Why providers are struggling to succeed under value-based care

An obvious question that has often been overlooked in the rush to promote value-based care (VBC) is whether providers are equipped to navigate the transition from volume to value.

Findings of a survey of providers and payers published in September suggest that there are reasons for concern.a Many providers report that capability gaps are negatively affecting their performance in VBC programs, and many are unhappy with their contracts in these programs, which they perceive as favoring payers. Providers are also encountering more-fundamental obstacles to success, most notably including:

- Fragmentation of the healthcare financing system, which ends up blunting cost-saving incentives under VBC

- A medical culture that has trouble acknowledging the need for cost-benefit tradeoffs

Worrisome survey findings

A closer look at the specifics around capability gaps and contract concerns offers deeper insight into how and why these forces are impeding progress toward widespread success in the adoption of VBC programs.

Let’s start with capability gaps. The survey asked respondents whether capability gaps in a variety of areas have negatively affected the clinical and/or financial performance of their VBC programs. Three-quarters of provider respondents reported that gaps in data availability have produced negative effects, while two-thirds reported that gaps in analytical capabilities and IT/digital capabilities have done so. Smaller but still substantial numbers of respondents also reported having gaps in contracting expertise, risk management, financial planning, clinical care management and staff/skill sets.

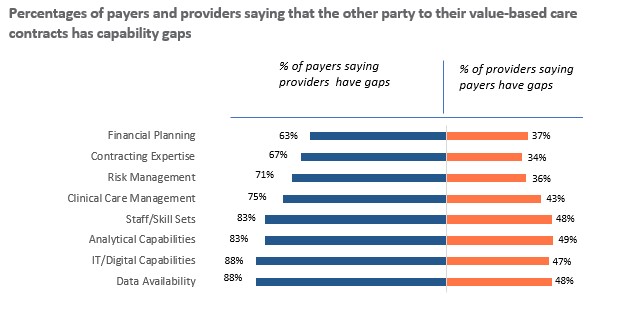

Perceptions about the organizations one does business with can sometimes be as revealing as perceptions about one’s own organization. With this in mind, the survey also asked respondents whether they believed capability gaps in the organizations with which they have VBC contracts have negatively affected the performance of those organizations. In every area, payers were much more likely to say that their provider counterparts have capability gaps than providers were to have the same concern about their payer counterparts. (See the exhibit below.) In other words, providers seem to believe payers are prepared to succeed in a VBC world, while payers doubt that providers are.

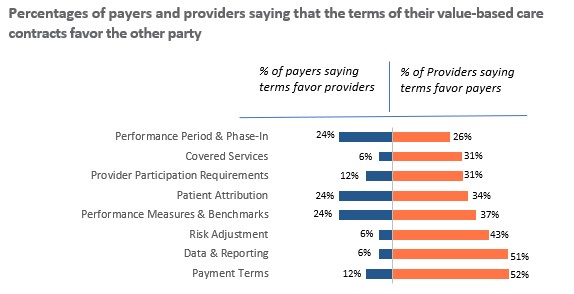

Now let’s turn to VBC contracts. The survey asked respondents whether the terms and conditions of their contracts favor their own organization or the other party to the contract, or whether they are neutral in the sense that they are fair and equally beneficial to both parties. In every contract area, from covered services to payment terms, providers were more likely than payers to believe that contracts favor the other party. In some areas, including covered services, risk adjustment, data and reporting responsibilities, and payment terms, they were far more likely to believe payers have the upper hand than vice versa, as is evident in the following exhibit.

Given the imbalance in bargaining power between most payers and most providers, it seems entirely plausible that the terms of VBC contracts would more often than not favor payers. But even if they do not, there is still a problem. The mere fact that providers perceive the terms as unfair can strongly dampen their enthusiasm for value-based care and undermine its long-term growth.

More fundamental obstacles

Leaving aside the survey findings for a moment, it is worth considering some more fundamental obstacles to providers’ success under VBC. The most significant is the fragmentation of the healthcare financing system.

Whether payers are dealing with fee-for-service (FFS) contracts or VBC contracts, their financial goal is always the same: to reduce costs. For providers, the goal depends on the type of contract. If it is a VBC contract, their financial goal is to reduce costs. But if it is an FFS contract, their financial goal is to increase revenues. Because providers are legally and ethically prohibited from treating patients differently based on their health plan, many end up defaulting to FFS practice patterns, regardless of the contract type. This dynamic will be difficult to change so long as FFS remains the dominant financing arrangement in the healthcare system.

The tendency of providers to default to FFS practice patterns is reinforced by the prevailing medical culture. Physicians are trained to do whatever they can for their patients, not to weigh cost-benefit tradeoffs. It seems clear that VBC incentives in most such contracts, such as shared savings and pay-for-performance, lack the power to reshape medical culture. Provisions that subject providers to significant downside risk, and especially full capitation, might succeed in doing so. But for now, such provisions remain the exception rather than the rule.

Then there is the matter of provider experience. The past half century in healthcare has witnessed the rise of corporate medicine, the erosion of physicians’ professional autonomy and a massive increase in administrative burdens that crowds out time spent on patient care. Not coincidentally, the past half century has also witnessed a dramatic decline in physician job satisfaction, a dramatic increase in physician burnout and a wave of early retirements.

VBC doesn’t improve any of these trends, and in fact, by further increasing provider workload, it may make them worse. To be sure, it is not the purpose of VBC to improve the provider experience. But just as providers’ perceptions about the fairness of such contracts will help to determine whether they embrace the movement or push back against it, so too will their perceptions about the VBC experience.

A troubling disconnect

All of this helps to explain a troubling disconnect between the intentions and results of VBC. When asked what persuaded them to pursue VBC contracts, three-quarters of providers in the survey reported that a belief in patient-centric care was a very important consideration and nearly four-fifths reported that improving clinical outcomes was one. Yet just one-quarter believe that their value-based care programs have been very successful at improving clinical outcomes, and just one-fifth believe that they have been very successful at improving the patient experience.

If VBC clearly were working well for patients, it might be less concerning that it is not working well for providers. But this does not appear to be the case, and on reflection, it is hard to see how it could be. Providers are the lynchpin on which the healthcare system turns. Therefore, for VBC to work well for patients, it also must work well for providers. And that will require bridging capability gaps, revisiting contract terms and conditions and finding creative ways to surmount the more fundamental obstacles to providers’ success that are embedded in how the healthcare system works.

If providers continue to struggle to succeed under VBC, it will have only a marginal impact on costs and outcomes, not the transformative one that its architects and advocates have long envisioned it will.

Footnote

a. This article presents results from a survey developed by Terry Health in 2023 and sent, with HFMA’s assistance, to member leaders of provider, payer, and hybrid pay-vider organizations. The full report, 2023 Perspectives on Value-Based Care, was published in September 2023.