Health System M&A Trends in 2026 Point to More Deals, Different Targets

Transactions are expected to rise from historic lows, driven by distressed assets, outpatient investment strategies and reassessment of market presence.

Hospitals and health systems were expected to accelerate the trend of mergers and acquisitions (M&A) in 2026, although the type and size could change, said an industry advisor.

Anu Singh, managing director for Kaufman Hall, said that overall, he expects health system M&A trends in 2026 to continue those of previous years.

Those trends include:

- More acquisitions of financially distressed or underperforming organizations

- Systems leaving markets in which they are not dominant

- More mega-merger deals

- For-profits that are selling, not buying

Hospitals and health systems increasingly are seeking deals for nonhospital targets like urgent care centers, ambulatory surgery centers and telehealth or virtual platforms.

Additionally, the average size of the acquired distressed organization is increasing.

2026 volume trend

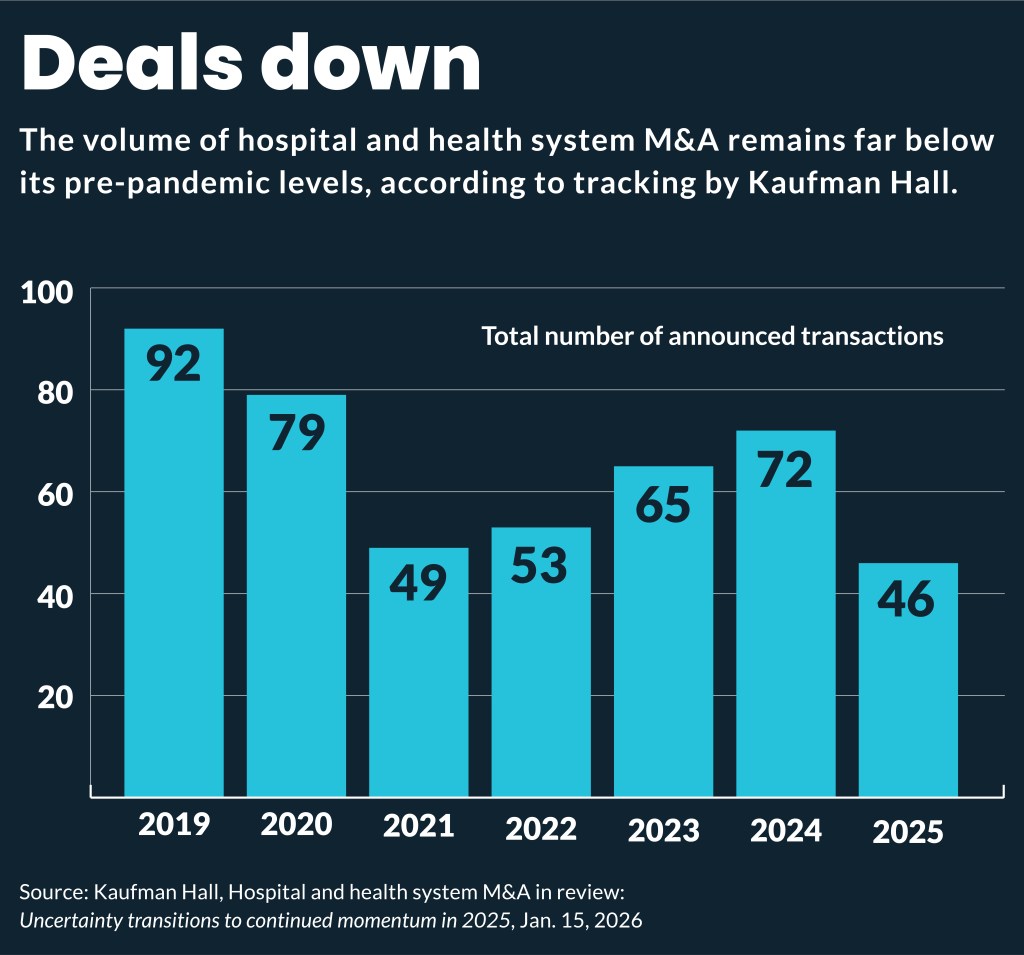

Although Singh expects transactions to increase in 2026, that will come off a historically low base. Last year, there were 46 transactions — only half as many as the 96 deals that occurred in 2019 and the fewest in the last 15 years of Kaufman Hall’s tracking.

That historically low volume likely was affected by the uncertainty in the first two quarters as the One Big Beautiful Bill Act (OBBBA) was taking shape.

“But now, withstanding those what I’d consider to be short-term or very focused time periods, we are on a trajectory of returning to transaction levels that were pre-pandemic,” Singh said. “And since we’re not there yet, I think we can continue to see that increase.”

Why for-profits are selling

Singh said the trend of for-profits switching from acquirers to primarily sellers in hospital M&A deals is driven by a post-pandemic spike in expenses and inflation, while payment increases have lagged.

“So, you’re actually in a negative margin trajectory,” Singh said. “Scale strategies won’t always work. You have to rethink a business strategy around market presence. And we’re hearing a lot more about being essential in marketplaces.”

That has led for-profit organizations to reassess their portfolio of offerings and markets and to purposely shrink their size to improve performance. The newer approach is to focus on markets in which they are more likely to have success.

“Think about it as a quality of revenue versus a quantity of revenue strategy,” Singh said. “In those instances, you’re going to have organizations that are going to be much more disciplined about how they grow and acquire.”

Outpatient shift accelerating

Health systems have undertaken a years-long shift to outpatient care, but Singh sees health system M&A trends in 2026 accelerating this push.

“Health systems right now are looking at their future plans, and many are saying that the level of investment required to hold on to this chassis and this throughput in the inpatient setting is increasingly going to become a challenge,” Singh said.

Another factor accelerating the outpatient shift is that recent physicians prefer different types of employment models and different lifestyles.

“It’s simply that there’s not the same level of supply when you look at overall availability of talent and desire of lifestyle to sustain the same infrastructure we have nationally for physicians,” Singh said. “So, systems are looking at alternative ways to treat patients in a very safe and highly reliable way, but in a new care setting.”

He expects innovative strategies, underlying business models to test, and eventually whole new channels to handle care throughput in the future.

“Now, the pace of that is going to vary by reimbursement and by market, but the fact is that almost every health system is proactively thinking about some of those changes,” he said.

OBBBA effects

Singh expects strategies and approaches prepare for OBBBA cuts to vary on a state-by-state basis. That’s because the timeline of federal cuts is relatively clear, but there is wide uncertainty about how states will react to OBBBA. They may institute their own cuts or new funding for providers, as well as how they will implement some of OBBBA’s provisions.

“That kind of uncertainty is going to create situations in which health systems will look at strategic initiatives and potential partnerships with those implications in mind,” Singh added. “That is, if we’re to do something or not do something, how does it impact where we situate ourselves against reimbursement expectations under the government plans and under state plans as well?”

Singh said some states’ policies are sending intended or unintended signals to market participants or potential market entrants on how the state will view future M&A transactions.