By adopting 4 models for managing risk, healthcare organizations can secure the foundation for value-based payment success

Daniel J. Marino

Kathy Najarian

To ensure their organization’s success under risk-based payment, healthcare finance leaders should use models for optimizing costs, care delivery, the continuum of care and contracts.

In the past decade, government and private payers have introduced dozens of widely varying payment models to healthcare. Although they differ significantly, these models have one common aim: To transfer risk from payers to providers by moving the payment focus from volume to value.

Healthcare finance leaders are responsible for ensuring their organizations are fully prepared for this transfer of risk. They must understand how financial results are affected by clinical processes, quality metrics, utilization, patient access, technology, data governance and other issues, and they must become adept at making the types of value-focused decisions that now drive financial outcomes.

For this purpose, finance leaders require models to inform decision-making that provide a vision and an operating philosophy for value-based care and risk-based payment. Here, we describe four such models focused on cost, care delivery, continuum of care and contracts, each of which can serve as a tool for managing a key driver of financial risk. By applying these models in combination, an organization can build an integrated approach to performing optimally under risk-based payment.

1 The cost model

Cost is a major issue in U.S. healthcare, but the term means different things to different health system participants. For payers, cost means service utilization and negotiated unit prices, and this sense of it is reflected in claims data. For healthcare providers, cost means expenses incurred to deliver care.

Providers are at a disadvantage here. Payers know their costs down to the level of the individual patient because their costs are driven by claims. Providers, meanwhile, are largely unable to identify costs at the patient level. While some direct expenses can be tied to individual patients, the bulk of expenses are allocated at the department or unit level.

Thus, when negotiating contracts, providers must “price” their services without fully understanding their cost to deliver those services.

To address this challenge, finance executives need a model for accurately identifying the true cost of care by capturing expenses at the most granular level available and tying them to patient populations (e.g., a health system’s Medicare Advantage attributed population for a specific payer). The model also must capture the cost of services delivered by outside providers such as imaging labs, post-acute care providers and other hospitals.

Developing such a model is a process, not an event. It starts with using risk stratification to better approximate the medical spend of different patient cohorts. For example, a finance team might begin by allocating additional costs to various chronic disease cohorts such as patients with diabetes. Later, the team could start allocating additional costs to cohorts with high emergency department spend and multiple admissions. Eventually, finance could begin using validated utilization risk tools to precisely allocate individual costs across a broad patient population.

Risk stratification techniques like these can provide an understanding of the cost implications of providing services to various populations and enable a health system to accurately price services to the 20% of patients who account for 80% of costs.

2 The care model

A well-organized care model is key to delivering high-quality patient care cost-effectively. Its purpose is to describe the system for organizing clinical staff, processes and technology around patient needs. Clearly, physicians and nurses take the lead in care model design, but finance leaders can play an important role by advocating for a fully coordinated approach.

The foundation of care model design is a well-defined system of clinical protocols and care pathways. Optimized care models often include new team structures that leverage advanced practice providers, clinical scribes and other staff members.

The focus is not just on delivering care in the clinic, but also on using care management, including patient outreach, to create a seamless patient experience.

Care model design may also incorporate innovative tools such as virtual visits and care coordination dashboards, which allow staff to utilize data from several sources to avoid redundant care.

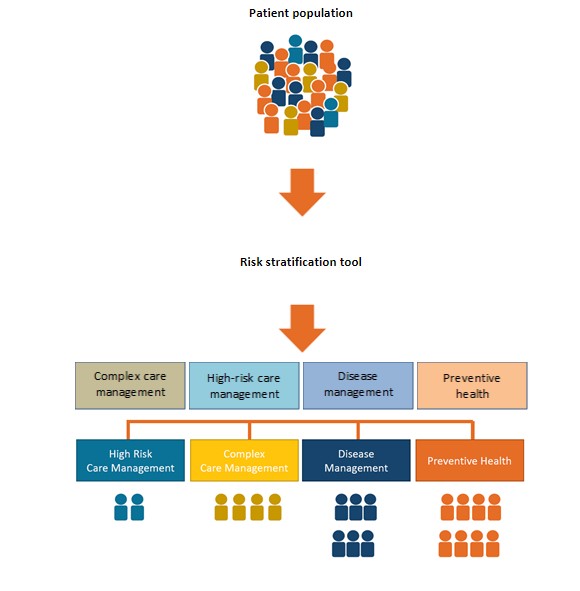

Risk stratification (discussed above in conjunction with the cost model) also is an important tool for driving care model performance. Some provider organizations use information from the electronic health record, clinical disease registries, payer claims data and other data sources to capture risk factors at the patient level. By analyzing this information, they can stratify patients by risk profile, thereby making it possible to triage patients to different care pathways and ensure each patient receives the right care at the right time.

