Battle of the Bots intensifies over denials

Will AI-powered tech give providers an edge in the denials fight? Here’s what first-movers are learning from AI use cases.

Care in Palo Alto, California. She says that payers continue to be more sophisticated in their use of AI.

Healthcare payer claim denials are getting smaller, sneakier and faster.

The battle of the bots over healthcare claims payment delivered record blows in 2025, with initial denials sometimes occurring within seconds of submission.a

“When I have conversations with some of our provider partners, I’m hearing them be much more open to the use of technology than they would have been even one or two years ago,” said Ryan Hartman, CHFP, MHSM, director of revenue cycle for Kodiak Solutions.

“Payers are becoming more sophisticated in their use of AI, and the denials are coming faster than we can keep up,” said Shannan Bolton, CRCR, RHIT, vice president of revenue cycle optimization and performance excellence for Stanford Health Care, Palo Alto, California.

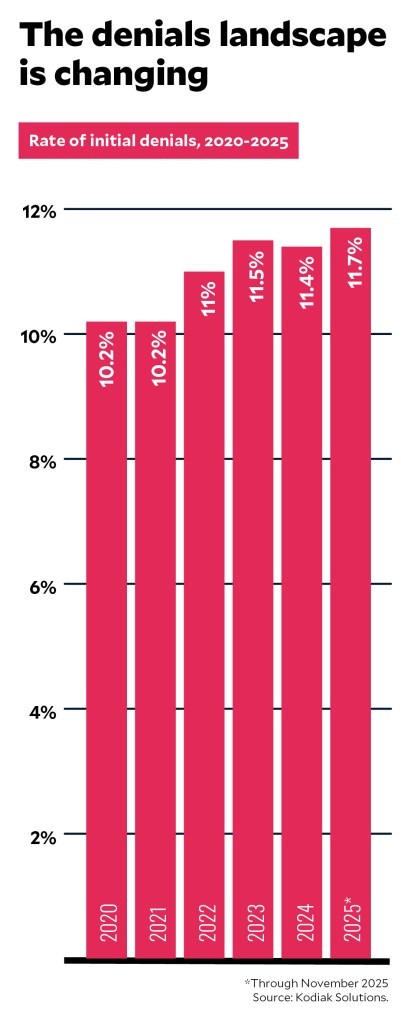

Recent data indicate that that’s true for the rest of the country. Hospitals and physicians experienced an initial denial rate of 11.65% in 2025 through November, compared with 11.41% in 2024, according to Kodiak Solutions. Initial denial rates related to prior authorization and precertification rose to 1.56% in 2025 through November, up from 1.46% in 2024, Kodiak Solutions states.

As a result, healthcare providers are clamoring to put AI solutions in place to stem the rising number of claim denials, adopting technologies that include ambient AI, generative AI and agentic AI.

“When I have conversations with some of our provider partners, I’m hearing them be much more open to the use of technology than they would have been even one or two years ago,” said Ryan Hartman, CHFP, MHSM, director of revenue cycle for Kodiak Solutions. “I’m hearing people talk about using technology to help draft appeal letters. I’m hearing them talk about automating routine tasks and redirecting some of their people resources toward follow-up activities.”

HFMA’s Vitalic Health takes action

No one wins in the fight over claim denials. In February, HFMA’s Vitalic Health is convening more than 50 payers, providers and tech leaders to study the issue and work toward meaningful industry solutions. The goal: Develop a universally accepted definition of a clean claim and begin to eliminate $25 billion in related administrative waste.

For more about the Vitalic Health mission or to get involved, visit hfma.org/vitalichealth.

A costly battle

U.S. healthcare providers’ expense associated with fighting claim denials exceeded $25 billion in 2023, up 23% year over year, a Premier analysis released last year found.b Given that 70% of denials are ultimately overturned after providers appeal them, Premier estimated that “nearly $18 billion was potentially wasted arguing over claims that should have been paid at the time of submission.”

In recent years, not only has the number of services requiring prior authorization increased, but denials for services that were preapproved also have shot up. Premier found that denials for preapproved services or procedures doubled or tripled from 2022 to 2023, with the rate varying by payer. It’s a sign of breakdowns in the claim preparation, submission and insurance review process, Premier stated.

“The approach by payers has drifted from one of payment integrity, which it very much was in the past, to one of payment avoidance. It’s revenue retention,” said Joshua Robinson, revenue cycle management executive for Signature Performance.

Insurers are reaching down to smaller claims when denying reimbursement. The dollar amount of claims undergoing review is lower than in years past, said Sheila Augustine, FHFMA, MHA, director of patient financial services for Nebraska Medicine in Omaha, Nebraska.

