Transitioning to a New Medicare Benchmarking Paradigm

As commercial health plans shift their payment policy to emulate Medicare’s MS-DRG approach, adjustments will need to be made to the MS-DRG model to reflect differences between the populations served by Medicare and those served by the health plans.

Across the United States in recent years, the idea of moving to a single payment approach of all payers, both government and commercial, has been gaining momentum, and it’s an idea that already has gained considerable ground in California. Under some proposals, hospitals would be paid at case rates like those of Medicare’s medical-severity-adjusted DRG (MS-DRG) payments. Whether or not such proposals become a reality, hospital leaders should understand the ramifications of such a change and the need for due diligence in analyzing the financial impact and risks of converting their payment from non-Medicare payers (especially commercial health plans) to a 100 percent Medicare MS-DRG-based methodology.

To allow for an effective transition to such a single payment approach, a new Medicare model is required that would allow MS-DRG performance to be compared on a more reasonable apples-to-apples basis between different patient populations (e.g., the Medicare population versus commercial health plan populations), both for internal use by hospitals and for benchmarking with other hospitals. The aim here is to describe the requisite elements of such a model, referred to here as the Medicare FOCUS model to reflect the myriad Financial, Operational, Clinical, Utilization, and Strategic responsibilities and risks associated with being paid by commercial health plans on a MS-DRG case-rate basis. First, however, to gain a perspective of the factors that necessitate such model, which can provide the basis for benchmarking under a universal payment approach across payers, it is helpful to consider California’s experience in transitioning to such an approach.

Moving Commercial Health Plan Payment to a Medicare-Based Model: The California Experience

Over the past decade in California, most commercial health plans have gradually transitioned their method of paying hospitals from their historic per diem or percentage-of-charges approaches for most general acute care inpatient services to a Medicare-derived methodology in which payment is based on select Medicare MS-DRG rates. Although the health plans still pay for some services based on a per diem basis (psychology, rehabilitation, skilled nursing, and neonatal intensive care services, for example), the bulk of payments by commercial plans in California are now based on these MS-DRG-like case rates.

Each year, due to this transition to case-rate payment, new challenges and risks to the hospital have been identified. Commercial health plans have needed to make constant modifications to their Medicare-based payment methodologies in response to revisions the Centers for Medicare & Medicaid Services (CMS) has made to its methodologies, including Medicare MS-DRG relative weights, geometric mean length of stay (GMLOS), the disproportionate share hospital (DSH) payment formula, indirect medical education (IME) add-ons, and value-based add-ons.

Also, in California, the Medi-Cal (aka Medicaid) payment methodology was converted from negotiated per diem rates to all-patient refined (APR) DRG rates in 2013. [a] Consequently, because Medicare, Medi-Cal, and many commercial health plans are now basing their payment methodologies on the APR DRG case rates, it is not unusual for California hospitals to now have 80 percent or more of all their inpatient general acute care discharges being paid on a per-discharge basis.

Moreover, in transitioning from the historical per diem rates to Medicare MS-DRG-based case rates, hospitals have encountered challenges from not having systems or tools in place to manage the myriad new responsibilities and risks associated with being paid by commercial health plans on a case-rate basis. A provider organization’s profit and loss statement could be affected by a variety of unknown factors, including the following:

- The specific multiple of Medicare baseline rates that would be required for breakeven (e.g., whether payment had to be 110 percent, 150 percent, or 200 percent greater than Medicare payment)

- How the younger commercial health plan population compares with the Medicare population in terms of resource consumption by MS-DRG and results for other key indicators such as average length of stay (ALOS) and utilization mix of MS-DRGs (such as obstetrics [OB] and neonatal intensive care services, which are more highly utilized by commercial health plan members than by Medicare patients)

- What risks the organization might face from converting to the lower-than-costMedicare outlier payment methodology relative to the known risks posed by the stop-loss methodology based on a percentage of charges historically used by commercial health plans

- How best the organization might quantify the risk of assuming full risk for all inpatient services delivered by its physicians (e.g., the utilization of resources by MS-DRG in terms of ALOS, intensive care unit [ICU] versus definitive observation unit [DOU] versus medical/surgical days, and supplies on a case basis compared with the less-risky per diem basis)

New Benchmark Required

Historically, hospitals have relied heavily on the industry standard of patient days as the common denominator to benchmark performance to other hospitals. For example, factors such as daily census, charges, payer mix, payments, and costs were benchmarked on a per-patient or adjusted-patient-day basis. Because many hospitals were paid on a per diem basis, this approach made sense to tie the patient days to key indicator performance measures.

