Future of Consumer Expectations

An outsider-led restructuring of the healthcare operating model is seemingly inevitable by 2030, with some CFOs getting ready now.

By LISA A. ERAMO, MA

|

Treating a simple sore throat doesn’t have to be the complicated affair it often is, and in the future it won’t be. |

Traditionally, the patient takes on most of the work, searching for an open slot at a primary care clinic, getting there on time and then waiting after filling out a repetitive and lengthy intake form, all the time holding out hope that the provider is in-network.

But in the future, managing healthcare may be more like shopping on Amazon, or it literally will be shopping on Amazon, depending on how things play out.

Tatyana Popkova, MSM, chief strategy officer for Rush University System for Health in Chicago, says the goal for the future is to give patients fast, easy options with transparent pricing. They should be able to go online to compare convenient care options, including costs, and then get what they need with a few simple clicks — and possibly without ever leaving home.

“We are very committed to providing consumers with multiple choices,” Popkova said. “I believe in giving our patients a retail experience.”

“When I look at Amazon, I think, ‘How can we partner with them and complement each other?’ For us to be a regional partner for one or several of these companies would be a terrific opportunity.”

Tatyana Popkova, MSM

Chief strategy officer for Rush University System for Health in Chicago

Popkova is not alone in her thinking. Such systems as Froedtert & the Medical College of Wisconsin, Prisma Health and Providence, as well as a slew of for-profit companies, are eyeballing that front door to the healthcare system.

“I think what’s happened in the last two years with the pandemic and explosion of venture capital funding for digital health disrupters is that there are some serious potential threats and opportunities to really change the way we deliver services — particularly the front-end, digital-first primary care,” said Ian Morrison, a healthcare futurist in Menlo Park, California. “All of these digitally enabled services have the potential, and I say, ‘potential,’ to undercut access to patient referral and flow.”

Rush is already laying the foundation for a broad and deep online experience. Patients can self-schedule clinic and virtual appointments based on real-time availability and can connect with a provider by video within about 20 minutes using the My Rush mobile app. Popkova describes it as a high-touch, high-tech front door.

It’s all part of a fully integrated digital health platform that will eventually include remote patient monitoring for various service lines. She said this type of platform is not an optional investment for organizations that want to remain competitive: “Before COVID, digital front door and telehealth were differentiators for a lot of us. Now, though, it’s an expectation. We’re past the point of no return.”

Eventually, Rush plans to commercialize its platform by offering digital front-door services to affiliated physician practices within the community.

“Not every private practice can afford this type of infrastructure,” she said. “We want to attract providers to us and offer digital-door services, so they have the consumer-direct exposure.”

In the next five years, Popkova said the health system’s strategy will enable it to handle 80% of non-tertiary care digitally — if payers cover these services. The health system has already successfully transitioned much of its non-tertiary care to a digital environment thanks to the effects of high-deductible health plans on consumer decisions.

“With the out-of-pocket for traditional services being as high as it is, we can now compete in the telehealth space,” she said. “Delivery systems are asking consumers to pay directly for it, and many of them are willing to do that.”

AMAZON, FRIEND OR FOE?

Popkova doesn’t view Amazon and other disrupters as a threat to the organization’s bottom line. Actually, it’s just the opposite.

“When I look at Amazon, I think, ‘How can we partner with them and complement each other?’” she said. “For us to be a regional partner for one or several of these companies would be a terrific opportunity. This is a very real possibility. One thing that these organizations don’t have, which Rush does, is clinical providers. That is something that any disrupter will need, and it’s something that we can sustainably supply.”

Amazon, which owns primary care provider Amazon Care, declined comment.

What will be most important for health systems going forward? Remaining nimble, said Popkova: “We need comfort with ambiguity, and we need to be open to innovation. We need to experiment with business models and take risks. If we can continue the momentum we gained during COVID-19, we’ll be OK.”

Cybersecurity and expanded digital health strategies

Digital healthcare, even after an explosion of telehealth use during the pandemic, is poised to experience more innovation and growth, creating opportunities and risks.

