HFMA’s Outlook quarterly reports monitor important healthcare finance trends and identify new topics for discovery.

This report shares results gathered in November and December 2021. For some questions, respondents were asked to provide their projections for the upcoming three months, comprising the first quarter of 2022. Approximately 1,530 HFMA members submitted responses.

HFMA will continue to plot the quarterly movement of specific metrics and highlight changes in the healthcare finance environment and how those changes may affect healthcare finance professionals in the future.

Operations and alternative services impact cost effectiveness

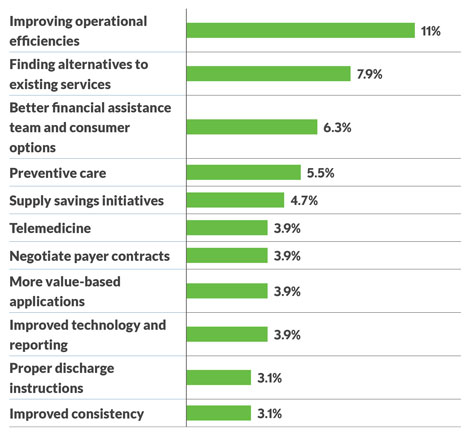

Almost 70% of respondents to the HFMA Outlook survey said their organizations are addressing cost effectiveness of health efforts that result in affordability to consumers and purchasers. When asked what efforts are yielding the best results, the top choice was improving operational efficiencies, while alternatives to existing services was the second most popular choice. Improved patient financial services and assistance was a close third option that impacted healthcare affordability.

What efforts are you finding improve cost effectiveness of health and its ability to increase affordability to consumers and purchasers?

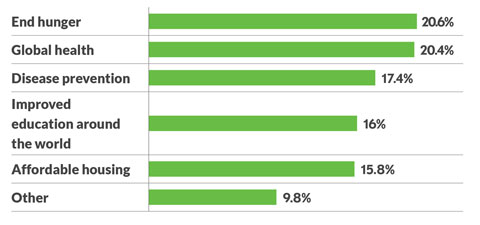

Considering the idea of cost effectiveness of health as a global just cause, survey respondents were asked to identify what social good they would choose as a solution if cost were not an option. Addressing hunger and access to achieving overall health were the top two choices with almost equal percentages (20 %) choosing them. All told, hunger and health accounted for 40% of the responses. Disease prevention and improved education were chosen by 17% and 16%, respectively.

If you had all the money in the world, in terms of social good, what would you invest in?

Strategy and cost are biggest technology decision challenges

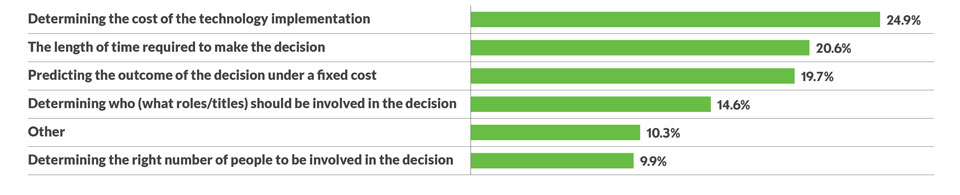

This latest HFMA Outlook survey addressed a new topic — the challenges of making technology decisions. Determing the cost of the technology implementation was reported as the most difficult task when making technology decisions. Length of time to make the decision was a close second, while predicting outcomes using a a fixed cost was the third most challenging area for HFMA member respondents.

What is the most difficult task in making technology decisions?

Understanding the strategic direction of the technology project decision was chosen as the top problematic oversight action. A lack of defined criteria for evaluating new projects was a close second choice along with lack of specificity in plans that do not clearly identify accountabilities.

Which oversight actions are the most problematic for your technology project decision-making?

Net patient revenue, price transparency and other highlights

- Net patient revenue. Projections for early 2022 rose to 0.51% from 0.28% in the previous quarter.

- Days in accounts receivable (A/R). Projections for average days in A/R for early 2022 stayed consistent with percentages for the previous quarter. Sixteen percent of survey respondents said A/R days would be down as much as 3% in the first few months of this year, while 43% said there would be no change. Thirty percent said average days in A/R would increase by 3% in early 2022.

- Equipment investments. Throughout the pandemic, investments in clinical equipment have outpaced non-clinical equipment spending. Survey respondents project a 0.88% increase in medical equipment spending for the first few months of 2022, while non-clinical equipment was expected to rise by 0.32% during the same period.

- Price transparency. Approximately six out of 10 survey respondents reported that their price transparency efforts were acceptable or good. That number was consistent across the quarterly Outlook surveys performed over the past year.

- Future trends. Changes to reimbursement models and reduced reimbursement because of lack of benefits, affordability of services or denials rose in the future trend rankings among respondents from 33% in Spring of 2021 to 61% of members responding to the final survey of 2021. Innovations that increase efficiency dropped significantly as a future trend to 6% in the final quarter of 2021 from 24% in Spring of 2021.