7 Considerations in the Financial Modeling of Value-Based Payment Arrangements

A forward-thinking financial model can help hospital leaders better predict and balance potential gains and losses from incentives, penalties, volume changes, and other factors related to value-based payment.

As hospitals and health systems in the United States continue to move from a purely fee-for-service (FFS) model to value-based payment, there are various ways in which they can accomplish this transition, some mandatory and others elective.

For example, hospitals and health systems already participate in mandatory Medicare value-based models such as the Value-Based Purchasing (VBP) Program, the Hospital-Acquired Condition (HAC) Reduction Program, and the Hospital Readmissions Reduction Program (HRRP). Meanwhile, elective value-based payment models include the Medicare Shared Savings Program (MSSP) and any number of commercial, Medicare Advantage (MA), and Medicaid managed care arrangements.

The financial impact of participating in these various models can be in the millions of dollars for these organizations and the provider organizations they may sponsor, such as accountable care organizations (ACOs) and clinically integrated networks (CINs).

For example, the ACOs participating in MSSP under the sponsorship of the Memorial Hermann Health System in Houston, Cleveland Clinic in Cleveland, and UT Southwestern Medical Center in Dallas each earned more than $14 million in shared savings in performance year 2016. a To be prepared for the impact of value-based payment, it is essential that hospitals create forward-thinking financial models to predict how much they may gain or lose from related incentives, penalties, volume changes, and other factors.

The seven considerations below provide healthcare finance leaders with a guide to determining whether their hospital’s financial model includes the key attributes and requirements to successfully manage a shift toward value-based payment.

1: The Type of Value-Based Arrangement

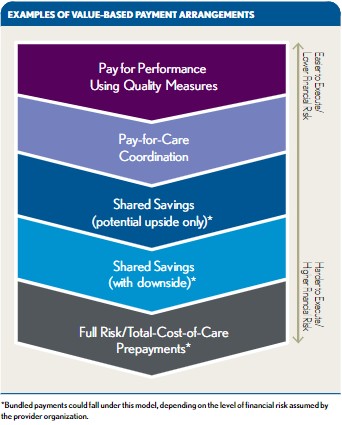

Because value-based payment arrangements vary widely, there is no one-size-fits-all financial model for hospitals or hospital-sponsored ACOs and CINs. A pay-for-performance model—in which bonuses or penalties tied to process adherence, quality scores, or patient satisfaction scores are added to FFS payments—will look different from a shared savings model, in which a share of the difference between actual and budgeted medical expenses is distributed to participating hospitals, physicians, and other providers in an ACO or CIN. Understanding the mechanics of the payment arrangement is critical to building a useful model. The first exhibit below shows a hierarchy of examples of value-based payment arrangements.

2: The Payer Offering the Arrangement

Value-based payment models differ among payers. The payer being modeled is important because all payers have specific rules for their value-based payment arrangements. The Centers for Medicare & Medicaid Services (CMS), for example, includes minimum savings rates, sequestration adjustments, and quality adjustments for MSSP. These details are publicly available and should be incorporated into any MSSP model.

Commercial and MA payers may have different value-based payment arrangements from hospital to hospital, or details about these arrangements may not be defined before the contracting process begins. When building a model for a commercial or MA arrangement, hospitals should define as many details about the arrangement as possible or work with the payer to obtain details.

Hospitals also should identify and evaluate opportunities for reducing medical expense, improving premium revenue improvements, and raising hospital quality and outcomes relative to current metrics—or request such analyses from the payer or a third party knowledgeable about population health analytics. If negotiations have not reached the point where the analytics or model details are available, then the hospital may need to initially model the arrangement using simple, high-level assumptions. After further analysis has been conducted and additional arrangement details have been agreed upon, the hospital should incorporate the additional variables in order to make the model more robust.

