Not-for-profit healthcare organizations should understand the benefits and risks of FASB’s new alternative accounting approach

The approach non-public business entities use to account for intangible assets and amortize goodwill is now available to not-for-profit healthcare entities, but they should be circumspect in their decision to adopt it.

On May 30, the Financial Accounting Standards Board (FASB) released an Accounting Standards Update (ASU) 2019-16, extending private company accounting alternatives on goodwill and certain identifiable intangible assets to not-for-profit entities.[1] The update affects all not-for-profit entities as defined in the FASB’s Master Glossary, including not-for-profit conduit bond obligors with publicly traded debt. It became effective immediately.

Although some non-public business entities have used these accounting alternatives since 2014, the alternatives continue to be puzzling to many CFOs, executives and investors. The decision to adopt this guidance affects company balance sheets and earnings and could potentially derail future sales or mergers of not-for-profit organizations. Before finance executives make use of the opportunity, they should thoroughly understand the accounting alternatives and their relevance for the healthcare industry and be mindful of potential implementation benefits and obstacles.

A decade in the making

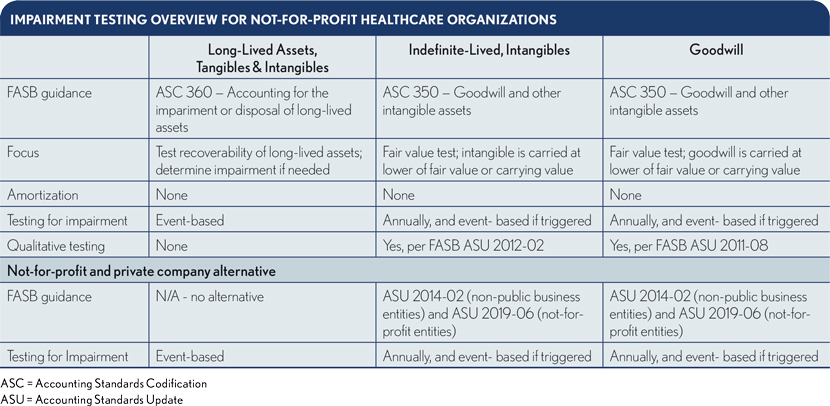

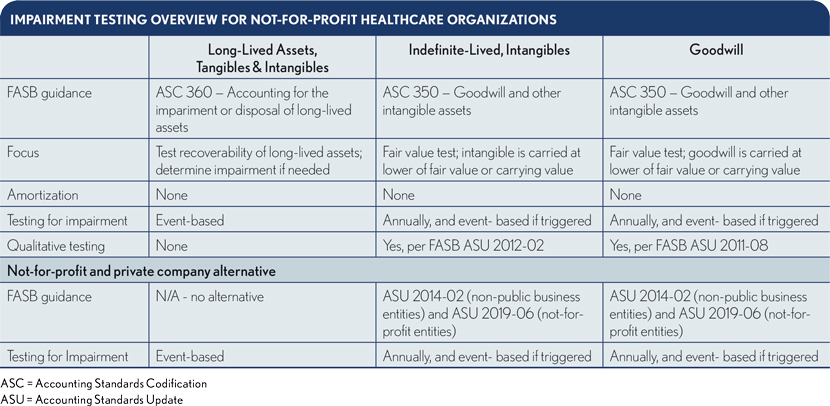

Business combination accounting rules for not-for-profits changed dramatically at the beginning of this decade when the FASB issued ASU 2010-07 in January 2010, allowing organizations to begin recognizing goodwill and intangible assets.[2] An attempt to relax rules with qualitative testing (ASU 2011-08 and ASU 2012-02) was met with skepticism by many, but it simplified impairment testing for many entities. In 2014, the FASB relaxed purchase accounting and impairment testing for private companies, and the change has been widely adopted. However, it has taken another five years for the FASB to extend the private company accounting alternatives from Accounting Standards Codification (ASC) Topic 350 (Update 2014-02) and ASC Topic 805 (Update 2014-18) to not-for-profit entities. (See the sidebar for acquisition accounting basics with respect to the FASB’s ASC Topic 805.)

