Recent Trends in Healthcare Philanthropy and Foundations: Implications From Activities in New York for the Nation

The strategies employed by New York hospitals in establishing foundations to promote philanthropy provide some valuable perspectives for hospitals across the nation.

Over the past few decades, the U.S. not-for-profit healthcare sector has undergone significant change as many smaller community hospitals have closed or become part of larger healthcare systems. One area that has not changed is the importance of philanthropy for hospitals, and how many hospitals use a separate fundraising foundation to implement their fundraising strategies.

As not-for-profit hospitals continue to merge and change, however, they are challenged to determine the appropriate strategy for these separate foundations: Is it best to have one parent foundation for the entire system? Is it best to have separate local foundations? Or is it better to implement a hybrid model?

Insights into how hospitals are addressing these questions can be gleaned from a recent study that examined foundation strategies of hospitals in New York State, which have implications for the entire country. a

A Closer Look at Hospital Philanthropy

Before determining which strategies and structures work best for a given organization, it helps to understand the current giving trends for the industry.

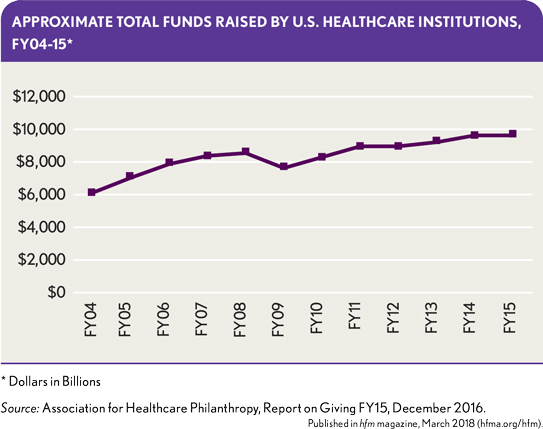

A report on healthcare giving in the United States issued by the Association for Healthcare Philanthropy (AHP) in December 2016 discloses that hospitals and healthcare systems raised more than $9.6 billion in FY15—a 0.2 percent increase over FY 2014. The report notes that donations to not-for-profit hospitals and healthcare systems in the United States increased by $19 million from FY14 to FY15. b The exhibit below provides a view of a decade in annual giving for health care, which shows the recent years trending back up.

Fundraising is a key revenue source for many hospitals and is on the rise for healthcare organizations. It’s clear that healthcare organizations need to continue to focus on building and cultivating relationships with individual donors, while maintaining a diversified fundraising approach.

Impact of Hospital Mergers on Foundation Model

After a hospital merger, the health system’s management and finance leaders must decide how to structure the merged organization’s philanthropic foundation. Hospital systems have two primary strategic options in such an instance: to have either a parent or a local hospital foundation. In the parent model, the hospital system uses one central foundation to represent all regional hospitals. In a local model, the local hospital maintains its own foundation. A third strategy is a hybrid strategy, in which a parent system has both a parent model and allows for some local foundations.

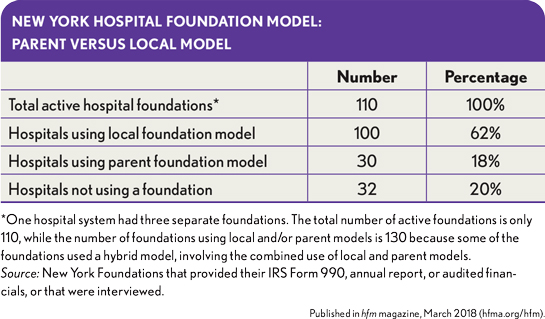

The previously cited study of hospital foundation strategies in New York State found that about 62 percent of about 160 hospitals use a local foundation model, while about 18 percent use a parent model. Some hospital systems use a hybrid model and have both parent and local foundations. The study also found that 20 percent of the hospitals did not use a foundation and performed their fundraising through a hospital development department.

Each of the models presents some advantages and disadvantages.

Parent model. The parent model is cost-effective and efficient because it comprises a single foundation structure and staff that can oversee the foundation operations from a single location. It provides for a more consistent marketing strategy, and it can manage all the investments in one pool.

A potential disadvantage of the parent model is that the local hospital name often is not associated with or included in the foundation’s name, which can reduce the effectiveness of fundraising to the local hospital communities. Local donors may perceive that the funds are leaving the local community and being used by the hospital system, not the local hospital.

Local model. The local foundation model allows the local hospital to maintain its local fundraising efforts with the local team and local foundation brand. The donors can continue to give as they have always done in the past, even though the local hospital may have a new parent or affiliation. But the local model may encounter inefficiencies when there are overlapping staffs between foundations while each foundation has its own investment manager and investment committee, which may result in staff contending with conflicting messages.

