Why evaluating skilled nursing options is important in an evolving post-acute landscape

The post-acute landscape is changing quickly, and skilled nursing facilities (SNFs) are changing with it. Health systems have numerous options to engage in this evolving landscape, and numerous factors to consider in determining the best option.

Skilled nursing facilities play an important role within the continuum of care. A high-performing SNF is a critical ally for health systems, particularly those that are focused on performance in value-based care arrangements or looking to enable earlier discharge from inpatient care to the lower-cost SNF setting and help to reduce hospital readmissions. Yet SNFs face an evolving and increasingly challenging environment:

- Effective Oct. 1, 2019, the CMS began using a new Patient-Driven Payment Model (PDPM) for SNFs that ties payment to the acuity of the patient’s condition instead of the volume of therapy provided.

- COVID-19 and infection prevention measures had a particularly dramatic impact on SNFs, posing unique threats to both patients and their caregivers and requiring reconfiguration of facilities to reduce infection risks.a

- Consumer preferences (likely accelerated by the pandemic) are pushing a broader transition to post-acute home-based care, including home health services and hospital-at-home.

- Like all other healthcare organizations, SNFs are struggling with staffing shortages and wage inflation that could permanently reset their cost structure.

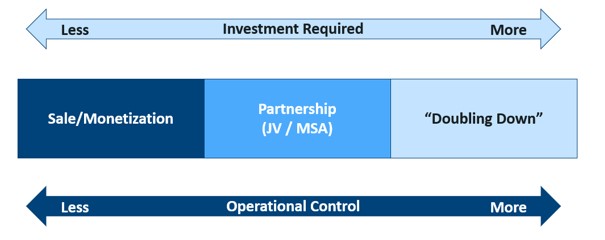

These changing dynamics — together with SNFs’ unique operational profile — are prompting health systems to reassess strategic options for providing post-acute skilled care. These options could variously include:

- Sale or monetization of current SNF assets

- Partnership (joint ventures, management agreements, etc.) with specialized SNF operators

- A “doubling down” strategy focused on increased investment in next-generation SNFs that can accommodate higher acuity patients in a more comfortable and appropriate care environment (see exhibit below).

SNF Strategic Options

In this environment, health systems have the following three options.

1 Sale or monetization of existing SNFs. Some health systems have examined whether operating a SNF is a core competency of the system, leading them to more closely evaluate whether a sale to a focused skilled nursing operator might help improve the operational efficiencies and quality of care provided in the SNF. This option can provide several benefits:

- An experienced operator may have proven protocols and technology to improve patient outcomes, enhance financial performance, reduce readmissions or enable earlier discharge of patients from inpatient settings to the SNF.

- The health system can use proceeds from the sale to reinvest in services or technologies that are central to its mission.

- Terms for the continued coordination and care of health system patients and hospital discharges can be negotiated as part of the transaction.

Although a health system may be concerned that ceding control of a SNF to an independent operator could limit its patients’ access to SNF beds, the opposite is often the case because operators tend to desire a collaborative relationship post-close.

“Despite divesting our two SNFs, we were able to ensure continued care for our most vulnerable, underinsured patients while also leveraging the expertise of our two organizations working together to create specialty programs that will improve outcomes in the future,” said Michael Capriotti, senior vice president of integration and strategic operations at Virtua Health, which sold its two SNFs to Tryko Partners in June 2022.

The health system also can tighten the relationship with a new SNF operator — and ensure continuation of high-quality care — by offering the operator participation in a preferred network defined by metrics such as Medicare star ratings, cost of care and readmission rates. Other strategies such as including the SNF in an ACO or having a system-affiliated physician serve as medical director for the SNF can also strengthen the relationship.

Despite the challenges facing the industry, independent operators werestill showing significant interest in acquiring SNFs from health systems in 2021, with activity showing a strong rebound in the final quarter of 2021.b

“We continue to see significant interest from health systems in exploring strategic alternatives for their SNFs,” noted Uri Kahanow, director of acquisitions at Tryko Partners. “These types of opportunities, whether through a joint venture or full monetization, continue to be highly attractive for skilled nursing operators due to the continued collaboration opportunities with the health systems, such as specialty programs with employed physicians and patient monitoring through ACO program participation.”