“If you think we’ve seen a revolution with the digitization of healthcare, I’d say we haven’t seen anything yet,” said Errol Weiss, chief security officer at the Health Information Sharing and Analysis Center (H-ISAC), a global, not-for-profit organization. “There will be an incredible explosion of data, and new innovative companies we haven’t even thought of will be born because of the availability of this kind of data.”

With that growth comes risk. “From a privacy standpoint, how do we protect our consumers, and how do we keep the information secure and in the right hands?” Weiss asked.

For hospital executives, that creates a balancing act between moving forward with digital health strategies and securing protected health information. Experts say there are no bulletproof tactics because threats constantly evolve. However, there are important questions to consider that can greatly enhance cybersecurity, and financial executives need to be leading the conversations and ensuring appropriate funding.

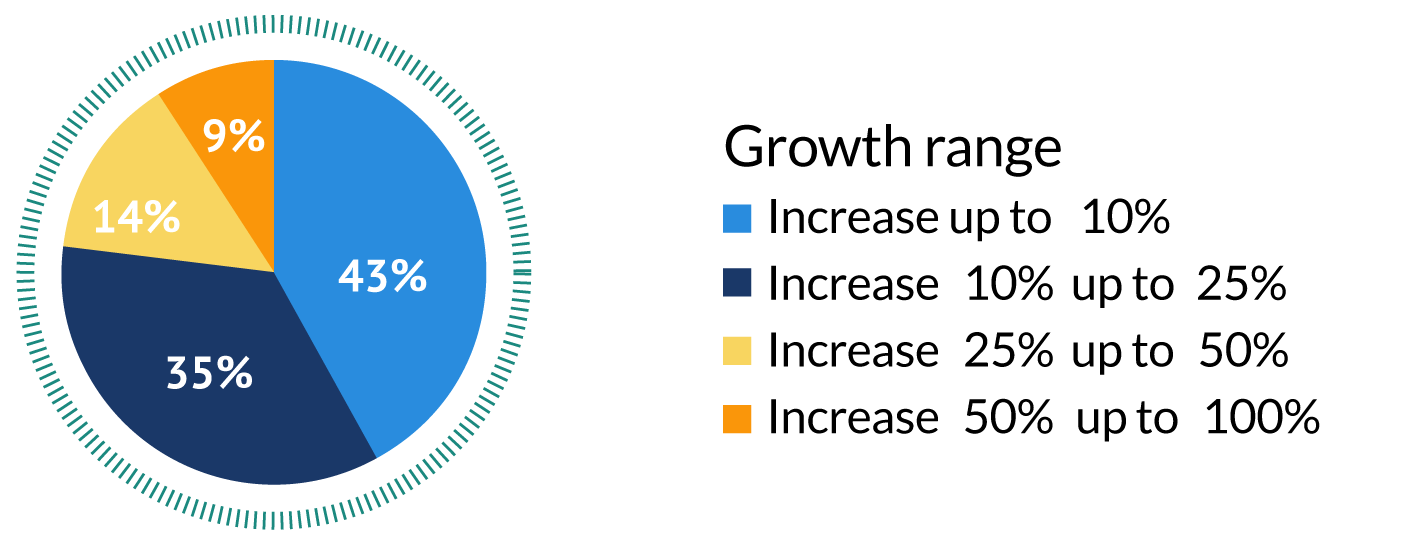

CFO SURVEY: CYBERSECURITY SPENDING

Expected annual growth in cybersecurity budget

Percentage of CFOs responding

Every respondent to a cybersecurity question in a recent HFMA survey said they plan to increase their cybersecurity budget going forward, with 35% planning to increase the budget by 10% to 25% from the previous year. See chart on page four for more results.

“The CFO of tomorrow needs to be cyber-savvy and cyber-aware,” said Frank Cilluffo, director of Auburn University’s McCrary Institute for Cyber and Critical Infrastructure Security. “A good CFO understands risk and exposure. Their entire business is in the cyber domain. Cybersecurity is a critical business function.”

Cyberattacks against U.S. healthcare entities rose by over 55% in 2020 compared with the previous year, according to research from cloud security firm Bitglass. The report also states there was more than a 16% increase in the average cost to recover each patient record in 2020 versus 2019. Restoration of systems to pre-attack status took 236 days on average.