“Years ago, I felt like it was the $100,000 claim amounts that payers would proactively review. Now, that amount is a lot lower, and there’s more scrutiny that is happening as well,” Augustine said.

While most claim denials are successfully overturned on appeal, the cost of appealing a denied claim — which Premier estimated amounted to $57.23 per claim in 2023 — means providers must consider whether an appeal is worth the time and expense.

Omaha, Nebraska. “Now, that amount is lower, and there’s more scrutiny that is happening as well.”

“Most payers are using some of the new technology as a means of really just pushing out the payment timeline,” said Hartman of Kodiak Solutions. “They’re getting more effective, frankly, at scrubbing the claims coming in the door. They’re probably keying in on smaller discrepancies that allow them to initially reject the claim and push out that cash flow, [knowing] that payment is probably going to get made in the long term eventually.”

A more complex task

Just as concerning, the types of denials healthcare organizations are seeing have become more complex.

“We’re seeing many medical necessity denials from commercial payers that aren’t initially labeled as such,” Stanford Health Care’s Bolton said. “Depending on how they are adjudicated, they might come back to us as ‘investigational’ or ‘non-covered,’ which makes it harder for us to determine the true denial type and root cause so we can appeal effectively.”

For healthcare revenue cycle teams, experts say one key to staying battle-ready rather than becoming battle-worn is adopting the tools and mindset needed to enact a defense as early in the revenue cycle as possible.

“Where I think renewed energy comes into play is being able to say, ‘These things aren’t so overwhelming that they’re beyond our control,’” Bolton said.

the work that our teams are doing.”

“A lot of this now is about organizations being accountable. Do we have the best technology? Are we able to access trends and look at the root causes so that we’re able to work denials more efficiently?” she said.

“This is where automation and a focus on performance take us to another level. In my work with the departments I support, we’re really diving into: Are we doing things in the most effective and efficient ways to keep up with the changes that are happening?”

Given the increasing volume and complexity of denials, providers must understand their contracts extremely well to be able to appeal effectively, Robinson said.

More than just denials

Underpayments, too, are on the uptick, providers say.

“We see DRG downgrades or underpayments of emergency department rates, for example, that are not shown transparently in the electronic remittances. We probably see more of that than we see the direct denials,” said Brad Tinnermon, senior vice president of finance shared services for Kaiser Permanente.

Spotting instances of underpayment isn’t easy, Tinnermon said.

“The codes they’re using or omitting aren’t triggering our denial workflows, so we have to find them in other ways,” he said. “Sometimes, we’re finding them in safety nets, where we’re using other technologies or vendors to scrub through our paid claims and see how well they were paid and check them against our local negotiated rates.”

Turning to technology to help

The pace of AI innovation in the revenue cycle picked up considerably in 2025 as demand for solutions for predicting, preventing and appealing denials in cost-effective ways increased.

“This year has moved pretty fast — probably faster than most,” said Michael Duke, partner and commercial healthcare lead for automation and innovation solutions at Guidehouse. Since March, he said, his team has developed 11 market-ready AI agents for release.

“The biggest push we’ve seen so far is on the denials follow-up and support side as well as the financial clearance process,” Duke said. “We’re also seeing interest in conversational support for inbound and outbound scheduling that we’re pretty excited about.”

The categories of AI that Duke is seeing in the healthcare revenue cycle space include:

- Ambient listening AI to assist with clinical documentation and support accurate coding

- Generative AI solutions for creating content that supports revenue cycle staff in taking the right steps toward denials resolution

- Agentic AI capable of handling call volume

- Financial clearance AI agents that perform eligibility checks, obtain authorization information from payer websites and systems and prepare authorization requests for submission

- Automated capabilities like robotic process automation to digitize routine tasks, increasing efficiency while enabling revenue cycle teams to focus on work that requires human oversight

“Medical necessity is one area where generative AI performance is just off the charts,” Duke said. “A good nurse practitioner can do a clinical review of a medical necessity denial at a rate of eight to 10 per day, or 50 on a great week. An AI agent can do around 3,500 in the same time frame. So the labor savings are massive. From there, the AI agent can spin up a letter that a clinical reviewer can review and edit, approve and then submit. Later, the agent will follow up on specific accounts until a determination is received.”

