Summary: 10 vital responses to healthcare disruption

Traditional providers such as hospitals can take steps to thrive in a rapidly evolving consumer-focused landscape.

Note: This article is a summary of a report on HFMA’s Spring Thought Leadership Retreat. The full report is available to download.

Disruption is reverberating throughout the healthcare industry, and it’s incumbent on legacy organizations to develop strategic responses for the benefit of their consumers, their communities and themselves.

With that overarching challenge becoming ever more pressing, HFMA’s 2023 Spring Thought Leadership Retreat brought together leaders from across the industry May 4-5 in Atlanta to consider approaches that can help hospitals and health systems fortify their positions.

Disruption is “a topic that’s both timely and critical to the future of healthcare,” past HFMA President and CEO Joseph J. Fifer said as he kicked off the gathering. (Fifer retired June 6.)

The pressures stem both from industrywide forces such as the labor crunch and from the ingenuity and dexterity of disruptive companies. Perhaps most notably, such companies tend to be more intentional than traditional providers about creating optimal experiences for consumers.

The concept of culture affects an organization’s ability to make the necessary adjustments, Fifer said.

“If the attitude that we take back to our organizations is that we really do care about keeping people healthy, we really do care about the consumer experience, we really do care about that electronic front door and making it as simple, as easy and accessible as using our phones, it will start to change the perception,” Fifer added.

Sponsored by Guidehouse, Strata Decision Technology and Vizient, and conducted in partnership with the American Hospital Association (AHA) and American Telemedicine Association (ATA), the retreat highlighted ways that hospitals and health systems can respond to the challenges and opportunities they face in trying to navigate an industry being swept by change.

1. Recognize the changing landscape

Insights shared during the retreat underscored the substantial risk many hospitals and health systems face in the current environment.

S&P Global Ratings has issued a negative outlook for the acute care sector because of several factors, said Anne Cosgrove, director with the company’s U.S. Public Finance Healthcare Group. These factors include continued cash flow compression, waning unrestricted reserves and a negative bias in ratings and outlooks for individual organizations.

Financial results for 2022 came in “with very large losses,” Cosgrove said. “And these losses run the gamut from small credits to large healthcare systems.”

To some, the threat seems existential. “We’re watching hospitals close [industrywide],” said Carol Friesen, CEO of Peoria, Illinois-based OSF HealthCare’s Eastern Region. “If we don’t [adapt], it’s the mission we’re committed to that is in jeopardy.”

2. Address wasteful costs

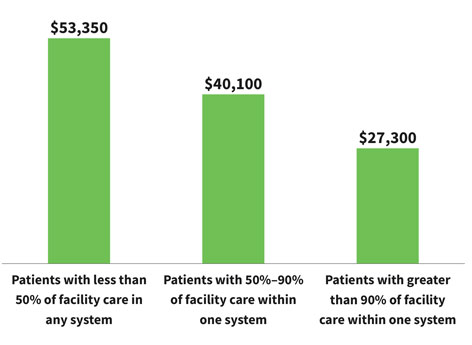

One of the most basic forms of healthcare disruption is the ability of new entrants to offer high-value services at lower costs. As they seek to match those competencies, including by addressing the fragmentation of care (see the exhibit below), providers should start by properly framing the issue.

“Purchasers want providers to reduce the total cost of care while maintaining or improving quality,” Fifer said. “And that doesn’t line up very well with this fragmented system that we have. Disruptors, especially [those] that don’t have the stand-ready obligations and the extensive infrastructure that hospitals do, can operate at a lower cost structure and thus potentially deliver more cost-effective care for the sliver that they’re addressing.”

In response, providers should tackle costs in a deliberate and thorough manner.

“We’ve started to see more organizations being really rigorous and thoughtful about their fixed and overhead expenses, their administrative areas,” said Alina Henderson, vice president for solutions and marketing with Strata Decision Technology.

Average total cost of care for chronically ill cohort varies based on degree of fragmentation

3. Improve the cost effectiveness of health

Matching the value proposition of disruptors means innovations should be geared toward keeping patients out of the hospital, even if that approach affects the finances of traditional hospital operations.