However, in converting from per diem rates to case rates, hospitals will require new measures based on admissions and/or discharges, because the key performance indicators must correlate to the new case rate method of payment. Consequently, the common denominator for benchmarking must be retooled and transitioned from a patient-day basis, to a new per-discharge MS-DRG basis.

A new Medicare reporting model, such as the Medicare FOCUS model, is required to provide the baseline for generating new tools to address the unknowns likely to be associated with the model, such as those faced by California hospitals. To compare commercial health plan utilization with utilization under Medicare, new calculations would be required for all patient discharges, regardless of payer type, accounting for the premise that hospitals would be paid 100 percent of the Medicare rate for each case. The actual payment received from each commercial health plan could then be compared with what Medicare would have paid for the same discharge. This approach allows all related Medicare key indicators to be linked to any discharge by any payer type (e.g., commercial, Medicare, Medicaid), thereby providing benchmark analytics for factors such as case mix index, GMLOS, and outlier utilization.

On making comparisons with the new data regarding a 100 percent of Medicare payment approach, it would become apparent that not all Medicare MS-DRG payments would apply equitably to a commercial health plan’s patients because of the differences in utilization and payment methodologies.

Adapting Medicare to Commercial Payment: What Works and What Doesn’t Work

The aim in converting to the Medicare FOCUS reporting model would be to help identify which components of the existing Medicare MS-DRG model would work under a uniform all-payer payment approach and which components (i.e., MS-DRGs and other factors such as outliers) would not be reasonable for hospitals, and would therefore be unacceptable.

Again, because MS-DRGs were developed for Medicare’s more senior patients, many of these MS-DRGs may not adequately address utilization and payment data for commercial health plans that have younger, healthier patient populations. Although APR DRGs are far more sophisticated for OB, newborn, and neonatal patients, most hospitals may not have purchased the APR DRG system and, therefore, the data would not be readily available to them. Consequently, for benchmarking continuity purposes, these DRGs need to be excluded from the case-rate payment model.

The goal is to create new payment model with Medicare-based payment categories that align with the MS-DRGs that commercial health plans typically are using to pay for inpatient cases and to exclude the Medicare MS-DRGs that do not provide a viable basis for payment.

Perfecting this model would necessarily involve an evolutionary process in which new ideas would continually be added and incorporated. The first step is to develop a new industry standard baseline that correlates with hospitals’ current existing MS-DRG internal data, and then create a new modified MS-DRG baseline that excludes MS-DRGs that may not provide a reasonable key indicator for benchmark comparisons for commercial patients.

If hospitals were to universally adopt this model, it would pave the way for the use of a new benchmarking system that would allow side-by-side, per-case performance comparisons among hospitals, and thereby provide a more reasonable and useful basis for measuring payment performance according to various factors, such as by payer and by MS-DRG. It also would help supplement current per-diem-based standards still in use.

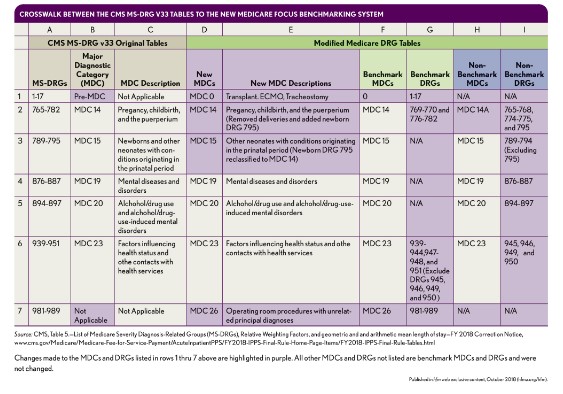

Crosswalk Between the CMS MS-DRG V33 Tables to the New Medicare Focus Benchmarking System

Differentiating Benchmark MS-DRGs from Non-Benchmark MS-DRGs

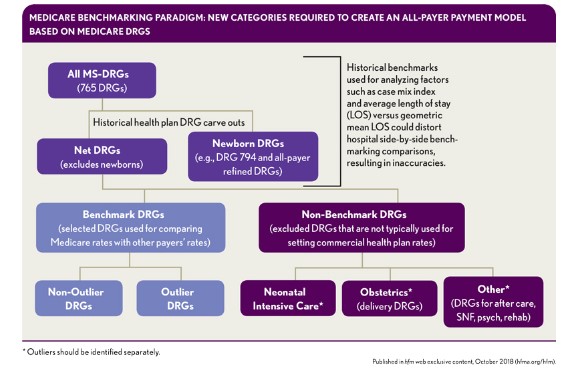

The preliminary baseline for the proposed model is all MS-DRGs, derived from CMS’s Table 5 List of MS-DRGs. This baseline includes the data regarding factors such as relative weight and the geometric and arithmetic mean LOS that CMS publishes each federal fiscal year. Annual updates would be required to carve out specific services that commercial health plans do not pay on a Medicare MS-DRG basis. The remaining MS-DRGs would be make up the list of benchmark MS-DRGs, and the carve-out MS-DRGs would be categorized as non-benchmark MS-DRGs.