“Healthcare organizations were always at risk for intellectual property theft, but I think this increased as medical responses and breakthroughs related to COVID-19 became more prevalent in the world,” said Cilluffo. “Anything that has value has a target on it.”

— Lisa A. Eramo

PRISMA HEALTH: SOLVING PROBLEMS WITH TECHNOLOGY

The first thing Nick Patel, MD, did as chief digital officer at Prisma Health, Columbia, South Carolina, was roll out a digital front door. The intention was to remove barriers to access and also appeal to a new generation of patients, Patel said.

“Millennials, who now outnumber the baby-boom generation, expect an on-demand, frictionless experience. Health systems have to understand there is a paradigm shift in terms of how we need to transform care delivery to our patients.”

Nick Patel, MD

Chief Digital Officer, Prisma Health in Columbia, South Carolina

“Millennials, who now outnumber the baby-boom generation, expect an on-demand, frictionless experience,” he said. “Health systems have to understand there is a paradigm shift in terms of how we need to transform care delivery to our patients.”

Prisma implemented the following changes:

- Patients can look up providers based on keyword searches of health conditions.

- Patients are able to view personalized videos and stories of each provider to find the best match for them.

- A new app was introduced to help patients navigate each step of a visit to Prisma Health facilities, including locating a provider practice, patient room and department using their smartphone.

- The app also provides visitors with turn-by-turn guidance from their current location to their destination and helps patients navigate inside buildings with a 3D map of the floor plans.

- Future features of the app: Patients will be able to self-schedule an appointment, access their health information, pay their bill and see waiting times for emergency rooms and urgent care.

As Patel thinks about a larger digital health strategy, he said these questions often come to mind: What challenges do consumers face in reaching their healthcare goals, and how can technology help them overcome those challenges? For example, the health system is currently rolling out remote monitoring programs for patients with diabetes, hypertension and congestive heart failure — patient populations that Patel said need better engagement and oversight outside of routine office visits. This helps patients achieve healthcare goals faster.

However, it also requires significant planning. For example, the health system must find ways to manage supply chain and logistics for the wearable technology as well as set up escalation points for intervention. It’s also important to work with community leaders to help tackle the social determinants of health, like access to broadband and tech literacy, that may hinder patients from using wearable technology and other digital health services.

But it can’t be all about the technology, Patel said. Health systems have to include a care team of coordinators, social workers, health coaches, pharmacists and others to provide ongoing patient support as part of their overall digital health design, he added.

“We think a lot of these low-level acuity problems can be handled via digital health asynchronously,” he said. “You don’t even need to leave your house.”

Looking to the future, having a data-driven digital health strategy will be paramount.

“The EHR has gotten us to where we are, but it’s really more of a data entry system,” he said. “We need to look at our overall architecture, see how we can consolidate and figure out how to get one single data stream so we can get insights faster.”

Although healthcare disrupters pose a threat, Patel said he isn’t too worried. “I think it’s important for health systems to realize that they can’t do everything,” he said. “They can’t be the provider for every single patient or every encounter. Partnerships are important because they help you grow organically without having to build another building. You’re partnering with others who already have a massive footprint.”

FROEDTERT: REMAINING AGILE

Bradley Crotty, MD, chief digital engagement officer and internist at the Froedtert & the Medical College of Wisconsin health network, aspires to create a digital transformation similar to that of Target. “Target uses data and analytics to manage all aspects of its business even though it has a really strong in-person presence,” he said.

This transformation requires a new way of thinking about digital investments. “We believe that we should be looking at these resources like we do other things we put on the balance sheet because they require investments, and they provide value,” Crotty said.

Providing value doesn’t necessarily mean direct revenue, said Crotty, who offers an example of digital therapeutics that physicians can prescribe from within the EHR. Internet-based cognitive behavioral therapy may be an ideal, low-cost intervention for certain types of patients with anxiety or depression.

“It’s convenient and it’s always on,” he said. “We can impact clinical outcomes at a relatively low marginal cost. If we’re moving toward fee-for-value, we’re going to find the most cost-effective way to make sure patients get the right care. For some, this may mean in-person care, but for others, it may mean lighter-touch interventions.”

ACCELERATION NEEDED

Crotty anticipates that the biggest challenge for the health system going forward will be innovating quickly.

