Healthcare in 2024: hfm columnists recount key issues finance leaders should keep on their radar

With every new year, our nation’s healthcare industry can expect to encounter a new world of opportunities and challenges, defined by a unique set of leading issues and developments. Some may be widely anticipated, others highly unexpected.

As 2024 begins to unfold, a key question challenges healthcare finance leaders: What are likely to be the defining issues for healthcare in the coming year?

Finance leaders should consider this question to make sure they are attuned to the potential for industry shifts, both positive and negative. And as they contemplate what’s in store for their organizations in 2024, they can benefit from looking to industry thought leaders, including hfm’s contributing columnists, for ideas and perspectives that will inform their reflections.

Susan Dentzer, president and CEO of America’s Physician Groups, for example, advises healthcare executives to be mindful of the decline in Americans’ satisfaction with healthcare providers and the industry overall. And Grace-Marie Turner, founder and executive director of the Galen Institute, says they should be prepared for the likelihood that Congress will pass important bipartisan healthcare reform legislation in the coming year.

Here, Dentzer, Turner and five other hfm columnists, past and present, offer thoughtful and often provocative ideas about what are likely to be the defining issues of 2024. Not surprisingly, some issues were cited by more than one of our columnists.

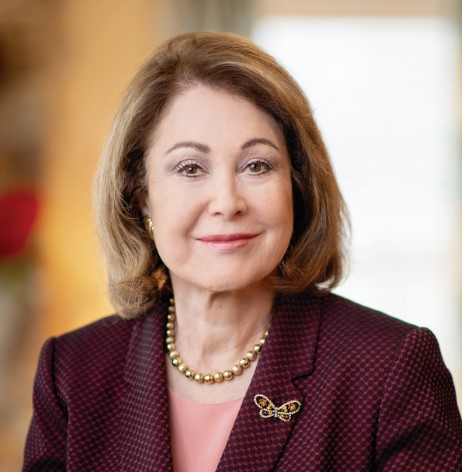

Susan Dentzer: Healthcare sector faces decline in public support

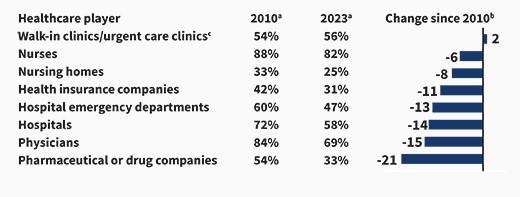

A defining issue for the U.S. healthcare sector in 2024 will be how it responds to growing public dissatisfaction with many of its aspects. A recent Gallup poll shows significant declines in public approval since 2010 across almost all health professions and sub-sectors, as shown in the exhibit on page 21.a

There is obviously a lot behind these results, and without further data, any effort to interpret them must rely on educated guesswork. The degree to which the public trusts health professionals, as distinct from sectors such as pharmaceuticals, is one core issue. In the pandemic’s earliest stages, clinicians were initially deemed heroes by much of the public — but many saw that trust and confidence in them diminish as COVID-19 wore on, as trust in public health authorities also fell.b

Nurses have always been the most trusted among healthcare professionals. But even they experienced a modest decline in trust in the Gallup survey, and patients’ direct experience with nurse shortages in hospitals may have played a role. After all, there is ample evidence that these workplace shortages have taken a toll across organizations, as at least one survey of healthcare leaders has shown.c

For organizations such as America’s Physician Groups — focused on physician leadership in the provision of value-based care — the decline in the public’s estimation of physicians is alarming. How much of this fall-off in support is due to a sense that physicians are mainly out for themselves and are not truly putting patients front and center in care delivery? What amount of this disregard is simply frustration about access — long wait times for getting appointments, or even long wait times when patients arrive on time for office visits?

Health insurers have never won any popularity contests, but Gallup found that public support for them is now as low as it was during the late-1990s-early-2000s-era backlash to managed care and the resulting drive to adopt a Patients’ Bill of Rights. To what degree does frustration about prior authorization tactics play a role, even as these utilization management tactics demonstrably help to weed out low-value healthcare?

Gallup poll results reflecting Americans’ views of the extent to which healthcare players are providing high-quality medical care and services

b. Percentage points

c. 2010 wording was walk-in clinics; 2023 results are an average of walk-in clinics and urgent care clinics.

Source: Saad, L., “Nurses first, doctors distant second in healthcare provider ratings,” Gallup News, Dec. 18, 2023.