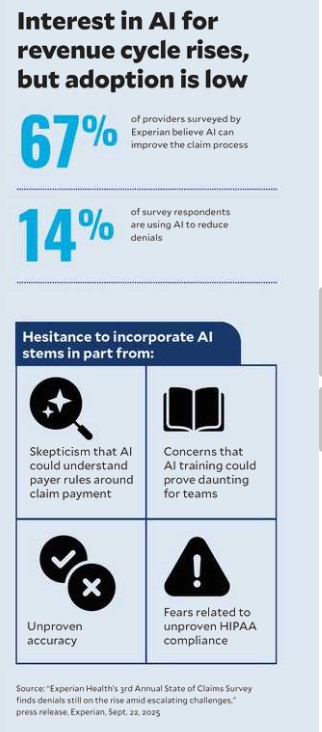

Interest in AI is high, but at least one survey suggests full implementation of AI for reducing denials has yet to take off. A 2025 Experian survey found that 62% of revenue cycle leaders believe they are well-versed in AI, automation and machine learning, up from 28% in 2024.[3] Among survey respondents who use AI in the revenue cycle, 69% pointed to reductions in denials and/or increased success around resubmissions.

But while 41% of respondents said their organization had upgraded their claims management technology in the past year, just 14% said they had deployed AI in the revenue cycle. Among these respondents, reluctance to incorporate AI stems in part from skepticism that AI could understand payer rules around claim payment.

That’s a mindset Duke hopes to change.

“I’ve spoken with some leaders who say, ‘We’re in a good place. We have a denials rate of 2% or less.’ I’ll say: ‘Can I get you down another million?’” he said. “We want to change the game and the thinking to say, ‘2% is not good enough anymore.’”

In his view, use of AI in revenue cycle operations could have profound implications for healthcare affordability.

“I grew up in a really small town in West Virginia,” Duke said. “And I think a lot about the closing of rural hospitals and access and whether people are going to get the care they need because it’s so expensive to run a facility in an outlying location. If we can infuse more of the revenue and cash that these organizations have earned so they can continue to provide that care, we could change the industry to help people who need care receive it and be able to afford it.”

AI at the ground level

Health systems nationwide are experiencing success in applying AI solutions to the healthcare revenue cycle. Here are just a few case examples of approaches used.

Enabling situation response. At Kaiser Permanente, advancements in AI capabilities for the revenue cycle have enabled leaders to deploy “situation response AI” that guides staff to the shortest path to the best outcome in denials appeal and recovery, Tinnermon said.

“It incorporates best practices in resolving specific types of denials based on a review of thousands of denials and all the different tactics we’ve used to recover payment,” Tinnermon said.

For each type of denial where best practices for resolution are identified, he said, “We have the ability to send a note into the system that essentially guides the end user through, ‘This is what we think the situation is, and this is the path we want you to take to address it.’”

Later, when employees encounter these denials, they automatically receive guidance on how to proceed. This tech-enabled approach can assist in preventing accounts from aging out due to inaction or inappropriate action.

“It lowers costs while improving the turnaround time by decreasing the amount of touches required to resolve a claim,” Tinnermon said. “We have a list of situation responses we’re building, and we’ve got the first five big ones mapped. As these tools evolve, we expect to see a 60% to 70% increase in productivity for these specific scenarios.”

Combating medical necessity denials. At Rush University System for Health in Chicago, a jump in medical record requests and medical necessity denials from a payer prompted the revenue cycle team to explore an AI-based solution.

“We saw this as a high opportunity to build a bot that would go in and mirror the workflows for medical necessity requests and determine how automation could help redefine those workflows or prevent that denial,” said Blake Evans, system vice president of revenue cycle at Rush.

“The insight that comes from looking at the data gives us the base logic to say, ‘Hey, we need to put a modifier in place before we send the claim out,’ or, ‘We keep getting denied for the same procedure. Have we stood up our processes correctly within our financial clearance department to obtain that authorization?’”

Since Rush began to incorporate this AI bot last year, “We’ve actually seen a decrease in our medical necessity denials, and we’ve seen a 25% drop in some of the requests for medical necessity, even,” Evans said.

Fast-tracking appeals. Nebraska Medicine leans into AI tools to write appeal letters, an area where Stanford Health and Kaiser Permanente have also found success. At Nebraska Medicine, the approach has reduced the amount of time staff spend on appeal letters from 15 minutes to just eight to 10 minutes while boosting appeals success.

“We’ve moved from a 68% to 70% overturn rate for appeals to probably 71% to 72% now, and we have not yet fully utilized AI for all our denial appeal letters. It’s only being used for certain aspects so far,” Augustine said.

Kaiser Permanente, meanwhile, has seen AI appeal writing increase recovery rates by about 15%. “We’re getting more appeals overturned at a lower cost with a higher return,” Tinnermon said.

Informing proactive denials prevention. Nebraska Medicine also explores the use of AI to review payer rules to support diagnosis.

“For example, we have a commercial payer that denies a certain type of lab for criteria not met,” Augustine said. “We use AI to scrub the patient’s record to support the diagnosis. We’re leveraging tools like this to help us be more proactive rather than reactive.”

