Total knee arthroplasty (TKA) procedures performed on an inpatient basis have long been an important source of revenue for hospitals, but hospitals should prepare for a decline in that revenue source due to the recent approval of the outpatient setting for TKA.

Orthopedics is one of the largest and most profitable service lines at many hospitals, and that success is driven in large part by total joint replacement (TJR) procedures. The removal of total knee arthroplasty (TKA) procedures by the Centers for Medicare & Medicaid Services (CMS) from the inpatient-only list for 2018 is a harbinger of things to come. It’s clear there will be a continuing shift of TJR cases to the outpatient setting, but the pace of the shift and the level of risk for hospitals will vary based on local market dynamics.

To prevent declines in volume and profitability, hospitals must understand the speed and magnitude of the shift that is likely to occur in their markets and position themselves for the change. Here, we focus on the impact of the shift in TKA procedures, which account for about two-thirds of all TJRs. a

Reasons for the Shift

Among the numerous well-known factors contributing to the shift of TKAs to the ambulatory setting are the following:

- Improvements in technology and medical techniques that have generally facilitated the ongoing shift of surgical procedures to ambulatory settings

- Growing evidence that TKAs can be performed safely and cost-effectively without an inpatient stay b

- Insurer concerns regarding costs associated with the increasing demand for joint replacement procedures c

- The increasing prevalence of payment models that shift risk to providers, encouraging cost reductions and improved outcomes

- Increasing consumer demand for care in lower-cost settings and recovery at home

- Increasing standardization of care management for TJR procedures, including TKA, resulting from hospitals’ participation in the Comprehensive Care for Joint Replacement (CJR) model mandatory bundled payment program

Implications: Risk to Hospitals

As TKA cases shift to the ambulatory setting, hospitals are faced with potential losses in income due to a reduction in inpatient cases and loss of cases to competitors that are better positioned to capture the outpatient business.

Increased competition. The shift of TKAs to the outpatient setting will occur regardless of whether hospitals support the idea. Hospitals require a proactive strategy to respond to the inevitable push of cases to lower-cost settings by insurers, patients, and competitors, including ambulatory surgery centers (ASCs).

Despite having been removed from the inpatient-only list, TKA has yet to be added to the list of procedures covered in ASCs. It is anticipated that CMS will add it in the coming years, a move that will further strengthen ASCs as competitors, particularly for younger, healthier patients. National ASC development companies are looking to cash in on the opportunity by partnering with independent physicians in markets ripe for the shift. Hospitals lacking adequate ambulatory surgery strategies, capabilities, or capacity will be poorly positioned to retain volume as it shifts.

Decreased revenue. Even when hospitals retain TKA cases, average payment will decrease as cases shift to hospital-based outpatient departments (HOPDs) or ASCs, given the following payment realities:

- The Medicare base rate payment for HOPD TKA cases is 18 percent lower than the payment rate for inpatient procedures. d

- On average, ASC payment rates for joint-related surgeries are about 75 percent of HOPD rates.

- Hospitals that own ASCs in joint ventures with physicians or other entities will generate less income per case due to the lower freestanding ASC rate—and only at a level proportionate to the hospital’s equity stake.

Market-Specific Shift Considerations

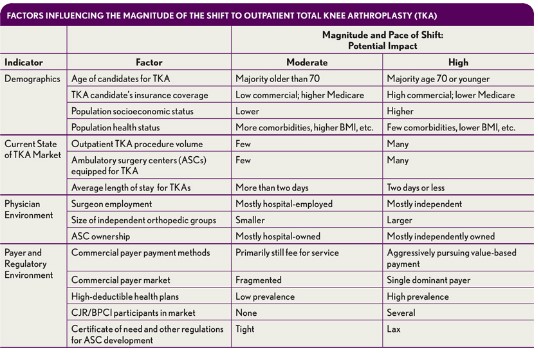

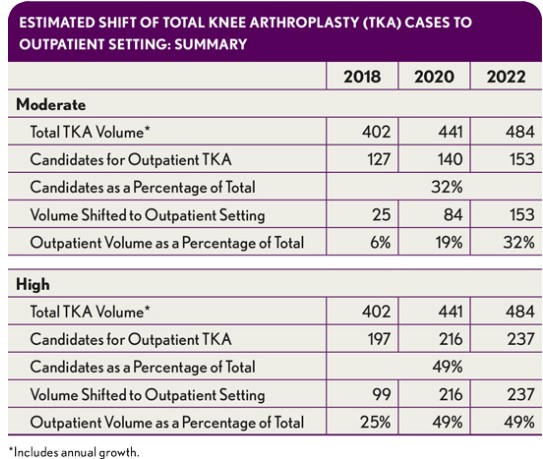

Local market dynamics, including patient demographics, the mix of independent and employed surgeons, independent physician ownership of ASCs, commercial health plan initiatives, and physician and hospital readiness, will dictate the rate and magnitude of the shift from the inpatient to outpatient setting (as shown in the first exhibit above).

