Analyzing the Frequency of Changes Among Worksheets in Medicare’s HCRIS

All facilities that participate in Medicare are required each year to file cost reports, which are made available through the Healthcare Cost Report Information System (HCRIS). Each cost report consists of multiple sheets, with each sheet covering specific information. Some worksheets are common to almost all facilities, but many worksheets are for specific situations that may apply only to selected facilities. Previously filed cost reports may be refiled to amend, correct, or update the originally submitted information.

Refiling is a common practice; only 43 percent of cost reports over two years old are not refiled reports, with 34 percent having been refiled once and 23 percent having been refiled two or more times. An analysis of cost reports released for third quarter 2017 compared with prior releases of cost reports since 2010 provides insight into which cost-report areas are changed most frequently.

Although much of the information in a cost report remains unchanged when refiled, certain worksheet areas undergo changes more frequently than others. To identify these areas, the analysis looked at the probability that a given sheet type would be changed during any refiling, based on the ratio of changed sheets to total sheets.

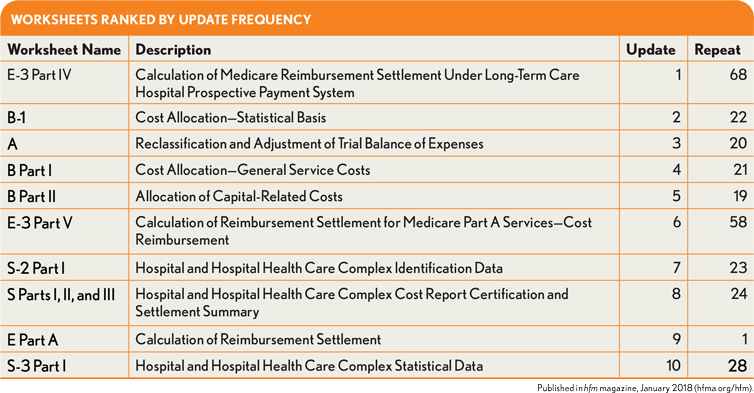

To evaluate the relative frequency of updates to worksheets, the worksheets were ranked from most likely to be changed to least likely to be changed. Not surprisingly, a look at the 10 most likely sheets to be updated discloses that seven of the top 10 most updated worksheets are from the A, B and S series of worksheets. These are the sheets used to gather and summarize the basic cost and statistical use data that are the main drivers of the costing process. The other three are worksheets used to calculate the settlement for different facility types.

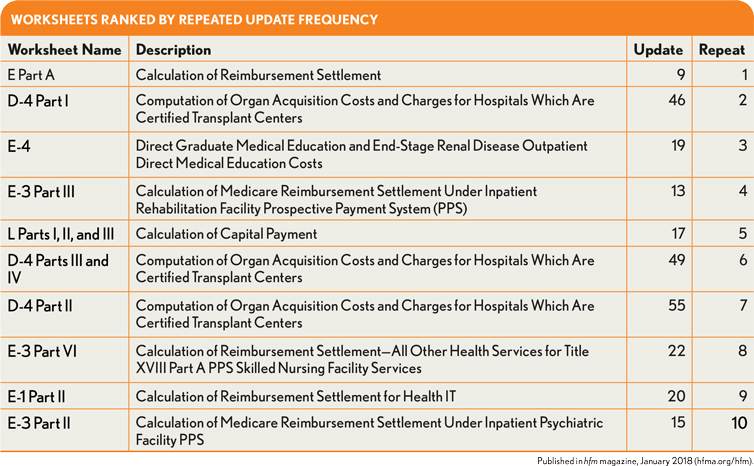

The analysis also disclosed that some worksheets were updated repeatedly over the course of additional resubmissions of updated cost reports. To compare the relative frequency with which different worksheets underwent repeated updates, the worksheets were ranked based on ratio of the total number of changes to the number of sheets that were changed. This measurement was called the repeated update rank. Each of the accompanying exhibits shows where its top 10 worksheets were ranked in the overall ranking depicted in the other exhibit.

With the single exception of Worksheet E part A, there are no overlaps in these two top 10 rankings. One could conclude from this finding that the worksheets in the top 10 of the repeated update ranking are particularly difficult to complete inside the current time constraints placed upon individuals charged with preparing the cost reports. The fact that many of the worksheets in these top 10 rankings directly affect payment suggests that, during audit and review processes, the providers may have discovered instances where the original information was incomplete in the initial filing, resulting in missed revenue opportunities.

Such analyses can help raise awareness among individuals who complete the cost reports regarding which areas in particular should be scrutinized for accuracy and completeness. Any healthcare leaders or researchers who use cost reports for benchmarking and comparative analysis should be aware that any work performed using information from these sections may be subject to revision by the providers, and that worksheets used in an ongoing study or by an analysis tool should be monitored for such revisions.

This analysis was performed by Cost Report Data Resources, LLC, Louisville, Ky. For more information, contact Ed Klein at support@ CostReportData.com.