Bottom-Line Implications of New Lease Accounting Standards: What Healthcare Leaders Should Know

A new lease accounting standard that takes effect in 2019 could significantly affect healthcare organizations’ financial covenant calculations under their borrowing agreements, as well as the structure of their future borrowing agreements and their choice of financing product.

Issued by the Financial Accounting Standards Board in February 2016, Accounting Standards Update (ASU) 2016-02 – Leases (Topic 842) requires organizations to report all leases longer than 12 months on their balance sheets. Prior to this change, only capital leases were recorded as assets and liabilities on the balance sheet, whereas operating leases impacted only the income statement and, in some cases, were reported in notes to the financial statements.

For public companies and not-for-profit healthcare organizations that have issued or are conduit debt obligors for securities that are traded on an over-the-counter market, the change takes effect in fiscal years beginning after Dec. 15, 2018. All other organizations must implement the reporting change in fiscal years beginning after Dec. 15, 2019. The standard also must be applied to interim periods within the fiscal year of adoption. Early adoption is permitted for all entities. Of note, this standard does not apply to any governmental entities reporting under Governmental Accounting Standards Board pronouncements.

Among healthcare organizations that have debt—whether publicly issued or privately placed with a lender—one important consideration is whether recording operating leases on the balance sheet will trigger financial covenant defaults for borrowers. Most commonly, financial covenant language is found in the master trust indenture (MTI), loan agreement, or continuing covenant agreement.

Taking a Closer Look

Even though the new lease accounting standard was announced in early 2016, the degree to which healthcare organizations and companies in other industries are prepared for the change varies. The extent to which the change will affect their compliance with financial covenants also will differ.

A recent survey by PwC shows that assessment and implementation are well underway, particularly for public companies, with only 8 % of survey respondents across industries indicating their companies had not yet begun to prepare for this change. However, as may be expected, 31% of nonpublic companies had not begun to prepare for the new lease accounting standard at all. Other survey findings include the following:

- Only 1% of all organizations surveyed had completed implementation, underscoring the sometimes-lengthy and arduous process that is required.

- Implementation was in progress at 57% of public companies compared with only 20% of nonpublic companies.

- The impact of this change was still under review at 34% of public companies and 48% of nonpublic companies.

In health care, larger organizations with specialized staff typically are more prepared to implement the lease accounting change. On the other end of the spectrum are healthcare organizations that have just begun to identify all their leases and are only beginning to understand how they will be affected under the new guidance. Very few of the latter organizations have reached the point of reviewing their various borrowing documents to determine the potential impact on financial covenant calculations. Kevin Gore, a partner with the accounting firm BKD, LLP, reports that, based on discussions his company has had with its clients, healthcare organizations, in general, appear to be behind other industries in assessing the impact of this new standard on their financial statements and financing agreements.

See related sidebar: Defining Finance and Operating Leases Under the New Lease Accounting Standard

ASC 842 provides for two types of leases: finance leases (formerly “capital leases”) and operating leases. Operating leases will generally be accounted for on the income statement under the new lease accounting standard in a manner materially consistent with the way operating leases are accounted for under the existing standard (i.e., lease expense for period recognized on a straight-line basis). Moreover, under the new accounting standard, finance leases will be accounted for in substantially the same manner as capital leases under existing standards, both on the balance sheet and the income statement.

The main impacts of the new lease accounting standard are as follows:

- Operating leases are included as an asset on the balance sheet in a new line item, “Operating Lease Right of Use Assets,” that is separate from “Property and Equipment” or similar line items (where finance leases are booked).

- The contra-account for that of “Operating Lease Right of Use Assets” is also a new balance sheet line item, “Operating Lease Liability,” which is separate from “Long-Term Debt” or similar line items (where finance lease liabilities are booked).

- Current liabilities will now include the current-year operating lease liability as well as the finance lease liability.

Additional disclosures regarding the amount, timing, and uncertainty of cash flows related to leases will now be required. Specifically, lessees must disclose qualitative and quantitative information about variable lease payments and options to renew and terminate leases. As leases are amended or new leases are signed, organizations will need to regularly reassess the impact to their financial statements.