Hospital Foundations in New York State: Review of Research Data

The study found that 130 hospitals, or about 80 percent of the study sample, had access to a hospital foundation. Notably, four of the largest hospitals in the metro New York area did not have separate foundations, including NYU Medical Center, Memorial Sloan Kettering, and Montefiore Medical Center, which may reflect their already established tradition and history of giving. It also is interesting to note that almost 80 percent of the foundations were formed after 1981, with 46 percent of the foundations being formed in the period of 1981-2000 and the mean starting date for all foundations being 1987.

The three largest New York parent foundations, with the value of their funds (according to the most recent available sources), are as follows:

- New York Presbyterian Fund, Inc., New York-Presbyterian Hospital in New York City ($2.4 billion as of Dec. 31, 2015)

- The Mount Sinai Medical Center, Inc., The Mount Sinai Health System Inc., New York City ($1.5 billion as of Dec. 31, 2014)

- Northwell Health Foundation, Northwell Health System, Great Neck, N.Y., ($235 million as of Dec. 31, 2014)

The three largest local hospital foundations, with their most recently identified fund value, are as follows:

- St. Francis Hospital Foundation, St. Francis Hospital, Roslyn, N.Y. ($153 million as of Dec. 31, 2014)

- Winifred Masterson Burke Foundation, The Winifred Masterson Burke Rehabilitation Hospital, White Plains, N.Y. ($97 million as of Dec. 31, 2014)

- Roswell Park Alliance Foundation, Roswell Park Cancer Institute, Buffalo, N.Y. ($94 million as of March 31, 2015)

New York Hospital Foundations: Fundraising Observations

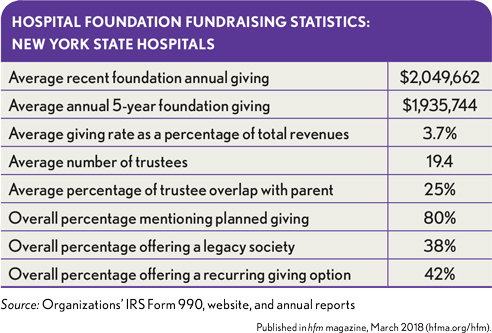

A basic objective of the New York study was to understand how the healthcare organizations are using foundations to support their fundraising efforts. The key data presented in the exhibit below provide insight toward such an understanding.

Average recent foundation annual giving. The study found that, based on recent data, average annual giving among the hospitals was about $2.0 million, which was 5.9 percent higher than the five-year average of roughly $1.9 million. The average giving rate as a percentage of overall hospital revenue was found to be 3.7 percent—a much lower measure than that seen among other types of not-for-profits because programs’ service revenues for hospitals are such a big component of revenues.

Average number of trustees. This is a key statistic for the hospital foundations because foundation trustees are often major donors to the hospitals, especially for the capital campaigns. The hospital foundations had 19 trustees, on average. A review of the trustee overlap between the hospitals and hospital foundations found an average overlap of 25 percent, with the board chair and CEO often being on both boards and with the range of overlap being from none to 100 percent. Larger organizations tend to have more trustees; one health system has 118 trustees on its foundation. Meanwhile, smaller organizations are considering expanding their boards to be proactive with their fundraising.

Planned giving. Planned giving is a key area for a hospital foundation to build up its endowment funds. Bequest programs are the most common programs offered. About one-third of foundations offer gift annuities, and many offer charitable trusts, and donor- advised funds. About 80 percent of the hospitals have a planned giving program.

Legacy programs. These programs constitute an important means for the hospitals to cultivate donors and provide some ongoing donor benefits. Only 38 percent of the foundations have legacy programs, but many hospital foundations are considering establishing such programs.

Technology. Fundraising technology is a key area; 94 percent of the organizations enable online donations. The growing use of such technology is an important trend as not-for-profits increasingly are using emails, websites, Facebook pages, and Twitter to get the word out and raise funds. One area where there seems to be room for improvement is recurrent giving for online donors; only 42 percent of the foundations offered this option.

Investment Considerations for Hospital Foundations

Although hospital foundations provide an effective fundraising tool, they also act as an investment management vehicle, which can provide professional investment management and administration of planned-giving and endowment funds. Foundations should seek to grow their assets, because as the assets grow, the annual spending dollars increase to the benefit of the hospital.