Analyzing payer trends. At Stanford Health Care, Bolton and her team have begun working with an AI vendor to identify trends in payer behavior and root causes of denials. The technology has advanced so much, “We’re now able to predict some denials before they occur,” Bolton said. “We have a dedicated team that uses predictive analytics to dive into the root causes and improve our performance.”

At UMC Health System in Lubbock, Texas, staff use an AI-powered assistant, Microsoft Copilot, to compare a payer’s cited policy against its current provider manual. In one instance, the team found that the health plan had quoted a policy from the previous year as the basis for a denial.

“It is very difficult to access provider manuals and their precertification requirements, so we have had to resort to using Copilot to help us gather that information,” said Karen Veselsky, vice president of revenue cycle for UMC Health. “[We’ve also begun] using that software to help draft appeal letters, using the payers’ policies to our advantage.”

Automating prior authorization. Rush leverages Epic’s payer platform to automatically create an authorization request when procedures requiring prior authorization are ordered. “The payer will respond within the portal, and the request comes right back into our Epic system as approved or denied,” Evans said. Rush currently is working with a third party to apply the same approach to payers that aren’t on Epic’s platform.

AI: A tool, first and foremost

Ultimately, success depends on framing the introduction of AI in healthcare revenue cycle operations as a tool for staff enablement — not a replacement for human talent.

“We really need people to embrace this technology,” Bolton said. “AI is not going away — but that doesn’t mean our team members’ jobs will be eliminated. It’s augmenting the work that our teams are doing. We want to celebrate the fact that our team has helped us identify a way to support them in doing their work more efficiently.”

Footnotes

a. For an earlier discussion of this overall trend, see Williams, J., “Battle of the bots: As payers use AI to drive denials higher, providers fight back,” hfm, April 2024.

b. Alkire, M.J., Saha, S., and Ingram, M., “Claims adjudication costs providers $25.7 billion – $18 billion is potentially unnecessary expense,” Premier, Feb. 24, 2025.

c. “Experian Health’s 3rd Annual State of Claims survey finds denials still on the rise amid escalating challenges,” press release, Experian, Sept. 22, 2025.

Determining the right path forward for AI: Leaders share insights

What should organizations consider in determining how to apply AI innovation to the healthcare revenue cycle? Leaders shared the following lessons learned.

1 Understand that there’s a need for speed. “Yes, you should have an AI Center of Excellence and a policy on how to deploy AI, but at the same time, don’t spend a year thinking about AI,” said Michael Duke, a partner and commercial healthcare lead for automation and innovation solutions at Guidehouse. “Try it, and if you like a tool, integrate it deeper and in other areas. Be willing to explore an AI use case even before you understand what your corporate strategy for AI might be.”

2 Take a data-driven approach to determining where to apply AI in the revenue cycle. “It all starts with using data to define the problem and then finding a hammer that can hit the nail on that problem versus randomly selecting vendors that say they can use AI to help with denials,” said Blake Evans, system vice president for revenue cycle, Rush University System for Health in Chicago.

At Rush, leaders try to lean into Epic’s AI capabilities as much as possible, given the investments the system has made in the EHR. “We always say, ‘Epic first,’ but not only Epic, because Epic can’t do everything,” Evans said. “We are open to using other vendors for specialized solutions, but we also try to maintain some consistency in the vendors we select so that we don’t have a ton of bolt-on AI tools that don’t orchestrate and interact with each other.”

3 Limit the number of AI pilot projects being rolled out at once in the revenue cycle. “We have 20 AI use cases right now that we want to implement. It’s important to take the time to finish the first three, get them live, get them operational and then move to the next one,” said Sheila Augustine, FHFMA, MHA, director of patient financial services for Nebraska Medicine in Omaha, Nebraska. “If you take on way too many at once, you run the risk of not utilizing AI to its full capability.”

One pro tip: Take your time in validating the information that results from an AI analysis, and make sure everyone is comfortable with the data produced.

4 Recognize when specialized expertise may be needed. “A lot of the big AI platforms will give you a workbench and a toolbox, but — to use an auto analogy — there are times when you may need to hire a certified mechanic to help you use the tools properly,” said Joshua Robinson, a revenue cycle executive for Signature Performance.

For example, building the right rules for automated denials prevention requires specialized understanding of policies across health plans.

5 Make sure your organization’s IT and operations teams take an active role in AI-based revenue cycle deployments. “Getting something live is a great start, but it is critical to ensure these solutions have ongoing review and maintenance to ensure they remain effective and efficient,” said Kaiser Permanente’s Brad Tinnermon, senior vice president, finance shared services. At Kaiser Permanente, team members monitor the performance of AI solutions daily and weekly.