“Rather than planning a massive project, running it through milestones and finishing something 18 months later, we’re working on delivering incremental value faster,” he said. In the past two years, the health system has implemented 26 innovation projects, including online tools for behavioral health, diabetes management, patient engagement, campus wayfinding and remote monitoring.

In doing so, Froedtert is trying to break away from the traditional slow-moving health system mindset that could delay changes for years. “If healthcare organizations plan everything meticulously, we’ll be like what an Amazon Care is by 2027,” he said. “We’ll lose the ability to be relevant today.”

As organizations decide whether to build, buy or partner to expand their digital health strategies, Crotty said they should consider these four questions:

What’s your desired time to value (understanding that building will take the longest)?

How will the experience grow over time?

How integrated into your workflow, operations and the digital experience do you want it to be?

How much control do you want over that full experience?

“We feel, at Froedtert, that we want to own the digital experience that our patients have with us,” he said. “We use our partners to do that, but it’s really important that it be ours. That does entail starting to build some of those capabilities with our own engineering team.”

PROVIDENCE: STAYING TOP OF MIND

Amazon founder Jeff Bezos is known for saying, “Your margin is my opportunity.” Sara Vaezy, chief of digital and growth strategy at Providence, a Renton, Washington-based not-for-profit system, says she thinks about this quote frequently. “Our industry is now a competitive one,” she said. “Health systems need to use this new factor to drive innovation from within.”

“Our industry is now a competitive one. Health systems need to use this new factor to drive innovation from within.”

Sara Vaezy

Chief of Digital and Growth Strategy, Providence, a Renton, Washington-based not-for-profit system

Amazon Care has a heavy presence in Washington state, where Providence is based, but Vaezy isn’t necessarily threatened by that. “There are plenty of technology-enabled companies doing things in healthcare,” she said. “Taken individually, each is very narrow in their focus and impact, but taken all together, they are a disruptive wave that should be driving new thinking and innovation within all health systems.”

That’s why Vaezy’s digital health strategy is all about engaging and retaining consumers. Brand uniformity and personalized, data-driven interactions become paramount, Vaezy said. “Most patients don’t interact with their health system more than a couple times per year,” she said. “We’re flipping that on its head and saying every interaction between you and your healthcare provider doesn’t necessarily need to be purely clinical in nature and related to a clinical episode of care.”

Just as people see different products on their Amazon homepage depending on their past purchases and viewing history, when consumers log onto the Providence app, they see customized content based on self-entered information, EHR data and more. “The more relevant the content, the more likely patients are to engage with it,” said Vaezy.

Online discoverability is also important: Many of Providence’s employees are from technology and other commerce-related organizations, so they really know what digital experiences are needed to both be discoverable by patients searching online and to drive conversion into the system, she said.

FOR-PROFIT COMPANIES COME KNOCKING

Meanwhile, digital front-door disrupters, many of which are venture-capital-funded companies, will continue to attract patients and pull them away from traditional healthcare providers, Morrison said. “Hospitals and health systems are going to have to emulate the digital front door to try and make that experience much better,” he said.

Hospitals and health systems also need to keep their eye on disrupters that use value-based care models to keep patients out of the hospital, said Morrison, pointing to companies like Oak Street Health, ChenMed and Iora Health. “To the degree that these entities scale up, they could have an impact,” he added.

Retail medicine will continue to lure consumers looking for cheaper, more convenient alternatives, said Morrison: “These entities have massive amounts of economic firepower and footprint. They have the same potential effect of controlling that front door to healthcare.”

No single disrupter poses a significant threat. “Some of these disrupters will have the intended effect of stealing front-end business,” Morrison said. “Some of them will provide services to existing incumbents to make them work better. Some of them will fail. I think we’re going to see a massive amount of consolidation in the next three years of these new actors. There’s just too many of them with very similar value propositions.”

Still, hospitals have two major advantages: Incumbency and cash, said Morrison. “There will always be sick people who need hospitalization and surgery, and hospitals are already there,” he said. “The power of incumbency should not be underestimated. Most hospitals also have 180 days of cash on hand. That’s not trivial. They can deploy that capital to buy assets or improve operations.”