Risk-pay diverges by payer

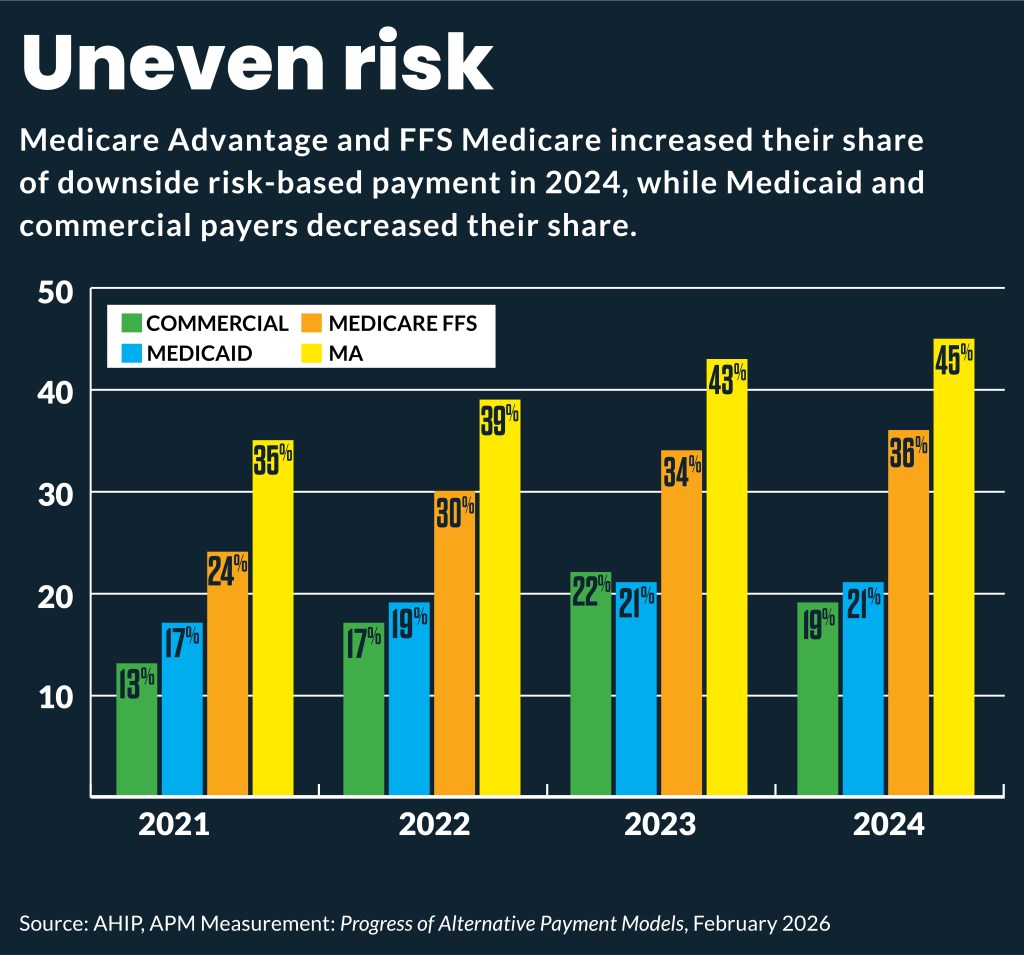

Medicare and Medicare Advantage increased downside-risk participation in 2024, while commercial and Medicaid shares declined, signaling uneven momentum in value-based care payment models.

The share of payments that include downside risk increased in traditional Medicare and Medicare Advantage (MA) but dipped in Medicaid and commercial insurance.

Those findings were included in the annual tracking of payer risk that AHIP took over last year from the Health Care Payment Learning & Action Network (HCP-LAN), which had tracked it since 2016.

Across all insurance types, 28.7% of healthcare payments came through a downside-risk alternative payment model (APM) contract in 2024, compared with 28.5% in 2023. The change from 2023 to 2024 in the share of payments with downside risk by insurance category included:

- Commercial: 21.6% to 19.4%

- Medicare Advantage: 43% to 45.2%

- Medicaid: 21.1% to 20.6%

- Medicare: 33.7% to 36.4%

Seventy percent of health plan respondents said they expect increased APM initiatives over the next two years.

That may be complicated by payer market turmoil, especially among MA plans. That category of Medicare has long driven growth in downside risk models, according to previous years of HCP-LAN data.

Hospitals and health systems “may see less of it from MA plans, given their currently vulnerable position,” said Katie Gilfillan, policy director at HFMA. “Still, they have to prepare because it is coming at them — as AHIP data show — from fee-for-service Medicare, regardless of what MA does.”

The value-based care (VBC) share of payments from fee-for-service Medicare was expected to increase due to such new models as the mandatory Transforming Episode Accountability Model (TEAM). That five-year payment model launched Jan. 1 to improve care coordination and reduce avoidable readmissions for Medicare beneficiaries. Those will add fuel to Medicare’s drive toward downside risk models.

This view was echoed recently by former leaders of Medicare’s Center for Medicare & Medicaid Innovation (CMMI). They said that more downside risk was coming to traditional Medicare, but administrative simplification also was needed to help provider adoption.

Further spurring Medicare risk share will be the Ambulatory Specialty Model (ASM) beginning Jan. 1, 2027. That mandatory, five-year, two-sided risk model is aimed at specialists treating patients with original Medicare for chronic conditions, specifically focusing on low back pain and heart failure.

Provider downside risk readiness

Payer survey respondents’ top three barriers to APM adoption:

- Provider willingness to take on financial risk

- Provider ability to operationalize

- Provider interest/readiness

Some hospital and health system leaders have questioned that payer view and, instead, said that risk model adoption is slowed by the reluctance of their local payers to offer such arrangements.

Still, Gilfillan said that providers’ appetite for risk continues to be driven by the local market and the culture of each organization.

The share of downside risk payment identified by the payer survey is higher than the share of the HFMA member-identified share risk-taking at their organizations. That difference may be driven by what plans have stated previously is higher risk- by nonhospital and nonhealth system providers.

“Providers recognize it is going to be coming at them either way, and there are some organizations that have been preparing for it, are able to operationalize and are doing very well,” Gilfillan said. “For those organizations that are still ramping up their capabilities, they will want to look to those organizations that are successful and learn from them.”

More than three-quarters of health system and hospital executives said in a recent survey that they plan to increase VBC model participation within the next two years. That was an increase from the 57% who said that in 2023, according to survey data from Sage Growth Partners.

Downside risk prep

Surveyed payers said the type of APM activity they expect to increase the most is fee-for-service-based shared-risk and procedure-based bundled/episode payments.

Gilfillan said that organizations that have moved more slowly on VBC would benefit from starting to create the operational processes they need to start taking on risk.

“It takes a while to operationalize risk models,” she said. “So, even if they are not in a lot of risk right now, they should prepare for it and start thinking about their care coordination strategies and all the operational aspects they need to get into place.”

This year, key VBC developments to watch will include provider performance in the TEAM or ASM model.

Additionally, the recently announced Advancing Chronic Care with Effective, Scalable Solutions (ACCESS) 10-year model, will further expand VBC in traditional Medicare. The voluntary ACCESS model will test whether outcome-based payments for technology-enabled chronic care reduce expenditures while preserving or enhancing care quality.

“The ACCESS model will be disruptive to primary care providers where a lot of the tech firms that are able to do primary care management may come into that space and take on those patients,” Gilfillan said.