Benchmark MS-DRGs

These MS-DRGs constitute the category of MS-DRGs that commercial health plans typically use when paying hospitals for services based on MS-DRG case rates, as modeled on the Medicare MS-DRG payment methodology. To illustrate how such payment might work, consider the following possible approaches to payment for benchmark MS-DRG 291, Heart Failure and Shock.

- If the actual Medicare baseline MS-DRG Payment rate were $8,000, and the rate negotiated with the commercial health plan were 125 percent × Medicare, then the new CHP rate would be $10,000 (i.e., 125% × $8,000). The baseline MS-DRG payment rate for the first contract with the health plan could be based on the hospital’s actual Medicare MS-DRG baseline payment (including the add-ons). In addition, in the first year, the hospital might negotiate a percentage annual increase for following years. Because the Medicare MS-DRG baseline payments could go up or down each year (e.g., the imposition of a 2 percent sequestration reduction), the second year of the contract should be negotiated based upon the first year’s base rate of $8,000 to ensure that annual Medicare policy changes do not cause the hospital’s commercial payment rate to fluctuate up or down in future years: The year 2 rate would be the agreed-upon percentage annual increase multiplied times the first year’s base rates, which would become the new base rate for each year thereafter.

- Under this approach, the payment calculation would be like the Medicare methodology: $10,000 base rate × 1.4759 relative weight = $14,759 payment paid by the health plan to the hospital for MS-DRG 291, regardless of the patient’s ALOS (unless the cost outlier threshold has been exceeded).

Non-Benchmark MS-DRGs

Again, non-benchmark MS-DRGs represent all other MS-DRGs typically not being paid by commercial health plans based upon the Medicare method of multiplying the relative weight times the baseline MS-DRG payment rate negotiated by the hospital and health plan, as shown above. For example, the commercial health plan might pay for a C-Section as follows.

If the negotiated OB rate for a C-Section delivery was $7,000 for the first three days of the stay, and an additional $1,500 for each day greater than three days, then the hospital would be paid $8,500 for a C-section with a four-day LOS. In this case, the Medicare-based case-rate method is not used, and the MS-DRGs for the mother and the newborn baby, as well as their respective relative weight for each MS-DRG have no bearing on determining the commercial health plan’s final payment. The assignment of a MS-DRG to the non-benchmarkcategory applies to all such MS-DRGs, where the fixed rates paid by the health plans are not affected by the MS-DRGs and their relative weight factors.

These same principles apply to Medicare’s major diagnostic categories (MDCs), with their multiple MS-DRG components, with MDCs similarly falling into benchmark and non-benchmark groupings, although an MDC might need to be split into two parts (e.g., MDC 14 would become MDC 14 and MDC 14A to reflect its non-benchmark DRGs [e.g., OB deliveries, NICU, mental health, alcohol] versus benchmark DRGs [all other DRGs).

Modifications to Benchmark MDCs and MS-DRGs

The exhibit below provides a crosswalk between the original MS-DRG tables provided by CMS, and the modifications applied to the MS-DRG-based FOCUS approach differentiating benchmark and non-benchmark MDC and MS-DRG categories.

Medicare Benchmarking Paradigm New Categories Required to Create an All-Payer Payment Model Based on Medicare DRGs

Columns D through I in the table are intended to provide a cross walk between the MDCs and MS-DRGs in CMS’s Medicare MS-DRG tables with the modifications required for the commercial health plan payment methodology (e.g., case rate for benchmarks versus per diems for non-benchmarks). The items highlighted in yellow reflect the crosswalk of the changes made from the existing CMS Medicare tables to the new proposed Medicare categories. The explanations are as follows:

- Relative to MS-DRGs 1-17, identified as “pre-MDC” by CMS, a new MDC 0 Category was created, which includes these MS-DRGs related to the range of transplant, extracorporeal membrane oxygenation ECMO, and tracheostomy procedures included among these MS-DRGs.

- MS-DRGs 981-989 had no assigned MDC, so a new MDC 26 category was created, which includes these MS-DRGs related to operating room (OR) procedures with unrelated principal diagnosis (i.e., the all-other category).

