Survey reveals 5 opportunities to tackle denial prevention and management

Organizations that devote greater resources to denial prevention see lower first-pass denial rates, a recent survey shows, but most steer more staff toward back-end denial management.

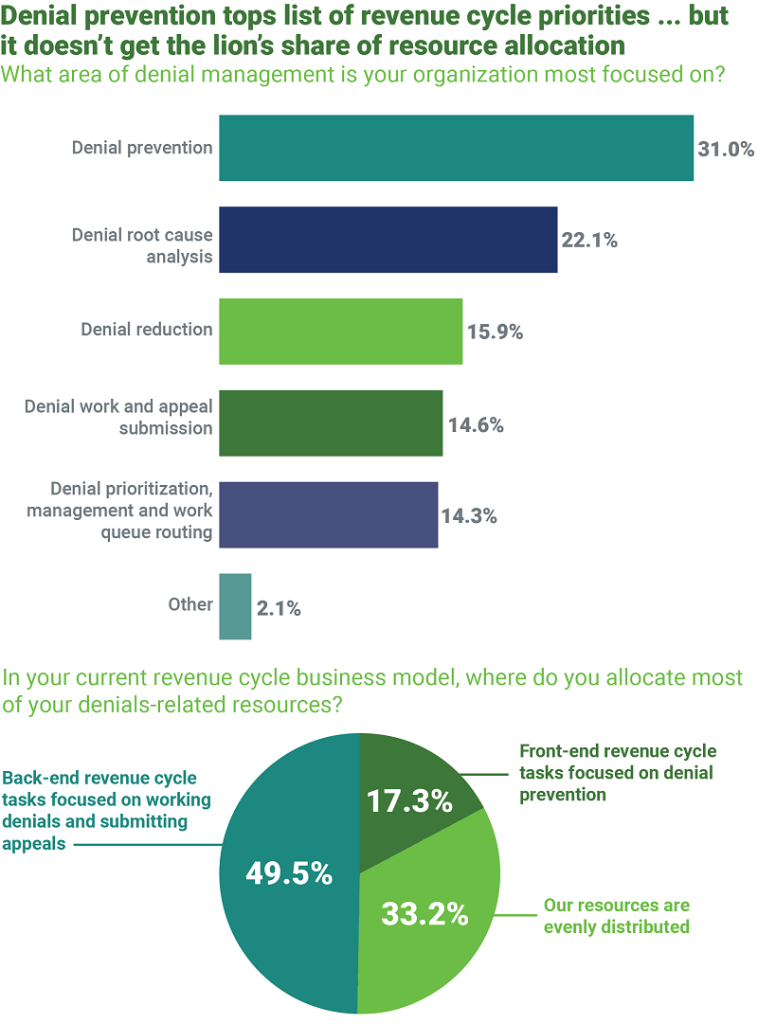

When it comes to denial management, 31% of healthcare finance professionals say their organizations are most focused on denial prevention — but that’s not where they’re putting the majority of revenue cycle resources, according to a recent HFMA survey.

The survey, sponsored by Waystar, a leading healthcare payments technology company, indicates nearly half of organizations (49.5%) allocate most of their denial-related resources toward back-end revenue cycle tasks like managing denials and submitting appeals. Just 17.3% devote more resources to front-end tasks focused on denial prevention. The difference between perception and resource-backed reality came as a surprise to revenue cycle experts, especially when compared with the decisions organizations are making around revenue cycle technology investments.

“We’re seeing success among clients that address the root cause on the front end and implement automation and intelligence to help their revenue cycle staff prioritize the work,” said Matt Hawkins, CEO, Waystar. “This approach enables providers to dedicate more time to higher-impact efforts and patient care.”

Not surprisingly, the survey indicates when organizations devote greater resources to denial management than to denial prevention, their rate of first-pass denials is higher: 13.6% versus 10.9%, based on survey responses. The rate of first-pass denials among organizations that devote equal attention to denial prevention and denial management, meanwhile, falls in the middle at 12.5%.

The survey identified four additional areas where misalignment between resource allocation, priorities and performance have a negative impact on denial prevention and management, creating opportunity for revenue cycle leaders.

