HFMA’s Outlook quarterly reports monitor important healthcare finance trends and identify new topics for discovery.

This report shares results gathered in October 2022. For some questions, respondents were asked to provide their projections for the upcoming three months that comprise the fourth quarter of 2022. Approximately 1,140 HFMA members submitted responses.

HFMA will continue to plot the quarterly movement of specific metrics and highlight changes in the healthcare finance environment and how those changes may affect healthcare finance professionals in the future.

Patient encounters, net patient revenue and equipment/IT investments increase

Increases across various data points signal recovery for hospitals and health systems

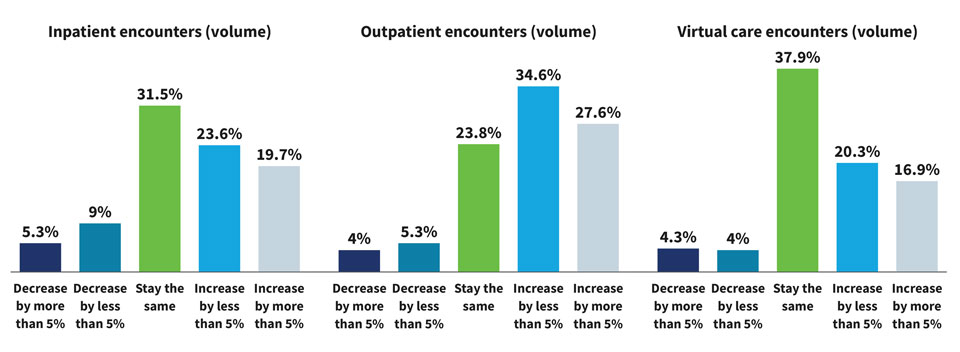

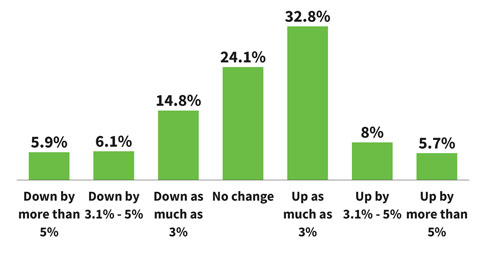

Across patient encounters – inpatient, outpatient and virtual care – between 37% and 62% of respondents said that encounters would increase. In relationship to more patient encounters, almost half of respondents said net patient revenue would increase over the next three months.

Providers project a higher number of care encounters

Net patient revenues follow increase in patient encounters

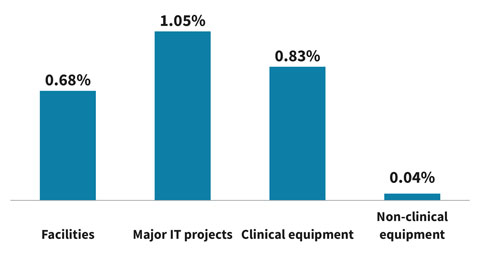

Hospital investments increase

With increases in revenue, hospitals and health systems are projecting more spending in facilities and IT investments. Spending on equipment is expected to grow with clinical equipment showing the highest gain at 0.83% and non-clinical equipment at a lower rate, 0.04%.

Hospital capital investments increase

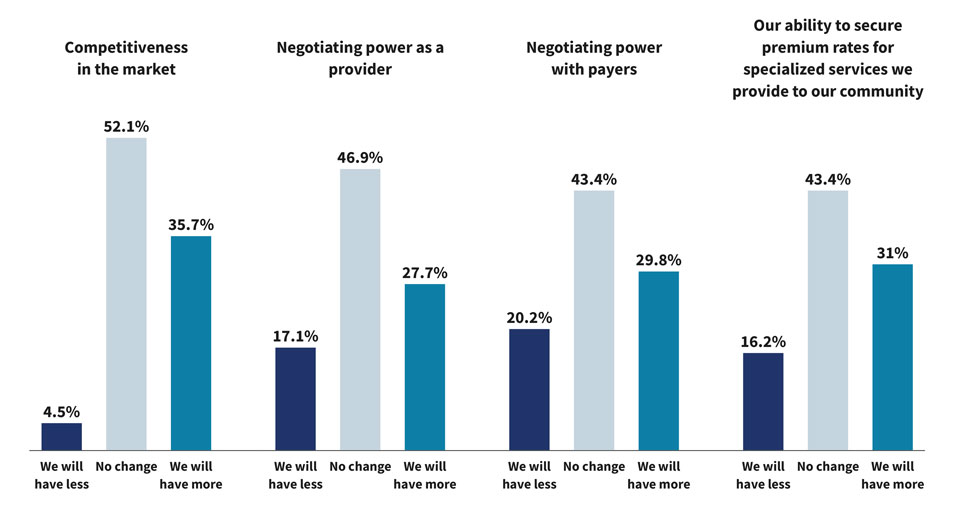

Transparency requirements offer healthcare providers improved market competitiveness and negotiating power with payers

Survey respondents revealed that the new transparency requirements will have some benefits. Almost 30% said that their negotiating power with payers would increase as result of transparency. A similar percentage of hospital and health system respondents said they would have more ability to secure premium rates for specialized services provided to their communities as a result of the higher attention to transparency.

Overall, one-third of respondents said their market competitiveness would increase as a result of price transparency efforts.

Providers anticipate benefits of transparency rules

Payment models, risk management and staffing top list of future concerns

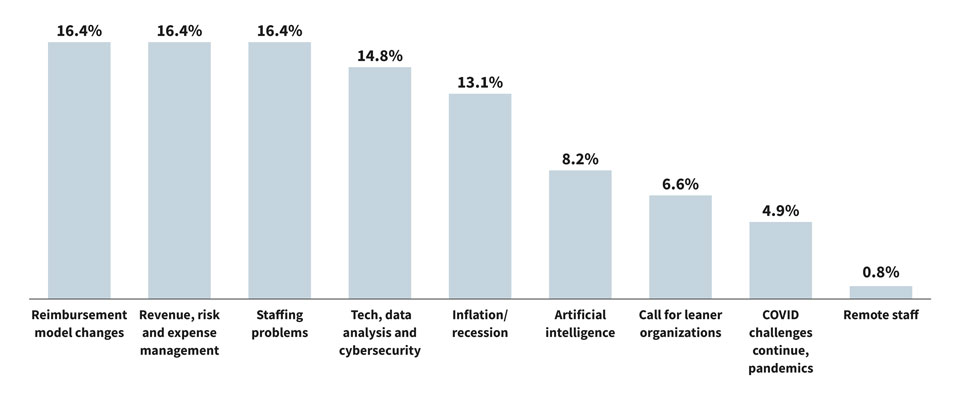

When asked what healthcare finance needs to be prepared for in the future, respondents chose three areas with the same frequency at 16% — changes in payment models; revenue, risk and expense management; and staffing. Technology areas such as data analysis and cybersecurity followed the top three concerns closely with 14% indicating this choice.

Healthcare providers reveal top topics outlook

Other survey findings:

- There is a consistent decline in popularity of contracted clinical staffing. The reduction in using contracted clinical staffing has occurred over the past year, with the second and third quarters of 2022 showing the steepest declines.

- Technology continues to dominate the future of healthcare. Areas to watch include technology innovations such as artificial intelligence and machine learning; telehealth and related remote patient monitoring and real-time authorizations.

- The top two ways that survey respondents are changing the capital planning process are rethinking prioritization processes and increasing analysis of return on investment.