News Briefs: Providers face trying times in the first month after the Change Healthcare cyberattack

Healthcare providers struggled financially and operationally in the first 30 days after a Feb. 21 cyberattack forced the shutdown of Change Healthcare’s claims submission and payment systems, among more than

100 other applications.

As of the week of March 18, parent company UnitedHealth Group had restored Change Healthcare’s payment platform and was reporting progress in getting the claims submission system back online.

Specifically, Change Healthcare was scheduled early that week to begin releasing medical claims preparation software to customers.

“Following this initial phase, remaining services restoration will continue through ongoing phases of activation until all customers have been connected,” a news release stated.

Change Healthcare, the nation’s largest such clearinghouse, processes 15 billion transactions per year.

Lingering impacts

The implications of the outage will not subside once everything is functioning normally.

For example, data from Kodiak Solutions showed that among 1,850 hospitals and 250,000 physicians in the company’s database, the claims submission shortfall between Feb. 21 and March 9 amounted to $6.3 billion.

“The impact from the cyberattack showed up immediately in our claims data, and it will soon show up in reduced cash flow to hospitals, health systems and medical practices across the nation,” Colleen Hall, senior vice president and revenue cycle leader at Kodiak Solutions, said in a news release.

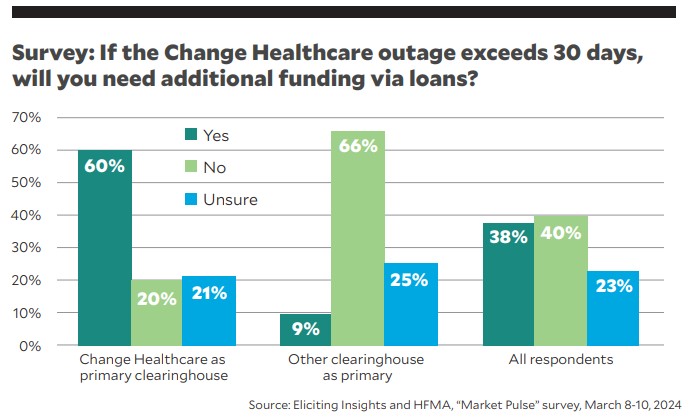

Organizations also are sustaining the costs of implementing workarounds such as connecting to alternative clearinghouses. In a Market Pulse survey conducted March 12-14 by Eliciting Insights in partnership with HFMA, 83% of respondents said they were dealing with additional costs (feedback from an earlier version of the same survey is seen in the exhibit below).

“We will incur significant investment transaction costs in addition to the manual process costs in order to cover the cash shortfall,” said one respondent.

Eliciting Insights on a survey of 146 health system executives.

Seeking advance payments

CMS on March 9 began offering Medicare advance payments to providers that have been affected by the outage. The payment allotments equal one-third of a provider’s total paid claims spanning Aug. 1-Oct. 31, 2023.

A week later, CMS released guidance to state Medicaid programs on regulatory flexibilities to reimburse rendered services for which claims could not be submitted. Payments can be retroactive to Feb. 21 and can draw on the usual federal Medicaid contribution.

The Biden administration also urged commercial payers to make advance payments to their provider partners as needed.

UnitedHealthcare, a sister company of Change Healthcare, had previously pledged to take that step, but it was unclear how many other payers would agree to do so.

New rule on Medicaid DSH payments will impose stricter limits on many safety-net hospitals

Numerous hospitals that receive Medicaid disproportionate share hospital (DSH) payments face a tighter cap on their payment amounts after the Feb. 23 publication of a CMS final rule.

The regulations were spawned by 2020 year-end legislation that made changes to the DSH hospital-specific limit (HSL).

Namely, a hospital’s Medicaid shortfall can be counted toward its HSL only based on costs and payments associated with patients whose primary payer is Medicaid. Thus, patients who also have Medicare or other coverage for the services they receive no longer will factor into the DSH payment determination.

An exception is available for hospitals in the 97th percentile in either the total number or the percentage of inpatient days for patients who are eligible for both Medicare Part A and Supplemental Security Income benefits. Those hospitals can maintain the old methodology if it’s more favorable.

The regulations are retroactive to Oct. 1, 2021, and will affect hospitals’ DSH payments as allocated in their state’s first plan-rate year that begins after that date.

Federal legislation addresses Medicaid DSH funding cuts, physician payments

Legislation to extend funding for segments of the federal government through the end of FY24 included relevant provisions for hospitals and physicians.

The bill took a big cut to Medicaid disproportionate share hospital (DSH) payments off the table through 2024. The four-year, $32 billion reduction was reduced to three years and $24 billion, with the cut currently scheduled to begin Jan. 1, 2025.

Physicians received a payment boost to lessen the reduction they incurred this year under the Medicare fee schedule. A 1.68% increase brought the net 2024 decrease to 1.66%.

The floor for the Medicare work geographic practice cost index was extended through year’s end, preventing a potentially substantial payment cut for practices in areas with lower physician labor costs.

Both the House and Senate passed the bill on bipartisan votes, sending it for President Joe Biden to sign hours before the March 8 expiration of funding for some federal departments.

New data shows providers continuing to win most No Surprises Act IDR cases

Providers won a large majority of disputes initiated during the first half of 2023 through the No Surprises Act’s arbitration portal for adjudicating out-of-network payments, according to newly published data.

HHS and the U.S. Departments of Labor and Treasury released public-use files showing the outcome of every dispute decided in the independent dispute resolution (IDR) portal from January through June. In a summary report, the departments wrote that providers prevailed in 77% of the nearly 84,000 disputes in which a decision was rendered.

The results indicate certified IDR entities (i.e., arbitrators) frequently considered insurers’ offers, which typically were linked to the qualifying payment amount for the item or service in question, to be inequitable. The arbitration is “baseball style,” meaning the IDR entity has to select one side’s offer instead of seeking a compromise.

A previous report examined data over a 50-week stretch ending March 31, 2023, and found providers had won 71% of cases.

Of the decisions covered in the latest report, 58% were for cases involving emergency department services. The next highest category was radiology,

at 17%.