Beyond the Rhetoric: Implications and Unintended Consequences of Tax Reform and Medicare Policy

Hospitals across the country have seen many changes in the past seven years as the Affordable Care Act (ACA) has evolved and states have implemented optional components of the legislation. More recently, hospitals have faced unknowns with the constant threat of repeal and replace and passage of the new tax-reform legislation. Chief among the unknowns are uncertainties around payment from government payers and the effect of the overall insured rate, which have kept providers on the edge of their seats.

Insured but Eligible for Charity Care

Under the ACA, many states expanded Medicaid coverage, attempted to roll out exchanges for commercial plans, or both. These changes have required the Centers for Medicare & Medicaid Services (CMS) to begin modifying certain payment methods to hospitals, redirecting funds from the hospitals’ prospective payment systems to pay for expanded coverage in other areas of federal and state spending.

Coverage through exchanges and changes to employer-based health plans had the intended effect of shifting many patients from uninsured to insured status. Unfortunately, as this category shift was occurring, many exchanges and insurance consumer- operated and oriented plans (CO-OPs) failed. Although now technically insured, many of these individuals have high-deductible health plans (HDHPs), with deductibles that often exceed $5,000, placing them in the self-pay category. And those who have difficulty meeting their patient financial responsibility—and consequently may qualify for financial assistance to meet these obligations—could end up in the charity care category, as well.

One of the biggest challenges with the influx of insured individuals who still qualify for charity care is the process by which CMS determines hospital payments.

Meanwhile, in the current environment, extraordinary financial pressure is looming over the healthcare delivery system, potentially causing a renewed spike in uninsured and underinsured populations and continuing uncompensated care issues across the country. There are three factors that could be major contributors to this trend:

- Elimination of the individual mandate

- Growth in the national debt

- Reduced federal subsidies of expanded Medicaid

Individual-Mandate Penalty

The recently enacted tax-reform law, the Tax Cuts and Jobs Act of 2017 (TCJA), eliminated the individual mandate penalty beginning in 2019—a move that the Congressional Budget Office (CBO) estimates will add 13 million to the number of uninsured Americansby 2027 and will cause average health insurance premiums to increase by about 10 percent per year over the next decade.

More conservative estimates still show significant increases in those who choose not to be insured when there are no penalties and in those who are priced out of the escalating insurance markets.

Growing U.S. Debt

Tax reform is projected to add almost $1.5 trillion to the national debt over the next 10 years. At that point, the CBO estimates publicly held U.S. debt will approach 100 percent of the country’s annual gross domestic product (GDP)—a key ratio many experts believe will put considerable strain on the economy as interest rates rise and available credit is reduced.

As political leaders grapple with this issue, they’ll need to address the largest budget-line item: federally provided or subsidized health insurance, which includes Medicare, Medicaid, the Children’s Health Insurance Program (CHIP), and market-exchange subsidies under the ACA. Efforts to rein in spending from these programs will likely either reduce the number of individuals insured or reduce the benefits available to enrollees.

Declining Federal Coverage of Medicaid Expansion

The ACA gave states an incentive to expand their Medicaid programs by covering 100 percent of the newly eligible individuals in the first three years. That level of federal funding would then be phased down, leaving states with uncertainty regarding how they will pay for the shortfall.

The reduction in federal support will put pressure on the 32 states that expanded to either reduce benefits or cut back on enrollees in their Medicaid programs. Ongoing healthcare reform attempts and annual congressional budget discussions continue to target state Medicaid payments as an area to slow growing costs.

Payment for Uncompensated Care

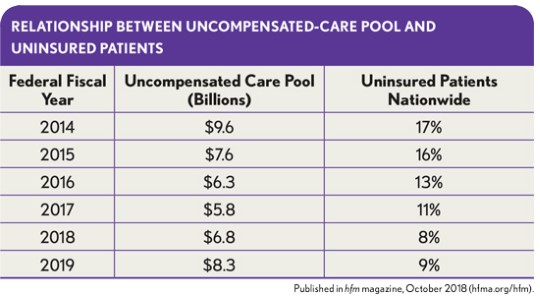

Under the ACA, the federal government uses the number of uninsured patients—which has steadily declined since 2014—to determine the amount that needs to be diverted from the uncompensated care pool to other programs under the ACA. The exhibit below illustrates the direct relationship between the uncompensated care pool available for distribution and the percentage of uninsured patients nationwide as measured by the CBO. In many cases, the change in the uninsured rate in this calculation was related to HDHPs and Medicaid-plan expansion, which meant that although more patients were insured, hospitals were being paid at lower rates relative to the cost of patient care—while they were receiving no payment charity care and bad debt cases.

Disproportionate-share hospitals (DSHs). DSHs serve a disproportionate number of low-income and uninsured patients, receiving payments from CMS to help cover some of these costs. Under the ACA, the calculation of these payments was changed to account for the expansion of Medicaid on a state-by-state basis and coverage on the exchanges nationwide.

Previously, Medicare handled DSH payments as an add-on to the payment for inpatient services using a threshold calculation of the hospital’s Supplemental Security Income (SSI) ratio and the percentage of Medicaid days to total patient days.

