Epic lawsuit filed by Texas aims to help health system finances

The lawsuit contains market insights that may benefit health system leaders, said a healthcare attorney.

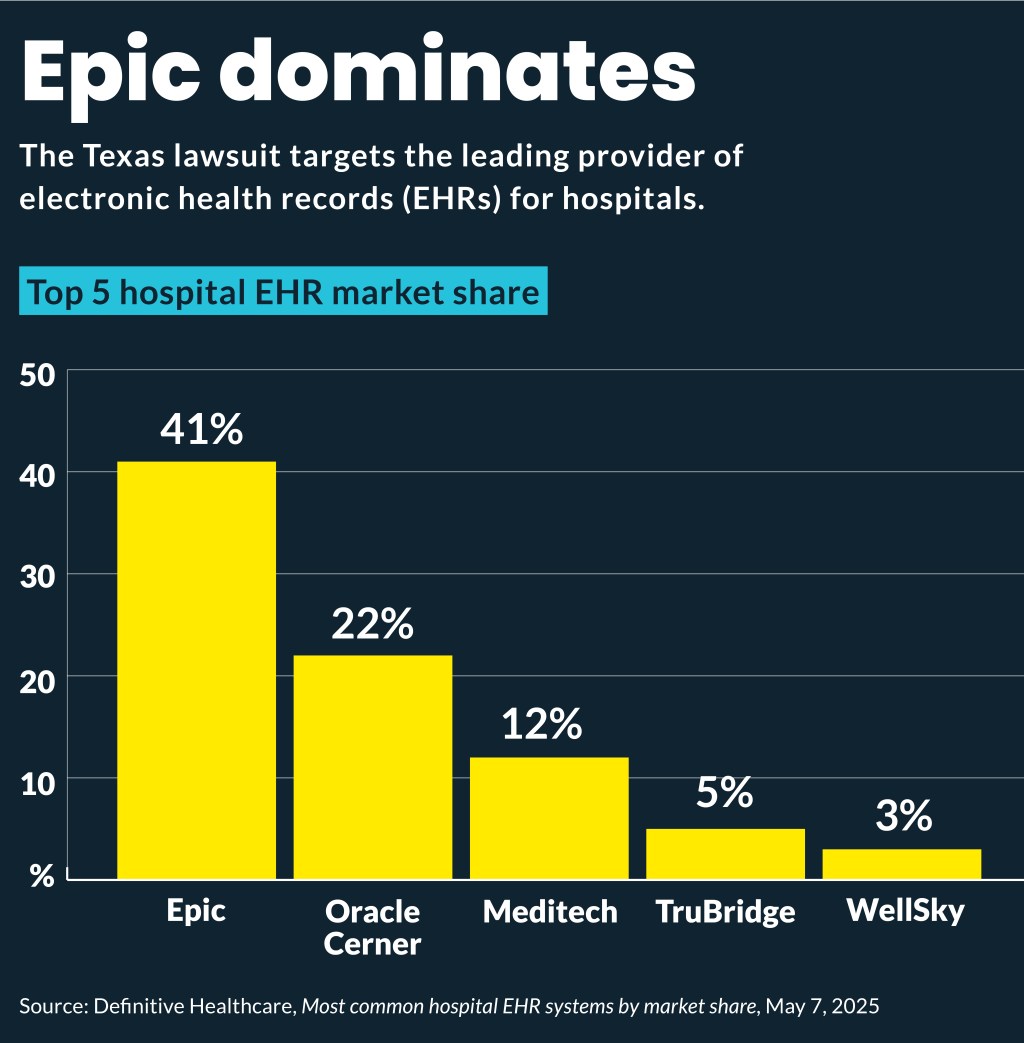

A range of alleged financial damages against hospitals and health systems underpins the recent anti-competitive lawsuit by Texas against dominant electronic health record (EHR) system vendor Epic.

Although not mentioned in a press release accompanying the Dec. 10 lawsuit against Epic, the Texas attorney general’s filing details a range of financial and other harms the company’s practices allegedly have inflicted on health systems, including:

- Highest costs among EHR vendors

- Increased fees if not using Epic exclusively

- High switching costs

- Yearslong in-person hospital IT staff training requirements

- Barriers to allowing other hospital vendors to access their patient data

- Financial burden on under-staffed rural hospitals

- Increased clinician burnout

The lawsuit said it aimed, in part, to help Texas hospitals that want to develop new Epic EHR applications that combine data with AI in order to give patients new care options.