Premium valuations, which have lately strengthened, are often possible for facilities, with characteristics including:c

- A geographically advantageous location near a flagship hospital

- An established relationship with nearby hospitals

- Modernized facilities with private beds

2 Joint ventures and other partnerships. The rationale for a joint venture, management agreement or other less integrated partnership with an experienced SNF operator is similar to that for the sale of a SNF. But a joint venture may be a more attractive option for health systems that are reluctant to cede full control of the SNF or wish to continue ownership of various aspects of the continuum of care with the help of additional resources. Other benefits of a joint venture or management agreement can include the following:

- Financial exposure is split with the joint venture partner, and the health system retains the ability to participate in any upside resulting from improved operation of the SNF.

- A more experienced partner can reduce operational risk and enhance the quality of services provided.

- The joint venture may be able to leverage the contracting experience, cost structure and other operational efficiencies provided by the experienced partner.

- The partner may bring a better focus on marketing, admissions and other operational matters.

While partnership options have several merits, there are potential downsides to joint ventures or management agreements. These downsides include:

- Reputational risk for the health system if the quality of care or the experience of patients or their family members declines under the partner’s management

- Inherent challenges associated with cultural, operational and governance differences between the two organizations

3 Doubling down on investments in SNFs. Given the important and evolving role SNFs play in post-acute care, some health systems are choosing to double down and increase their investment in SNFs. The “super SNF” — a facility which combines the ability to care for medically complex patients with an emphasis on the patient experience (e.g., private rooms, on-site cafes, staff hired from the hospitality industry — is a relatively new phenomenon. With their focus on higher acuity patients, super SNFs use wage scales for clinical staff that match the compensation paid at hospitals in the market.d

Because they emphasize higher-acuity care and use wage scales equivalent to inpatient facilities, super SNFs might align better with established health system capabilities than traditional SNFs. Health systems interested in a super-SNF strategy should also consider the following points:

- Super SNFs tend to perform best when stationed near flagship hospitals to care for post-discharge quaternary and tertiary patients.

- They can lower inpatient length of stay for complex patients, with continuation of care in a lower cost setting.

- They can offer new opportunities for specialists outside of the acute-care setting.

Health systems have several options for pursuing a super-SNF strategy, depending on the scope of the strategy and available resources. They can develop the facilities on their own, acquire and repurpose an existing facility or partner with an independent operator.

“Several leading health systems focused on performance under value-based care have begun to explore partnerships with ProMedica to establish a specialized, private room sub-acute rehab facility to help reduce hospital average length of stay (LOS) and prevent readmissions throughout their system. ProMedica Skilled Nursing and Rehabilitation at MetroHealth in Cleveland, Ohio, is a great example of this model and just opened in Q1 2022,” said Griffin Julius, vice president of corporate development, ProMedica Health System.

Health systems that prefer to maintain a more “status quo” trajectory still have options to align their SNF strategy with current trends. They should consider:

- Potential renovation of existing facilities to increase the number of private or semi-private beds

- Conversion of existing space or rooms from long-term to short-term, sub-acute beds

- Investment in infrastructure or capabilities to add more specialty services for medically complex patients

- Tightening alignment between hospitals and SNFs and ensuring continuation of physician care at the SNF

Additional considerations

Health systems that currently own or operate SNFs should make sure their assessments address the following questions:

- Is operation of a SNF a core competency of the organization?

- Are current facilities and service offerings financially viable?

- Could future capital expenditure needs be better allocated elsewhere in the system?

- Are facilities being properly utilized, with a tight degree of integration for the sub-acute population?

- Are the facilities positively influencing inpatient LOS and readmission rates?

- Are specialty programs in place at the SNFs to serve post-acute needs of the broader market?

- Do market demands necessitate a change in how care is currently being administered?

For health systems without owned or operated SNFs, the key questions to address are as follows:

- How well aligned are we with independent SNFs in our network and how satisfied are we with patient outcomes at those facilities?

- To what extent could those relationships be improved?

- What protocols are in place to determine whether a patient should be discharged to a SNF or to a home-based setting?

If improvements to existing relationships and protocols are possible, this may be a lower-cost option. If not, and the health system is not satisfied with its current post-acute options, other partnership options could be considered.

Footnotes

a. Fischbeck Howell, K.. “COVID-19’s Lasting Impact on Long-Term Care Assets,” Reuters, July 12, 2021.

b. Swett, B.: “Seniors Housing and Care M&A Activity Soared in Q4:2021, According to Acquisition Data from LevinPro LTC,” PRWeb, Jan. 12, 2022.

c. LevinPro, LTC: “60 Seconds With Swett: SNF Values Soar Post-Pandemic, AL Falls.” Aug. 17, 2022.

d. Mullaney, T.: “Symphony Shares Secrets of the ‘Super SNF.’” Skilled Nursing News, June 13, 2017.