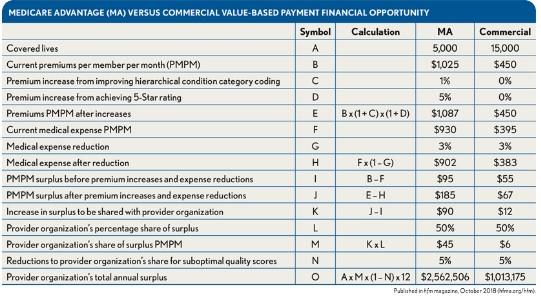

Disparities in premiums and medical expenses by payer. In shared savings or other total-cost-of-care arrangements, the ACO’s or CIN’s shared savings, surpluses, or deficits may be impacted by premiums, medical expense budgets, or both, and may also be adjusted based on quality scores. Therefore, another aspect of this consideration is that premiums and medical expenses also vary widely among payers, including Medicare, Medicaid, and commercial insurers.

Initially, it may seem as though there are greater financial opportunities in commercial shared savings or total-cost-of-care arrangements than in MA arrangements because each service area almost certainly will have more commercial beneficiaries than MA beneficiaries. However, on a per person basis, the financial opportunity for MA shared savings or total-cost-of-care arrangements is typically much larger. MA premiums and medical expenses typically are two to three times higher than those for commercial insurers, providing greater opportunity to reduce medical expenses and earn shared savings or surpluses.

Sharing in MA premium increases. ACOs and CINs can benefit from premium adjustments that they help MA payers earn. The physicians in an ACO or CIN can affect MA premiums by improving the accuracy of their hierarchical condition category (HCC) coding to ensure premiums are adjusted to reflect the actual risk of the patient population. The relative accuracy of HCC coding can make the difference between a reasonable medical loss ratio (MLR) for an MA plan and an unacceptably high MLR. Furthermore, ACOs and CINs can participate in quality initiatives to help MA plans earn 4-star or higher ratings from CMS in its Five-Star Quality Rating System. A rating of at least 4 stars qualifies a MA plan for bonus payments from CMS. Payers must use these bonuses to furnish extra benefits, which make their plans more attractive to members. If the premium adjustments from better HCC coding and star-rating bonus payments enhance the MA plan’s MLR, then the ACO or CIN may be able to receive a share of the improvement.

Because of the higher premiums and medical expenses—as well as the ACO’s or CIN’s ability to benefit from premium adjustments—MA shared savings or total-cost-of-care arrangements typically offer greater opportunities for participating hospitals to mitigate the impact of declining utilization or offset otherwise low rates compared to commercial arrangements. This is the case even if the commercial arrangements have appreciably more covered lives. (See the exhibit below.)

3: How to Project Performance

One way to project performance in the model is to build in assumptions based on what similar organizations have accomplished. For example, before participating in MSSP, an ACO may expect to achieve the average first-year savings percentage among similarly sized MSSP ACOs in its region. This is a simple methodology, and the information is publicly available, but it is backward-looking and may not be appropriate for organizations that reasonably expect to perform above, or below, the average.

Another approach is to assume that an organization will achieve certain actuarial benchmarks. For example, a hospital may calculate the commercial pay-for-performance bonus it will earn if it improves from the 50th percentile nationwide for avoiding readmissions to the 75th percentile. Alternately, an ACO may calculate the shared savings it will earn if it reduces emergency department (ED) utilization, high-cost imaging, and brand-name drug use to state averages. However, this approach requires organizations to have detailed and reliable claims data and for appropriate benchmarks to be readily available.

4: Associated Expenses

Typically, hospitals entering value-based payment arrangements need additional IT, care management, and management capabilities to be successful. Infrastructure investments and ongoing operating expenses must be accounted for in the modeling.

IT systems. One common infrastructure expense is the implementation of IT systems to enable care coordination or population health management. These systems may be modules in a hospital’s existing electronic health records, or they may be stand-alone systems.

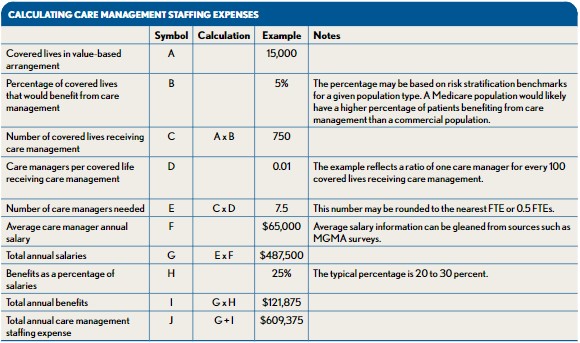

Care management staffing. Care management staffing is another large expense—often the largest—that hospitals, ACOs, or CINs incur to succeed under value-based payment arrangements. Care managers are used to ensure that high- or medium-risk patients in such arrangements—such as patients with chronic conditions—are obtaining the services they need, taking medications properly, achieving wellness goals, and otherwise adhering to the care plans established by their physicians. The exhibit below provides an example calculation of care management staffing expenses.

