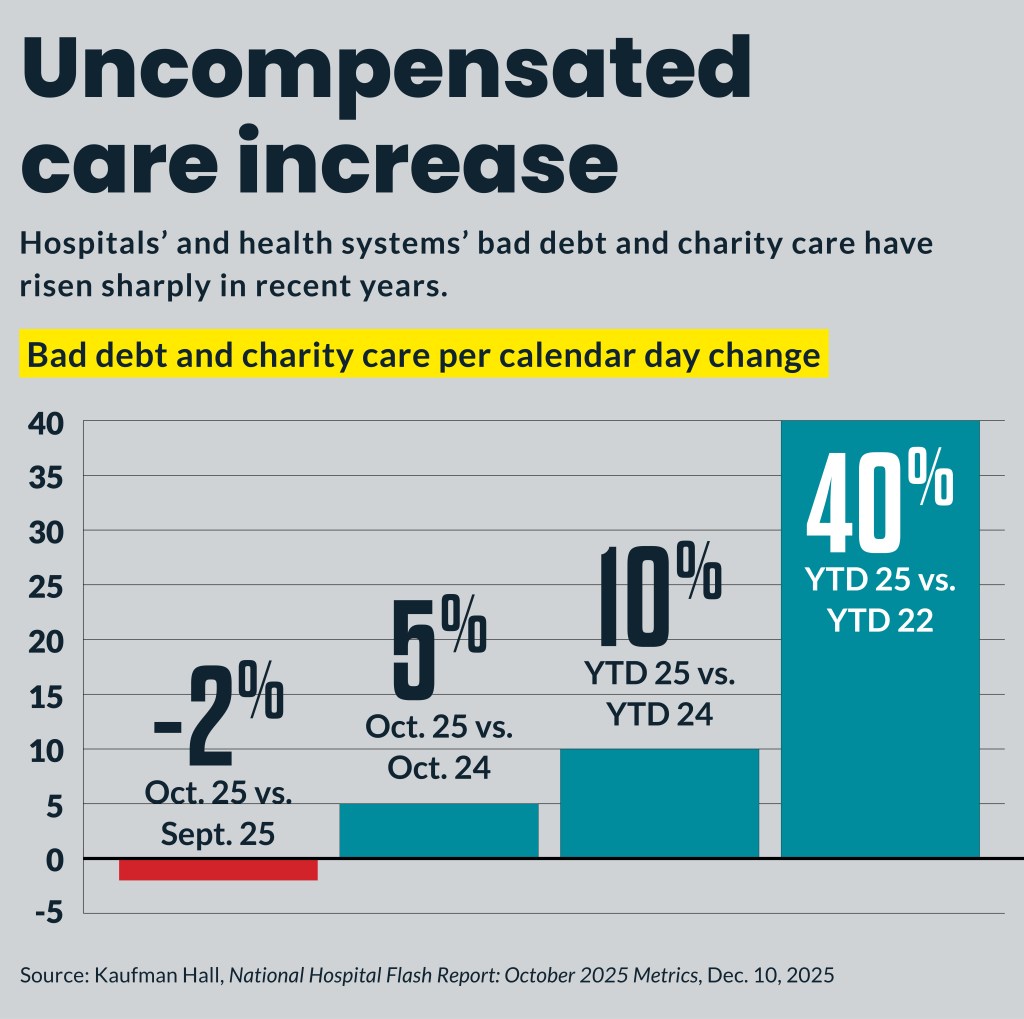

Huizenga: It has trended a lot higher. Our charity is up year-over-year and the majority of that is presumptive charity.

We know that there are some patients that would pay their bill eventually. They would pay their bill once it went to bad debt or once it went to collections. But by moving presumptive so far up in the process, it is better for patients. But it does provide a negative financial impact because we’re not giving patients the opportunities to pay their bills throughout the cycle.

If you go through collections, you can be in collections for a year and then get charity. So, we’ve definitely expedited adjustments and probably seen some patients that would have paid their bills that we’re providing charity to.

FF: Are there benefits, like less bad debt?

Huizenga: Exactly, as charity went up, bad debt went down, which is better for the patients and better for the organization to provide charity from a public [view]. We prefer to provide charity versus writing something off to bad debt.

FF: Does Trinity match its approach to presumptive charity eligibility to varied state requirements?

Huizenga: Trinity Health is on our journey for a single instance of Epic. And ever since we went live in 2020 with our first site, we went live with the presumptive charity program at that time. And at that time, it was essentially right before we sent the patient to bad debt, we would do presumptive charity.

Since then, as we brought on more of our ministries and re-reviewed our financial assistance policy — and in an effort to reduce bad debt and consumer debt — we’ve expanded charity and the timing of presumptive charity in the past few years. We made one systematic change to do that in 2023 to bring presumptive charity up even further in the process.

In 2024 the Oregon law was enacted. Oregon, so far, is the only state that we run charity before patient even gets a statement.

FF: Otherwise, it’s after the statement?

Huizenga: Yes, after a few statements, we’ll run it for presumptive charity and [if they don’t qualify] then they’ll get another statement and then go through the collections process.

FF: Are there lessons learned for others looking at this approach?

Huizenga: Yes, absolutely. Sending letters to the patients when they are approved for charity, that does come with an expense. Our mail and postage costs are up. A lot of that is due to all of the financial assistance letters that we’re printing. Because when you do presumptive charity, we just do an account. And every time they come in for a visit, that’s one account. It’s not like an application, where we just adjust all your accounts associated with an application.

So, we send a letter every single time. But it’s important to communicate that to the members.

Making sure that our customer service colleagues are trained and aware of ‘Here’s what happened on the account,’ particularly if a member calls in and wants more financial assistance or they have older accounts that for some reason fell through. Or they have upcoming procedures where they want to get it taken care of. Making sure that we have a pathway there and we’re really helping the member through and navigating that. And also that they’re aware that a patient can opt out if they wish. We’ve had probably less than a handful that ever wish to opt out [of charity care]. People are generally very happy that we’re taking care of their statements.

FF: What would you change if you had the process to do over again?

Huizenga: We chose a vendor that we knew. But over the past few years there’s been a lot of vendors in the space of financial literacy and helping members. If you can tie the full financial experience in a bit more. So, perhaps we would shop around more. Or just see what’s out there; how we can tie presumptive charity into an overall member experience. Maybe that’s ways to pay. Maybe there’s some organizations that say ‘Oh, they don’t qualify for charity,’ but they can kind of instantly set them up with a payment plan link. There’s some really cool stuff out there that we have not taken full advantage of, just because we’ve focused on going live.

Editors’ note: This transcript was edited for length and clarity.