1. Inefficiencies in processes drive denials

Eight out of 10 healthcare finance leaders say there is room for process improvement in addressing and working denials — and nearly 30% say the need for improvement is significant, survey responses show. Interestingly, organizations prioritizing denial management were 77% more likely to cite a significant need for process improvement than those prioritizing denial prevention (37.89% versus 21.43%).

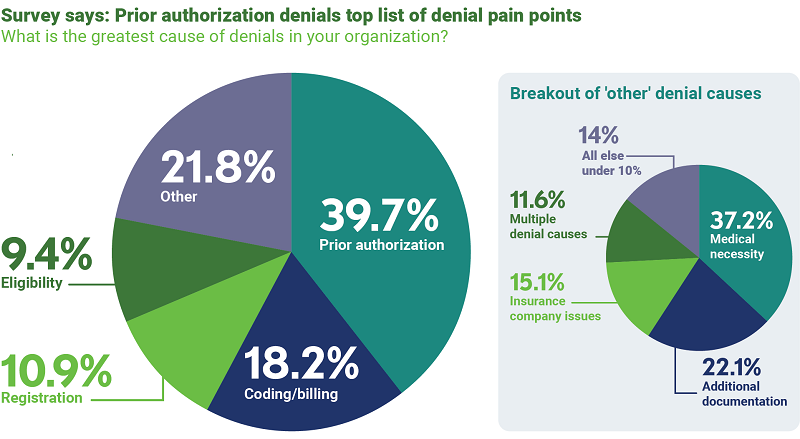

This could be because prior authorization denials were reported to represent the largest chunk of denials for healthcare organizations, at nearly 40%. Additionally, more than 70% of respondents indicated prior authorization is the most time-consuming front-end process, further exacerbating the pain point.

“Prior authorizations don’t have to consume so much time and resource commitment. We’ve seen significant improvement for providers who implement holistic, end-to-end automation platforms,” said Hawkins. For example, one client experienced a 46% decrease in authorization-related denials and a 340% improvement in working denials — going from nine days to fewer than three days.

One factor complicating prior authorization management for providers is payers’ shifting policies, which makes it challenging for providers to stay on top of them.

“By the time they see a denied claim, a trend may have already been in play for 90 days, which forces providers to continually play catch up,” Hawkins said.

Leading providers are leveraging technology to discern the root cause of denials sooner — a top area of focus for 22.1% of survey respondents. They also are seeking ways to reduce inefficiencies in front-end revenue cycle processes — cited as the cause of 25% of denials, on average. A third of providers are considering investing in a new denial and appeal solution in the next one to two years, according to survey data.

Survey data also revealed that just 40% of healthcare organizations rely on an automated solution for identifying or detecting insurance coverage prior to claim submission. This could represent a missed opportunity to strengthen front-end processes, given that nearly 10% of denials are related to challenges in determining eligibility.

“Providers should not be experiencing the level of eligibility denials that these results suggest,” Hawkins said. “Those are some of the easiest denials to get overturned or, better yet, to harness technology on the first pass to avoid a denial altogether.”

It’s an area where automating eligibility verification could not only optimize productivity and revenue, but also elevate the patient payment experience.

2. Low-balance denials merit greater attention

More than 70% of organizations surveyed have established a minimum balance write-off, accepting that they won’t be able to work all denials. Another 10% of respondents shared that they don’t have a way to filter or prioritize denials to support a minimum balance write-off.

“Providers can prioritize appeals for those likely to yield the most reimbursement when they apply AI-enabled prioritization analytics and automation for low-balance appeals,” Hawkins said.

One tactic revenue cycle teams may wish to consider: bulk automation for processing low-balance denials related to eligibility or denials from a single payer that exhibit a similar pattern.

“With automation, you can lump those denials together in a workflow tool, auto-populate the appeal letter with the information from a remit in the system and get dozens of appeals out at once, rather than one at a time,” Hawkins said. “If there’s an opportunity there and you can expedite the workflow, you should go after it, even if it’s considered a low-balance claim.”