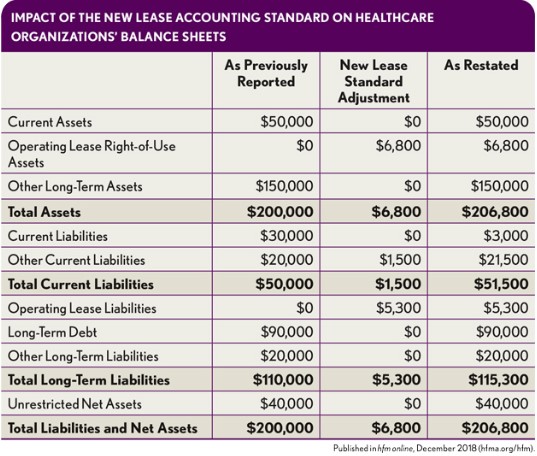

The exhibit below illustrates how the new lease accounting standard will be reflected on healthcare organizations’ balance sheets. The current-year lease liability of $1,500 is added to other current liabilities, and both new balance sheet line items—Operating Lease Right of Use Assets, and Operating Lease Liabilities—are adjusted accordingly to reflect operating lease exposure.

Potential Impacts on Financial Covenant Calculations

Borrowing agreements associated with bonds, loans, credit facilities, and other types of debt frequently have financial covenants, such as minimum days cash on hand, debt service coverage, and debt to capitalization. Many borrowing agreements also include covenants that prevent an organization from borrowing additional debt if certain debt-service coverage requirements or other financial tests are not met. A violation of any of these covenants could trigger a default.

Financial covenants that could be affected by the change in accounting treatment of operating leases can be broadly categorized into two types: ones in which debt (or indebtedness) is a component, and ones in which line items from the balance sheet are components. These broad categories overlap, and there are some financial covenants that use a combination of total debt (or indebtedness) and line items from the balance sheet as their components.

The most common covenants in which debt is a component are the “rate covenant” or “debt service coverage” and the “additional debt test.” Under a rate covenant, the borrower agrees to manage its business in a manner that is compliant with a stated ratio of net income to debt service (either maximum annual debt service or annual debt service). Under an additional debt test, the borrower agrees not to incur additional debt unless certain debt service coverage or other financial metrics are met.

Whether the new lease accounting standard will have an impact on these ratios and, ultimately, on the borrower’s compliance with its financial covenants may depend on how the borrowing document defines debt or indebtedness. Consider the following examples.

Example 1. Operating leases are not a form of debt. Consider in this case that debt is defined as “any obligation of the Borrower for (a) repayment of borrowed money (b) with respect to finance leases or (c) under installment sale agreements.” Here, debt is confined to specific categories of obligations that do not apply to operating leases. This definition also uses the new accounting term finance lease, making it clear that operating leases were not intended to be included as debt.

Example 2. Operating leases could be construed to be debt. In this case, let’s assume debt is defined as “any indebtedness or obligation of the Borrower (other than accounts payable and accruals), as determined in accordance with generally accepted accounting principles, including obligations under conditional sales contracts or other title retention contracts, and rental obligations under leases which are required to be capitalized on the balance sheet under generally accepted accounting principles.”

This definition of debt is open-ended and dependent on whether generally accepted accounting principles (GAAP) treat operating leases as debt or obligations. Further, under the new accounting lease standard, operating leases will be “capitalized” on the balance sheet. A conservative reading of this example could include operating leases.

Some documents already have included forward-looking provisions that take into consideration the impact that changes in accounting standards—including the new lease accounting standard—could have on financial covenant calculations. These provisions allow the borrower, at its option, to compute a financial covenant contained in the borrowing agreement in accordance with GAAP in effect on the date of execution and delivery of the borrowing agreement instead of current GAAP. These types of provisions reflect unequivocal intent to allow the borrower to maintain current treatment of operating leases, notwithstanding any change in GAAP.

Financial covenants using metrics derived from balance sheet items can take various forms. Common examples include a ratio of current assets to current liabilities (current ratio), a ratio of total liabilities to the sum of total liabilities plus net assets, and a ratio of long-term indebtedness to the sum of long-term indebtedness plus unrestricted net assets.

Let’s compare covenant calculations under current accounting guidance compared with covenant calculations after the new lease accounting standard has been implemented.

Prior to the lease accounting standard change, the current ratio from the previously cited exhibit would be 1.0x ($50,000 of current assets divided by $50,000 of total current liabilities). After the new accounting standard is implemented, the current ratio would decrease to 0.97x. The denominator (total current liabilities) would increase by the amount of the current year’s operating and finance lease liability total amount.

