How to keep your balance sheet steady in tumultuous times

The balance sheet contributes significantly to cash flow at most not-for-profit (NFP) hospitals and health systems. Yet few organizations have developed a strategy that reflects the balance sheet’s contributions to financial sustainability.

Throughout the operational and financial turmoil of the past few years, many health systems have relied on their balance sheet to compensate for depressed or negative operating margins and reduced cash flow from operations.

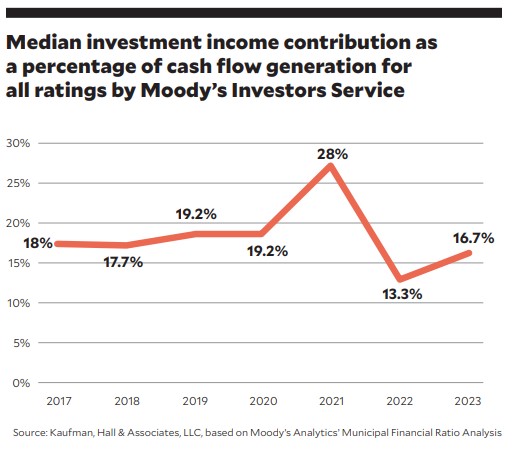

Prior to the COVID-19 pandemic, the median investment income contribution to cash flow across all rating categories (AA, A and BBB) was just under 20%, according to an analysis by Moody’s Investors Service, the ratings agency now called Moody’s Ratings (see the exhibit below). Since the pandemic’s inception, that median contribution has climbed to as high as almost 30% of cash flow. For organizations with negative operating performance, the percentage can be much higher. An interesting question is whether there is any other strategic area within the organization responsible for such a large portion of cash flow.

A need for a balance sheet strategy

Health system leaders devote a significant amount of time to setting strategic direction for the organization. They also dedicate significant time and resources to improving operations. Yet despite its contributions to financial sustainability, the balance sheet has not been given a comparable amount of strategic attention from health system leaders.

The importance of the balance sheet for NFP health systems is driven by three realities:

- NFP healthcare is an asset-heavy enterprise, requiring significant investments in brick-and-mortar assets and high-cost equipment and technology.

- Unlike for-profits, NFP hospitals and health systems cannot access equity markets for funding; instead, they rely on cash flow, investments, debt or financial reserves.

- There are a high number of noncontrollable factors in the NFP healthcare business model, a point made painfully clear during the COVID-19 pandemic.

The net effect is that NFP health systems carry large balance sheets largely comprising bricks-and-mortar assets and investment portfolios. On average, these two assets constitute about 70% of a typical health system’s total assets, supporting operations, contributing to liquidity and enhancing debt capacity for projects with significant funding needs.a

A composite analysis

Health systems may already have resources dedicated to individual components of the balance sheet, such as real estate management and investment or debt advisers. These resources can help optimize the performance of these individual components by focusing on matters such as platform design, policy development, opportunity identification, execution, fee arrangements, technology selection, risk management and policy compliance. Although these efforts can yield substantial improvements, an overall balance sheet strategy that focuses on the interplay of these individual components through a composite analysis can reap greater benefits.

The goals of a balance sheet strategy will vary by organization; they may include optimizing the risk-adjusted balance sheet yield, ensuring the stability of balance sheet resources and/or increasing aggregate cash flow.

Regardless of the goals, a composite analysis will help management determine, for example, when it is necessary to add or reduce leverage, revisit portfolio asset allocation, boost liquidity or access various funding channels (e.g., debt, real estate, leasing) to achieve identified goals.

A composite analysis of the balance sheet is particularly valuable in promoting understanding of how a decision affecting one component of the balance sheet might affect others, and how it might affect the organization as a whole. The sale of a real estate asset, for example, might bolster liquidity, but it also might run counter to the organization’s long-term efforts to expand.

Once balance sheet strategy goals have been established, they can also help define performance metrics that are tied to management compensation arrangements, which often are tied to operating performance. Adding metrics for balance sheet performance underscores their significance to the organization.

Varying risk

Another consideration is the role of risk in defining balance sheet strategy and assessing performance. In many areas of performance, health systems rely on peer comparisons to assess their progress. But two organizations with comparable balance sheet compositions may be in very different situations with respect to a host of matters, including capital investment cycle, strategic opportunities, market dynamics and the rate at which balance sheet resources are being drawn upon.

Given the limited usefulness of peer analyses, health system leaders must develop a deeper understanding of their own organization’s capacity for and willingness to take on risk. They need to analyze how the organization assesses and measures risk and how risk is factored into the development of strategy and performance objectives. Many health systems conduct enterprise risk management (ERM) assessments, but fewer take the next step in connecting the ERM assessment to a balance sheet strategy.

Balance sheet strategy should identify and address the subset of risks that represent major headwinds the organization could face. Understanding what the headwinds are, the likelihood they will occur and their potential impact if they do occur will help establish the organization’s risk capacity parameters and risk appetite. The parameters, in turn, will help define the degree of risk incorporated within the balance sheet strategy.

Footnote

a. Based on data from Moody’s Analytics’ Municipal Financial Ratio Analysis service.