3. Revenue cycle leaders should take a closer look at metrics

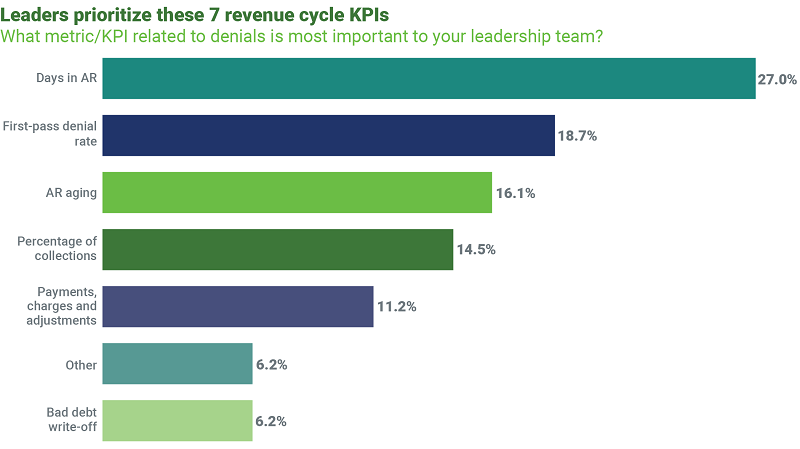

When gauging revenue cycle performance, leaders cited days in accounts receivable (A/R) as the primary metric they look at, followed by first-pass denial rate, A/R aging and percentage of collections. Days in A/R is an important metric, Hawkins said, noting that he encourages providers to place emphasis on additional measures, such as percentage of collections.

“If you have a successful denials prioritization strategy in place, you will impact the percentage of dollars owed that are collected,” he said. “First-pass denials rate is also a key metric to consider. If your team is skilled in tracing the root cause of denials and making sure they don’t continue to occur, your first-pass denials rate will decrease. It’s an excellent way to gauge the effectiveness of your team’s denials management approach.”

4. Automation is a proven lever to address revenue cycle staffing concerns

For Hawkins, the need to tackle inefficiencies in denials processes — cited as a key concern for 83% of respondents — isn’t just important for financial performance. It’s also an opportunity to help revenue cycle staff improve their skills and knowledge and feel more fulfilled in their work.

“Giving these professionals the tools to drive efficiency through advanced technology like machine learning and automation empowers them to perform at a higher level,” he said. “The technology we can apply to healthcare payments today is incredible, and there is an increasing comfort with these tools among both seasoned and younger staff.”

As revenue cycle leaders look for opportunities to engage team members more fully, such as by establishing career paths for their teams, providing modern technology to perform their work could be key to staff retention.

“In my conversations with revenue cycle leaders, I’m hearing thoughtful ideas around developing resources that help staff feel as though they have growth opportunities within their system,” Hawkins said. “For organizations that are struggling to fill those roles, adopting a more modern approach to denial prevention and management, backed by technology and analytics, has proven to be impactful.”

Making the right moves for improved performance

It’s clear that leaders must take steps toward giving denial prevention the attention, staffing and resources it deserves. Bold action — including around process improvement and adoption of holistic healthcare payments platforms — will be key. Investigating how to apply automation and other technologies to system-specific opportunities for improved performance will differentiate mid-level performers from high achievers – and provide the capability to sustain success.

About Waystar

Through a smart platform and better experience, Waystar helps providers simplify healthcare payments and yield powerful results throughout the complete revenue cycle. Waystar’s healthcare payments platform combines innovative, cloud-based technology, robust data, and unparalleled client support to streamline workflows and improve financials so providers can focus on what matters most: their patients and communities. Waystar is trusted by 1M+ providers, 1K+ hospitals and health systems, and is connected to over 5K commercial and Medicaid/Medicare payers. Annually, Waystar’s AI-powered solutions process $6B+ patient payments, $4B+ out-of-pocket estimates, and claims for over 50% of U.S. patients. Discover the way forward at waystar.com.

This published piece is provided solely for informational purposes. HFMA does not endorse the published material or warrant or guarantee its accuracy. The statements and opinions by participants are those of the participants and not those of HFMA. References to commercial manufacturers, vendors, products, or services that may appear do not constitute endorsements by HFMA.