HFMA’s latest Outlook Survey reflects a healthcare industry on more stable footing: 5 takeaways

- Amid a relative lull in the COVID-19 pandemic, fewer respondents to HFMA’s Outlook Survey expected to increase their reliance on contract labor.

- Survey responses also indicate a reduction in deferrals of nonelective care.

- Other noteworthy issues explored in the survey include technology, capital planning and price transparency.

Even as the COVID-19 pandemic remains a reality for healthcare providers, recent feedback from HFMA members signals that healthcare operations are returning to something closer to normal.

The latest edition of HFMA’s quarterly Outlook Survey, drawing responses from 1,196 members between April 1 and April 17, illustrates a period of relative steadiness as hospitals and health systems seek to stabilize their workforce and other aspects of their businesses.

Here are five key insights from the data.

1. The need for contract labor diminishes

Last August, when looking ahead to the following quarter, 45% of respondents to the Outlook Survey projected an increase in their hiring of contract clinical staff. Virtually an identical share predicted the same in a survey conducted in November and December.

But as the healthcare industry emerged from the delta and omicron surges, the need to supplement the clinical workforce with contractors subsided for some organizations. About 32% of respondents to the latest survey estimated an increase over the next three months, spanning most of Q2 2022 and the start of Q3. And 27% thought their volume of contracted clinical staff would fall, up from 11% and 18% in the two previous surveys.

The share of respondents projecting an increase in full-time clinical staff ticked up to 47% from 44% last August and 43% in November-December.

Those trends no doubt would come as a relief to hospital finance leaders, many of whom watched their organizations’ labor costs soar over the previous year amid the increased demand for contract staff such as travel nurses. In a recent monthly update on hospital finances, for example, Kaufman Hall reported that labor expenses in April were 11.1% higher than in April 2021 and 26.2% higher compared with April 2020.

Even if there’s a prolonged decrease in labor expenses, some of the approaches implemented during the last year or two may persist.

“The pandemic caused many health systems to rethink their overall strategies around temporary and permanent staffing,” noted Rick Gundling, FHFMA, senior vice president of healthcare financial practices with HFMA. “Many leaders address contract or temporary staffing as not only a way to fill immediate staffing gaps but also as a way to introduce contract staff to permanent roles.

“Dealing with unplanned situations such as a regional outbreak of the coronavirus or a seasonal surge has caused health systems to be increasingly nimble with all ways to address staffing challenges.”

2. Deferred care seems less prevalent

Following the peak of the omicron variant in mid-January, when 6.45 people per 100,000 were being admitted with COVID-19, clinical operations appeared to be on steadier ground at the time of the latest survey. By the beginning of April, the national hospitalization rate was down to 0.44 per 100,000, according to CDC data (the rate had risen to 1.23 as of June 10).

Concurrently, somewhat fewer hospitals reported seeing deferrals of nonelective care. The share of respondents whose organizations were experiencing such postponements dropped to 20.2% in the latest survey, down from 23.8% and 24.3% during the two previous quarters.

The application of telehealth as a strategy for minimizing deferred care has declined significantly, falling from 24% of responses the previous quarter to 11.1% in the latest survey. The shift could be a response to the increasing willingness of patients to see clinicians in person.

In another noteworthy change, space utilization rose from 10.3% to 17.4% of responses to a question about how deferred care has affected deployment of resources. More organizations may be looking to repurpose (or perhaps divest) facilities or units.

A large majority of respondents foresaw deferred revenue returning either this year (38.5%) or in 2023 (42.3%). Fewer than 1 in 5 thought revenue would return either in later years or never.

3. Technological adjustments become a strategic focus

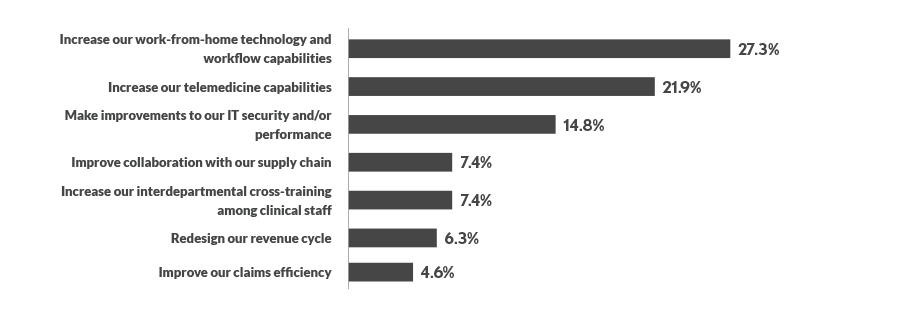

In a question about permanent adjustments being made in response to COVID-19, the most frequently selected answer (27.3%) was increasing work-from-home technological and workflow capabilities. Many respondents also said their organizations would look to increase telemedicine capabilities (21.9%) and make improvements to IT security and/or performance (14.8%).

