Does your organization’s ambulatory real estate footprint need right-sizing?

From left to right: Mark Grube, managing director; Robert Turner, managing director; Matt Robbins, senior vice president; Lauren Clementi, vice president; all from Kaufman, Hall & Associates LLC.

As healthcare continues its shift toward chronic disease management and prevention, it will be necessary to ensure delivery of health services is configured to enhance patient convenience and access.

Healthcare has long been undergoing a shift from inpatient and hospital-based services to the ambulatory and virtual setting. There has been an increasing demand for local access to specialty, subspecialty and higher acuity ambulatory services. And the COVID-19 crisis has accelerated this shift, as evidenced by the nationwide increase in the use of telehealth service. As health systems assess these changes, including how likely they are to continue and their potential impact, they should also consider if their current ambulatory real estate footprint will remain viable in the new environment.

The opportunity

Hospitals and health systems today have large portfolios of fixed assets, the product of legacy payment models and a focus on hospital-centric care. Recently, new competitive forces and a strategy of bringing lower-acuity care closer to patients have pushed health systems to build more ambulatory sites in broader geographies. As a result, most health systems have unbalanced real estate portfolios, with capital trapped in real estate assets that could be deployed more productively elsewhere in their organizations. For example, it is all too common for physicians to maintain multiple offices, each of which is used for some portion of the week.

To the extent less physical space will be needed for clinical care, a large opportunity exists for organizations to reduce costs and free up capital. Organizational leaders should consider both rightsizing owned real estate assets and taking a critical eye to leased real estate, identifying gaps in the portfolio that may impede the organization’s strategic objectives and development of new care delivery models.

This opportunity is best addressed in a context that considers strategic, operational and financial vantage points to ensure that the organization is making decisions consistent with its plans for future growth and financial strength. For example, there may be locations where the organization should increase its footprint, or opportunities to consolidate activities better within the existing footprint. And there may be opportunities to reduce the footprint, where the organization would need to carefully consider the best candidates for downsizing and the right approach.

Such a broad assessment is critical to determining the best financing options for the ambulatory real estate portfolio to meet current and long-term needs.

Assessing the portfolio

The current ambulatory portfolio should be assessed against the organization’s strategic vision for healthcare services to determine the optimal configuration of services and facilities across the network. Considerations will include, among other things, market and consumer demand for services and the impact of telehealth and other technology on future models of ambulatory care. As noted above, portfolio opportunities must be assessed within a context that considers operational and financial impacts, as well.

Key considerations with respect to strategy, operations, and finance are outlined in the exhibit below.