- C-Section Delivery MS-DRGs 765-768 and Vaginal Delivery MS-DRGs 774-775 were reclassified as non-benchmark MS-DRGs but remain in MDC 14 (although reclassified as MDC 14A to distinguish the non-benchmark MS-DRGs from the benchmark MS-DRGs in this MDC). Medicare pays these MS-DRGs for the mother, and it also provides an additional payment for the Normal Newborn MS-DRG 795. It was necessary to move this MS-DRG from MDC 15 to MDC 14A because most health plans pay an all-inclusive case rate for deliveries that combine the payments for both the mother and the newborn together. Also, MS-DRG 795 was reclassified in this way to link the mother with the baby instead of using the Medicare’s MDC 15 which combines the Newborn MS-DRG 795 with Neonate MS-DRGs.

For payment calculations relating to all deliveries, commercial health plans typically combine the mother and the newborn baby accounts, as well as all charges, costs, and other financial data. However, the non-financial key indicators relating to MS-DRG 795, Normal Newborn, such as discharges, days, case mix index (CMI), and GMLOS, are excluded from all calculations. Therefore, the denominators for all mother/newborn deliveries are reported as net discharges, net days, and net CMI, and the numerator will include all charges, costs, and payments for the mother and baby together.

Although MDC 14 and MDC 15 apply to general acute care services, MS-DRGs for deliveries (765-768, 774-775 and 795) have all been redefined as non-benchmark MDCs and MS-DRGs because hospitals that provide high volumes of OB deliveries compared with other benchmark MS-DRGs will skew the analytical data. For example, OB and newborn cases have much lower CMIs, average charges, and costs that other cases, so including them in the aggregation of general acute care data can have a major impact on the total data summary reports—e.g., lowering overall CMI, charges, costs, and outliers, especially on a per diem and/or per-discharge basis. The effect would be to render the data meaningless for comparing the hospital with other hospitals that may not provide OB services.

Also assigned to the non-benchmark bucket are MS-DRGs 876-887 (MDC 19), Mental Diseases and Disorders, and MS-DRG 894-897 (MDC 20), Alcohol/Drug use. These are typically not considered to be general acute care services, and most health plans pay for these services on a per diem basis. Also, including the higher LOS that some Psychology and Chemical Dependency units may have can skew the overall total hospital per-day and/or per-discharge summary reports (e.g., CMI, LOS, costs, charges) when comparing the hospital that provides these services with those that do not.

MS-DRGs 945 and 946 (an MS-DRG subset of MDC 23), Rehabilitation Discharges, which typically represent post-acute care discharges, also are reclassified as non-benchmark MS-DRGs. Hospitals that have licensed inpatient rehabilitation units typically discharge patients from general acute care beds and create admissions for patients transferred to the units. Most health plan payments for these services are based upon per diem rates. Also, including the higher LOS associated with some rehabilitation units could skew the overall total hospital per-day and per-discharge summary reports (e.g. CMI, LOS, costs, charges) when compared with other hospitals that do not provide these types of services.

Finally, MS-DRGs 949 and 950 (also an MS-DRG subset of MDC 23), Aftercare Discharges, also are typically post-acute care discharges and are reclassified as non-benchmark MS-DRGs. Hospitals that have licensed inpatient long-term care (LTC) units typically discharge patients from general acute care beds and readmit the patients to the LTC units, and, again, most health plan payments for these services are based upon per diem rates. Including the higher LOS of some LTC units similarly would skew the overall total hospital per-day and per-discharge summary reports compared with other hospitals that do not provide LTC services.

A New Medicare FOCUS Paradigm of Key Indicators for a New Era

Once these changes have been made to convert to the new Medicare FOCUS categories, a hospital will be able to create a new Medicare-based data set for all its discharges, regardless of payer. Such a new benchmarking baseline can then be used to create new reports and develop new MS-DRG case-rate strategies.

All historical key performance indicators would need to be reassessed and retooled to focus on the factors that will impact the hospital’s future financial success in transitioning to the MS-DRG payment systems. This entails working to reduce resource consumption to the appropriate services required.

For example, as a hospital becomes more efficient in managing cases to the appropriate level of care and prerequisite services needed, it may be able to reduce its ALOS, but its cost per day may increase because patient care in the first few days of admission typically involves more costly services, such as days in the intensive care unit; surgical procedures in the OR; diagnostic procedures with X-ray, computed tomography, and magnetic resonance imaging machines; and lab tests. Conversely, it is typical that fewer ancillary services will be provided in the last day or days before the patient is discharged, because the patient is in the recovery mode, and should require fewer services.

Thus, if a hospital reduces the ALOS from 6 days to 5 days, for example, the cost per day will increase because of the front-loaded ICU and ancillary costs remain in the first 5 days. Meanwhile, the cost per discharge should decrease because there is one less day of care provided in an inpatient room, and one less day of any ancillary services.

Glen Kazahaya is a retired independent consultant, Redondo Beach, Calif., and a member of HFMA’s Southern California Chapter.