Medicaid eligibility: Strategies to provide care access and maximize reimbursement

Hospitals and healthcare systems are constantly seeking ways to help patients access care through Medicaid while maximizing their own reimbursement.

Efforts focus on eligibility, patient advocacy and finding alternative reimbursement sources to increase recovery, with many seeking help from a revenue cycle partner.

To get a finger on the pulse of the situation, the Healthcare Financial Management Association (HFMA) conducted a survey at its 2021 Annual Conference. The following research report, sponsored by Parallon, explores the challenges and effective solutions.

Rating the Medicaid eligibility process, respondents — representing mostly health systems and medical groups — find it “good,” with others — mostly hospitals — finding it “acceptable.” Some 15% find it “very good,” while a small number find it “poor” or “very poor.”

“The Public Health Emergency, allowing states to suspend redetermination, which allows recipients to maintain Medicaid coverage, has affected the current process favorably,” said Tom Yoesle, chief experience officer with Parallon’s Customer Service Operations division.

“The number of states that have expanded [Medicaid coverage] are finding the simplified application process online for those recipients that are not disabled less time consuming,” he said. “While there are benefits in the current state of Medicaid processing,” delays in processing are occurring in the understaffed counties where Medicaid workers are not based in facilities.

A successful program incorporates a comprehensive eligibility screening technology platform with patient advocates who are effective communicators, well-versed in state and federal programs and have the acumen to collaborate with case management and social work departments.

“Preferably, a hospital will leverage facility-based patient advocates who can accept applications and process supporting documentation [efficiently],” Yoesle said. “Utilizing comprehensive eligibility screening technology tools that can track and monitor productivity metrics can demonstrate a dramatic return on investment.

“Additionally, creating an excellent training program and policies and investing in management with a clearly defined operational strategy will support success in hospital and physician-based settings.”

The Medicaid coverage gap crisis encompasses several driving factors. According to Bankrate, fewer than four in 10 people can afford a $1,000 emergency bill. Some 14.6 million Americans lost employer-sponsored healthcare coverage as a result of the COVID-19 pandemic, according to the Commonwealth Fund. Some people have been pushed into the coverage gap as their income is too high for Medicaid, but they are unable to afford ACA Marketplace plans.

Yoesle points out that the Affordable Care Act was originally designed for all states to expand their Medicaid programs, covering childless adults up to 138% of the Federal Poverty Level (FPL). The coverage gap was the consequence of the 2012 U.S. Supreme Court ruling making program expansion a state-by-state decision.

The health insurance marketplace will only provide subsidies for applicants from 100% to 400% of the FPL, leaving individuals living at or under the FPL unable to receive any type of help or Medicaid in non-expansion states, said Yoesle.

Over the years, some states have chosen to expand their Medicaid programs, which provides coverage to those in the gap. Three out of four people in the coverage gap live in just four states — Texas, Florida, Georgia and North Carolina — which remain non-expanded.

In 2013, the uninsured rate was 14% and is estimated to have been 9.8% in 2021 and 9.5% in 2022, according to the Department of Health & Human Services Centers for Medicare & Medicaid Services.

“This decline can be traced to the decreasing unemployment rate as people regain their employer-sponsored insurance,” Yoesle said. “Additionally, 13.8 million Americans will have health insurance coverage through the health insurance exchange and the increasing Medicaid expansion programs across the states.”

While the trends are positive, two million of the poorest citizens have very limited coverage options, according to Yoesle, citing Kaiser Family Foundation data.

“A law framed to eliminate the coverage gap would drastically help the national uninsured rates,” he said.

Among the Medicaid eligibility and patient advocacy challenges: patient cooperation, retroactive and reinstated coverage, out-of-state Medicaid, Medicaid paying very little, handling volume, constant changes and uncovered services.

While some may be individual challenges, Yoesle noted there are several common to most situations:

- Gaining the trust and cooperation of patients and their families necessary to determine eligibility.

- Having access to a technology, enabling patient advocates and patients to track their application status through the enrollment process.

- Aligning patient advocacy technology to process patient application data in ways that are acceptable and effective for the states’ respective eligibility process, such as requirements for an original signature rather than an electronic signature.

- Staying current on federal and state legislative changes impacting states’ Medicaid eligibility.

- Having a clear understanding and insight into the Social Security Disability eligibility process — particularly in non-expansion states — as a vital pathway to accessing coverage for some patients.

“Having compassion for our patients is crucial,” Yoesle said. “They are often in the midst of a clinical and financial or social crisis and look to the staff of a hospital or service provider for expertise and sometimes emotional support.

“The ability to convey program application process steps, requirements and expectations in an empathetic manner is required in every case.”

