October 2019: Developments and trends shaping healthcare finance

Big drop in Medicaid enrollment drives 2018 increase in uninsured rate

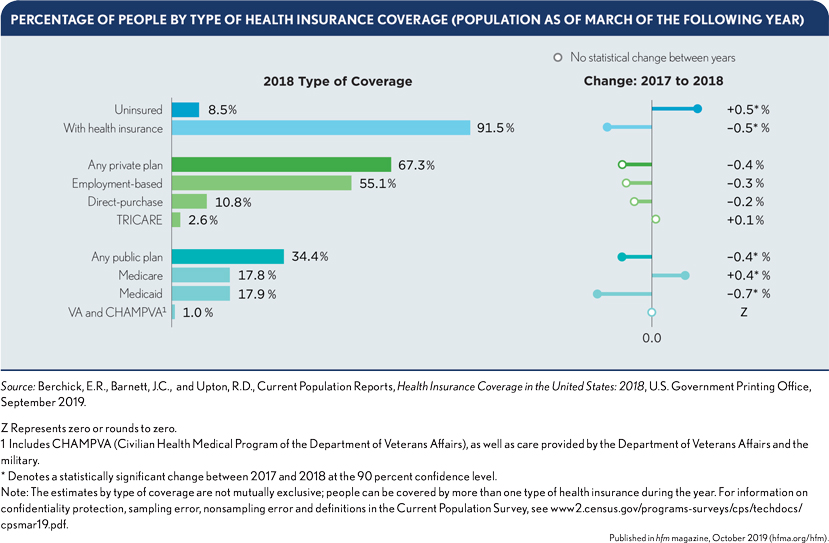

The number of uninsured increased from 25.6 million in 2017 to 27.5 million in 2018, while the insurance coverage rate declined from 92.1% to 91.5%, according to a report from the U.S. Census Bureau.

The biggest change by insurance type was a decrease of 0.7 percentage points in the share of the population enrolled in Medicaid, amounting to nearly 2 million people. The increase in the number of uninsured occurred across both Medicaid expansion and non-expansion states, although expansion states generally had lower uninsured rates.

The share of people without health insurance coverage increased in eight states, led by:

- Idaho (1 percentage point)

- South Dakota (0.7 percentage points)

- Tennessee (0.6 percentage points)

- Alabama (0.6 percentage points)

- Arizona (0.6 percentage points)

Not-for-profit hospital revenue growth tops expense growth for first time in 3 years: Moody’s

Median growth rates in not-for-profit hospitals’ 2018 operating revenues surpassed expense growth for the first time in three years, according to Moody’s Investor Service. Median revenue growth for the 284 not-for-profit hospitals and health systems tracked by the rating agency reached 5.5% in 2018, while expense growth slowed to 5.4%. Revenue growth remained well below the 2015 peak of 7.8%.

The revenue increase occurred despite “ongoing reimbursement challenges” and small inpatient volume increases compared with outpatient visits. Payment challenges included a decline in commercial health plan revenue as a share of gross revenue and an increase in “less lucrative” Medicare payments.

The second consecutive year of slowing expense growth was attributed to “aggressive cost-reduction strategies,” including in the areas of salaries and benefits, supply management and care settings.

Cash balances stagnated at $536.8 million in 2018 from $534.2 million due to merger-and-acquisition initiatives and weaker equity market returns, according to Moody’s.

Although margins largely held steady, they remained well below past levels. The 1.8% median operating margin was a small improvement from 2017, but the operating cash flown margin slowed from 8.1% to 7.9%.

Moody’s also found that not-for-profit hospitals in 2018 had:

- 200.9 median days cash on hand, down from 206.6 days

- $63.7 million in median additions to property, plant and equipment — down from $65.7 million

- A 1.1% median growth rate in total admissions (inpatient admissions plus observation stays)

- A 2.9% increase in outpatient visits

Supporters of releasing privately negotiated health plan rates dominate public comments

In late August, halfway through the 60-day comment period on a controversial proposal to require hospitals to release their privately negotiated rates with health plans, nearly all the public comments submitted so far had come from supporters of the transparency proposal.

The CY20 Medicare Outpatient Prospective Payment System proposed rule would require hospitals — starting Jan. 1, 2020 — to make public a list of their standard charges, which the Centers for Medicare & Medicaid Services (CMS) defines as both gross charges and payer-specific negotiated rates.

Although researchers and transparency advocates have said the public is not very interested in healthcare transparency tools, most of 99 public comments on the transparency proposal halfway to the Sept. 27 due date came from anonymous supporters of it.

Verma pushes back on hospital transparency concerns

In response to concerns hospital advocates have raised about several Trump administration price and quality transparency initiatives, one of its senior healthcare leaders says it will double down on those efforts.

