Nathan Kaufman: Hospital-based anesthesia and radiology operate in a broken financial model

The good ol’ days of hospital-based physicians providing services at no cost in exchange for exclusivity are over, creating significant disruptions.

Health systems are facing a growing shortage of anesthesiologists and radiologists, a shortfall that is driven by a broken business model for those types of services.

Underpayment for anesthesia and radiology care by Medicare and Medicaid combined with a lack of experience in related revenue cycle management and high fees charged by select private equity (PE)-backed companies translates into hospitals having to pay more for those much-needed services.

Hospital subsidies for anesthesia range from $10,000 to $30,000 per bed, and those for radiology range from $5,000 to $15,000 per bed.

How hospitals can meet the subsidy challenge

To address this disruption, health system leaders should ask themselves the following questions:

1 Should we make or buy? The expense of hiring hospital-based physicians is substantial. These physicians expect compensation at the higher end of fair market value (FMV), along with benefits and support staff. Many hospitals lack the expertise to manage a revenue cycle for the professional services of these physicians. Health systems must objectively assess whether it is more cost-effective to employ hospital-based physicians or to contract with and financially support an independent or PE-backed group.

2 Do we have the right leadership in place? Leadership is a crucial success factor for hospital-based physician groups, regardless of ownership. A physician with exceptional leadership skills — beyond just being an outstanding clinician — should be paired with an administrative dyad partner who is intimately familiar with the specialty’s service delivery and is respected by clinicians. An organization cannot compensate for poor physician or administrative leadership. In addition, health systems should designate both anesthesia and radiology as service lines that are overseen by executives that have deep experience in these fields.

3 Can we optimize payment rates from commercial insurers? Government payers are underfunding hospital-based physician services. Optimal commercial reimbursement is critical to support the service. Some hospital-based physician groups can receive as much as twice the commercial reimbursement as other groups, depending on the group’s or the hospital’s ability to negotiate fair rates from the payer. The higher the rates, the lower the financial support the hospital must provide.

4 Are we using the appropriate benchmarks? The hospital and physician group must agree on metrics for quality, productivity, professional conduct, efficiency and administrative services. Specific definitions of breaches due to a group’s inability to achieve metrics should be detailed in the hospital-based physician employment agreement or professional services contract to address negative variances. A common process is to provide a few months for the group to correct their breach in order to avoid the disruption associated with replacing the existing group. Regardless of how a health system proceeds, these hospital-based physician services should be treated as a serviceline with an experienced executive team assigned to and accountable for their performance

Enter PE investors

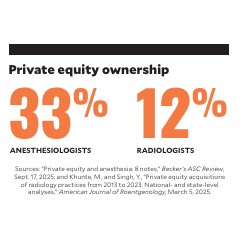

PE firms have invested heavily in anesthesia and radiology practices, promising efficiency, growth and enhanced services, and seeking a handsome ROI. A study published in March 2025 found that between 2013 and 2023, PE-backed firms acquired 151radiology practices involving 3,463 locations.a The same study found that about 11.8% of radiologists are employed by private equity investors.b Meanwhile, about 33% of anesthesiologists have been acquired through private equity physician practice buyouts.

While some PE-backed companies are improving care delivery and maintaining a group practice culture, others prioritize short-term business interests over long-term clinical and professional value.c Some PE-backed companies take advantage of the hospital-based physician shortages by charging hospitals management fees well above the value of their administrative services. In 2023, the Federal Trade Commission (FTC) sued a PE firm and its affiliated anesthesia company, alleging that the two groups executed a multi-year anticompetitive scheme to consolidate anesthesiology practices, hike prices and increase their own profits.d

No simple solutions

Challenges lie ahead for hospitals in both of these service lines.

Anesthesiology. The problems we are facing are only going to become more severe in the future. The shortage of anesthesiologists is worsening. The proportion of medical facilities reporting a shortage of anesthesiologists rose to almost 80% in 2022 from 38% in 2020.e Also in 2020, 45% of anesthesiologists were over 55 years old.f Moreover, there are geographic disparities in the supply of anesthesiologists, especially in rural markets. Within rural counties, 81.2% had no anesthesiologist, and 58.1% had no certified registered nurse anesthetist (CRNA).g While CRNAs have eased the problem, their compensation has increased significantly, and commercial insurance companies are paying CRNAs less for the same work that an anesthesiologist performs. Thus, hospitals must subsidize the professional fees of CRNAs as well.