Provider performance incentives. Provider performance incentives can be another significant expense. If providers change the way they practice to deliver higher-quality, lower-cost care that helps a hospital, ACO, or CIN earn value-based payment incentives, then the hospital, ACO, or CIN typically uses some share of the incentives to compensate the providers for their efforts, assuming they meet whatever criteria the hospital, ACO, or CIN has established for receiving incentive distributions.

Additional expenses. Other expenses may include salary, benefits, and occupancy for the staff necessary to administer value-based arrangements for a hospital, ACO, or CIN; marketing expenses to promote value-based organizations such as ACOs and CINs; and legal and professional fees. Such expenses will vary greatly depending on the organization(s) entering the value-based arrangements, the types of arrangements, and other factors.

5: The Impact on Volume and FFS Revenues

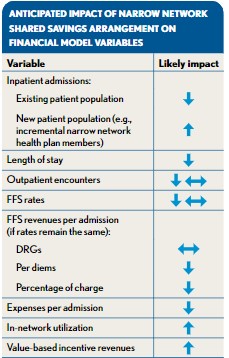

Value-based payment incentives do not exist in a vacuum, given that lowering the total cost of care could result in revenue reductions for hospitals. For example, a hospital-sponsored ACO that earns shared savings may have reduced its overall admissions, thereby decreasing the hospital’s FFS payments by an amount greater than the shared savings. However, this may not necessarily represent a negative outcome. It could be beneficial if, for example, the hospital ultimately was able to improve market share through enhanced value and services, already had been facing downward payment pressures from payers and consumers, or had been operating at full capacity and was able to avoid the need to expand.

Offsetting the revenue impact from per patient utilization reductions. There are several ways that participating in value-based payment arrangements can help offset the revenue impact from per-patient utilization reductions.

First, becoming a high-quality, low-cost-of-care hospital—the type of hospital likely to earn shared savings and other value-based incentive payments—may spur more patients to seek care from the hospital.

Second, commercial insurers are increasingly interested in developing narrow networks that include lower FFS rates and value-based payment arrangements for participating hospitals. One benefit of participating in such narrow networks is their potential to generate incremental patient volumes for the hospital, which could help offset utilization and rate reductions.

Third, the providers in value-based payment arrangements typically have an incentive to refer patients within their network because they are committed to providing high-quality, high-value care, thereby reducing “leakage” to hospitals outside the value-based network. Fourth, focusing on internal case management may help hospitals reduce their lengths of stay (LOS). If these hospitals are paid based on DRGs, then their revenues per admission will remain flat while their costs per admission will decrease, improving profitability per admission.

In summary, the net effect of FFS payment reductions, offsetting volume increases, and reduced LOS should be factored into value-based payment models—in addition to the value-based incentive payments the hospitals may earn. The exhibit at left shows the impact that a value-based arrangement is likely to have on several hospital statistics.

