Analysis: ‘Medicare for All’ supporters more concerned about cost

- A recent poll by Harvard, the Commonwealth Fund and The New York Times finds 32% of Americans are in favor of Medicare for All.

- Those that favor Medicare for All are more dissatisfied with the cost of healthcare and more concerned about their ability to pay for care if they became ill.

- HFMA’s Chad Mulvany says it makes sense that public support for Medicare for All would increase as more individuals and families become concerned about their ability to pay for healthcare.

According to an article in the Oct. 30 issue of The New York Times, a recent poll by Harvard, the Commonwealth Fund and The New York Times finds 32% of Americans are in favor of “Medicare for All” (defined as a single-payer system).

Those that favor Medicare for All are more dissatisfied with the cost of healthcare and more concerned about their ability to pay for care if they became ill than those who are supportive of either expanding the ACA or replacing the ACA with state-based plans.

Takeaway

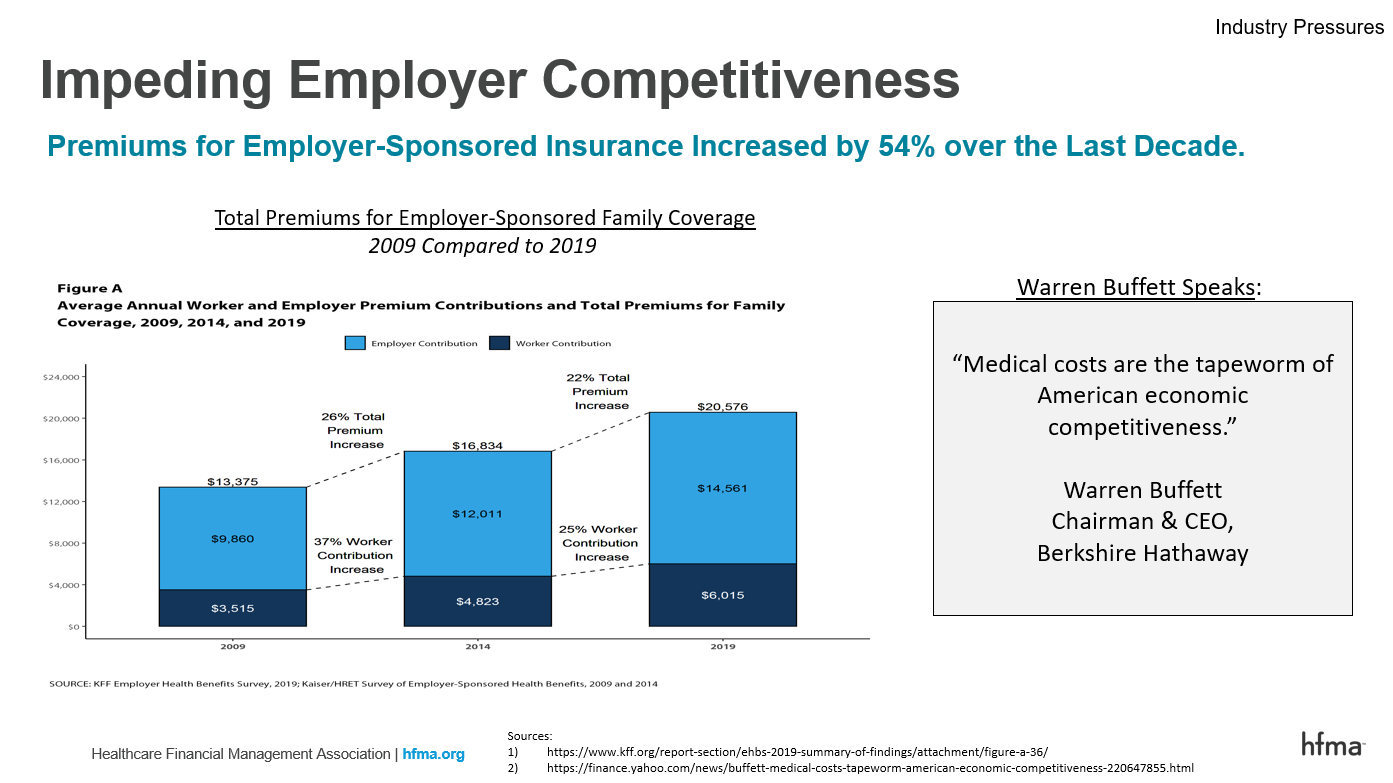

We don’t have longitudinal data to state this definitively, but it makes sense to me that public support for Medicare for All would increase as more individuals and families become concerned about their ability to pay for healthcare (both premiums and cost sharing at the point of service). And if the recent trend in employer sponsored insurance cost growth continues — 5% increase compared to last year, 54% since 2009 — it’s likely public support will grow with it.

It’s probably in the best interest of providers, health plans and employers to quickly figure out ways to “bend the cost curve” instead of pointing fingers at each other. There’s shared accountability to go around.

One way would be to come to the table and develop equitable alternative payment models that reward provider groups who consistently deliver good outcomes at a lower total cost of care with not just shared savings but increased volumes. One might even argue that since employers are purchasing coverage on behalf of their employees, they have a fiduciary responsibility — even in the face of employee backlash, which could be tamped down with education and passing along savings in the form of reduced premiums and increased wages — to steer their employees away from low-value providers.