Navigating change: Implications of CMS’s 2021 Physician Fee Schedule

Changes to the CMS Physician Fee Schedule (PFS) for 2021 present another pressing challenge that demands the attention of healthcare provider organizations and their financial leaders, even as they contend with urgent financial and workforce challenges amid the evolving COVID-19 pandemic.

The final rule for the 2021 PFS, appearing in the Dec. 10 Federal Register, lays out broad physician payment changes of the magnitude not seen since 2006-07. It is critically important that organizations with productivity-based physician compensation plans understand the implications of the final rule on payer payments, physician and advanced practice provider (APP) reported productivity levels, survey benchmarking data and regulatory compliance. These organizations should prepare for the likelihood that commercial payers will soon follow CMS’S lead in the PFS revisions. (For background on developments leading up to CMS’ revisions, see the sidebar, “Background on the 2021 Physician Fee Schedule final rule.”)

The rule’s changes

The most significant revisions reflected in the 2021 PFS final rule include:

- Increasing work relative-value unit (wRVU) values for office-based evaluation and management (E&M) and similar ambulatory visit services to recognize the increased time burden associated with documentation in an electronic health record

- Increasing Medicare payment for office-based E&M services, which will increase payments for specialties most often performing these services (primary care and medical specialists)

- Modifying the service time associated with each E&M code and establishing a new add-on code to recognize clinician work effort beyond the maximum visit time expectations

The magnitude of the E&M office visit wRVU increases was so significant that CMS’s statutory requirement for budget neutrality could not be met without a significant reduction in the Medicare conversion factor — i.e., the dollar amount multiplied by RVU values to calculate Medicare allowed amounts for Part B clinicians.

That reduction was mitigated by passage of the Consolidated Appropriations Act of 2021, which set the 2021 conversion factor rate for Medicare payment at $34.89, a reduction of 3.32% relative to the 2020 conversion factor. It is important to note that the rate reduction designated for 2021 is only about half of the total mitigation called for in the act, and an additional reduction in the conversion factor may be looming in 2022.

Impact of the 2021 changes

Although these changes were effective starting Jan. 1, 2021, and have already impacted Medicare payments, it is unclear when and by how much commercial payers will respond by changing their payment schedules in the near term. It is clear, however, that any assessment of the financial impact of the 2021 changes should consider both payer payment and the office visit E&M wRVU increases that directly affect many physician and APP compensation plans. This assessment will be critical to maintaining an affordable physician enterprise and ensuring compliance with standards for fair market value (FMV) and commercial reasonableness.

CMS’s 2021 wRVU changes affect each specialty differently based on their service mix. Overall, organizations will see an increase in Medicare payments to primary care and medical specialties and a new baseline for wRVU productivity measurement.