Meanwhile, healthcare faces a revenue crisis.

In terms of the number of acute beds associated with hospitals and healthcare systems, 27% of survey respondents have one to 99, 19.18% have more than 1,500. The others range from 100 to 1,500 acute beds.

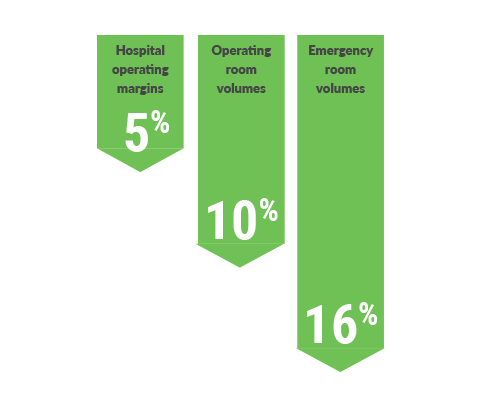

Respondents say hospital operating margins are down 5%, operating room volumes are down 10% and emergency room volumes are down 16%. Their average net patient service revenue range is $1.6 billion for health systems, more than $265 million for hospitals and medical centers, and nearly $397 million for medical groups and specialty practices.

“Providers must leave no stone unturned when assisting uninsured and underinsured patients in finding state or federal program coverage,” Yoesle said. “There is always a financial ROI when moving a patient from uninsured to an insured program source. The benefit to the patient and their family can be life changing.

“An investment in a dedicated program with specialized staff, constant education support and technology, which enables program determination, will be key. Absent an ‘in-house’ program with these attributes, providers must find a service partner with the scale, expertise and values to match their needs. A true partner will deliver compassionate patient assistance and also be an advocate for a provider’s financial success.”

Most healthcare entities are engaged in attempting to find alternate sources of reimbursement to increase recovery.

Some seek state-specific programs while others pursue Social Security Disability Insurance and COBRA coverage. Some 14% do not pursue any alternate sources for reimbursement. Commercial insurance opportunities expand as more patients qualify for the ACA marketplace due to loss of income, particularly in Medicaid expansion states.

Common Medicaid eligibility and patient advocacy challenges

- Patient cooperation

- Retroactive and reinstated coverage

- Out-of-state Medicaid

- Medicaid paying very little

- Handling volume

- Constant changes

- Uncovered services

Key points to consider

According to Yoesle, the following are key points healthcare organizations should consider when assisting patients with coverage options.

- A successful Medicaid eligibility program is constructed on a foundation of people, process and partnership.

- Good scripting ensures representatives follow the right process to uncover revenue while understanding the conversations are dynamic in response to regulatory and legislative changes. Expertise, empathy and tenacity are key.

- With COBRA, it is important to understand when each self-pay patient last had health insurance. If eligible, COBRA can cover the person’s date of service.

- Although assisting patients in the process of obtaining continuing healthcare coverage is often time-consuming and complex, the provider’s ROI can be substantial.

- If parents do not follow all steps defined by their commercial insurance to add a newborn, a high-dollar NICU bill could be denied. Steps for coverage vary by commercial insurance company.

- Having a comprehensive library of process details is critical to an efficient and effective program.

- On health exchange plans, in non-expansion states, there will be no subsidies for anyone trying to obtain health insurance if they are under 100% of the FPL.

- A person can only sign up for a health exchange plan through annual open enrollment or if they qualify for a Qualifying Life Event.

- Health exchange plans cover future dates of service and are not retroactive to cover the current date of service. Typically, if a person chooses a plan from the 1st-15th of the month, the coverage will begin the following month.

Social Security Disability

Assisting patients with coverage for Social Security Disability is often overlooked by many providers and eligibility advocacy companies.

“The importance of understanding how to apply for Social Security Disability or SSI is crucial, especially in non-expansion states where you can only obtain Medicaid if you are pregnant, a minor, parent caretaker of a minor or disabled,” Yoesle said.

“Many people come to the hospital not disabled but learn of a disabling or terminal diagnosis while they are at a hospital facility, which will qualify them for coverage,” he added.

That entails diligent case management communication and understanding medical records to identify if a person may be disabled.

“If we can assist with the disability process, a patient’s case could be converted to Medicaid and cover past dates of service,” Yoesle said.

In uncovering options, patient advocacy is key. Displaying empathy, building quick connections and establishing trust is necessary to eligibility discussions. Utilizing process, technology and support teams optimizes opportunities to qualify patients for financial relief and ensures maximized reimbursement revenue for a hospital.

The overall goal is to give the patient financial well-being so they can take care of their emotional, mental and physical well-being.