In a September address to a Washington, D.C., meeting of members of the American Hospital Association, Seema Verma, CMS administrator, said transparency efforts will expand.

“I’ve heard the doomsday warnings about price transparency, and they typically come from those who want to protect the status quo because it works for them,” Verma said. “But it doesn’t work for patients.”

Hospitals have raised concerns about the administration’s latest transparency initiative that would require hospitals to publicly post all rates privately negotiated with health plans for 300 services. Among their concerns are that the requirement would cost far more than the $1,000b annual cost the administration estimated and that it would undermine their ability to effectively negotiate with health plans.

But Verma touted the outcomes of a related transparency effort in New Hampshire, where prices for some services had to be listed on a public website where consumers could compare prices, and which provided “millions of dollars ofsavings.”

“And it’s not only the patients that use the tools to save money,” Verma said. “Providers lowered their prices to stay competitive, reducing overall healthcare costs.”

Some providers have warned that the proposed CMS transparency requirement could increase prices if it informs hospitals thatb neighboring organizations are charging more to health plans for services, and they demand the same rates.

Search for federal funding driving surprise bill legislation: advisers

A pitched battle in Congress this year over legislation to address the problem of surprise healthcare billing has been driven by a search for funding for other federal healthcare programs. The strength of that drive will determine whether a bill is enacted this year, according to former congressional staff.

Efforts in Congress to find savings to pay for certain kinds of spending will be an important factor in the fate of surprise bill legislation, according to Yvette Fontenot, a partner at consultancy Avenue Solutions and a former Obama administration official.

Among the pieces of surprise billing legislation under consideration, a measure approved by the Senate Health, Education, Labor and Pensions Committee in July would provide $24.9 billion in 10-year savings, according to an estimate of the nonpartisan Congressional Budget Office. The savings would generally come from reduced subsidies for Affordable Care Act marketplace plans as provisions of the bill drive down provider payments.

Different versions from multiple committees in the House of Representatives are expected to provide different projected savings amounts. Fontenot said Congress was looking for such savings to pay for unrelated healthcare programs.

Rodney Whitlock, PhD, a vice president at McDermott + Consulting and a former Senate healthcare staffer, said both the surprise bill legislation and a separate drug price reductionbill could provide “tens of billions of dollars” (TOBOD) in federal savings.

“You get excited because I can do some real policy with TOBOD,” Whitlock said at a media briefing also attended by Fontenot and sponsored by the Alliance for Health Policy.

A look at the financial ramifications hospitals may see from ‘public charge’ changes

Hospitals may see Medicaid revenues decline and bad debt increase as the result of a recently finalized rule limiting legal immigrants’ access to public healthcare coverage. In August, the Department of Homeland Security issued a final rule modifying the definition of services not freely available to immigrants, saying use of any of the services would cause an immigrant to be designated a public charge and ineligible for permanent residency.

The change added “non-emergency Medicaid” to the list of services that would render immigrants ineligible for residency if they used such services for more than 12 months of any 36-month period.

The rule is set to take eff ect Oct. 15 and applies to immigrants trying to enter the United States or those already living here who are trying to obtain a green card.

An analysis by Manatt concluded hospitals could experience steep fi nancial impacts if the rule deters enrollment in Medicaid or the Children’s Health Insurance Program (CHIP). The final rule did not include CHIP as a disqualifying service for residency, but Manatt analysts argued that misinterpretations of the rule changes likely would lead legal immigrants to avoid any chance of running afoul of the rule.

The result could be an increase in hospitals’ uncompensated-care costs, especially in states and communities with large immigrant populations, according to the Manatt analysts.

According to the analysis, major impacts include:

- Affecting enrollment in Medicaid and CHIP of 4.4 million noncitizen adults and children

- Affecting enrollment of 8.8 million citizen adults and children who are family members of a noncitizen

- Affecting $26 billion in Medicaid and CHIP services provided to noncitizen enrollees

- Affecting $42 billion in services to citizens who are family members of a noncitizen

- Risking $7 billion in hospital payments for noncitizen enrollees

- Risking $10 billion in hospital payments for citizen enrollees who have a noncitizen family member

MedPAC proposes post-acute care value-based payment

Staff for the Medicare Payment Advisory Commission (MedPAC) laid out a proposed design for a post-acute care (PAC) provider value-based payment program in Medicare, during the panel’s September meeting.

The program would track provider performance using a small number of risk-adjusted, claimsbased measures, such as all-condition hospitalizations during the PAC stay.

Key provisions would include:

- Scoring performance using absolute, prospectively set targets.

- Accounting for social risk factors by comparing providers with similar shares of dualeligible beneficiaries when determining rewards and penalties.

- Establishing a 5% w ithhold to fund the bonus payments.