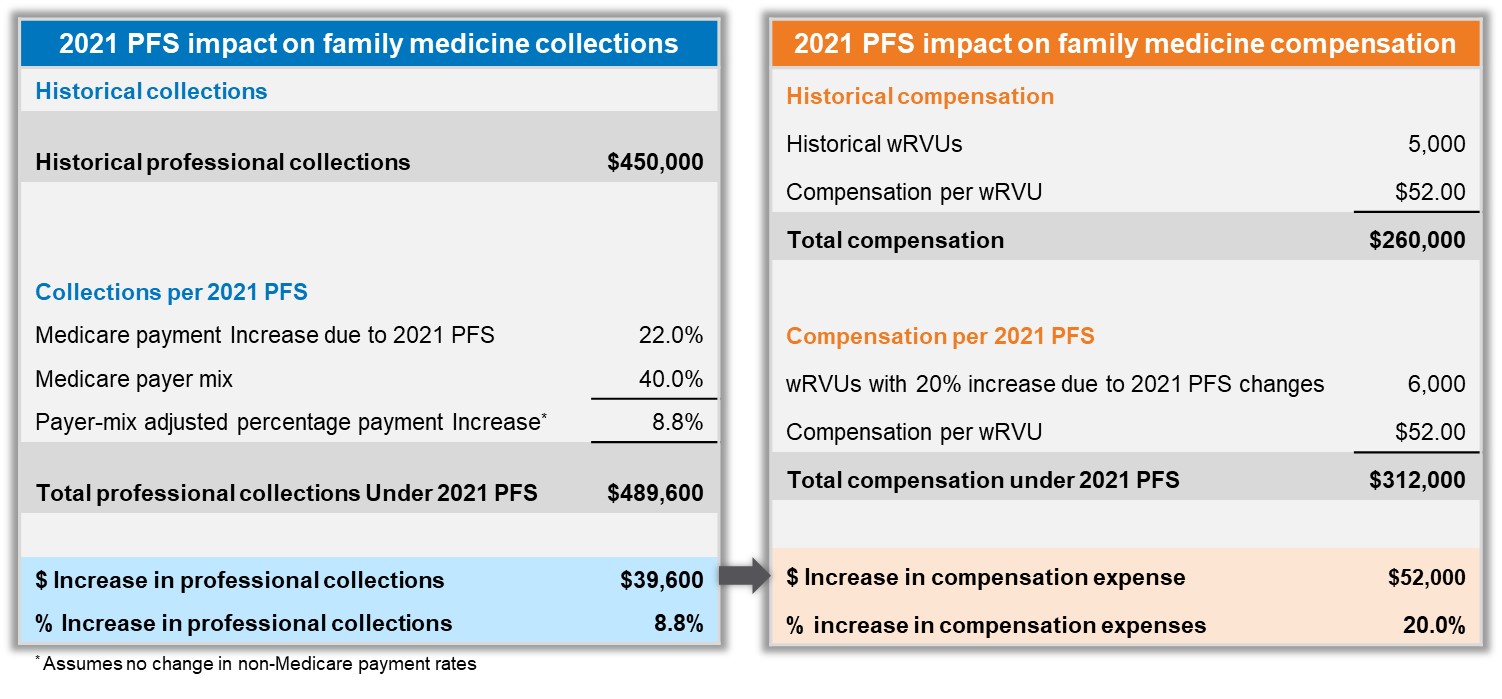

The exhibit below provides a simplified example.

Sample calculation of impact of 2021 PFS changes on collections and compensation for a family practice physicians

Source: SullivanCotter, 2021.

The exhibit shows a family medicine physician who historically produced 5,000 wRVUs and was paid $52 per wRVU would receive an annual compensation amounting to $260,000. For this specialty, assuming identical services provided, reported wRVUs are expected to increase by 20% in 2021 to 6,000. At the same $52 compensation rate per wRVU, annual compensation would increase to $312,000 in 2021 with no change in physician work effort. Although the Medicare conversion factor is lower in 2021, this change is offset by the higher wRVUs, resulting in 22% net positive payment impact for Medicare services for this specialty. If Medicare patients make up 40% of this physician’s practice, the overall payment would increase by about 9% (or $39,600), assuming no change in commercial payment rates in 2021.

The exhibit also shows the Medicare payment increase will be offset by a much larger compensation increase of $52,000 (20%) due to the higher wRVU values and no change to the historical compensation rate of $52 per wRVU. This increase in physician compensation without a corresponding boost in payment across all payers is likely not financially sustainable for many organizations.

Scope of the impact

Productivity-based compensation plans continue to be prevalent in the industry due to the historic relative stability of wRVU values and the pressure within not-for-profit healthcare organizations to have a payer-neutral metric upon which to base physician compensation. About 70% of organizations responding to a recent survey reported having a wRVU-based compensation plan for primary care, medical and surgical specialties.

For hospital-based specialties, this number was lower, at 40%. Among organizations that provided incentive compensation, the survey found that 87% used individual physician productivity as a metric. The survey also found that more than 95% of respondents were using survey data and benchmarks to help establish physician compensation. The broad use of wRVUs in compensation arrangements demonstrates the magnitude of the potential financial implications of CMS’s final rule to an organization.

The organizational impact of these changes will vary based on specialty mix, coding profiles, the range of services provided, payer mix and physician compensation plan structure, and these variables need to be considered in any analysis of that impact. The analysis also should consider both the short-term and long-term implications of the wRVU changes, because survey data capturing the industry’s response will lag behind the 2021 changes to wRVU values, depending on how quickly commercial payers respond in each market. It seems likely that survey data will evolve over several cycles before it reflects the full impact of the PFS final rule.

Potential short-term impact

The potential short-term impact on individual physician compensation plans may be significant based on the type of services performed. A recent SullivanCotter analysis of proprietary CPT code data shows that the new 2021 wRVU values will result in an estimated increase in reported wRVUs of 18% for primary care, 12% for medical specialties, 8% for surgical specialties and no increase for hospital-based specialties (which do not provide office-based E&M services). Despite the 3.32% decrease in the 2021 CMS conversion factor, Medicare payments will still likely increase for most organizations, assuming no change in volume. However, the impact on commercial payer payments will be unique to each organization depending on their contract terms.

Options to consider

Organizations need to make immediate decisions with respect to compensation arrangements. For example, if an organization uses the 2021 wRVU values, has primarily productivity-based compensation arrangements for primary care and medical specialties, and does not modify historically determined compensation rates per wRVU, physicians and APPs will receive a significant increase in compensation with no change in actual work effort. However, as shown in the exhibit above, the corresponding increase in payment to the organization will likely be insufficient to cover the additional compensation expense, creating a potentially unsustainable financial dilemma.

Organizations can respond to the 2021 CMS wRVU and payment changes in one of four ways:

- Maintain 2020 wRVU values and historical compensation rates into 2021. This option may not be contractually feasible and is likely just a temporary solution.