“It’s not only the cost effectiveness of healthcare that’s important. It’s also the cost effectiveness of health,” Fifer said, referring to the strategic focus HFMA is championing for the industry.

“As a society, we spend the vast majority of healthcare-related dollars on healthcare, not on the social determinants of health and the behavioral factors that largely determine an individual’s health status,” he added. “The resource allocation is not sustainable in this way at a societal level.”

Hospitals recognize the shift in incentives, said Lindsey Dunn Burgstahler, vice president for programming and intelligence with the AHA’s Center for Health Innovation. “The profit in healthcare is going to go [toward] keeping people healthy or, if they have chronic conditions, keeping those managed,” she said. “We’re really not set up for that. We are working toward being set up for that.”

4. Update contracting strategies

A disruptive environment necessitates a new emphasis on achieving optimal terms with payers.

For a growing number of payers in the commercial space, “Their focus is entirely on value-based care,” said Tawnya Bosko, PhD, DHA, senior principal for value transformation with Vizient. “No more fee-for-service rate increases unless you can show the quality and outcomes, and hopefully that you’re not the highest-cost-of-care provider in the market when health systems frequently don’t even know if they’re a higher- or lower-cost care provider in their market.”

Given the challenges, Ascension has made a point of shoring up its contracting approaches, said Michael McMillan, senior vice president for payer contracting and payer relations.

“If you are a health plan, you know when you’re across from HCA because they have a way of behaving that lets [payers] know what they want and what they need,” he said. “I don’t know if that’s true on the not-for-profit [hospital] side.”

5. Seek value-based payment opportunities

Bringing the right mindset to value-based payment initiatives is important because the finances don’t always line up at first glance.

“Most health systems are going to say, ‘How are we going to offset the changes in utilization — because that financial impact is more than any shared savings I’m going to get,’” Bosko said. “You have to think about it as growth in managing populations, growth in lives.”

In terms of opportunities for shared savings, risk-based contracts with commercial insurers are less advantageous compared with such contracts in Medicare.

“The [commercial] payer’s definition of value-based care is site-of-service utilization with steerage,” said Vivek Gursahaney, director with Guidehouse. “It’s aggressive utilization management and denials, and it’s basically low unit-rate increases.”

Fifer said hospitals and health systems are arriving at “a fork in the road” regarding the approach to risk.

“Either do a deep dive and have a significant amount of your revenue that’s at risk … or go the other direction,” he said. “And that is to pull back and be an incredibly efficient provider of care within that insurance process.”

Sidebar: Medicare Advantage is a leading vehicle for disruption

6. Accelerate consumerism strategies

“Loyalty to healthcare brands is fragmenting,” Vizient’s Bosko and Jon Barlow, vice president for consumer innovation, said in a presentation. In response, “health systems must move beyond traditional marketing and brand building to deep market analyses and retail-inspired relationship building.”

“There’s a time and a purpose for brand marketing,” Barlow said. “But the days of putting up your quality scores or your U.S. News and World Report [ranking] on a billboard saying ‘We have the greatest services’ are over because that’s not enough anymore.”

The stakes are substantial, noted Richard Bajner, partner and payer/provider leader with Guidehouse, given that the difference between patient retention rates of 65% and 85% can equate to “tens of millions of dollars.”

In efforts to become more consumer-centric, organizations can start with the basics — including the patient financial experience. “There is a ton of friction around understanding what something might cost you, the bill when you receive it, and then payment of that,” said Burgstahler of the AHA.

7. Evaluate your care delivery model

The pandemic highlighted the “considerable vulnerabilities” of a healthcare delivery system anchored by acute care hubs, Barlow and Bosko said in their presentation. The system is evolving into new vertical integrations that are “purpose-built” to reverse patient flow across the system, reducing acute care utilization and spend.

In a market such as Las Vegas, Guidehouse’s Bajner said, only 1% of commercial outpatient surgery volume takes place in hospital outpatient departments (HOPDs). The rest has migrated to physician offices on the back of disruptor models such as UnitedHealthcare/Optum.

Ascension’s McMillan added, “This is such an underrealized part of strategy. It goes back to, ‘We will never give up our HOPD.’”

With such an approach, he added, you very well could “miss the market.”

