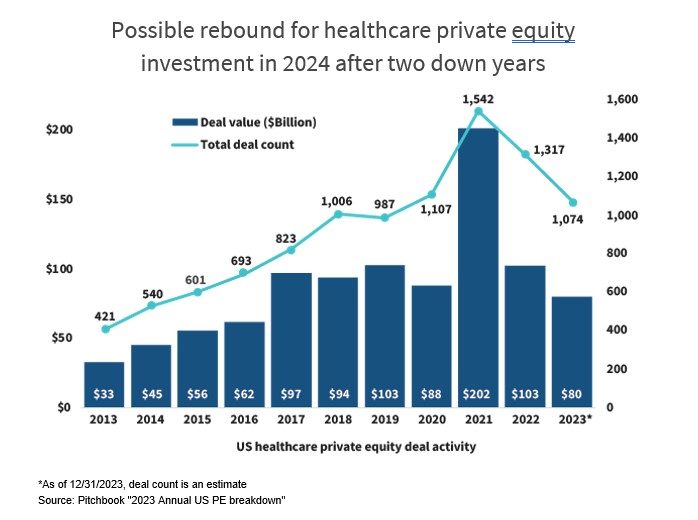

Private equity investing showing signs of rebound

Physician groups remain a popular target of PE buyers.

The Federal Reserve’s plan to begin reducing interest rates in 2024 will likely unleash private equity’s pent-up demand for physician practices and other healthcare services companies.

“Everybody wants to transact,” said Bret Schiller, managing director and head of healthcare in corporate client banking at J.P. Morgan. “I think that, at the first rate cut we see (this) year and as we see inflation continue to stay near (the Fed’s) target, we’re going to start seeing lots of activity.”

In December, the Fed announced that after a series of hikes bringing the overnight federal funds rate to a 22-year high in the 5.25% to 5.5% range, it would continue to hold rates steady for the time-being. But it projects three quarter-point cuts, bringing the rate to 4.6% by the end of 2024 and continued cuts in the following year.

Nonetheless, Fed Chair Jerome Powell, in a press conference after the announcement, said that additional rate hikes are still possible, so investors may wait for interest rates to become more predictable.

Brett Schiller, J.P. Morgan

“The people I’m talking to say that high interest rates are not the problem, it’s the uncertainty in the market,” said Dylan Sammut, who gathers transaction information in his role as editor of healthcare at Irving Levin Associates. “Not knowing when the Fed may raise (interest rates) again and how much they will raise them makes it very hard to plan and do deals.”

When the time is right, private equity funds will enthusiastically return to their dealmaking within America’s physician practice landscape, deal-watchers say. Physician practices are transitioning from cottage businesses to corporate organizations as physician owners accept the need to be part of a bigger organization. That gives them more negotiating power with commercial insurers and possibly more management sophistication and financial wherewithal to accept risk under value-based contracts.

Private equity funds, most of which buy and run companies with the plan to sell them in a relatively small number of years, have been a significant funding source behind the physician practice consolidation trend in the last several years. The funds typically acquire all or majority interest in one practice, combine it with others to gain economies of scale and take over the administrative management or hire a company to do that, while leaving clinical management to the providers.

Lance Beder, Grant Thornton

Grant Thornton, which tracks about 200 private equity funds that have at least a few portfolio companies in healthcare, saw interest in buying growing healthcare organizations while interest rates were higher than they were in previous years.

“If a seller has a business that shows the potential to expand, that’s going to drive interest (from buyers) no matter what,” said Lance Beder, leader of Grant Thornton’s healthcare transaction services. “Even with higher interest rates, growth will still drive enough return to an investor to do a transaction.”

For example, Sentinel Capital Partners invested in MB2 Dental in 2017 when the Texas-based company had 85 affiliated practices. By 2021, when Charlesbank Capital Partners bought controlling interest in the company from Sentinel and others, the company had grown to 275 practices in 24 states.

MB2 Dental Solutions, as the company is now known, was the most prolific dealmaker in the medical-practice market in 2023, with 37 transactions in the second and third quarters alone, according to LevinPro HC. The company now includes more than 650 general and specialty dental practices in 39 states.

Because healthcare practices are so fragmented, from the broader view the consolidation trend is still in its early stages, Schiller said. The dental segments have had the most consolidation, but even there it is far from over.

“There is still incredible fragmentation,” Schiller said. “So there’s still a ton of interest there.”

Among physician practices, nearly 90,000 physicians have been hired by Optum, a division of UnitedHealth Group, while Walgreens, CVS Health and Amazon have also been buying practices. Many more physicians have sold their practices to or been hired by hospitals and health systems.

