Real strategy for healthcare real estate

Matt Robbins

Lauren Clementi

It is in hospitals’ and health systems’ interest to dedicate resources to develop and execute a real estate strategy that serves their interests rather than the interests of others.

Hospitals and health systems are first and foremost healthcare providers. However, they also accumulate substantial real estate holdings, making them some of the largest property owners and most sought-after tenants in their communities. Without dedicating meaningful attention to real estate strategy, they may find that their owned and leased real estate assets are neither aligned with their strategic goals nor efficiently deployed, structured or financed.

In the wake of the coronavirus pandemic, hospitals and health systems face a critical imperative to optimize resource deployment. Moreover, the possibility of long-term changes in care delivery and workforce deployment may have a significant impact on the size and composition of the real estate portfolio. It is imperative that hospital and health system leaders devote the same strategic focus and analytical rigor to their organization’s real estate that they apply elsewhere within the enterprise.

How the real estate industry views healthcare

Real estate market participants — including investors, brokers, developers, designers and property managers — are sophisticated organizations increasingly focused on healthcare real estate portfolios to generate revenue and investment returns. Why? Hospitals and health systems are creditworthy tenants with predictable needs, expensive capital projects, long time horizons and specific location requirements. Healthcare real estate is considered a highly desirable investment alternative and relatively stable market sector compared with retail, office or hospitality assets. As a result, the healthcare sector of the real estate market has attracted many experienced participants.

5 objectives for a strategic real estate framework

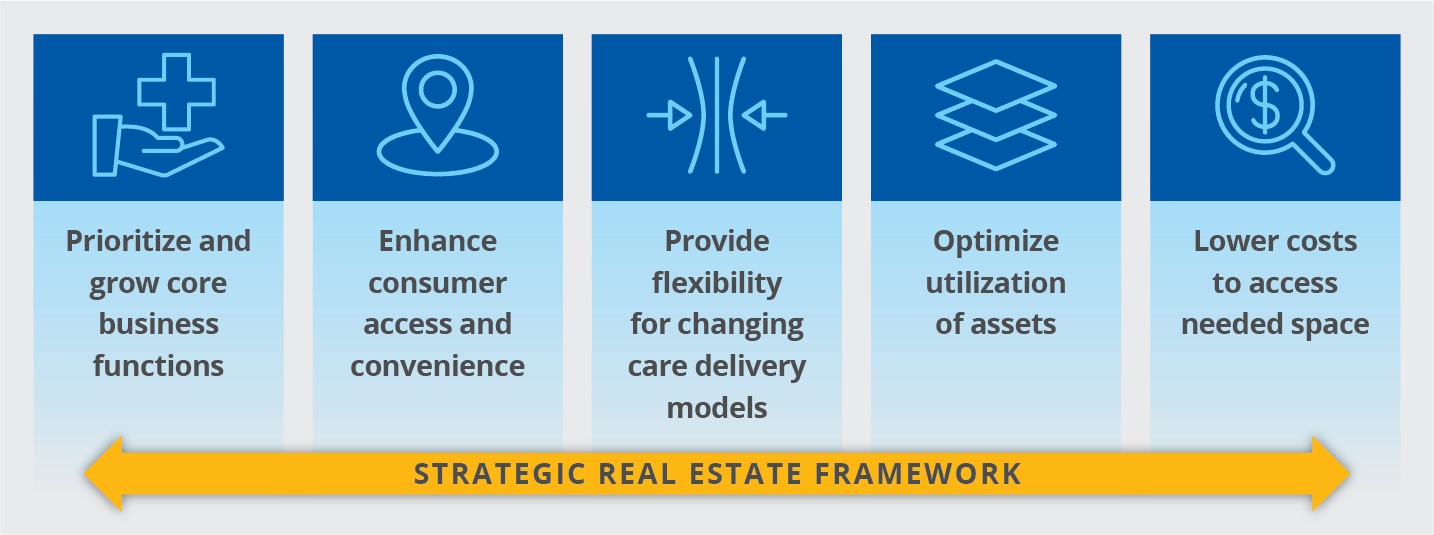

To be effective, a strategic real estate framework must align with the organization’s core business functions and support its strategic, operational and financial goals. This framework should have five objectives:

1. Prioritize and grow core business functions by accounting for competitive dynamics in the market, ensuring that the organization is positioned to grow market share for its core services in existing and new locations

2. Enhance consumer access and convenience by identifying locations that are easy for consumers to access and convenient to major work, leisure or residential centers

3. Provide flexibility for changing care delivery models by considering the adaptability of sites for such new models as the organization seeks to strike the correct balance between virtual and in-person care

4. Optimize utilization of assets by facilitating efficient deployment of services to lower-cost sites of care and assessing real estate portfolio opportunities within a context that balances the organization’s strategic, operational and financial needs.

5. Lower costs to access needed space by evaluating the wide range of real estate ownership, leasing and financing options through a process that accounts for the comparative acquisition or carrying costs of portfolio opportunities.

An effective real estate framework enables organizational leaders to cohesively assess the extent to which the current portfolio aligns with the organization’s strategic, operational and financial goals. This systematic assessment can identify opportunities to consolidate, divest or monetize portfolio elements that are not central to the organization’s core business functions as well as gaps in the portfolio that the organization needs to address.

With this assessment in place, analysis can go deeper, determining optimal geographic reach, market positioning and financing structures for current and prospective properties in the organization’s portfolio. Organizational leaders also can assess the impact of potential actions on the operational, financial and capital position of the organization and its strategic initiatives.

A strategic real estrate framework helps align the portfolio with organizational goals

Source: Kaufman, Hall & Associates LLC, 2021.

Immediate next steps for healthcare organizations

Hospitals and health systems must elevate the attention they give to their real estate holdings or risk losing their opportunities in this area to external real estate market participants. Equally important is the use of an independent adviser — one who is agnostic to portfolio strategy and transaction structure, size, or outcomes — to develop a strong, objective framework for identifying and evaluating portfolio opportunities. The real estate portfolio should be given an equal footing within a comprehensive framework of strategic resource allocation that focuses on how all the organization’s financial resources (i.e., cash flow, cash, debt capacity) are best deployed given the realities confronting the business across operations, strategy, capital and financing channels.

Decisions about the real estate portfolio are often long-term, costly and difficult to unwind. A well-developed strategic framework for real estate enables healthcare leaders to do the following:

- Make independent and objective assessments of opportunities

- Optimize use of organizational resources

- Pursue improved returns on invested capital

- Align the real estate portfolio with their organizations’ strategic, operational and financial goals