Most healthcare organizations want to augment current EHR workflows and would consider flexible outsourcing contracts

As revenue cycle management challenges persist, providers continue to leverage automation, artificial intelligence and flexible outsourcing contracts to ensure every dollar is collected as efficiently as possible. Seventy-four percent of healthcare organizations say they currently augment or would consider augmenting EHR workflows with new tools and reporting. Nearly 84% say flexible outsourcing contracts are valuable. This trend was identified in a 2022 survey of 100 healthcare finance, accounting and revenue cycle executives, sponsored by Currance. Other findings included:

- Only 15% of providers are very satisfied with EHR functionality for revenue cycle.

- 63% of providers are less than satisfied with EHR revenue cycle reporting.

- 52% of providers are less than satisfied with traditional revenue cycle outsourcing companies.

The survey highlights a growing chasm between what healthcare organizations need to ensure effectiveness and efficiency throughout the revenue cycle and what EHR vendors actually provide, said Adam Halberda, chief development officer at Currance.

This chasm comes at a time when healthcare staffing challenges are at an all-time high, said Halberda.

“Organizations need to be able to do more work with the same resources,” said Halberda. “The question is: How do we better leverage prioritization and automation to target work efforts?”

The good news is that organizations are responding proactively. More than a third of respondents (36%) say they’re not waiting for an EHR road map for workflow tools and reporting innovations. Instead, they’re exploring staffing and technology solutions to promote a high performing revenue cycle.

Calculating precise yield performance in near real time

Healthcare organizations that can confidently calculate yield performance (i.e., cash divided by earned revenue) in near real time can proactively manage revenue cycle performance, says Currance’s Adam Halberda.

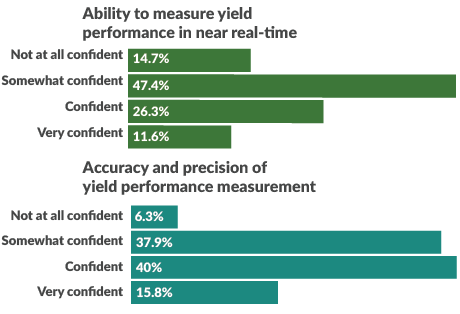

“This isn’t net revenue that’s usually calculated after the month’s close,” he said. “It’s what organizations should be paid for the services they provide. According to the HFMA survey, only 12% of providers are very confident in their ability to measure yield performance in real time. Only 16% say they’re very confident in their yield performance calculations.”

Using data-driven account prioritization

One of the biggest challenges with maximizing staff time and efficiency is a lack of prioritization to drive workflow, said Christine Adams, senior vice president, client delivery at Currance. For example, healthcare organizations may typically default to prioritizing high-dollar accounts even when doing so may not be the best use of resources.

Technology-driven prioritization, on the other hand, can dynamically group accounts to maximize efficiency and yield. One example is the ability to automatically read incoming 835 data (Electronic Remittance Advice) from payers to prioritize denials and integrate automated payer responses so staff can focus only on accounts that require action.

“With process-focused analytics, revenue cycle teams can understand payer behavior at the account level and react in near real-time to performance challenges,” said Adams. “It allows revenue cycle teams to drill down into accounts, understand why processes are failing and empower the entire revenue cycle team to resolve inefficient processes.”

Are you waiting for EHR road map for workflow tools and reporting innovations?

Is now the time to outsource revenue cycle management?

Consider these three questions when deciding to outsource all or a portion of your revenue cycle management services. If the answer to one or more of these is “yes,” it may be time to consider a flexible staffing solution.

- Does the organization continue to struggle with revenue cycle staffing shortages and/or access to a skilled workforce?

- Has the organization tried to improve financial performance and failed?

- Does the organization lack access to innovative tools that would improve revenue cycle management efficiency?

How confident is your team in yield performance measurement (cash collected from earned revenue) for each of the following?

Remaining proactive in a dynamic environment

“Healthcare is a dynamic environment in which people, processes and priorities change frequently and processes must be constantly fixed and tweaked,” said Adams. Being able to quickly isolate the processes that are creating performance issues is critical. You have to stay on top of it, which is why near real-time process analytics are paramount.”

Leveraging flexible staffing solutions

Equally as important as tools to prioritize accounts and gain actionable insights in near real time is the ability to flex staff up and down as needed, according to Halberda. Seventy-eight percent of respondents say an outsourcing partner can fill a resourcing gap. Nearly 79% of providers say an outsource partner can help them improve performance. Other reasons to outsource: Access innovative tools, access industry experience and reduce costs.

The specific value proposition will vary for each organization, says Halberda. However, flexibility is always important.

“Some providers need triage support — immediate outsourcing on day one just to stabilize,” he said. “Then once performance has improved and stabilized, they can bring all or part of the revenue cycle back in-house. There shouldn’t be a fixed model. It should evolve, as needed, over time.”

For example, many healthcare organizations struggle to fill patient access roles and may have an immediate need to outsource those functions. That need may evolve to include health information management or patient financial services. Organizations that aren’t tied into a lengthy contract can respond as priorities shift and evolve, according to Halberda.

Flexible staffing solutions also allow organizations to maintain control. He said, “This is beneficial because what if the performance or service levels changes, and you’ve signed a long-term contract? The question leaders must answer is this: What is my short-term need versus my long-term strategy? Can the outsource partner support both?”

6 questions to consider when improving revenue cycle analytics capabilities

When evaluating analytics tools, CFOs should ask these six questions:

- Can I identify what percentage of earned revenue is being paid in near real time?

- Will I have insights into any process failures as they occur?

- Will the analytics provide root cause analyses into payer performance and recurring denial trends?

- Am I able to measure the speed of cash conversion?

- Can my revenue cycle team take immediate action based on the insights provided?

- Does the analytics partner also provide best practice methodologies, training and staffing to increase performance, effectiveness and efficiency at collecting earned revenue?

Improving process efficiencies

Even when healthcare organizations have people and technology, they still need the processes to pull them together effectively, according to Adams.

“Structured playbooks identify roles and responsibilities,” Adams said. “It’s about identifying ways to approach the day-to-day work at every level of the organization with the goal of identifying and fixing process failures,” she adds. “If you don’t deviate from the plan — and people do what they need to do every day — performance will follow.”

Conclusion

There’s no one-size-fits-all solution for managing today’s revenue cycle challenges. Savvy healthcare organizations know they need a combination of actionable insights and high-performance work teams to be successful. They also need to able to make data-driven decisions that align with strategic goals.

“It’s about provider empowerment,” said Halberda. “New technologies and services are meant to augment what they’re currently doing and provide a new lens and new insights they can use to drive incremental improvement and change.”

About Currance

Currance helps healthcare providers achieve a new benchmark in revenue cycle performance. Our patented hybrid approach uses both fi nancial and operational yield metrics to measure performance. While unique approach leverages data to integrate people, process, technology, and a management system that empowers high-performance work teams to collect more cash from earned revenue — for financially and operationally stronger organizations that deliver better care. Our Team brings decades of industry leading experience to help Providers discover the difference in managing and measuring revenue cycle performance. To learn more, visit www.currance.com and follow us on LinkedIn.

This published piece is provided solely for informational purposes. HFMA does not endorse the published material or warrant or guarantee its accuracy. The statements and opinions by participants are those of the participants and not those of HFMA. References to commercial manufacturers, vendors, products, or services that may appear do not constitute endorsements by HFMA