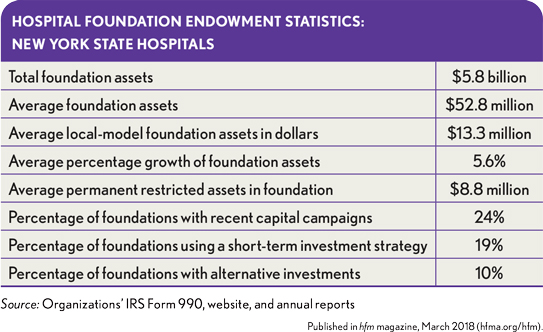

The study found that, as of October 2017, total assets invested in hospital foundations in New York State amounted to more than $5.8 billion, which translated into an overall average of $52.8 million per foundation, or about $13.3 million per foundation if the eight parent foundations were excluded. Foundation total assets ranged approximately from $250,000 to $2.2 billion.

Many of the foundations report having restricted endowment assets as part of their overall pool of funds, which means that their foundations comprise funds that donors have restricted and that are perpetual in nature. As mentioned previously, this finding shows that some foundations are succeeding in their planned-giving marketing strategies, as they target bequests, charitable gift annuities, charitable trusts, and endowment funds.

As with any long-term pool of assets, making sure the appropriate objectives, spending and liquidity requirements, and risk tolerance are defined is imperative. Creation or revision of an investment policy statement codifies this work.

The study also found that 19 percent of the foundations seem to be using only short-term, conservative investment strategies. The reason for this approach may be that they are being operated as flow-through foundations, where all fundraising is used by the hospital in the near team. But it could also signify that the foundations have not taken the time to develop their investment policies. Some foundations may be invested too conservatively, and they could benefit from considering more robust investment plans, as appropriate, which match their risk profile and time horizon.

Implications for Finance Officers

The survey findings have clear implications for finance leaders of hospitals and health systems nationwide.

Among these implications, they point to five key steps that finance leaders should consider as their organizations pursue mergers or the addition of a new hospital foundations:

- Step 1: Develop a foundation subcommittee of foundation stakeholders including trustees, leadership, and finance, development, communications, and legal experts.

- Step 2: Review the current foundation mission and operating strategy, and give special attention to any new hospital foundations that have joined the system.

- Step 3: Review the costs and benefits of the parent foundation, local foundation, and hybrid foundation models, and perform a foundation peer analysis to see how other hospitals have implemented their foundation strategy.

- Step 4: Review any governance requirements, such as the need to work with the state attorney general’s office if a hospital foundation is merged or changed.

- Step 5: Partner with an investment advisory firm that has experience working with healthcare foundations that can assist with the investment policy and structure.

Further, several best investment practices can be gleaned from the study, which all foundation finance leaders could benefit from adopting:

- Create and document an investment policy statement (IPS)—to be reviewed and updated annually—that addresses short term, intermediate, and long-term funds.

- Take time to understand the cash flows of the foundation, with a recognition that not all funds are long-term funds.

- Explore whether it is necessary to track separate pools of funds.

- Focus on a long-term asset allocation that stresses diversification.

- Have a customized benchmark to compare the performance returns.

- Review the costs and benefits of different adviser models, understanding the importance of knowing the organization’s total fees.

- Monitor the investment adviser quarterly, but take a long-term view.

- Build an experienced and engaged investment committee, using non-trustees with investment expertise if needed.

- Have a fundraising plan that offers planned gifts such as bequests and endowment funds.

The Future of Healthcare Philanthropy: A Role for Finance Leaders

Hospital foundations continue to be an important fundraising structure for most hospitals across the county. Expanding health systems are reassessing their foundation strategies, as they acquire hospitals that may have their own local foundations. Healthcare finance leaders will have a crucial role in these conversations.

Merging the foundations into the parent foundation can enhance the operating efficiencies of the foundations. But having a parent foundation also can challenge local hospital fundraising efforts because local donors may become confused about where their philanthropic dollars will be allocated. Each model presents pros and cons, and each system needs to assess its specific situation to determine which option is best. The fundraising and endowment management strategies also should be fully reviewed.

Philanthropic dollars will be even more important in the future. Thus, finance leaders of hospitals that have separate foundations should take steps to ensure the foundations are operating efficiently, while hospital finance leaders whose organizations lack separate foundations should advocate for their creation, recognizing such a strategy is essential for managing enhancing and a successful fundraising plan.

Walter J. Dillingham, Jr., CFA, is managing director, Wilmington Trust, NA, New York.

Footnotes

a. Dillingham, W.J., Healthcare Philanthropy and the Use of Separate Foundations: New York State Revisited, Willmington Trust, NA, June 23, 2017.

b. AHP, Report on Giving FY15, December 2016.