Accounting alternative implications: Topic 805

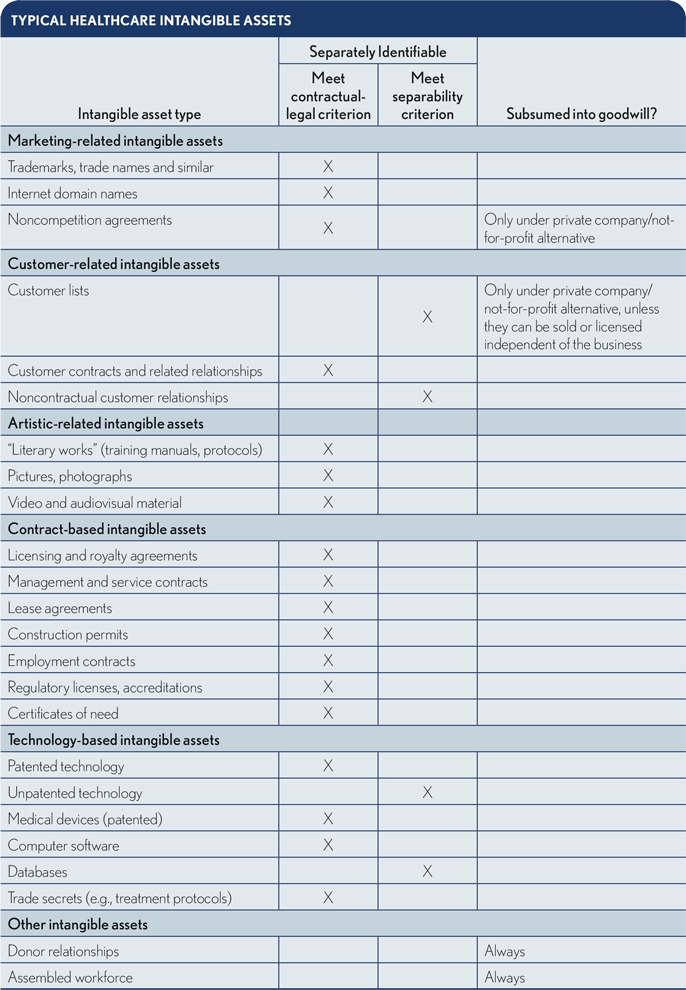

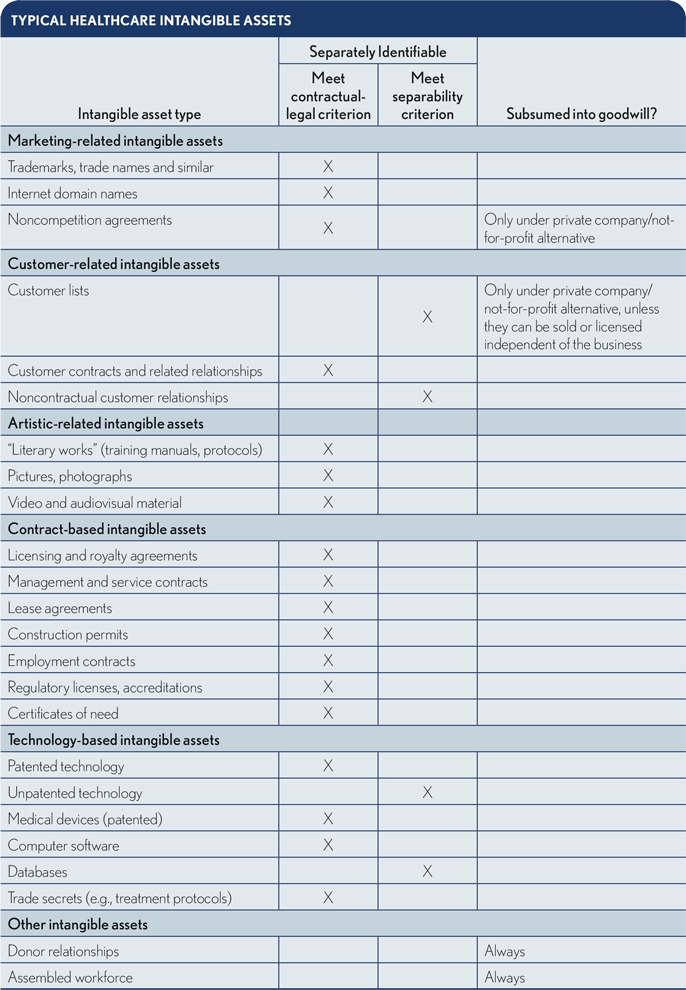

According to the accounting alternative set forth in ASC Topic 805, noncompetition agreements (NCAs) and those “customer-related intangible assets [CRIs] that are not capable of being sold or licensed independently from the other assets of a business” are subsumed into goodwill.

The exhibit below summarizes intangible asset examples from ASC Topic 805 and those typically found in healthcare transactions. Upon an acquisition, it is important to identify any potential separately identifiable intangible assets and begin assessing the relative importance of each qualitatively before performing a formal valuation. NCAs and “patient relationship” assets (a subcategory of CRIs) are the two asset types that are most relevant to not-for-profit healthcare organizations considering implementation of the accounting alternative.

NCAs. Noncompetition stipulations are routinely part of purchase agreements. From a valuation perspective, however, there is nothing routine about NCAs, given that they often are among the more valuable assets acquired. When a health system divests a service line, the buyer’s ability to serve patients without competition from the health system can be quite valuable. Lab, pharmacy, imaging, dialysis, wound care and other such services are prime examples. As such, implementation of the accounting alternative could materially affect a not-for-profit’s financial statements because NCA values would be subsumed into goodwill.

Patient relationships. In many service industries, customer relationship intangibles are frequently assigned significant value. But it is apparent from a recent review we performed looking at the audited financial statements of providers across the continuum of care that healthcare entities tend not to recognize “patient relationship” intangible assets on their balance sheets.