Why it matters

The financial significance of EHRs for health systems underscores the importance of the case for executives, said Colin Zick, partner and chair of Foley Hoag’s healthcare compliance practice.

“It definitely bears watching because … your EHR is going to be one of your most significant expenditures,” Zick said.

The details of lawsuit can help executives under the EHR marketplace, not just what products are available, but what terms health systems can get.

“That’s valuable information that may not have been that easy to get,” he said. “So, I would say that for folks in management positions in hospitals, this complaint is required reading.”

EPIC’s response

Epic said the lawsuit is “flawed and misguided by its failure to understand both Epic’s business model and position in the market and the enormous contributions our company has made to our nation’s healthcare system illustrated by products like MyChart —software that tens of millions of Americans depend on every day.”

“Every month, we improve quality of care by helping providers see a more comprehensive picture of their patient through over 725 million record exchanges—more than any other electronic health records vendor—and over half of these are with non-Epic systems,” an EPIC spokesperson wrote in an emailed statement. “Health systems using Epic shared information with almost 1,000 patient-facing apps 2 billion times in the past year.”

The lawsuit makes “some really broad claims,” Zick said, so it will be important to see what support there is for those.

“You can expect Epic to pretty quickly file some sort of motion to get rid of this,” Zick said. “It’ll be interesting to see what that is; what do they say in response?”

National ramifications

The suit marks the third major case filed in 2025 against Epic.

Earlier in the year, Particle Health filed a federal lawsuit that accuses Epic of leveraging market power to restrict patient data access. A federal judge rejected Epic’s request to toss the case and it is proceeding into the discovery phase.

Additionally, a lawsuit filed by CureIS Healthcare alleges Epic used market dominance to block innovation.

If Texas’ lawsuit is successful, Zick expected other states to undertake their own such lawsuits.

“It is something that could be setting a model here,” he said.

It is also possible that Epic will respond by changing business practices targeted by the lawsuit.

“They could change some of their contract language, for example, going forward, some of their contracting policies and be able to say, ‘Look, you’re looking at stuff in the past, we’ve evolved,’ and make themselves a bit of a moving target, which would be harder for the attorney general to land on,” he said.

Case specifics

The Texas filing took aim at Epic’s market dominance by highlighting that it has at least partial patient EHRs for 90% of the U.S. population.

It highlighted health system costs by noting the initial onboarding and storage for EHRs costs hospitals tens of millions to billions of dollars. It specifically cited the $500 million cost for Memorial Hermann Health System to implement EPIC in 2024.

The suit said Epic has the power to exclude competitors by deciding whether to allow vendors to send API calls to access the health systems’ data that Epic stores.

“Even if a hospital wants to give access to a hospital’s data, Epic can veto the access by refusing to provide the relevant APIs to the developer,” said the lawsuit.

That is how Epic blocks access to patient data, despite Epic saying it does not own or claim rights to its customers’ patient data, said the lawsuit.

Epic is often the highest-priced option for an application, said the lawsuit, and its employees say the company’s EBITDA margin is at least 30% — double the margin of the average healthcare IT company.

“Epic uses these monopoly profits to build literal castles and moats around their headquarters in Verona, Wisconsin,” said the lawsuit.

Epic locks out other competitors by overstating Epic’s coming capabilities and threatening customers with across-the-board “maintenance” fee increases if they opt out of Epic exclusivity, said the lawsuit.

If a hospital keeps its Epic software current across the board, and meets additional requirements, it receives an “honor roll” good maintenance discount, said the lawsuit. The combination of maintenance penalties and honor roll discounts, according to the lawsuit, can be larger sums than EPIC’s recurring fees.

“Therefore, Epic de facto conditions a hospital’s use of Epic’s database software and hospital’s continued use of Epic’s applications,” said the lawsuit.

The risk of paying higher fees is enough to deter many customers from even considering other developers even if another developer’s solution is better than Epic’s and even if Epic does not currently offer the solution, it said.

Health system’s staff also are negatively impacted by Epic’s “increasingly complex software architecture,” which they are forced into retaining, said the lawsuit. The dominant EHR provider’s approach requires physicians, nurses and staff to spend hours on the administrative portion of Epic rather than on providing care, contributing to the high rates of provider burnout, it said.

The lawsuit seeks unspecified damages and injunctions on anti-competitive actions by Epic.