How Health Systems Are Preparing in 2026 for Medicaid Cuts

Fitch Ratings analysts say margin gains, expense discipline and AI adoption are helping hospitals prepare for Medicaid cuts that begin in 2027.

Hospitals and health systems rated by Fitch Ratings are using 2026 to boost revenue and cut expenses in preparation for federal Medicaid cuts that start next year.

Overall, those organizations’ operating margins and operating cash flow margins improved in 2025 and were expected to further bolster both of those key performance metrics in 2026, according to Fitch analysts.

The record 2025 balance sheets and expected further gains in 2026 are driven, in part, by those organizations’ efforts to prepare for coming Medicaid cuts under the One Big Beautiful Bill Act (OBBBA), said Mark Pascaris, a senior director for Fitch.

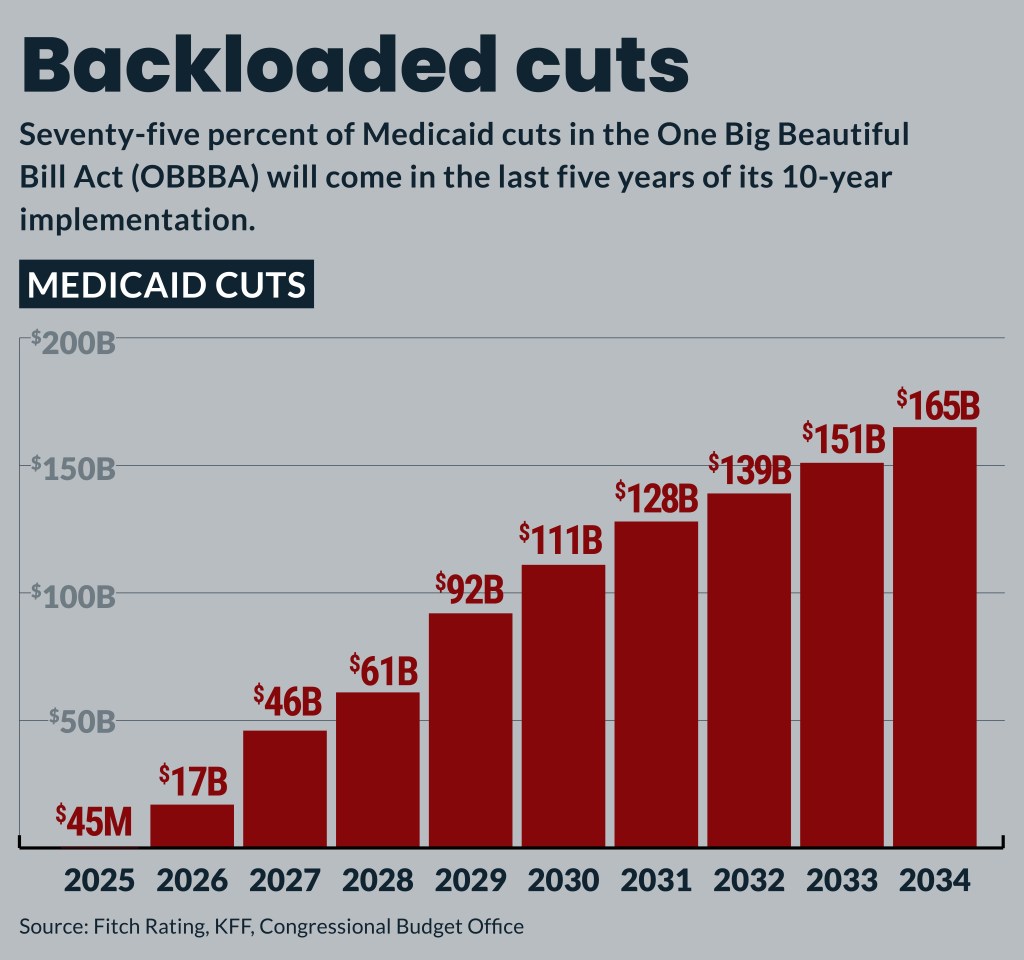

That 2025 law included about $1 trillion in 10-year cuts but those won’t begin to bite until 2027. Three-quarters of OBBBA cuts won’t come until the last five years of its 10-year implementation, said Kevin Holloran, senior director and sector leader for Fitch.

“We’ve got a little blessing of time here; that’s what the sector is going to have to use,” Holloran said.

Overall, Fitch has a neutral outlook on the not-for-profit hospital sector and forecasts median operating margins will improve from about 1.5% to about 2%.

Organizations’ response

Health systems’ policies — both those undertaken in 2025 and planned for 2026 — to prepare for OBBBA cuts include:

• Expanded use of AI. AI has been a major part of every management meeting Pascaris attended for the last year. Its use has focused on labor management and supply throughput.

• Supply cost management. Amid tariff uncertainty, some organizations have partnered with other not-for-profit health systems, private equity and venture capital, said Pascaris. Aggressively managing nonlabor expenses this year will be particularly important since that has supplanted labor as the primary driver of expense growth.

“It’s been a conversation for so long [that] you think, ‘Well, how much more expense management can be done in the sector?’ The answer is ‘Quite a bit, actually,’” said Pascaris.

• Rapid-cycle assessments. Most organizations preparing in 2026 for Medicaid cuts have shifted from periodic, aggressive pushes to eliminate expenses and boost revenue after they were spurred on by a financial crunch, said Holloran. But that push needs to be a daily priority. It could include looking for new ways to diversify revenue and maximize personnel and facilities.

“Do we offer all services at all locations or — and I know this is a horrible word to say in healthcare — do I rationalize some care in certain ways?” he said.

• Payer focus. Larger systems with more leverage report decent top-line rate increases but rates are a headwind for organizations without dominant market positions, said Pascaris. But there also is an increased use of denials and more aggressive claims management. Those trends are driving more contentious negotiations, and more providers are expected to go out of network. At the same time, both payers and hospitals continue to ramp up their use of AI in fights over claims.

• Culture focus. Leaders need to focus on positively shaping their organizations’ cultures, which can affect both revenue and expenses. Those leaders also need to embrace the “culture to take some risk” and try new improvements in revenue and cost management.

“If you have a hunker-down culture, that’s not sustainable, frankly,” Holloran said.

Other 2026 prep opportunities

Health systems preparing in 2026 for Medicaid cuts have split on how they approach investment income, said Holloran. Some only have conservatively invested excess cash, while others are using it to provide long-term growth through equity and alternative investments.

Since the pandemic, more health systems have undertaken more hospital commercial paper programs to provide short-term debt financing to manage working capital and fund projects at lower costs than traditional bonds.

Holloran urged organizations to use caution when they consider issuing more debt for capital projects. He cited the carpenter’s rule of thumb to measure twice and cut once to caution organizations.

“I’d measure three or four or five times before you cut and pull the trigger on capital, and just be absolutely sure it’s the right thing for your organization,” Holloran said.

Overall, capital spending will continue but will shift toward outpatient care, increasing access points and information technology. High-growth markets also will continue to add large patient tower projects.

Energy as service transactions, which aim to add liquidity to the balance sheet, are not seen by Fitch as inherently risky moves. But it is a new type of effort “that will require some scrutiny,” Pascaris said.

Other factors to watch

In addition to the known policy and secular trend pressures, organizations should watch for the emergence of new ones this year, said Holloran. Those could include a resurgence of inflation or new, impactful rounds of tariffs.

They also should track potential lost revenue from the expiration of ACA exchange subsidies. A recent report from Fitch warned that not-for-profit hospitals in a dozen states are at high risk of negative credit shocks if the subsidies are not renewed.