The role of risk stratification in the care model

By applying best evidence to clinical and claims data, healthcare organizations stratify patients by risk for high-cost care. This process enables them to triage patients to the appropriate level of care and thereby optimize patient outcomes and control costs.

Source: Lumina Health Partners, 2021

Finance leaders can help drive care model design by advocating for a decentralized planning and management approach. Under this approach, clinical pathways and protocols are defined and monitored by a care coordination governance group. While the governance group reports up to the chief medical officer, all clinical protocols are executed locally at the provider level.

In general, care model design should be aligned with an organization’s risk-based contracts (as described below). For example, if an organization is participating in the CMS Oncology Care Model (OCM) program, the care mode should incorporate care management planning, patient navigation, 24/7 patient access and other elements key to OCM performance.

3 The continuum model

Many risk-based payment programs encompass services delivered in any setting, not just in the hospital. Organizations participating in such programs therefore must build a network of providers that covers the full spectrum of clinical and support services.

Network participants. The accountable care organizations (ACOs) and clinically integrated networks (CINs) that health systems have developed over the past decade have provided a good starting point for assuming risk. But most of them include only hospitals and physicians, creating challenges around making efficient post-discharge transitions, and increasing the risk of driving problems.

To promote the continuum model design, finance leaders should advocate for including the following care settings in the network to create a seamless patient experience beyond hospital services:

- Skilled nursing facilities and home care services to optimize post-acute care

- Patient-centered primary care clinics that emphasize wellness and prevention

- Specialist care that supports complex care management

- Behavioral health and community-based services to help manage social determinants of health

- Urgent care and walk-in clinics to improve patient access and convenience

- Telehealth capabilities to establish virtual entry points to the care system

A comprehensive continuum model also ensures pharmacies, labs, specialty clinics, emergent care providers and end-of-life care are well integrated within the overall system.

Participation agreements. To build a successful continuum model, organization must construct effective provider participation agreements, based on clear performance metrics. The metrics may include quality measures, readmission rates, cost targets, and other measures of clinical care and efficiency.

Contracted providers also must commit to participating in collaborative efforts around care, such as transition-of-care protocols and patient access standards. Members of a preferred provider network should commit to referring patients with the CIN or ACO, where appropriate.

An effective provider participation agreement also requires an appropriate incentive structure that accurately reflects market conditions. In a competitive environment, for example, the opportunity to secure patient volume may be an ample incentive for post-acute care providers to participate in the network. In a less competitive market, the opportunity to earn additional revenue may be critical, with shared savings incentives tied to clear performance metrics and other network goals.

4 The contract model

Risk-based contracting has a long history, and most CFOs are well familiar with its concepts. Yet many finance leaders may not be familiar with the full diversity of existing tools for mitigating contractual risk. By gaining a deeper understanding of all the elements of risk-based contracting, finance leaders can design contract models that deliver both adequate risk protection and strong margin potential.

Important contract elements include patient attribution methods, risk protection measures (i.e., risk corridors such as a per patient cost cap) and data sharing provisions.

A strong contract model starts with carefully defining the following three key elements.

Shared-savings methodology. Shared savings is the foundation of most risk-based contracts. When establishing shared savings parameters, it is important to delineate the baseline comparison data. Payers use many targets, including:

- The organization’s historical performance

- The organization’s actual costs

- Cost trends within the local market

Risk-adjustment methodology. Risk adjustment can be used to ensure provider risk reflects the risk profile of the covered population. For instance, an academic medical center (AMC) treats complex patients who are typically sicker and more resource-intensive than the patients cared for by a community hospital. Consequently, risk adjustment in an AMC contract should trend the cost target to a higher level.

Reconciliation methodology. When spelling out the reconciliation methodology, it is important that performance targets be defined in detail and that third-party actuary audit rights be addressed.