With COBRA opportunities on the rise and the CARES Act and American Rescue Plan having created relief for employees and employers, patients who are unaware they qualify for disability represent a missed opportunity for themselves and the provider.

Critical to meeting that challenge is navigating programs at the local, state and federal level, employing expertise, empathy, tenacity and knowledge of the dynamic regulatory and legislative changes through constant communication with the patient advocacy team.

Supplemental training and education on these changes should be facilitated as soon as the changes are understood.

“Patient advocates must understand our patients may be experiencing a clinical crisis,” Yoesle said. “We must balance compassion, patience and understanding with the technical ability to help convert their account from uninsured to a payer source.”

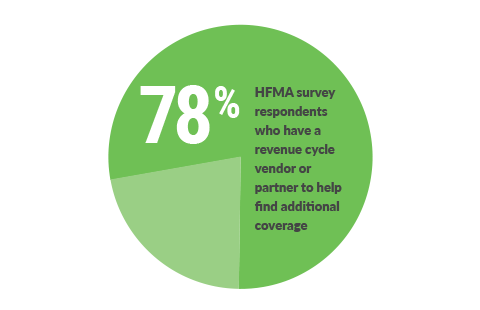

Of those healthcare entities that attempt to find alternative sources —including health systems, hospitals or medical centers, and medical groups — 78% of respondents have a revenue cycle vendor or partner to help find additional coverage.

Knowing the functional requirements and processes of COBRA, SSDI/SSI, Medicaid and health exchanges takes an intense amount of time and training, said Yoesle. Successful provider-based teams and service provider vendors are intensely focused on and invested in educating and retaining staff.

Eligibility advocates need to understand regulatory changes on the local, state and federal level and how to apply them in a given situation, which also leads to compliance and Quality Assurance.

Case in point: For COBRA premiums paid for by employers under the American Rescue Plan Act and under the CARES Act, the time to elect COBRA expanded from 60 days to one year for employers.

There are several key factors in identifying a patient advocacy vendor partner who aligns with a healthcare entity’s values. The service partner should create a flexible program tailored to a hospital or practice group’s needs. The ability to meet patients where they are — either with high-tech solutions or a high-touch approach — is key.

A service partner also should understand the national landscape on changes which allow them to share and leverage best practices across states.

“At Parallon, solid, historical relationships with state leaders allow us to be at the table as state program logistics are discussed,” Yoesle said. “We want to not only understand what changes are coming to our clients’ states but [are] able to advocate on our patients’ behalf to create a program which benefits both healthcare providers and the communities they serve.”

Technology that enables an expedited application and approval process benefits all parties, Yoesle noted.

“Success is attained through portals that help patients share documents and other information in a system designed to facilitate program application submissions,” he said. “Data helps front-line teams prioritize work and identify patient eligibility.”

Understanding where a hospital has gaps is the foundation for an outside partner attaining success in identifying solutions. A strong partnership is built on communication, reporting, transparency, new ideas and collaboration.

“Technology focused on and built to support the patient advocacy and Medicaid eligibility process is key to optimal outcomes,” Yoesle said.

The ability to capture detail data points throughout the application journey allows for greater insight into the process. Having a view into the multiple stages and steps of that application journey creates insight beyond just activity trending.

“Risk analysis of the entire portfolio can be accomplished to target the efforts of patient advocates,” Yoesle said. “While some patient eligibility programs can be completed and approved in less than 30 days, others can take months. Having discreet KPIs throughout that application journey helps to evaluate a program’s success.”

“In addition, we’ve learned over these past two years how important it is to have multiple patient communication and interaction methods,” Yoesle said. “Technology processes must include text notifications to patients, incorporate electronic signatures, leverage photo and screen capture for patients, as well as other methods to make it easier for patients to collaborate with patient advocates. The past days of forcing a patient to conform to a manual interview and application process are gone. We want to meet patients where they are.”

Note: Parallon’s John Young, COO, Medicaid eligibility operations, and Marie Hinds, director, Medicaid eligibility, provided insight for this article.

About Parallon

Parallon enables providers to care for and improve the health of their communities by optimizing financial performance, navigating regulatory challenges, providing operational best practices and leveraging the latest technology. We provide customized revenue cycle solutions including, eligibility and advocacy, early-out self-pay, bad debt collections, third-party liability and workers’ compensation, legacy A/R, insurance services, physician billing and A/R resolution. Parallon is the premier revenue cycle partner to more than 850 hospitals and over 3,900 medical practices nationwide.

This published piece is provided solely for informational purposes. HFMA does not endorse the published material or warrant or guarantee its accuracy. The statements and opinions by participants are those of the participants and not those of HFMA. References to commercial manufacturers, vendors, products, or services that may appear do not constitute endorsements by HFMA.