6: The Importance of Performing Sensitivity Analyses

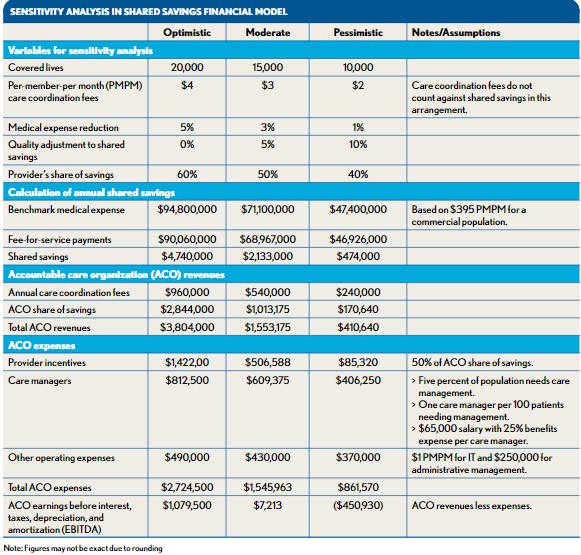

The accuracy of a financial model for a value-based payment arrangement will never be exact. The best approach is to make sound assumptions, accurately model the mechanics of the arrangement, and account for as many downstream effects from it (e.g., potential volume reductions, market share capture) as possible. Moreover, to understand the range of possible financial outcomes, hospitals should perform sensitivity analysis on high-impact variables by modeling assumptions for optimistic, moderate, and pessimistic scenarios. Each scenario should include different assumptions for model inputs that may be highly variable and/or have a significant impact on the model outputs when adjusted. The exhibit below provides an example of three different scenarios in a financial model for a shared savings arrangement.

7: The Cost of Inaction

Perhaps the most difficult cost to quantify when modeling value-based payment arrangements is the cost of inaction. Hospitals may be deterred from action by the sheer challenge involved with comparing projected financial performance under a value-based payment arrangement with the FFS status quo. In the short term, remaining in FFS arrangements and maintaining current volume levels may appear more profitable than entering a shared savings arrangement, reducing volume, and sharing in the savings generated. However, the status-quo scenario does not account for the possibility that MA or commercial insurers may direct volume away from high-cost hospitals, nor does it account for the possibility that Medicare, Medicaid, and commercial insurers may someday require all hospitals to enter shared savings or other value-based payment arrangements. If payers were to adopt this approach, then hospitals lacking experience with value-based arrangements would struggle financially.

Unfortunately, creating alternative scenarios in which hospitals do not enter value-based payment arrangements is even more speculative than projecting performance under such arrangements. Many hospital leaders seem to agree that healthcare costs in the United States are too high and outcomes are too poor. Among respondents to a 2015 Modern Healthcare survey of hospital CEOs, 78 percent said value-based arrangements should become the norm in healthcare payment. b Leaders with this view of the healthcare environment shy away from “do nothing” scenarios because they are convinced their hospitals will be left behind if they do not improve value. The modeling these hospitals perform is instead focused on understanding the potential impact of various value-based payment scenarios, allowing them to adequately plan for and execute their transitions from FFS to fee for value.

Financial Modeling for Value-Based Payment Arrangements

The point cannot be overstated: Hospitals should model the financial impact of entering into various value-based payment arrangements. However, the specific model that a hospital builds will depend on the answers to several questions:

- What is the desired or proposed structure and value-based arrangement type?

- With what type of payer would the provider be entering the value-based payment arrangement, and does that payer already have defined details of the arrangement?

- How will performance be projected, and what is the cost of accomplishing the projected performance?

- How will accomplishing the goals of the value-based payment arrangement affect volume and FFS revenues?

Using such questions as guidance, a hospital can consider different performance scenarios for various value-based payment arrangements, as well as the cost of not participating in them.

The transition to value-based payment is real, and hospitals and health systems that do not design appropriate financial models for this evolving environment will have a blind spot in projecting future performance. In essence, developing such analyses is highly complex requires a detailed understanding and consideration of five key components:

- The structure and attributes of each value-based payment arrangement

- The varying levels of opportunity a given arrangement may have across payer types

- The availability of data, benchmarks, and other key inputs to conduct the modeling

- The incremental expenses required to enter and manage a value-based arrangement

- The potential impact on overall volumes, utilization, and revenue outside the arrangement

Hospitals should not let the challenges of developing financial modeling for value-based payment deter them from action, because the cost of inaction is very real. The leaders of forward-thinking hospitals and health systems clearly recognize this reality and are incorporating such models into the overall financial management and guidance of their institutions.

Footnotes

a. CMS, “ 2016 Shared Savings Program (SSP) Accountable Care Organizations (ACO) PUF.”

b. Conn, J., and Sandler, M., “ CEO Power Panel Poll Finds Broad Support for Value-Based Pay,” Modern Healthcare, May 2, 2015.