If the parties cannot agree on an annual shared savings/losses reconciliation, the final amount due or owed will need to be determined by a third-party actuary.

Risk-based contract protections

| Downside limitation | A cost cap on the financial liability of the provider organization, established on either a per-patient or an aggregate bas |

|

Attribution protectionn |

Exclusion from the risk pool of patients who enter the provider’s system of care only after requiring catastrophic or tertiary service |

| Minimum volumes | Minimum threshold of attributed/assigned lives, ensuring the statistical validity of the cost and care models by reducing random variatio |

| Unforeseen changes | Right to terminate or renegotiate the contract if a policy change or material event impacts the shared savings and/or attribution calculation |

| Data sharing | Definition of the standard data package, a fixed reporting schedule, and the right to initiate dispute resolution for incomplete or inaccurate data |

| Audit rights | Right to request an audit by a third-party actuary if provider and payer cannot agree on the annual shared savings/losses reconciliation |

| Ability to exit | Right to terminate the contract without cause with x days of notice, with reconciliation of completed performance periods only |

Source: Lumina Health Partners, 2021

Tying it all together

A strong understanding of these components can help finance teams negotiate strong risk-based contracts with a variety of partners, including both commercial payers and large companies. (See the sidebar below for details on direct-to-employer contracts.)

Once a leadership team has started to develop these four models, they can begin to understand and predict the interactions among clinical care, contracts and costs.

For example, using the care model as a starting point, finance leaders can model how process efficiencies from various changes in clinical workflow and physician behavior might affect the cost model. They would be able to predict how treating patients in different care settings could maximize cost resources and contract performance.

Similarly, a strong understanding of the continuum model can raise finance leaders’ awareness of how different network configurations could affect clinical workflows (the care model) and direct and indirect expenses (the cost model).

Finance teams also can use their cost, care and continuum models to manage the contract model by showing how a variety of key levers — including utilization efficiencies, unit price changes, leakage control and program build costs — drive contract performance and impact incentive dollars.

Ultimately, the four models will enable finance leaders to identify areas of vulnerability by developing robust “what-if” scenarios. (“What if our patient population becomes sicker?” “What if we cannot stop leakage out of our network?”)

The principles reflected in the four models are not new. Many organizations have applied them to various extents over the past decade. What many organizations have lacked, however, is an integrated framework for guiding their value-focused strategy and focusing their efforts in risk-based contracting. Taken together, these four models provide such a framework, with the potential to accelerate the industry’s movement to value-based payment.

DTE contracts present a growing opportunity for provider organizations

Healthcare provider organizations have a growing opportunity to contract directly with large companies. Research from the National Business Group on Health suggests that nearly a quarter of large companies are now exploring the possibility of direct contracting.[1]

Direct-to-employer (DTE) contracts are typically negotiated around a provider’s center of excellence (CoE) that has a proven ability to deliver exemplary patient outcomes. DTE contracts give the employers greater stability in healthcare costs. The organization becomes the exclusive provider for a range of services or a participant in a narrow network of other high-performing providers.

Most DTE contracts so far have been structured around care episodes such as joint replacement or cardiac surgery. Increasingly, however, organizations are entering DTE contracts to provide a broad range of primary care services for a defined employee population. Under a fixed per-patient-per-month payment, the provider network delivers fully coordinated primary care, manages chronic diseases and serves as gatekeeper to specialty services.

4 DTE best practices

Although DTE contracting is still in its early stages, best practices are emerging. In addition to the standard success factors for all risk-based contracts, providers negotiating DTE agreements should do the following:

- Design steerage into the agreement. Benefit design should include incentives that steer employees toward the ACO or other preferred-provider networks.

- Build in adequate exclusion criteria. Employer-based populations can introduce adverse selection into the risk pool. DTE contracts should specify comorbidities that disqualify an employee from the CoE agreement. Stop-loss provisions should be included to guard against high-cost events.

- Commit to data sharing. The contract should spell out the claims data that the employer must report to the provider, and the provider organization should commit to sharing an annual report on quality and outcomes.

- Use alternative payment administration. DTE payments ideally should be administered outside of standard insurance networks, using a third-party administrator (TPA) or another outside vendor.

Footnote

a. Catalyst for Payment Reform, “Mythbuster: Direct contracting will never become a real trend,” Jan. 14, 2020.