Reimbursement changes for 340B drugs reverberate in Medicare’s 2023 outpatient payment final rule

The Medicare payment rate for hospital outpatient services will increase significantly in 2023, but the net gain for the sector will be less than is apparent at first glance.

Payment rates for hospital outpatient care and ambulatory surgical centers technically will increase by 3.8% over 2022 for facilities that meet quality-reporting requirements, CMS said in a final rule with comment period published Nov. 1. That’s up from an increase of 2.7% in an earlier proposed rule. The change, which was based on updates to the prices of the inputs that make up the hospital market basket, had been expected after a similar hike to the FY23 inpatient payment rate.

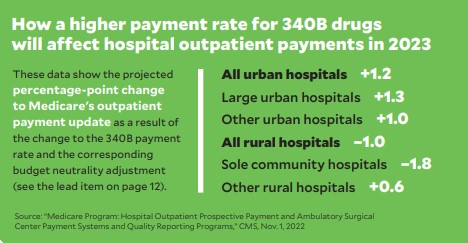

A reduction to the outpatient update is in store as a result of a new payment rate for drugs purchased through the 340B Drug Pricing Program. As required by a Supreme Court decision, CMS boosted the rate from average sales price (ASP) minus 22.5% to ASP plus 6% starting in late September.

Due to statutory requirements relating to budget neutrality, however, CMS will reduce the payment rate for all non-drug services by 3.09% in 2023. As illustrated in the chart at right, different categories of hospitals will be impacted differently by the combination of the payment increase for 340B drugs and the budget neutrality adjustment.

CMS establishes payment rates and policies for rural emergency hospitals

A newly available designation for some rural hospitals will take effect Jan. 1, with CMS having finalized previously proposed criteria and payment rates.

Critical access hospitals and rural hospitals with no more than 50 beds can choose to be categorized as rural emergency hospitals (REHs) if they meet certain criteria, including that they cease inpatient services. The goal is to ensure the availability of emergency services and observation care in areas where the closure of a struggling hospital would significantly curtail healthcare access.

REHs can opt to provide outpatient department services in addition to emergency and observation services. Payment for services will be 105% of the general outpatient payment rate. REHs can furnish outpatient services that aren’t covered under the outpatient payment system — e.g., those paid under the fee schedule for laboratory services — but any such services would not be subject to the 5% boost.

REHs also will receive a monthly facility payment that will amount to $272,866 in 2023 and then increase annually based on the hospital market basket.

Physician payment update for 2023 draws criticism and concern

CMS finalized a decrease to the Medicare physician payment rate for 2023, with physician advocates saying the adjustment could adversely affect healthcare access.

The conversion factor will be $33.06, a reduction of $1.55 (or 4.5%) from 2022. With CMS saying its hands are tied because of statutory constraints, physician advocacy groups called on Congress to reverse the cuts before the new year.

“The rate cuts would create immediate financial instability in the Medicare physician payment system and threaten patient access to Medicare-participating physicians,” Jack Resneck Jr., MD, president of the American Medical Association, said in a written statement.

He noted that the 2023 cuts could total 8.5% because, when hfm went to press, a 4% across-the-board Medicare payment decrease was scheduled to take effect Jan. 1 as a result of a pay-for clause in COVID-19 relief legislation that was passed in 2021. Stakeholders hoped Congress would postpone that cut.

Published essay examines the long-term financial challenges facing hospitals

Amid persistent financial and operational turbulence for hospitals, it appears unrealistic to expect significant improvement in upcoming months — and perhaps not even in ensuing years.

Writing in Health Affairs, health economists Andrew Sudimack and Daniel Polsky said the factors that continued to erode performance this year will be entrenched concerns.

“While it’s tempting to view these challenges as transient shocks, a rapid recovery seems unlikely for a number of reasons,” they wrote in an article published Oct. 25. “Thus, hospitals will be forced to take aggressive cost-cutting measures to stabilize balance sheets. For some, this will include department or service line closures; for others, closing altogether.”

The factors they cite include a long-term labor crunch, insufficient payment rates and continuing disruptions in patient volumes for elective procedures.

Yet the long-term challenges present an opportunity to bolster hospital operations, they added, if policymakers implement “targeted, evidence-based policies” that curb hospital costs while continuing to support vital services.

CMS continues to relax enforcement of COVID-19 vaccination requirements

CMS has updated its guidance to state survey agencies regarding assessment of healthcare provider compliance with COVID-19 vaccination requirements for staff.

The revisions seek to “ensure that deficiency citations recognize good-faith efforts” to comply, CMS stated in a memo issued Oct. 26.

It’s the agency’s latest move to ease up on the requirements, and it follows a June statement that assessments would be conducted during initial and recertification surveys only when there had been complaints alleging noncompliance. That memo also established that surveyors should communicate with their CMS liaison if they intend to cite serious violations.

The latest changes clarify that many violations can be cited at the standard level, which means noncompliance with narrow regulatory standards. A condition-level violation is a more serious designation, indicating a breach of Medicare and Medicaid conditions of participation. The category should be used for violations of the vaccine mandate only in cases of “egregious noncompliance, such as a complete disregard for the requirements,” CMS wrote. Such categorization might be called for if more than half the staff members are unvaccinated, for example.

New study explores the link between patient-room features and outcomes

The features of hospital rooms play a role in post-surgery clinical outcomes, according to a recent presentation.

Researchers examined nearly 4,000 patients who underwent 13 high-risk surgical procedures at the University of Michigan Hospital.

Among the key takeaways, which were presented in October at an American College of Surgeons conference, the researchers found that adjusted mortality rates were 20% higher if patients were admitted to a hospital room without a window.

Other features that correlated with post-surgery outcomes included distance from a nursing station, whether the room was single occupancy and whether clinicians had a direct line of sight into the room.