Initiatives related to areas such as supply chain and revenue cycle were farther down the list, indicating that technology-related projects are strategic priorities pertaining to the pandemic.

What are the 3 most important permanent changes your organization will make as a result of COVID-19?

Source: HFMA Outlook Survey conducted April 1-17, 2022. Respondents were asked to select up to three choices (n =237).

Big challenges when making technology decisions include determining the cost of the implementation (24.6%), the amount of time required to make the decision (23.2%) and predicting the outcome of the decision under fixed costs (23.2%), respondents said.

A variety of issues tend to crop up in oversight of decision making around technology projects:

- Unclear strategic direction and priorities (30.5%)

- Lack of specificity and ability to measure plans, with clearly identified accountabilities (30%)

- Lack of defined criteria (e.g., financial feasibility, market potential, impact on safety and quality) for evaluating new projects (27.6%)

- Lack of formal corrective action for underperformance (23%)

4. Capital spending gets a closer look

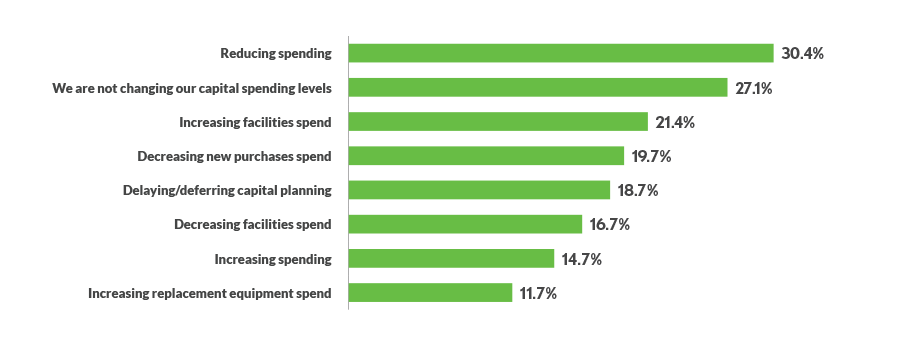

Many organizations were considering whether and how to modify their capital spending, with a plurality of respondents — 30.4% — saying they were reducing their spending. Meanwhile, 27.1% said they were maintaining their spending and 14.7% were increasing it.

In terms of spending on facilities, 21.4% of respondents anticipated increases, while 16.7% were planning reductions.

In what ways are you changing your capital spending level?

Source: HFMA Outlook Survey conducted April 1-17, 2022. Respondents were asked to select all answers that applied (n =299).

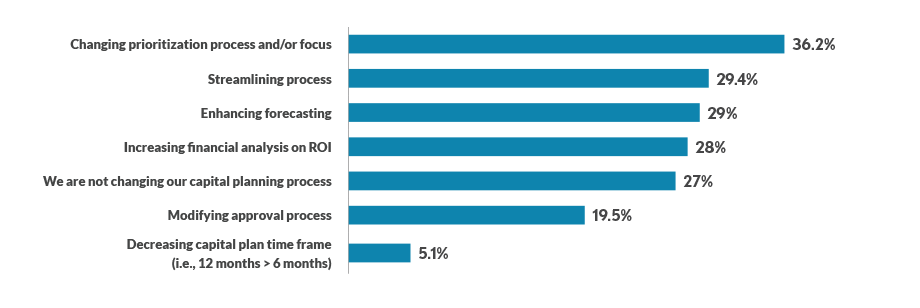

In addition, 18.7% reported delaying or deferring capital planning. Others were looking to alter their capital planning processes in a variety of ways, as seen in the exhibit below.

In what ways are you changing your capital planning process?

Source: HFMA Outlook Survey conducted April 1-17, 2022. Respondents were asked to select all answers that applied (n =293).

5. Price transparency efforts continue

More than a year after the Jan. 1, 2021, start of federal price transparency regulations for hospitals, respondents generally viewed their organization’s price transparency policies as adequate: 60.9% selected “acceptable/good” when asked to describe price transparency at their organization.

The year-over-year trends, dating back to when the regulations recently had been implemented, suggest improvement in hospital transparency initiatives. For example, the share of respondents saying their organization’s price transparency was “nonexistent” decreased from 5.2% to 1%, while the share choosing “poor” dropped from 15.3% to 8.9%. Shares of respondents selecting “very good” (22% to 24.3%) and “the best” (3% to 4.9%) inched upward from early 2021 to early 2022.

A likely caveat can be found in the subjective nature of the responses. For example, one respondent’s definition of acceptable price transparency might differ from what’s required by regulation or what the average consumer might consider acceptable.

“As consumers are faced with increasing out-of-pocket financial responsibilities, they expect providers and their health plans to provide reasonable estimates for services,” Gundling said. “This includes the application of the health plan’s network status and benefit design. Consumers deserve a reasonable estimate of their out-of-pocket payments.”