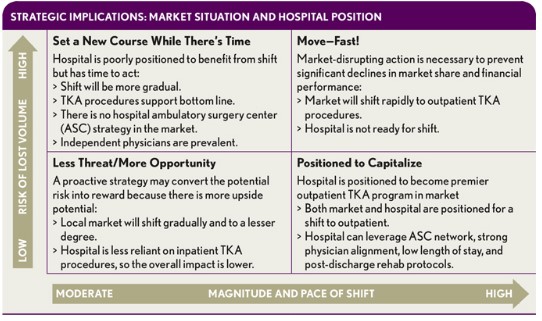

When assessing the risk of lost volume and revenue due to TKA shifts, hospitals must also understand their own positioning relative to the market, and the implications for potential strategies to capitalize on opportunity or mitigate the risks (see the second exhibit above).

Potential Impact for a Community Hospital

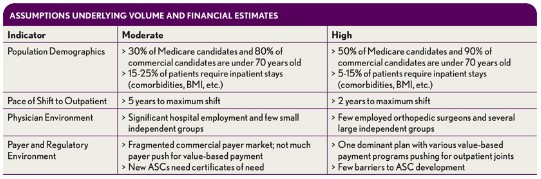

To assess the hospital impact of an anticipated TKA shift to outpatient care, organizations should weigh various risk scenarios based on their particular circumstances. Consider, for example, an analysis of “moderate-risk” and “high-risk” scenarios for a medium-sized community hospital with $300M in revenue and 15,000 annual admissions.e Key assumptions for such an analysis include the following:

- 100 percent of TKA procedures are currently performed on an inpatient basis.

- Medicare will pay for TKA procedures performed in ASCs beginning in 2020.

- Although cases for DRG 470 (major joint replacement or reattachment of lower extremity without major complications or comorbidities) will show a shift to outpatient, those for DRG 469 (with major complications or comorbidities), which are estimated to constitute less than 5 percent of cases, will continue to require inpatient care.

- The baseline market growth for DRG 470 will be about 5 percent annually, based on national growth projections.

- Inpatient TKA cases have a contribution margin of roughly 50 percent. f

For this analysis, we have conservatively estimated the impact of the shift only for Medicare and commercial health plan populations. The impact of the shift will be amplified if Medicaid and self-pay patients show a similar pattern. Specific assumptions for each scenario are outlined in the third exhibit above.

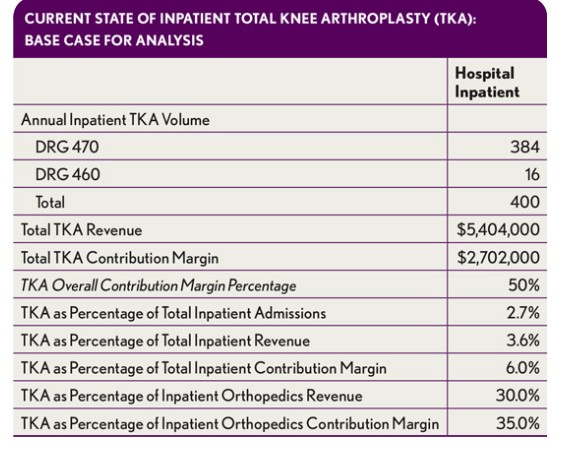

Methodology: Case Volume

The volume of TKAs at a given hospital varies with the size of its orthopedic program, the number of joint specialists aligned with the hospital, and numerous other factors. Our sample analysis is based on a hospital with a notable joint replacement program, performing 400 TKA procedures annually on an inpatient basis (see the exhibit directly above).

To assess the total number of candidates for TKA in an outpatient setting at this hypothetical hospital, we estimated the number of Medicare and commercial TKA patients under age 70, and we made two assumptions:

- That a proportion of patients under age 70 would not meet outpatient selection criteria due to high body mass index, comorbidities, distance from facility, and/or absence of a local support system

- That markets where joint replacements are already being performed in ASCs will see a faster shift than those in which there must first be a shift from inpatient settings to HOPDs, and then a shift of HOPD volume to ASCs (see exhibit directly above)

In the moderate-risk scenario, the hospital captures 80 percent of the ASC cases in its hospital-owned ASC due to the higher rate of surgeon employment and lower penetration of physician-owned ASCs in the market. In the high-risk scenario, the hospital retains only 20 percent of the ASC cases due to the higher prevalence of independent surgeons and physician-owned ASCs (see the exhibit directly below).

