News Briefs: 2023 brings a steep fee hike for No Surprises Act arbitration cases

As published in the February 2023 issue of hfm, this roundup presents the top news stories for healthcare finance professionals.

The No Surprises Act’s independent dispute resolution (IDR) process has become more expensive for healthcare stakeholders.

For the new year, the nonrefundable administrative fee due from each party involved in any payment dispute that goes to arbitration increased from $50 to $350, according to a Dec. 23 memo from CMS’s Center for Consumer Information and Insurance Oversight.

The increase, which modified an Oct. 31 announcement that the $50 rate would carry over from 2022, was attributed to “increasing expenditures in carrying out the federal IDR process.”

A big issue was the logjam of cases that quickly developed, far exceeding the anticipated volume. The federal agencies overseeing implementation of the No Surprises Act reported that nearly 164,000 cases were filed between April 15, when the IDR portal opened for business after delays, and Dec. 5. That compares with a preliminary projection of about 17,500 for the full calendar year.

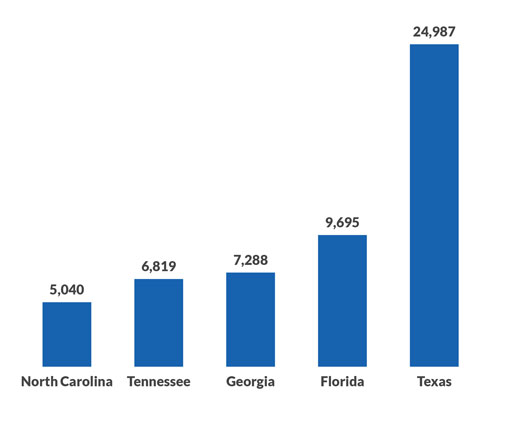

States with the most payment disputes under the No Surprises Act

Remedies for 340B underpayments remain up in the air

A federal court is allowing the U.S. Department of Health and Human Services (HHS) to decide on remedies covering Medicare underpayments to hospitals for drugs purchased through the 340B Drug Pricing Program.

Healthcare provider plaintiffs had hoped the U.S. District Court for the District of Columbia would dictate terms. But in an opinion published Jan. 10, the court declined to impose specific remedies.

“When a plaintiff brings an [Administrative Procedure Act] claim to set aside an unlawful agency action, it is the prerogative of the agency to decide in the first instance how best to provide relief,” Judge Rudolph Contreras wrote, quoting a prior case.

Hospitals and health systems participating in 340B are due remedies after a Supreme Court decision last June established that the Medicare payment rate for 340B drugs was unlawful as it stood between 2018 and 2022. During that span, HHS (specifically CMS) dropped the payment rate from average sales price (ASP) plus 6% to ASP minus 22.5%. The higher rate was restored in late September as a result of the Supreme Court decision and remains in place for 2023.

New federal rule aims to eventually ease prior authorization processes

In a proposed rule, CMS is seeking to improve the prior authorization process in government programs such as Medicare Advantage (MA) and Medicaid, although the rule’s core provisions would not begin until 2026.

72 hours

Proposed limit on prior authorization for expedited requests (increasing to one week for standard requests)

The new proposals are included in an update of a Trump administration proposed rule. MA plans, state Medicaid programs, Medicaid managed care plans and health plans participating in the Affordable Care Act insurance marketplaces would need to implement an HL7 FHIR API to automate certain processes for providers.

Those processes include determining whether a prior authorization is required; identifying prior authorization information and documentation requirements; and facilitating the exchange of prior authorization requests and decisions via electronic health records or practice management systems.

HIPAA-covered entities would continue to be required to use the current adopted standard for prior authorization transactions (e.g., X12 278 version 5010).

MACs should more closely examine providers’ bad debt claims, HHS watchdog says

Medicare administrative contractors (MACs) soon could apply more scrutiny to providers’ reported bad debts if CMS implements recommendations from the HHS Office of Inspector General (OIG).

OIG in December issued a report in which it examined bad-debt reimbursement claims on Medicare cost reports spanning 2016 through 2018 for 67 randomly selected providers, including 29 hospitals.

In those cost reports, investigators found that among a set of 62 claims involving bad debt, providers did not comply with federal requirements pertaining to collection efforts in 18 instances. In four other cases, the claims did not reflect the amounts owed by beneficiaries.

CMS should update the guidance it provides to MACs regarding reviews of Medicare bad debts as claimed in cost reports, according to OIG. One option would be to establish a dollar threshold beyond which a reported bad debt would trigger an audit.

Proposed 2024 rule for MA health plans would enhance provider directories

Medicare Advantage (MA) health plans would need to incorporate information about cultural and linguistic capabilities in provider directories starting in 2024, according to a proposed rule. The requirement mirrors an existing mandate for Medicaid managed care organizations.

Directories also would have to identify providers that have received waivers allowing them to furnish medications for opioid use disorder (MOUD).

“MA enrollees may have little insight as to which providers can provide MOUD,” CMS wrote in the rule. “This problem is especially urgent, as overdose deaths from opioids have skyrocketed during the COVID-19 pandemic.”

2024 ACA marketplace rule would expand the categories of essential community providers

Proposed regulations for health plans participating in the Affordable Care Act (ACA) insurance marketplaces call for expanding the essential community provider (ECP) designation to include two new categories: mental health facilities and substance use disorder treatment centers.

Those facilities previously were included under the miscellaneous “other ECP” category, among which plans need to make good-faith efforts to contract with only one provider type to satisfy regulatory requirements.

As of 2023, the primary ECP categories are hospitals, federally qualified health centers, Ryan White Program providers, family health providers and Indian health providers. Plans must seek to contract with at least one of each of those and have at least 35% of all available ECPs in their network.