5 DRGs Are Primary Contributors to Rising Average Loss per Medicare Hospital Admission

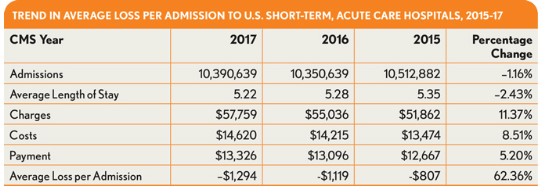

Estimated costs for short-term, acute care hospital admissions have been rising at rates higher than the corresponding payments in recent years, according to data from Medicare Provider Analysis and Review (MedPAR) file for 2015-17—the most current three years for which the Centers for Medicare & Medicaid Services (CMS) has made data available in the file. The data point to a trend in which the average loss per Medicare admission rose from $807 in 2015 to $1,294 for 2017, representing a 62 percent increase in the average loss per Medicare admission over three years.

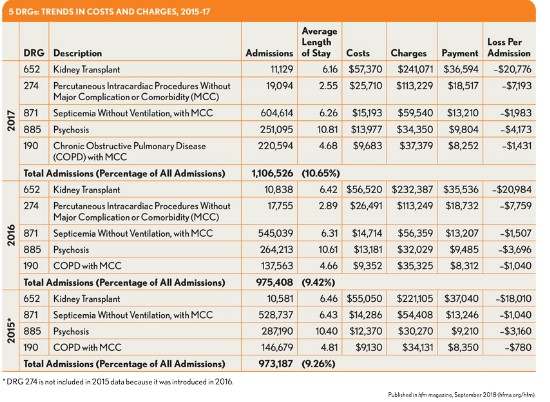

A more in-depth review of the data discloses five DRGs for which the high number of assignments combined with high costs and low payments led to significant losses per admission that exerted a significant impact on the overall Medicare financials.

The greatest impact was seen with DRG 652 (Kidney Transplant), with more than 10,000 admissions per year assigned to this DRG over the three-year period. For these admissions, the average loss per year increased by 15 percent, from $18,010 to $20,776. Meanwhile, this DRG saw a 4.6 increase in costs and a 1.2 percent decline in payment.

Another set of admissions having a significant impact are those dealing with a nonspecific diagnosis of psychosis (DRG 885). For the review period, the number of admissions assigned to this DRG fell from 287,190 to 251,095, and the average length of stay remained relatively consistent, at just under 11 days. Costs, however’ increased by 13 percent to $13,977 per admission, compared with a payment increase of only 6.4 percent to $9,804. The high number of admissions under this DRG suggests hospitals nationwide can expect to see losses exceeding $1 billion for psychosis-related admissions.

The remaining three DRG codes (274, 871, and 190), accounting for more than 844,000 admissions in 2017, were also found to be responsible for high losses per admission. Notably, the average loss for DRG 190 (Chronic Obstructive Pulmonary Disease with Major Complication or Comorbidity) increased by 83 percent over the three-year period.

It is important to note these five DRG assignments accounted for 10.7 percent of the total admissions reported for 2017, meaning that the DRGs are not only associated with the high financial losses per admission, but also represent some of the most commonly treated conditions requiring hospital admissions in the United States.

The MedPAR file, which CMS compiles and makes available for purchase, represents every inpatient hospital admission processed for Medicare beneficiaries in the nation and contains a number of data elements that can provide hospitals with in-depth and meaningful indicators relating to utilization, diagnosis, and procedure use as well as financial performance.

A primary benefit of this data set is the inclusion of financial indicators from which charges per admission can be calculated. By mapping the MedPAR data to the hospital cost reports that hospitals submit to CMS, it is possible to calculate a ratio of cost to charges that provides an accurate account of hospital costs at the admission level. The inclusion of payment indicators further allows for the identification of profit-loss analysis at the admission level.

This analysis was provided by Optum Advisory Services; questions or comments may be directed to Jan Welsh.