One notable exception from June 2004 is Accredo Health in Memphis, a specialty pharmaceutical and service provider serving patients with complex and chronic health conditions. Accredo Health recognized “patient relationship intangibles” in connection with its acquisitions of providers of pharmaceutical care for certain long-term patient populations.[3]

In contrast, dialysis providers like DaVita Inc., Fresenius Kidney Care, and Dialysis Clinic, Inc., do not recognize any “patient relationship asset,” even though they, like Accredo, serve long-term patient populations.

It is possible that provider organizations are hesitant to recognize an asset that may misalign with Federal fraud and abuse laws, particularly the Anti-Kickback Statute. Whatever the reason, the type of “patient relationship” asset that could be subsumed into goodwill under the accounting alternative does not appear to be in wide use.

One benefit of the implementation of Topic 606 — Revenue from Contracts with Customers is that most organizations will have a detailed understanding of their contract-based revenue streams, which should facilitate an analysis of non-contractual relationships that may qualify for the accounting alternative.

It should be noted that a not-for-profit entity that elects the accounting alternative in Topic 805 must adopt the alternative in Topic 350 to amortize goodwill. But the opposite does not apply: A not-for-profit entity that elects the accounting alternative in Topic 350 is not required to adopt the alternative in Topic 805.

Impairment testing implications: Topic 350

The amendments to the accounting alternative in Topic 350 provide for the following:

- Straight-line amortization of goodwill over 10 years (or less if the not-for-profit can show a more appropriate useful life)

- Subsumption of NCAs and certain customer intangibles

- Goodwill impairment testing when a triggering event occurs[4]

The exhibit below provides additional detail regarding impairment testing.