In the absence of a more granular understanding of public attitudes, it behooves the healthcare sector as a whole to look carefully in the mirror, particularly amid the dramatic changes afoot in the marketplace. I’ve written for hfm about the complexities inherent in consolidation and the need to understand and track the benefits as well as the costs (hfm, October 2023). But clearly, there’s a risk that public attitudes could only sour further, especially if patients’ wants and needs are subsumed by other forces, such as the drive for profits. And relatively little is known about how much more consumers will value greater convenience in access to care, such as through telehealth or retail clinics, over their desire to have longstanding connections with an individual care provider.

Given the public mood, the lesson that healthcare professionals should probably take from the Gallup poll is not to spend 2024 breathing their own exhaust.

Footnote

a. Saad, L., “Nurses first, doctors distant second in healthcare provider ratings,” Gallup News, Dec. 18, 2023.

b. SteelFischer, G.K., et al., “Trust in US federal, state, and local public health agencies during Covid-19: responses and policy implications,” Health Affairs, March 2023.

c. Optum, “C-suite check-in: The health care workforce crisis,” Fact sheet, 2022.

About the author

Susan Dentzer, MS, is president and CEO, America’s Physician Groups, Washington, D.C.

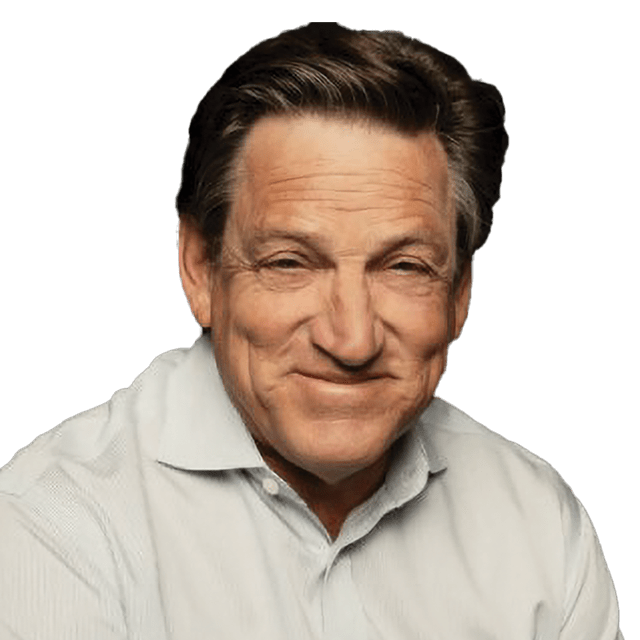

Marcus Whitney: Expect healthcare to be reshaped in 2024 by AI, CMS, biotech and demographics

As we wrapped up 2023, the stage was set for a seismic shift in the healthcare industry in 2024. Healthcare isn’t easily disrupted, but a confluence of change that is dismantling its decades-old value network has started, and the new year will only continue to dislocate players unable to adjust. Healthcare finance leaders should monitor four key areas.

1 AI deployment. For the first time since the mid-2000s brought us the iPhone and the Cloud, a step-change innovation in technology has occurred in the form of large language models. While error-prone, these models open the imagination and raise the ceiling on what we can imagine computers can do that humans currently do. In 2024, we will see significant realized productivity gains from the deployment of AI in provider organizations.

2 CMS regulatory actions. The Physician Fee Schedule final rule issued on Nov. 1 showed a redistribution of payments away from physicians and toward community health workers, caregivers and behavioral health providers. It also ushered in a major cleanup of Medicare Advantage that will make that model unviable for many payers and providers. These kinds of shocks to the system force unexpected changes. We are just starting to see the shakeup from CMS’s actions in 2023, and we can expect to see more such changes in 2024.

3 Biotechnology developments. GLP-1 (glucagon-like peptide-1 receptor agonist) therapies aimed at lowering blood sugar levels and promoting weight loss dominated the pharmaceutical headlines for most of 2023, bringing with it the threat of decimating provider lines of business that are comorbid with obesity and creating huge headaches for employers that are trying to determine how to, or whether they even should, pay for these therapies for their employees. But 2023 ended with the FDA’s approval of two CRISPR-based therapies, opening the door to the potential eradication of diseases previously thought to be incurable.a This new wave of therapies will disrupt providers and have ethical and financial ramifications for employers who scramble on how to manage their responsibilities to their beneficiaries.

4 Demographic shifts. The final act of the baby boomer generation is upon us and brings with it massive uncertainty, whether it’s in the presidential race, the passing away of Senate elders or the shrinking growth curve of eligible Medicare members. Many innovators are deciding to stop building for the current healthcare industry, instead choosing to build a parallel one for the world that the millennials will soon run. This tension will make it hard to assess the industry and will result in a different kind of fragmentation, with the patient at the center.