Key considerations fopr a portfolio assessment

Strategic |

Operational |

Financial |

|

|

|

Source: Kaufman, Hall & Associates LLC

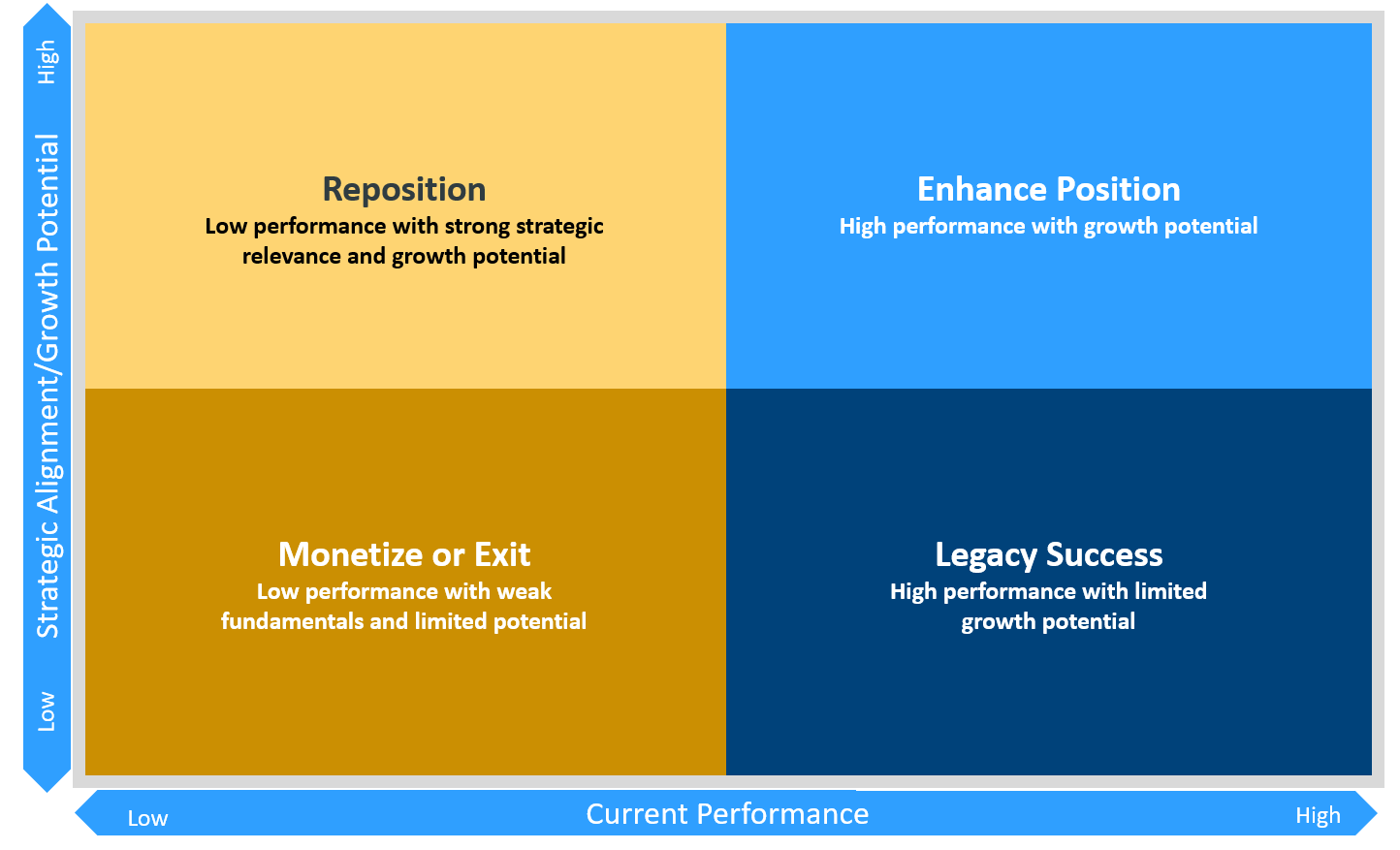

By assessing its existing portfolio, organizations should create an objective framework for determining which sites should be retained and which should be exited (see the exhibit below). The assessment should also identify gaps in the current portfolio to close as market opportunities arise. The same framework should be used to determine which opportunities are of greatest value.

Sample framework for evaluating portfolio options

Source: Kaufman, Hall & Associates LLC

This assessment and framework should inform the organization’s perspective on the “now, near and far” of ambulatory portfolio management. In the “now,” the organization will have a view of which portions of its portfolio may be optimally restructured, monetized or refinanced with external capital providers to enable it to pursue new opportunities and its other strategic capital needs. As it transitions toward the “near” and “far,” it should be developing points of view on what portions of the portfolio must be repositioned to better align with strategic objectives and longer-term trends in care management.

Optimizing capital financing options

In addition to determining the optimal components and structure of its portfolio, the organization must determine the optimal ownership and financing options for its real estate assets. For assets core to the organization’s strategic objectives, financing decisions will depend on factors such as the degree of control it needs to maintain over the asset, costs of capital and accounting and cash flow impacts.

With respect to cost of capital and control, ownership options provide greater control and typically lower financing costs. Sale and leaseback transactions provide monetization of the asset value in return for unrestricted cash; these and other leasing options offer the flexibility of shorter terms and can be tailored to an organization’s needs. In return, the organization surrenders some degree of control over the asset, and the transaction may be of higher cost than a pure debt transaction. Regardless of financing choice, organizations should maintain a total-cost-of-ownership/leasing perspective. Accounting and cash flow considerations include how the asset will be presented on the balance sheet and income statements, as outlined in the exhibit below.

Comparison of debt and lease financing options

Financing choice |

Debt finance |

Lease finance |

|

Control |

Full control |

Limited control (potential for ground lease or purchase options) |

|

Term |

Up to 30 years |

Flexible |

|

Renewal risk |

Potentially — on debt only |

Yes — both access to space and financing source |

|

Cost of capital |

Market interest rates |

Market capitalization rates, plus escalators |

|

Considered “on credit” |

Yes |

Yes |

|

Balance sheet asset |

Real estate as PP&E |

Right of use asset (present value [PV] of lease liability if operating lease) |

|

Balance sheet liability |

Long-term debt |

PV of lease liability (if operating lease) |

|

Period expense |

|

Rent expense (straight line) |

|

EBIDA impact |

Net income plus depreciation and interest |

Net income |

Source: Kaufman, Hall & Associates LLC

Conclusion

Decisions made with respect to an organization’s ambulatory real estate portfolio can have significant impacts on itsfuture growth, financial position and capital platform. These decisions should have a sound strategic rationale, balance flexibility with cost-effectiveness and support long-term growth and development. To reposition themselves for what might be a significantly altered healthcare environment, organizations should act now to ensure that ambulatory real estate assets are best positioned to help them adapt and thrive.