Meanwhile, Medicare and Medicaid underpay for professional anesthesiology services. In its 2026 physician fee schedule, Medicare pays about$22 per American Society of Anesthesiologists (ASA) unit, while Medicaid pays even less.h Anesthesiologists generate about 10,000 ASA units per physician.i As a result, an anesthesiologist who treats Medicare and Medicaid patients exclusively may collect $200,000 in professional fees. In this scenario, after malpractice, benefits and overhead costs, these highly trained professionals would take home less than $150,000 in compensation. Anesthesiologists have relied on a massive cost shift to stingy commercial payers to compensate for the government’s underfunding. In 2024, the national average commercial payment per ASA unit was $80.70.j

Most anesthesia groups are not sustainable without significant support from the hospital.

Radiology. Imaging volumes are increasing 3%-4% annually, outpacing workforce growth, which is only about 1% per year.k

Training bottlenecks and retirements constrain the radiologist workforce. Attrition rates among radiologists have increased by 50% since 2020, primarily due to retirements. About 32% of radiologists are 55 or older.l And there is a shortage of graduates to replace them.m

Geographic disparities are severe — some states have as few as nine radiologists per 100,000 people, while the national average is 13.n This has led to underserved regions, especially in rural areas.

In the face of this severe shortage, reimbursement is falling, with the Medicare conversion factor for 2025 decreasing by 2.83% for diagnostic radiology and 4.83% for interventional radiology. In many cases, the professional fees generated by interventional radiologists cover less than half of the current compensation rate for these physicians. These factors have forced radiology groups, which were once self-sufficient, to seek ever-increasing financial support for their services.

An unavoidable mandate

The struggles hospitals face with their anesthesiologists and radiologists are unlikely to improve in the near term. The cost of employing and/or contracting with hospital-based physicians is just another unplanned, unfunded mandate that health systems must absorb.

Footnotes

a. Khunte, M., and Singh, Y., “Private equity acquisitions of radiology practices from 2013 to 2023: National- and state-level analyses,” American Journal of Roentgenology, March 5, 2025.

b. Mathewes, F., “Private equity and anesthesia: 8 notes,” Becker’s ASC Review, Sept. 17, 2025.

c. Balesh, E., Hund, H., and Keller, E., “Private equity and radiology: Productive partnership or inherently misaligned?,” Seminars in Interventional Radiology, Nov. 2, 2023.

d. Mathewes, F., “Private equity’s place in anesthesia,” Becker’s ASC Review, Jan. 23, 2025.

e. “Job outlook: Anesthesiologist employment opportunities in 2025,” Wellhart.

f. Menezes, J., and Zahalka, C., “Anesthesiologist shortage in the United States: A call for action,” Journal of Medicine,

Surgery, and Public Health, April 2024.

g. Cohen, C., et al., “The surgical and anesthesia workforce and provision of surgical services in rural communities:

A mixed-methods examination,” Journal of Rural Health, January 2021.

h. American Society of Anesthesiologists, “CMS finalizes policies undermining anesthesia payments and ability for

anesthesiologists to meaningfully participate in the quality payment program,” Washington alert, Oct. 31, 2025.

i. Anesthesia Business Consultants, “How hard do anesthesia providers work?” Anesthesia Industry eAlerts, Aug. 5, 2019.

j. Morewood, G., et al.,“ASA commercial conversion factor survey results – 2024,” ASA Monitor, November 2024.

k. Anderson Hospital, “Radiologist shortage: A national healthcare challenge,” Aug. 7, 2025.

l. AAG/H, “Running on empty: How hospitals can survive the radiologist shortage in 2025,” Aug. 24, 2025.

m. Casey, B., “Radiology workforce shortage tightens,” The Imaging Wire, June 23, 2025.

n. Hall, J., “Where things stand with the radiologist shortage,” Diagnostic Imaging, June 18, 2025.

Private equity ownership

Anesthesiologists 33%

Radiologists 12%

Sources: “Private equity and anesthesia: 8 notes,” Becker’s ASC Review, Sept. 17, 2025; Khunte, M., and Singh, Y., “Private equity acquisitions of radiology practices from 2013 to 2023: National- and state-level analyses,” American Journal of Roentgenology, March 5, 2025.