Revenue Impact

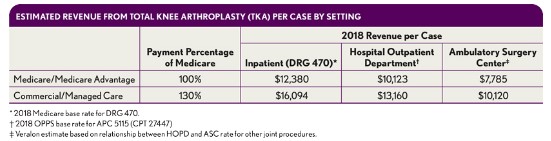

Our analysis is based on Medicare base rate payments (unadjusted for wage-index or other impact factors) and assumptions for commercial payment relative to Medicare rates. Because TKA has not yet been added to the Medicare ASC fee schedule, the ASC payment rate was estimated based on the average ratio of ASC to HOPD rates for other joint-related procedures in ambulatory payment classifications (APCs) 5115 and 5116—amounting to about 75 percent, for an estimated Medicare ASC payment of $7,785 (see exhibit below).

The current Medicare base payment for DRG 470 is $12,380. The actual payment for a specific hospital is adjusted for expenses for graduate medical education, uncompensated care, the disproportionate share hospital (DSH) ratio, and the local wage index. The HOPD payment has a base rate of $10,122 under APC 5115 and is adjusted only for the wage index.

Although the difference in base payment between inpatient and HOPD cases is 18 percent, the total payment differential is greater for hospitals with higher levels of supplemental funding built into their Medicare rate, as these adjustments are not incorporated into the HOPD payment. A review of 2015 Medicare payment data for hospitals with at least 300 admissions for DRG 470 found that the average inpatient payment per hospital ranged from $9,800 to $27,600, with a median of $14,100.

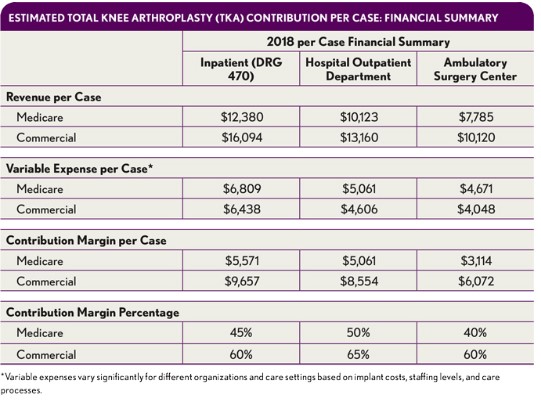

Financial Impact per Case

The revenue impact of cases that shift to HOPDs or ASCs is dictated by Medicare and negotiated rates with commercial health plans, while the expense and resulting contribution margin will be determined by efficiency and expense management. Implant cost will continue to be significant, but greater efficiency—through decreased operating room (OR) turnaround time, reduced time in OR, and lower staffing expenses, for example—can result in significant contribution margin on outpatient cases despite lower revenue levels, as has been seen with other procedures that have shifted to the ambulatory setting. Estimates of reductions in variable expenses in both the HOPD and ASC settings that are reasonably achievable are depicted in the exhibit below.

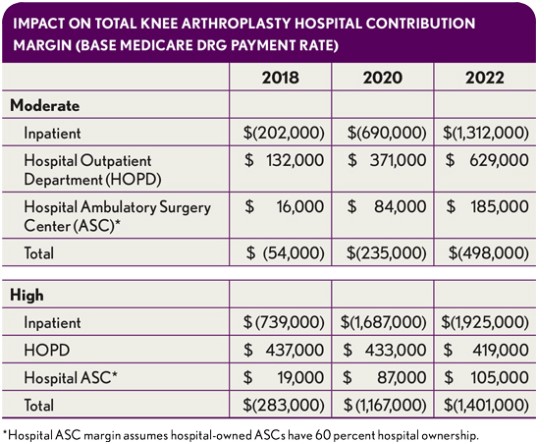

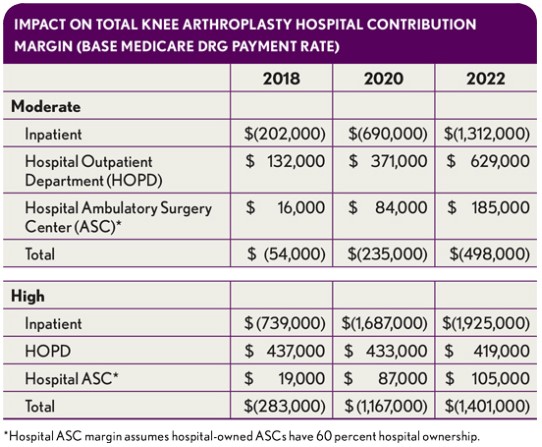

Total financial impact. The impact on a given hospital will vary greatly depending on how market dynamics play out. In the moderate- and high-risk scenarios for our sample hospital, the bottom-line changes range from $500,000 to $1.4 million in 2022, as shown in the exhibit below.