Atlanta-based Emory Healthcare is considering ways to right-size its services, said Bryce Gartland, MD, hospital group president and co-chief of clinical operations: “Do you really need to be doing everything at all locations?”

Such conversations “traditionally have been a third rail in healthcare,” he said.

8. Incorporate digital care

A key part of an updated care model is a digital care platform that can make high-quality healthcare more seamless and convenient. As with other aspects of the response to disruption, traditional providers must shift their thinking.

Ann Mond Johnson, CEO of the ATA, referred to the healthcare industry’s “edifice complex.” In other words, “We’re very tied to our bricks and mortar.”

Organizations should take a different mindset when implementing digital care, Johnson added: “I’m doing this not because of the reimbursement. I’m doing this because we have fundamental problems in the healthcare system that we cannot address unless we deploy technology differently than we have in the past.”

Based on population needs, for example, Salt Lake City-based Intermountain Healthcare would need to hire 15 neurologists, said Adam Hornung, executive director of operations. But, he said, “if I try to post and hire for 15 neurologists, it’s just not going to happen.”

Intermountain found a way to ease the demand for such positions. In a pilot program using e-consults in the primary care setting and patient visits with advanced practice providers via video, only nine of 200 patients ended up having to see a neurologist.

9. Maximize your reach

Incorporation of digital health is, in part, a manifestation of the effort to improve patient acquisition and retention.

As part of its strategic focus coming out of the pandemic, Emory Healthcare is “focusing very heavily on access,” Gartland said. “How do we make sure that we’re able to never say no?”

“All of us get trapped into a usual way of doing business on stuff,” he added. “Think about: How would Chick-fil-A come in and work on clinic throughput? They’re phenomenal at how they get drive-throughs going. We [in healthcare] stink at patient throughput.”

Traditional providers can enhance access through partnerships with disruptors. For example, UCI Health in Irvine, California, seeks to partner with companies that specialize in telehealth or home-based care.

“We don’t have the strength in our balance sheet to do everything alone,” said Tatyana Popkova, UCI Health’s chief strategy officer.

10. Be agile (and calm)

As daunting as the task of responding to disruption may seem, hospitals and health systems can be methodical at first.

“The organizations that we see driving sustainable and successful change start small and humble initially but quickly pivot into a very aggressive change rollout within their organization,” said Frank Stevens, chief growth officer with Strata.

The pandemic and ensuing struggles have brought a sense of urgency that hospitals and health systems should channel during such processes.

“Change management has never been easier than what it is now — because there is an overwhelming need to change,” OSF HealthCare’s Friesen said.

A final note from experts: Don’t panic. Many disruptors are proving not to have all the answers just yet, at least when it comes to achieving financial returns. And few if any seem eager to take on acute care.

“Don’t be scared of this disruption,” Vizient’s Barlow said.

“Utilize some of the tactics they’re doing, some of the approaches, the acquisitions that they’re making, and learn from it and try and adapt it to your situation in your organization.”

Medicare Advantage: A leading vehicle for disruption

As the program technically known as Medicare Part C steadily overtakes the traditional Medicare program in beneficiary volume, healthcare providers should take stock of the consequences.

In January, Medicare Advantage (MA) edged past the 50% mark in its share of total Medicare enrollment, with 30.19 million out of 59.82 million beneficiaries. That’s up from 29% a decade ago.

MA is a platform for big payviders to control the longitudinal journeys of frequent utilizers of healthcare, said Vizient’s Jon Barlow, vice president for consumer innovation, and Tawnya Bosko, PhD, DHA, senior principal for value transformation.

“In general, it’s going to reimburse on a fee-for-service basis, and then you’re going to [adjust for] administrative burden, and the net impact is less than Medicare fee-for-service reimbursement,” Bosko said.

In other words, “You’re losing every time a patient switches from fee-for-service to MA,” said Richard Bajner, partner and payer/provider leader with Guidehouse.

He added, “Your unit reimbursement is probably 7%, 8%, 10% less on Medicare Advantage because of denials, bad debt, etc.” Such issues highlight why providers would do well to set their MA unit prices above 100% of Medicare fee-for-service rates heading into negotiations, Bajner noted.