Pressure to grow

The future is not going to get easier for small independent practices which, among other things, will need to acquire and use AI tools as they become requisite to the practice of medicine, said Susan Dentzer, president and CEO of America’s Physician Groups, an organization of more than 335 physician practices focused on value-based care.

“There is going to continue to be more consolidation, more affiliations, larger parent organizations,” she said. “It’s just very difficult in this environment to be out on your own and be able to make the kinds of investments that even the present demands, let alone the future.”

Even if practice owners are eager to sell, Rick Gundling, HFMA’s senior vice president of content and professional practice guidance, expects private equity funds to be selective in their healthcare transactions in the foreseeable future.

“It’s not going to be frothy like it has been,” he said. “I think we’re going to see (many) more strategic decisions about coming into certain markets. And I think we will see a blend of divestitures as well as just fine-tuning where they want to put their dollars.”

Dentzer points to big buyers of physician practices that are sorting out their purchases. For example, VillageMD was already one of the country’s largest chains of physician practices before it acquired Summit Health-CityMD, which had more than 370 locations in five states, in January 2023. And it bought Starling Physicians, with more than 30 locations in Connecticut, in March 2023. But in the fall VillageMD’s majority owner, Walgreen’s, announced plans to close 60 VillageMD clinics and exit five markets as part of a cost-cutting move.

“There’s a period of digestion going on now where these buyers are evaluating what they bought,” Dentzer said. “A lot of entities are trying to decide whether they absorbed the right amount of activity and what they should do now.”

Regulatory rumblings

In some situations, regulatory scrutiny may tamp down healthcare deals this year.

“The Biden Administration has looked at these mergers and acquisitions much more skeptically than in the past, especially as they have gotten bigger,” Gundling said.

In 2020, the Federal Trade Commission expressed concern about “roll-ups,” the private-equity strategy of buying one physician practice in a given specialty and merging many other same-specialty practices into it. In September 2023, the Commission sued U.S. Anesthesia Partners, a major provider of anesthesia services in Texas, and private equity firm Welsh, Carson, Anderson & Stowe, accusing them of an anticompetitive scheme to consolidate the state’s largest anesthesiology practices and, as a result of reduced competition, increase their prices.

“The FTC will continue to scrutinize and challenge serial acquisitions, roll-ups, and other stealth consolidation schemes that unlawfully undermine fair competition and harm the American public,” FTC Chair Lina M. Khan said in a press release at the time the lawsuit was filed.

A LOOK BACK AT 2023

Healthcare deal–making in 2023 was either big or small, depending on one’s perspective, according to Dylan Sammut, editor of hHealthc Care at Irving Levin Associates, which has been tracking merger and acquisitions data for decades.

“It was a tough year — slower than 2022,” he said. “But if you look at activity from 2017 and 2018, the number of transactions in 2023 still dwarves them. So historically it’s a very high level of activity.”

Irving Levin Associates recorded 2,395 mergers and acquisitions in the healthcare sector in 2022, an 8% increase over the previous record-breaking level in 2021. The sector includes a wide range of assets — physician medical groups, biotechnology companies, home health and hospice, behavioral health care, ambulatory surgery centers, fertility storage solutions, health insurance support services, medical transportation services, medical office buildings and others.

2023 saw an overall slowdown in most healthcare sectors. Looking specifically at physician medical groups, the LevinPro HC database listed 411 transactions in the first three quarters of 2023, a 9% decrease from the previous year.

Despite that, Schiller does not foresee anti-competition regulation to be a barrier to the overall consolidation trend.

“We haven’t seen either of the parties in the election year coming up targeting this as something they are interested in,” he said. He added that the fragmentation is so great that those PE-backed platforms represent a tiny fraction of the total market.

Grant Thornton performs due diligence investigations for healthcare transactions, and Beder said most private equity investors are currently not interested in businesses that do not demonstrate growth potential.

“That’s what we’ve seen,” he said. “In certain deals that don’t show a growth pattern, the parties are maybe going to just put down the pen for now and wait to see if they can show growth in the future.”

Likewise, private equity investors are currently unwilling to buy practices simply because they want healthcare assets.

“The enterprises that are attractive have a high command of the financial performance,” Beder said. “They have a strong understanding of the revenue reimbursement cycle, the payer mix and the importance of being in command of the operations.”

Schiller advised physician owners who want to sell to have financial records that can easily be audited by prospective buyers.

“That’s a major impediment for some of these groups,” he said. “It’s not necessarily the interest from the private equity firm — it’s getting the group up to speed so that they can transact. And the first part of that is getting their financial house in order.”