- Utilize the 2020 wRVU values and modify historical compensation rates per wRVU to reflect Medicare’s 2021 increase in reimbursement for primary care and medical specialties.

- Transition to the 2021 wRVU values and modify historical compensation rates per wRVU to factor in the increased wRVU values and reimbursement impact.

- Transition to the 2021 wRVU values and use historical compensation rates per wRVU. This approach may be feasible for specialties that don’t provide office-based E&M services or for single-specialty groups where historical compensation rates are set conservatively and an increase in compensation is warranted.

Choosing the right option or mix of options will require consideration of contractual obligations, current and anticipated changes to payment and wRVU values, compensation plan design, affordability, regulatory compliance and internal group equity both between and within specialties.

Pros and cons of the 4 options for physician compensation

Approach |

Pros |

Cons | |

1 |

Maintain 2020 wRVU values and historical rates |

|

|

2 |

Maintain 2020 wRVU values and modify the rates |

|

|

3 |

Transition to 2021 wRVU values and adjust rates |

|

|

4 |

Transition to 2021 wRVU values |

|

|

Source: SullivanCotter, 2021.

Surveys conducted in the fall of 2020 found most organizations were planning on using 2020 wRVU values and historical compensation rates for the near future. These decisions were likely based on the short timeframe that CMS provided for organizations to consider and implement the final PFS changes.

Moving through 2021, organizations will likely experience mounting pressure from their clinicians to assess the potential impact on organizational finances related to payments, reported wRVU productivity, and physician and APP compensation. As organizations complete this assessment, they should address the following questions:

- Will we adjust our compensation rates per wRVU prospectively for 2021 or delay adoption of the new wRVU values and adjusted compensation rates until 2022 or later?

- Do our commercial payer contracts use Medicare wRVU values or payment rates and, if so, how soon will commercial payments be affected?

- Do we intend our compensation plans to reflect CMS’shift in payment from proceduralists and hospital-based specialties to primary care and medical specialties? If so, how quickly?

- Will there be FMV and commercial reasonableness compliance risks created due to higher compensation if 2021 compensation plan rates are based on historical benchmarks?

What changes can we anticipate from CMS’s intent to reevaluate wRVU values in other E&M code groups (e.g., hospital visits, skilled nursing facility visits) and visits within the surgical global period in the future?

Stay tuned for additional changes

Further changes in wRVU values and Medicare payment rates are likely as early as 2022. CMS has indicated it will be re-evaluating other E&M codes in the near term, which may lead to additional changes in wRVU values and, potentially, the Medicare conversion factor. Also, as commercial payer contract negotiation cycles approach, it will be critical for organizations to be prepared for changes in this area, as well.

Depending on market dynamics, the disruptions caused by the PFS changes may also result in other responses from commercial payers such as additional value-based payment opportunities.

It is likely not enough to simply identify and monitor the impact of fee-schedule changes on payment for services and compensation. Hospitals and health system leaders also must ensure that all physician compensation arrangements continue to follow regulatory requirements for FMV and commercial reasonableness.

Conclusion

To address the financial challenges presented by the 2021 PFS final rule, the ability to effectively assess and analyze the impact of its changes is critical. Responses will vary based on an organization’s unique circumstances, including the specialty mix of physicians, the compensation plan designs in place, payer mix and commercial payer contract terms. For most organizations and their financial leaders, doing nothing indefinitely is simply not an option because any changes in compensation without a corresponding increase in payment will prove financially unsustainable.

Acknowledgement

The authors also would likely to thank the following individuals from SullivanCotter for their contributions to this article: Bob Madden, principal, Stan Stephen, principal, and Brad Vaudrey, managing principal.

Background on the 2021 Physician Fee Schedule Final Rule

Annually, the American Medical Association’s Relative Value Scale Update Committee (RUC) makes recommendations to CMS regarding relative value unit (RVU) values assigned to CPT codes to reflect the evolution of patient care. RVU values have formed the basis of Medicare’s Part B fee-for-service payment methodology for physicians and other clinicians since 1992. The extent of CMS’s revisions varies from year to year, and the impact on individual specialties depends on which CPT code RVU values are modified and the magnitude of those adjustments.

CMS has a statutory mandate to maintain overall Medicare payment budget neutrality, which means that any RVU value revisions must offset each other in the aggregate or other components of the payment formula must be adjusted.

Through this initiative, CMS established an internal process to evaluate and streamline regulations with a goal of reducing unnecessary burden, increasing efficiencies and improving the beneficiary experience. As part of this strategy, CMS proposed the significant revisions to RVU values for commonly used office visit codes in 2021. Work RVUs (wRVUs) are assigned by CMS to each CPT code based on the relative provider work effort involved as measured by the time it takes for the clinician to perform the service, the technical skill and physical effort required, and the mental effort, judgment and stress involved related to the potential risk to the patient. A change in the assignment of wRVUs is one of the major features of the 2021 PFS final rule.