Under the ACA, the algorithm was modified to take the previous pool of DSH funds and redistribute them in the following manner:

- 25 percent, referred to as the empirical DSH payment, continues to be handled as an add-on to each claim using the prior methodology, and it is settled on the hospital’s annual Medicare cost report.

- 75 percent, referred to as the uncompensated care pool, is distributed to the same population of hospitals based on factors that account for the change in the uninsured population nationwide as well as hospital-specific data.

Non-Expansion of Medicaid in some states. Compounding the DSH issue is the fact that several states opted not to expand their Medicaid program and, thus, continue to see an increasing number of uninsured patients in their communities. For example, the uninsured rate in Texas, which did not expand Medicaid, was nearly 19.5 percent in 2017—far above the 11 percent uninsured rate nationwide—and certain areas of the state have even higher uninsured rates. The states with the highest uninsured rates as of 2016 are, in order, Texas, Oklahoma, Alaska (which recently expanded its Medicaid coverage), Georgia, and Mississippi.

In the first few years of the new uncompensated-care-pool distribution, hospitals in expansion states realized a small benefit from increased Medicaid plan payments because of a swell in patients who were previously uninsured but became eligible for Medicaid. This change resulted in an increase in Medicaid DSH payments as the ratio of the states’ Medicaid patients grew as a percentage of their total patient populations. Hospitals in the non-expansion states listed above didn’t realize this benefit, however, because it depended on an expanded Medicaid population.

Charity care and bad debt. In addition to the changes in the level of insured patients, certain providers are also beginning to overhaul the reporting of patient charges, charity care, and bad-debt expense to meet the new revenue recognition standards issued by the Financial Accounting Standards Board (FASB).

Charity care and community benefits are two areas that affect not-for-profit hospitals in many ways. From reporting on the IRS Form 990 to the Medicare cost report and audited financial statements, the outcome of serving uninsured and underinsured patients has a direct impact on a hospital’s tax-exempt status, level of payment from government payers, and overall bottom line.

Medicare Cost Report Worksheet S-10

From federal fiscal year 2013 (FFY13) through FFY17, the distribution of the uncompensated care pool to eligible hospitals was driven by a calculation of the hospital’s Medicaid days and SSI days compared with the national average. This calculation wasn’t dramatically different from the historical settlement calculation of DSH dollars on each hospital’s annual Medicare cost report, but it allowed CMS to account for the reduction in the number of uninsured patients in the overall amount paid before distributing the remainder.

Beginning in FFY18, CMS added a third element to the hospital-specific calculation: the calculated uncompensated care cost from each eligible hospital’s Worksheet S-10. Note that CMS is using only the uncompensated-care cost amount, which doesn’t include the shortfall from Medicaid programs—another section of Worksheet S-10.

This policy creates issues for hospitals in states that expanded their Medicaid program. As noted previously, although the expansion decreased their uninsured populations, the amount of payment they receive from Medicaid plans falls far short of the cost of patient care. And with the new calculation, more money will be diverted from the uncompensated care pool to hospitals with high charity care costs due to uninsured patient populations.

Many groups—including the American Hospital Association, the American Federation of Hospitals, and HFMA—have provided CMS with written comments and concerns about the use of Worksheet S-10 data in calculating payment for inpatient services. These concerns include the unclear nature of the worksheet’s instructions and the inconsistent nature in which hospitals apply their charity care policies nationwide, either due to organization type or varying demands of government bodies.

Commenters have emphasized that it’s especially unusual for CMS to overhaul payment methodologies using data that have not been reviewed by a Medicare administrative contractor (MAC) or assessed by CMS for aberrations that may create issues down the line for hospitals.

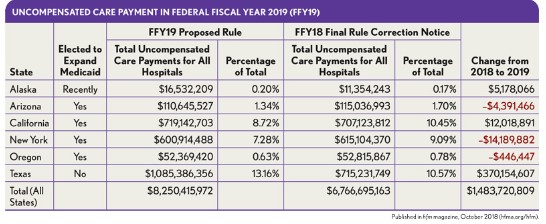

Texas—a state that did not expand its Medicaid program—is the largest beneficiary of this change, gaining a significant increase in its inpatient payment, as shown in the exhibit above. Hospitals in New York and other states, on the other hand, will see declining payment rates due to their Medicaid expansion and other factors.

Looking Forward

For individuals able to pay rising premium costs due to the increase in uninsured individuals, the current trend of HDHPs is expected to grow. Under these plans, the monthly premiums grow at a slower rate in exchange for policies that require higher deductibles from consumers if they use their coverage for services beyond certain preventive care issues. These high deductibles often are more than families can afford to pay, however, which means a family member being unexpectedly hospitalized can lead to bad-debt write-offs for providers that cannot collect the deductibles from patients.

The result is a system of underinsured individuals who technically have insurance, but who often can’t use it without being billed beyond what they can afford to pay.

With such factors weighing on hospitals’ financial assistance programs and ability to meet patient’s unmet needs, it will be vital for hospitals nationwide to capture and report the most accurate information available to optimize their payment and sustain operations. As Medicare and Medicaid begin to evolve payment mechanisms that more closely align with each hospital’s quality of care, service to indigent patients, and ability to bend cost curves, a hospital’s understanding the full picture of its marketplace and patient demographics will correlate to its ability to achieve better financial performance.