Footnote

a. The National Genome Research Institute defines CRISPR (which is short for clustered regularly interspaced short palindromic repeats) as “a technology that research scientists use to selectively modify the DNA of living organisms.”

About the author

Marcus Whitney is co-founder and partner, Jumpstart Health Investors, Nashville, Tennessee, and a member of HFMA’s National Board of Directors.

David Johnson: The machines are coming, the machines are coming!

Legend has it that just after midnight on April 18, 1775, Paul Revere rode his horse north from Charlestown, Massachusetts, shouting “To Arms! To Arms! The British are coming! The British are coming!” And with Revere’s warning, the American revolution was underway.

Today, another type of revolution is underway. Generative AI (GenAI) technologies are reshaping economies in real time at an accelerating rate. ChatGPT-3, launched by the AI research and development company OpenAI in November 2022, had over a million users within five days and has spread geometrically since.a

Unlike other technological breakthroughs, GenAI requires no hardware. Its capabilities manifest through well-developed consumer search habits. With no learning curve, GenAI has the potential to provide an immediate boost to worker productivity.

What’s truly amazing is how large language models like ChatGPT-4 are employing machine learning and natural language processing within deep neural networks to think and create like human beings. They’re already solving math problems.b AI art generators like OpenAI’s DALL-E2 use prompts to fashion original works. If that’s not thinking and creating, I don’t know what is.

Unlike other technological revolutions, the ability of the machines to perform nonroutine cognitive tasks threatens the livelihoods of knowledge workers far more than manual laborers. A Goldman Sachs report suggests GenAI technologies could affect two-thirds of all occupational tasks and fully substitute for a quarter of them.c

The transition to AI-supported work will generate enormous productivity improvement and wealth creation. A McKinsey analysis suggests that AI can boost annual productivity worldwide by as much as $4.4 trillion.d That’s the equivalent of adding a Japan, with the world’s third-largest GDP, to the global economy each year.e Incredible!

Sitting directly in GenAI’s sights is U.S. healthcare. It is the largest industry ever created and still largely operates the way it did in the 1970s. It is riddled with intermediaries, inefficiencies and inferior outcomes. Healthcare also generates 30% of the world’s total data, most of which is disconnected, unstructured and begging for effective application.f We need machines to help us make sense of it all.

I’m not riding a horse like Paul Revere, but I am proclaiming that the machines are coming to revolutionize America’s broken healthcare system. We are likely to see many current healthcare jobs evaporate even as outcomes improve. Those constructive changes will begin in earnest during 2024.

Footnotes

a. DeVon, C., “On ChatGPT’s one-year anniversary, it has more than 1.7 billion users — here’s what it may do next,” CNBC Make It, Nov. 30, 2023.

b. Cobbe, K., et al., “Solving math word problems,” OpenAI, Nov. 18, 2021.

c. Hatzius, J., et al., “The potentially large effects of artificial intelligence on economic growth (Briggs/Kodnani),” Goldman Sachs Economics Research, March 26, 2023.

d. Chui, M., et al., The economic potential of generative AI: The next productivity frontier, McKinsey & Company, June 14, 2023.

e. The World Bank, GDP (current US$) – Japan, 1960-2022.

f. Wiederrecht, G., et al., The convergence of healthcare and technology, RBC Capital Markets, Page accessed Jan. 2, 2024.

About the author

David W. Johnson is CEO of 4sight Health, Chicago, and a member of HFMA’s National Board of Directors.

Grace-Marie Turner: Bipartisan action on health reform likely in 2024

Amid the partisanship and chaos that dominate news reports about Congress, many people are surprised to hear that serious work is being done behind the scenes that could very well result in bipartisan healthcare reform legislation being enacted this year.

Two bills are on tap for Senate action that already have passed the House.

Just before Congress adjourned in December, the House passed 320 to 71 the Lower Costs, More Transparency Act (H.R. 5378). Among other changes, it would codify and expand price transparency requirements set in motion by the Obama and Trump administrations. If enacted, hospitals, labs, imaging facilities, outpatient surgery centers, pharmacy benefit managers and health plans would be required to make accessible pricing data available to purchasers and consumers.

The Senate Health, Education, Labor, and Pensions Committee has reported price transparency legislation to the floor. Price transparency is popular with voters, so there will be a big incentive to get something through Congress and to President Biden’s desk before the November elections.