Such figures represent a starting point for the hospital’s leaders to consider the likely impact on their organization.

Potential additional contributors to financial impact. Several factors not included in the sample analysis may change the overall financial impact of a shift to outpatient cases.

One factor is the potential for total hip arthroplasty (THA) cases also to shift to outpatient settings.THA volumes are anticipated to grow at a lower rate than those of TKAs, but as THA cases begin to shift to lower-cost settings (as has already begun with commercial health plans in certain markets), the financial impacts will increase.

Another possible additional factor is that CMS’s stance on inpatient versus outpatient could change. CMS is allowing, not requiring, outpatient TKAs. As the shift progresses and outcome data are collected, CMS may “direct” more TJR patients to the outpatient setting, increasing the financial impact.

As a third factor, continued efforts by CMS to equalize payments across sites of service either by reducing HOPD payment rates or increasing ASC payment rates also will likely increase the financial impact on hospitals.

Finally, an additional impact will come from increased patient demand for lower-cost settings.

Impact for Individual Hospitals

There also are many factors that will affect the financial impact of a shift of TKA to ambulatory settings for a given organization.

The impact will be greater for hospitals with higher levels of supplemental funding. The contribution margin impact for a hospital with a higher Medicare DRG payment (due to a higher wage index, supplemental funding for medical education, or DSH payment) will be much more significant. For example, a hospital with a Medicare DRG 470 payment of $20,000 would have a bottom-line loss of $2.5 million under the high scenario by 2022.

Hospitals or health systems with larger TJR programs than the sample hospital modeled here will lose more revenue. Holding other assumptions constant, a healthcare organization with 1,000 inpatient TKAs could experience a loss of up to $3.5 million based on the base-rate DRG payment in the high scenario.

The contribution margin on inpatient cases will likely decline. This effect will be due to the greater proportion of older patients with comorbidities.

The extent to which each hospital will be affected by the shift of TKA to the outpatient setting also will be determined by the hospital’s own unique circumstances. For example, hospitals participating in CJR or BPCI Advanced for joint replacement may encounter challenges to success in those programs if healthier patients receive surgery in an outpatient setting, leaving more complex, higher-risk patients in the TJR bundles.

A Strategic Imperative

The shift of TKAs—and, potentially, THAs—to outpatient settings will continue to occur regardless of hospital preparation. Hospitals that lack adequate ambulatory capabilities or capacity and/or strong alignment with their orthopedic surgeons risk significant loss of revenue in one of their largest and most profitable service lines, even if they are able to retain the majority of TKA cases within their ambulatory network. However, that loss may just be the tip of the iceberg if a hospital’s lack of preparedness results in a more fundamental shift in physician loyalties.

The analysis presented here assumes that the hospital will retain those TKA cases that do not shift to outpatient settings. Yet the likely reality for hospitals in many markets is that competitors already are pursuing closer alignment with independent physicians and groups. The realignment of key orthopedic surgeons with a competitor could precipitate a hospital’s loss of a significant portion of TKA volume altogether, almost overnight. The resulting economic impact could dwarf that estimated here and have a much more deleterious impact on hospital market position and financial performance. However, by honestly assessing market dynamics and internal capabilities and acting swiftly to address deficiencies, hospitals can turn this risk into a powerful opportunity.

Footnotes

a. TKA is anticipated to become an increasing portion of total TJRs due to greater projected growth than THA.

b. Barad, S.J., Howell, S.M., Tom, J., “ Is a Shortened Length of Stay and Increased Rate of Discharge to Home Associated With a Low Readmission Rate and Cost-Effectiveness After Primary Total Knee Arthroplasty?” Arthroplasty Today, March 2018.

c. A conservative projection suggests that the incidence rate of TKAs will increase from 429 to 725 per 100,000 population by 2050, resulting in a more than 100 percent increase in the number of procedures. M Inacio MCS, E Paxton, S Graves, R Namba, Nemes S. “Projected increase in total knee arthroplasty in the United States – an alternative projection model.” Osteoarthritis Cartilage, November 2017.

d. Based on Medicare 2018 base rate payment of $12,380 for DRG 470 and $10,123 for APC 5115.

e. Other TJR procedures (e.g., hip) that could eventually shift to outpatient were excluded, because CMS has only changed the classification for TKA to date.

f. Our analysis assumes the hospital receives the full DRG payment; this situation can vary based on several factors.