Financial ratios dependent on only balance sheet items, such as the current ratio, will be affected to varying degrees due to the accounting change, depending on how much exposure an organization has to operating lease liabilities. Because what constitutes indebtedness when it comes to testing financial covenants is open to interpretation, a calculation comparison assuming the two definitions of indebtedness in our examples is appropriate.

Example 1 above does not qualify operating leases as indebtedness; therefore, a ratio that is based on total long-term indebtedness to the sum of long-term indebtedness plus unrestricted net assets will be lower and more likely to pass this covenant test. Based on the sample balance sheet shown in the exhibit referenced previously, excluding operating lease liabilities under example 1 would produce a result of 69%, which would pass if the covenant was 70%. Conversely, assuming a conservative reading of example 2 and including operating lease liabilities in the calculation would cause the issuer to fail the test at 70.4%.

In sum, the lease accounting standard change could exert pressure on some covenant calculations, but the effect ultimately will depend on operating lease liabilities outstanding, the definition of indebtedness (or debt), and the actual covenant calculation language found in the borrowing documents.

Meanwhile, Moody’s Investors Service anticipates the new lease accounting standard will affect few, if any, ratings. The rating agency, like other credit rating firms, already takes into consideration the leases disclosed in the footnotes of the financial statements when assessing an organization’s credit risk.

Strategies for Healthcare Leaders

Although the impact of the new lease accounting standard will vary by organization, there are several steps all healthcare leaders can take now to mitigate their organizations’ risk.

Carefully review financial covenants in existing borrowing agreements before the lease accounting change goes into effect. As explained previously, borrowers need to be aware of three considerations:

- Whether their borrowing agreements would include operating lease obligations in debtor indebtedness

- Whether any balance-sheet-based financial covenants are adversely affected by the lease accounting change

- Whether their borrowing agreements allow them to continue financial covenant calculations under GAAP prior to the lease accounting change

In instances where the change in accounting treatment would result in a covenant default, borrowers should consult with their financial advisers and counsel to assess whether the borrowing document should be amended.

Talk with lenders regarding their interpretation of the lease accounting guidance and any amendments. If a borrower has privately placed debt, amending the documents may be easier because the borrower need negotiate with only a single holder for that debt. However, if the borrower has publicly held debt, such as bonds, amending the borrowing agreement (such as the MTI or loan agreement) would require the consent of at least a majority (in principal amount) of holders, which can be difficult to obtain. In such an instance, the borrower should consult with its financial adviser and counsel regarding the best strategy to effectuate these amendments. Further, whether publicly or privately held, if interest on the debt is exempt from federal income tax, the borrower should consult with bond counsel to ensure any amendment will not adversely affect the tax-exempt nature of such debt.

Include language excluding operating leases from the definition of debt in all new borrowings—before and after implementation of the new lease accounting standard. Until the new lease accounting standard takes effect, borrowing agreements should incorporate language that states that any lease that was considered an operating lease at the time of inception will be considered an operating lease, and that covenant calculations will be based on GAAP at the time of entry into the borrowing agreement. After the new lease accounting standard takes effect, borrowers should make sure future borrowing agreements feature language that contractually excludes operating leases from the definition of debt or that clarifies that operating leases are not considered when calculating financial ratios.

Complete financial statement impact analysis in advance of making lease-vs.-buy decisions. The new lease accounting standard applies only to leases that are one year in length or longer—but it is doubtful that the industry will see an influx of 11-month lease agreements designed to avoid recognizing the lease asset and lease liability on the balance sheet. Although it certainly will be important for borrowers to discuss with their financial advisers the need to evaluate the lease-versus-buy decision and the structure of all leases in the context of the new accounting standard, many other factors, both quantitative and qualitative, also must be analyzed. Specifically with respect to their real estate portfolios, healthcare organizations must also consider the important operational and regulatory compliance advantages and disadvantages of both options.

Heighten transparency in disclosure to investors. For example, healthcare organizations can promote such transparency when preparing quarterly continuing disclosure reports for investors or disclosure for new debt to be issued by including a narrative that explains the lease accounting change. Such a discussion could include the anticipated date of adoption and whether the impact to the balance sheet and income statement will be material. It also could illustrate how previously reported ratios will be affected.