The House transparency bill also would take a step toward “site-neutral payments” by equalizing payments for Medicare-covered drugs, whether they are administered in a physician’s office or hospital. While meritorious, passage is a heavier lift since many hospital groups object to the legislation out of fear it would lead to reductions in payments for a longer list of services.

Last summer, the House passed another package of targeted bills, the CHOICE Arrangements Act (H.R. 3799), with a 220-209 vote. The bill’s goal is to provide flexibility and financial certainty for small businesses while expanding health coverage options for their employees. It would, for example, create the Association Health Plans Act so businesses could pool risk and negotiate lower health insurance premiums. And it would give businesses a new way to provide tax-free compensation to employees to purchase health coverage outside the workplace.

Congress also has a number of routine bills on deck, including renewed funding for community health centers, pandemic preparedness and opioid treatment that are almost certain to pass.

In a presidential year, committees can be expected to hold hearings on issues in the public spotlight, including the use of AI in healthcare, telehealth and other innovative technologies. Rural health and healthcare workforce issues also are at the top of the leadership’s health policy agenda for 2024.

All of these developments will likely add up to make healthcare reform a defining issue for 2024.

About the author

Grace-Marie Turner is founder and executive director, Galen Institute, Paeonian Springs, Virginia.

Paul Keckley: 3 major shifts are in store for healthcare in 2024

Three factors are contributing to uncertainty about the future of U.S. healthcare in 2024.

First, it’s an election year, so candidates make promises for votes that are rarely fulfilled. Major laws are unlikely. Industry change will come through actions such as executive orders, agency directives and court rulings.

Second, in an economic-recovery year, as the Fed seeks to quell inflation, consumer financial insecurity is high and antagonism toward the lack of healthcare transparency is growing.

Third, it’s the make-or-break year for healthcare’s private investors who’ve seen sustained IPO opportunities shrink, expected returns fall short and many healthcare deals face maturity cliffs.

Complicating matters, 2024 seems likely to present significant challenges due to three major post-pandemic shifts.

1 From trust to distrust. Polls have consistently chronicled the declining confidence in government: Congress, the presidency, the FDA and CDC, and even the Supreme Court are at all-time lows. Thus, lawmaking about healthcare is met with unusual hostility.

2 From big to bigger. The market has consistently rewarded large-cap operators, giving an advantage to national and global operators in health insurance, IT and retail health. In response, horizontal consolidation has enabled healthcare organizations to grow, increasing attention from regulators. Access to private capital and investor confidence are major differentiators for leading players.

3 From regulatory tailwinds to headwinds. In recent years, regulators have forced insurers, hospitals and drug companies to disclose prices and change business practices deemed harmful to fair competition and consumer choice. Incumbent-unfriendly scrutiny has increased at the state and federal levels, with bipartisan support for anti-industry legislation. Healthcare favor appears to have run its course.

So it seems obvious that bolder strategic moves by healthcare organizations will be constrained. In every sector, the punch list of priorities will be short:

- Cut operating costs and maximize workforce effectiveness in the core business to maintain a sustainable operating margin.

- Leverage relationships to increase scale through investments in adjacencies for strategic advantage.

- Monitor and enhance reputation among key stakeholders and aggressively manage disinformation about the organization.

- Assess and verify compliance and performance risks for key federal, state and local directives.

- Secure working relationships with private equity funds that offer opportunities for strategic growth.

- Monitor payer actions of significance to short-term profitability and long-term stability.

- Protect the balance sheet, monitor credit and secure capital at efficient rates.

- Keep the board informed and engaged.

For healthcare finance professionals, market surveillance of key trends such as clinical innovation, technology adoption, capital market access, regulatory compliance, and consumer attitudes and behaviors is imperative. Financial navigation in 2024 will be more complicated and judicious decision-making more vital.

About the author

Paul H. Keckley, PhD, is managing editor, The Keckley Report, Washington, D.C.

Andrew Donahue: Demographic changes signal growing economic challenges for healthcare

In 2024, an issue that has been looming in the background for many years will begin to emerge and become a fundamental concern for the nation’s healthcare sector: demographic change.

Consider this: Almost 100 years ago, during the 1924 presidential election year, the proportion of Americans aged 65 years and older was about 1 in 20. This year, during the 2024 presidential election, the proportion of Americans aged 65 years and older will have risen to above 1 in 6.a

Our society is beginning to experience a relative inversion of the U.S. population pyramid. For almost a century, American children, young adults and mature adults were steadily outstripping American retirees, widening the pyramid’s base and contributing to impressive domestic consumption, productivity and savings. The prosperity justified an expansion of social welfare programs meant to serve a relative few at the top of the pyramid.

