News Briefs: Final rule for Medicare inpatient payments brings large rate increase

Dealing with high costs of labor and supplies amid prolonged inflation, hospitals received a significant Medicare inpatient payment raise in an FY23 final rule.

Payments to hospitals that meet quality-reporting requirements and are “meaningful users” of electronic health records will increase by 4.3%, driven by a market basket update of 4.1% and statutory adjustments resulting in a 0.2% gain. The proposed rate change had been 3.2%, drawing protests from hospital advocates who said payments needed to come closer to covering surging costs.

Newly available economic forecasting data spurred the higher market basket update in the final rule. CMS said the increase is the biggest since 1998.

While pleased to see the increase relative to the proposed rule, hospital groups noted there was still cause for concern. For example, outlier payments are being reduced by 1.7 percentage points, and cuts are in store for disproportionate share hospital and uncompensated care payments ($300 million), new-technology payments ($750 million) and supplementary payments to designated low-volume and Medicare-dependent hospitals ($600 million).

The last of those cuts is due to the expiration of the supplementary payment programs for low-volume and Medicare-dependent hospitals. Congress would need to authorize extensions.

The overall update “still falls short of what hospitals and health systems need to continue to overcome the many challenges that threaten their ability to care for patients and provide essential services for their communities,” Stacey Hughes, executive vice president of the American Hospital Association, said in a written statement.

340B drug payments due for substantial raise in 2023 after Supreme Court ruling

Technically, the 2023 proposed rule for Medicare outpatient payments calls for drugs acquired through the 340B Drug Pricing Program to continue to be paid at average sales price (ASP) minus 22.5%. However, the rate will go up significantly when the final rule is published in November.

The Supreme Court ruled unanimously in June that the approach used to establish the current payment rate in 2018 was not permissible under the Medicare statute. But the timing of the ruling didn’t leave enough time to incorporate a new rate in the proposed rule, CMS said.

Nonetheless, “We fully anticipate applying a rate of ASP + 6% to such drugs and biologicals in the final rule,” the agency stated.

Given that the current rate was established impermissibly, hospitals seemingly are entitled to financial remedies covering 340B payments that have been made since 2018. But no announcement is expected imminently regarding how those remedies would be determined and paid, and the timeline and scope of such restitution remain to be seen.

CMS indicated that the drug pricing data it collected from 340B hospitals in a 2020 survey could be used to establish an appropriate rate for remedies.

Hospitals criticize proposed outpatient payment increase, which will be affected by 340B payments

Payments for outpatient services would increase by 2.7% in 2023 for hospitals that meet quality-reporting requirements, according to CMS’s proposed rule for such payments. That would equate to a cumulative $6.2 billion increase.

The proposed raise was met with disappointment by hospital advocates, who said it would do little to ease the ongoing cost burden. However, the increase in inpatient payments between the proposed and final rules suggests a similar boost could be in store for outpatient payments, based on updated economic forecasting data.

CMS advised that reverting to paying for 340B-acquired drugs at the same rate (ASP plus 6%) that covers all separately payable drugs and biologicals “will have an effect on the payment rates for other items and services due to the budget-neutral nature” of the payment system for hospital outpatient care.

In other words, the increase in 340B payments would have to be taken out of general outpatient payments. According to CMS’s projections, rural hospitals and smaller urban hospitals would face a decrease to their payment update.

Costs of data breaches have surged in healthcare, IBM report finds

Data breaches continue to take a financial toll on the healthcare industry, according to a new report from IBM Security.

The average cost of a healthcare data breach grew from $7.13 million in 2020 to $10.1 million in 2022, the report found. It’s the 12th straight year in which healthcare has been the costliest industry for data breaches.

The report noted that the 42% increase in the average cost of data breaches far outpaces overall healthcare inflation.

Of 550 organizations that were researched across industries, IBM found that 83% have experienced more than one data breach. Almost 80% of critical-infrastructure companies — a category that includes healthcare organizations — do not deploy “zero trust” architecture. Data breach costs are $1.17 million higher for organizations that lack a zero-trust cybersecurity strategy.

For ransomware victims that opted to pay ransom demands, the average cost of data breaches was only $610,000 lower than for those that did not pay. Meanwhile, the average ransom payout in 2021 was $812,000.

Even as costs rise, Medicare payments to physicians are scheduled to decrease

Medicare anticipates reducing physician payments next year, according to CMS’s proposed rule.

The conversion factor is projected to decrease from $34.61 in 2022 to $33.08 in 2023, reducing physician payments by more than 4%. The change is based on:

- A statutorily required annual update of 0% from 2020 through 2025

- The expiration of a one-time 3% increase for 2022 that, per statute, may not factor into payment rates for subsequent years

- A statutorily required budget neutrality reduction of 1.55% due to proposed changes to RVUs

Physician advocacy groups criticized the projected payment reduction, noting it would come on top of a 4% across-the-board Medicare cut that’s scheduled to begin Jan. 1 as a result of pay-for provisions in the 2021 COVID-19 relief legislation. Plus, a 2% Medicare payment sequester has been in effect since July 1.

The proposed payment change “would create long-term financial instability in the Medicare physician payment system and threaten patient access to Medicare-participating physicians,” Jack Resneck Jr., MD, president of the American Medical Association, said in a written statement.

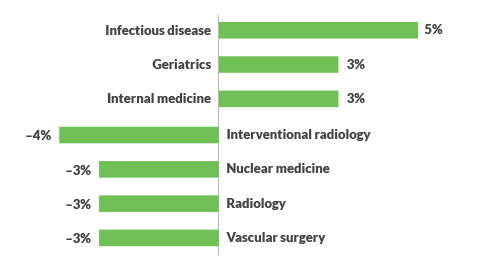

Impact of proposed Medicare physician payment rate changes on specialties

The proposed update to Medicare physician payments in 2023 (see the news item above) is projected to affect different specialties in different ways based on changes to RVUs. Here are the specialties for which the biggest payment changes are in store. (Source: CMS, “CY 2023 Payment Policies under the Physician Fee Schedule and Other Changes to Part B Payment Policies,” July 7, 2022.)