How to build a resilient not-for-profit healthcare company

Resiliency in a not-for-profit healthcare company is about harnessing and then effectively deploying all available resources.

Having corporate resiliency means being able to withstand adverse changes to the organization’s core business model. This capability includes, as a critical response factor, the capacity to adapt to change by managing the organization to a different place. An organization cannot adapt, however, if it has not established a foundation for absorbing the first shocks of dislocation and then carrying the financial burden of the change, keeping things in place until a new and stable platform is achieved.

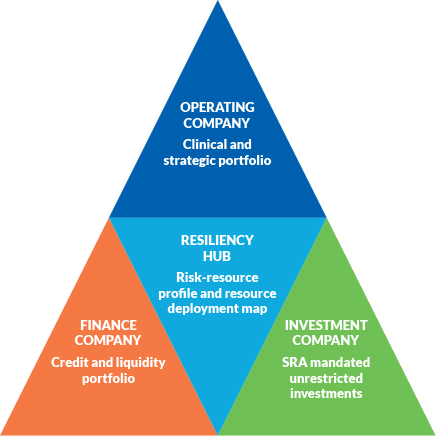

Resiliency in a not-for-profit healthcare company is about harnessing and then effectively deploying all available resources. The process we favor starts with breaking the total company into three subsidiary components (referred to here to as companies):

- An operating company, which grows and manages the portfolio of clinical and strategic initiatives that drive cash flow and define the charitable mission of the organization

- A finance company, which leverages the resources of both the operating company and the investment company to secure the liquidity and capital (internal and external) needed to fund the operating company

- An investment company, which serves as the “resiliency engine” by deploying its resources to hedge operating and finance company exposures (i.e., stabilize the enterprise against cash flow and event shocks) and to pursue independent returns

The resilient healthcare company

Source: Kaufman, Hall & Associates LLC, 2020

Each of these companies has a distinct “resiliency” profile, meaning that it either contributes to or makes use of the resources available. Typically, the operating company uses resiliency resources because of the risk it carries in operating the business.

The resiliency profile of different organizations’ finance companies can vary significantly, depending on how much risk is embedded in the debt instruments used to secure external capital.

The investment company is an altogether different, and hugely important, animal because its resources are the most flexible. Gyrating asset allocation is a terrible idea, but asset allocation can be adjusted relatively faster than a debt portfolio (call provisions) or a portfolio of operating and strategic initiatives. This relative flexibility makes investment-company resources best suited to play the role of corporate stabilizer.

The three companies come together in an integrated “resiliency hub” where two powerful things occur. First, claims on resources can be matched against those resources, thereby helping to define a resiliency profile. Second, a road map is developed to guide the deployment of invested assets and transform them from a random resource into a resiliency engine.

We call this two-step process strategic resource allocation (SRA), and its power rests in integrating vertical management (the operating, finance and investment companies) and horizontal management (the enterprise-focused resiliency hub).

Putting these perspectives together creates the opportunity to establish an interlocking business foundation that can absorb business model dislocation, no matter whether it is positive (e.g., thrust from an aggressive growth strategy) or negative (e.g., COVID-19). This is how corporate and credit resiliency gets built.