Beginning in 2024, this dynamic will reverse in earnest, and the consequences to U.S. healthcare financing and local health system performance will become more readily apparent.

For instance, as unbalanced budgets, deficit spending and debt ratios contribute to unprecedented American ratings downgrades, annual tax revenue will also diminish, leaving lawmakers with fewer spending levers to pull at the state and federal levels. Consequently, elected officials will look to the largest share of their budgets, healthcare, for fiscal relief, and they will begin to tuck and trim provider payment rates and benefits in ways unseen heretofore.

These top-line pressures will emerge during a year that many analysts have described as “make or break” for community health systems, which are hovering somewhere barely north of break-even depending on their success with workforce recruitment and retention (also exacerbated by retirement rates and an exodus of senior experience). In other words, 2024 will mark the first year in which the long tentacles of demographic change will come into plain view: from shifting consumption and utilization patterns among American generations, to payer-mix erosion as seniors retire from service, to a shortage of post-acute and long-term care solutions.

What’s important to understand is this: Nearly every American alive today was born and raised in a golden age of extraordinary demographic fortune and economic prosperity. Today, still, as you look across all segments of society, there is an impression of “I am owed this,” or, “If it was before, it will always be,” or, “What got us here will keep us here.”

The year 2024 will begin to reveal a hard macroeconomic truth: “No, not necessarily.” The era of proliferation in U.S. healthcare is ending, and behind it may soon follow a period of rationalization. In our lifetime, financial leadership with a wide lens has never been more important.

Footnote

a. Caplan Z., “U.S. older population grew from 2010 to 2020 at fastest rate since 1880 to 1890,” United States Census Bureau, May 25, 2023

About the author

Andrew Donahue, FHFMA, CPA, is director of healthcare finance policy, HFMA’s Washington, D.C. office.

Ken Perez: Healthcare and the nation begin to meaningfully address homelessness

Tackling homelessness is one of those hard things that has long been intractable. Yet recognition of the problem has been growing, to the point that the discourse may be transformed more than ever into action in 2024. For that reason, it may well become one of the defining issues for our society, and for U.S. healthcare in particular, in 2024 and certainly beyond.

As I write this, many Americans, including U.S. Secretary of State Antony Blinken, are rightfully concerned about the deteriorating humanitarian conditions in Gaza. It prompted me to wonder how humanitarian we are when it comes to the roughly 600,000 homeless people in our own nation.

Last November, in preparation for the Asia-Pacific Economic Cooperation summit, San Francisco moved homeless people to other parts of the city, cleared tent cities and trash off the street and pressure-washed sidewalks. But the cleanup in no way fixed the real homelessness problem. That is much harder. To spur meaningful action to address homelessness, the issue needs to be raised much higher in the public discourse, and that needs to happen now.

Further, the healthcare sector will need to play a role. It is important that we recognize the connections between homelessness and healthcare: Consider, these points, for example:

- Homelessness is a major social determinant of health.

- Homeless encampments pose public safety and health hazards.

- Individuals who are homeless — especially chronically so — are frequent users of emergency departments (EDs), even though most of the care these people receive in the ED does not adequately address their health needs.

The financial impact on hospitals delivering this care is significant. Essential hospitals — more than 300 of the nation’s largest safety-net providers — serve communities with about 40% of the nation’s homeless population and 10 million people lacking health insurance. These hospitals delivered more than a quarter of all charity care nationally in 2021, but charity and other uncompensated care adversely impacted their finances, as they reported an average operating margin of –8.6%, versus –1.4% for all other hospitals, based on Medicare cost report data.a

Homelessness is not just a simple housing supply-and-demand problem, although, of course, a greater supply of affordable housing would be helpful. The challenges of the homeless are multifactorial, and the needs of each individual person who struggles with homelessness must be understood and met. Based on the experiences of communities that have succeeded in significantly reducing chronic homelessness, what’s required is an extraordinary amount of grit and exceptional levels of communitywide collaboration, with hospitals and health systems well positioned to play a key role.

Footnote

a. Lagasse, J., “Uncompensated care hammering finances of essential hospitals,” Healthcare Finance, Oct. 16, 2023

About the author

Ken Perez is a healthcare marketing, strategy and policy consultant in Menlo Park, Calif., and former vice president of healthcare policy

and government affairs for Omnicell, Inc.