Advantages of adopting the accounting alternatives

There are two cases where an organization that implements these accounting alternatives will likely realize only minimal cost savings. The cases are as follows.

Two types of intangible assets (certain CRIs and all NCAs) are assumed into goodwill. This approach reduces the number of assets to be valued and likely will result in minimal changes because the overall purchase price allocation will still need to be performed, including:

- The valuation of any other separately identifiable assets.

- The final reconciliation of weighted average returns analysis, weighted average cost of capital and internal rate of return.

A transaction has an NCA term of less than 10 years and implies minimal goodwill except for the existence of the NCA. In this case, a full NCA valuation will likely be required to demonstrate a shorter amortization period for goodwill. More significant cost savings are likely in the following cases:

- When impairment testing is performed at the entity level, thereby removing the need to perform essentially separate purchase price allocations for each reporting unit acquired

- In a case where a not-for-profit with multiple reporting units can test goodwill at the entity level

- When testing is to be performed only when a triggering event occurs, as opposed to annually

Disadvantages of adopting the accounting alternative

There also are circumstances where adopting the accounting alternative would not be the best choice, including the following.

Increasing expenses and shrinking assets. The amortization of goodwill under the accounting alternative will result in a shrinking balance sheet and higher amortization expense. This may affect lending relationships, the public’s perception of the strength of the organization and other facets of the organization.

A limited universe of potential buyers. An acquisition by a buyer that has not or cannot adopt the accounting alternative would be challenging because the acquired entity would need to restate its financial statements and test goodwill for impairment retrospectively. Limiting the universe of potential suitors may not be in the best interest of many health systems. Both the direction and the pace of merger and acquisition transactions in healthcare suggest that acquisitions among not-for-profits or those involving not-for-profits will continue. A transaction between two not-for-profits (like this year’s merger of Dignity Health and Catholic Health Initiatives to form Chicago-based CommonSpirit Health) could have been derailed had the two systems followed different accounting paths. Similarly, a transaction like HCA Healthcare’s recent acquisition of the not-for-profit Mission Health in Asheville, North Carolina, could have suffered had Mission Health followed the accounting alternatives.

Uncertainty about how investors will react. Just as public business entities are precluded from implementing the alternatives, presumably in the interest of investors in publicly traded securities, municipal bond issuers may need to preclude themselves from implementation to assure investors that do not welcome issuers adopting the accounting alternatives.

(See the sidebar for a checklist an finance leader can use to assess accounting alternatives.)

Conclusion

Fair value accounting rules continue to evolve, and the FASB continues to examine accounting for goodwill and intangibles. Not-for-profit organizations, especially municipal bond issuers, should consider the accounting alternatives carefully. Because access to capital has become a major factor in determining an organization’s long-term survival, it is important for not-for-profit boards to consider the potentially chilling effect adoption of the accounting alternatives may have on debt issuances or potential buyers. However, reducing complexity and costs may work well for many organizations, as four years of experience in the for-profit world have shown.

[2] See FASB ASU 2010-07 — Not-for-Profit Entities (Topic 958): Not-for-Profit Entities: Mergers and Acquisitions, January 2010; see also, Heuer, C., and Travers, M.A.,“Valuing Goodwill: Not-for-Profits Prepare for Annual Impairment Testing,” hfm, February 2011, and Heuer, C., and Travers, M.A., “FASB Issues New Accounting Standards for Business Combinations,” hfm, June 2010.

[3] Accredo Health, Incorporated SEC Form 10-K/A for the fiscal year ended June 30, 2004.

[4] A triggering event is described by FASB in Topic 350 as an event “that indicates that the fair value of an entity (or a reporting unit) may be below its carrying amount.” Organizations must make an accounting policy decision to test for goodwill impairment at the entity level or reporting unit level.